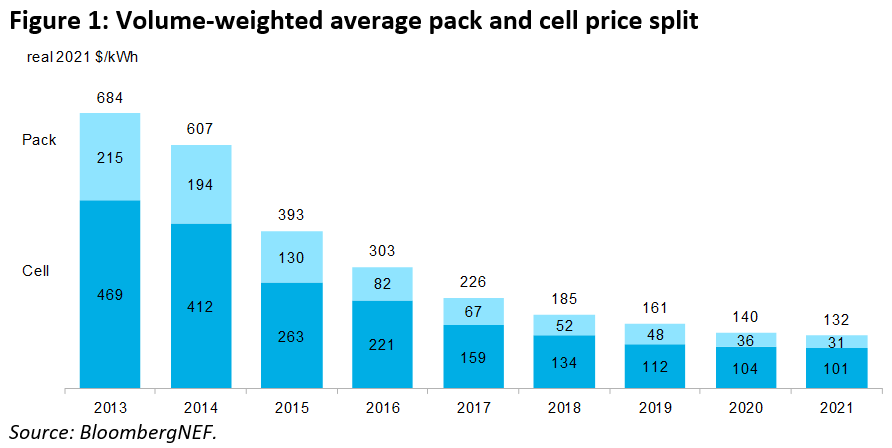

Battery Pack Prices Be Up To an Average of $132/kWh, Yet Rising Commodity Prices Beginning to Bite

- Lithium-ion battery pack prices, which were above $1,200 per kilowatt-hour in 2010, have fallen 89% in genuine terms to $132/kWh in 2021 [1] This is a 6% decline from $140/kWh in 2020.

Continuing expense reductions bode well for the future of electrical vehicles, which count on lithium-ion innovation. However, the influence of rising commodity prices and also increased costs for crucial products such as electrolytes has put pressure on the sector in the second fifty percent of the year.

These prices are an average throughout multiple battery end-uses, consisting of different sorts of electric vehicles, buses as well as fixed storage space projects. For battery electric vehicle (BEV) packs in particular, prices were $118/kWh on a volume-weighted average basis in 2021. At the cell level, average BEV prices were just $97/kWh. This indicates that on average, cells represent 82% of the overall pack price. Over the past 2 years, the cell-to-pack expense proportion has diverged from the typical 70:30 split, a result of modifications to pack design, such as the intro of cell-to-pack styles.

On a local basis, battery pack prices were most affordable in China, at $111/kWh. Crams in the united state and Europe cost 40% and also 60% higher, specifically. This reflects the relative immaturity of these markets, the varied range of applications and, for the higher end of the variety, low volume and bespoke orders.

Prices continued to fall in 2021 as the adoption of the low-priced cathode chemistry referred to as lithium iron phosphate (LFP) increased, and also as using pricey cobalt in nickel-base cathodes continued to slide. Typically, LFP cells were virtually 30% cheaper than NMC cells in 2021. Nevertheless, also low-priced chemistries like LFP, which is particularly revealed to lithium carbonate prices, have felt the bite of rising expenses throughout the supply chain. Given That September, Chinese producers have actually increased LFP prices by between 10-20%.

Based upon historic trends, BNEF's 2021 Battery Price Survey, which was released in time for the virtual BNEF Summit Shanghai, predicts that by 2024 average pack prices should be below $100/kWh. It goes to around this price factor that automakers should be able to create as well as market mass-market EVs at the very same price (and with the exact same margin) as comparable inner combustion vehicles in some markets. This assumes no aids are available, however real prices strategies will certainly vary by automaker and geography.

Nonetheless, higher raw material prices mean that in the near-term, average pack prices might rise to $135/kWh in 2022 in nominal terms. In the lack of various other enhancements that can mitigate this impact, this can indicate that the point at which prices fall below $100/kWh could be pushed back by two years. This would certainly influence EV affordability or suppliers' margins and can hurt the economics of power storage space projects.

James Frith, BNEF's head of energy storage study and also lead author of the report, claimed: "Although battery prices dropped general across 2021, in the 2nd fifty percent of the year prices have been rising. We approximate that typically the price of an NMC (811) cell is $10/kWh greater in the fourth quarter than it was in the initial 3 months of the year, with prices now surrounding $110/kWh. This produces a challenging atmosphere for car manufacturers, particularly those in Europe, which have to raise EV sales in order to fulfill average fleet exhausts criteria. These car manufacturers might now have to make a choice in between reducing their margins or passing expenses on, at the danger of putting customers off acquiring an EV."

Kwasi Ampofo, head of steels and mining at BloombergNEF said: "Prices for lithium have actually risen substantially this year as a result of restrictions within worldwide supply chains, rising demand in China and also Europe and the current production curbs in China. Although we expect demand to keep growing in 2022, various other elements such as international supply-chain constraints and China's manufacturing curbs should have been solved by 1Q 2022. This will assist to ease lithium prices."

The course to attaining $100/kWh is clear, although the timing now looks more uncertain. In 2021, a wave of automakers launched battery technology roadmaps describing how prices can be reduced below $100/kWh. Companies like Renault and Ford have actually publicly announced targets of $80/kWh by 2030.

Continued investment in R&D alongside capability expansion throughout the supply chain will certainly assist to enhance battery modern technology and lower expenses over the next years. BloombergNEF anticipates next-generation innovations, such as silicon and lithium metal anodes, solid-state electrolytes and new cathode material as well as cell production procedures, to play an important role in making it possible for these price reductions.

Also read