The Sun Is Setting On Tesla's Solar Service

- In Q3, Tesla saw its solar installations climb 111% quarter over quarter and also 33% year over year; Solar Roof setups tripled from Q2.

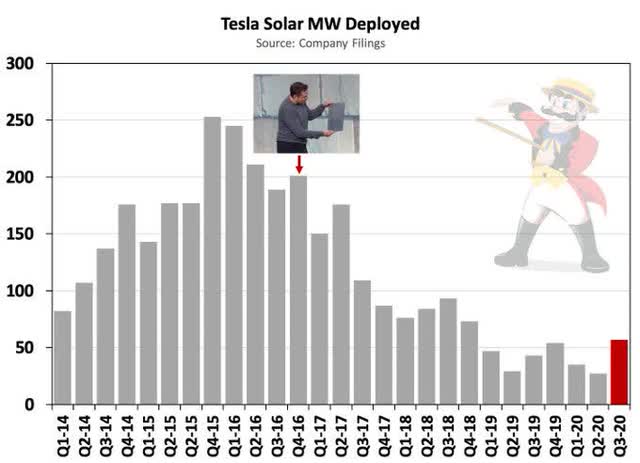

- Regardless of the ostensibly robust growth, complete solar releases were still much lower than had actually been the norm up until 2016.

Summary

- In Q3, Tesla saw its solar installations climb 111% quarter over quarter and also 33% year over year; Solar Roof setups tripled from Q2.

- Regardless of the ostensibly robust growth, complete solar releases were still much lower than had actually been the norm up until 2016.

- Solar power plays a vital function in Tesla's development story, differentiating it from other car manufacturers as an "energy business that makes cars" as well as validating its extremely divergent evaluation multiple.

- The solar power industry, constrained by efficient commodity rates, has left Tesla without any noticeable competitive advantage; the Solar Roof, unveiled in 2016, has actually acquired little traction to date.

- Tesla Solar's continuous battles may harm financiers' perception of Tesla as a power innovator, which may in turn weigh on the stock.

When Tesla (TSLA) reported Q3 earnings in October, the business took terrific discomforts to highlight the development in its solar energy service. Solar deployments increased a tremendous 111% from the previous quarter to 57 megawatts. Points looked great on a year-over-year contrast too, with releases up 33% from Q3 2019.

Seen on a bigger timescale, however, Q3's solar deployment growth is significantly less impressive. Undoubtedly, it stands for yet another quarter of stagnancy for a business section that has actually been embeded a multi-year sag.

Capitalists would certainly be important to take note of the warnings waving over Tesla's solar segment. As Tesla's solar power narrative diverges ever additionally from its solar power fact, the threats to the firm's vaulting assessment are readied to intensify.

Darkness Gather Around Solar Segment

Tesla's solar organization has remained in decrease for several years. An evaluation of historic solar deployment degrees places the latest sequential uptick into stark perspective. Quarterly implementations reached their high water mark in Q4 2015 when Tesla set up 253 megawatts. However solar install numbers fell from there, reaching its nadir in Q2 2019 when it took care of to deploy just 29 megawatts. Hence, while the 57 megawatts deployed in Q3 2020 might be two times what Tesla managed at its lowest point, it is less than 25% of what Tesla released during its ideal quarter.

Source: Tesla, TESLAcharts

Unsurprisingly, Tesla has tried to change concentrate away from complete solar implementations and also towards its Solar Roof, which has at last begun to see an uptick in installments after years of hold-ups. First unveiled in October 2016 ahead of Tesla's ill-fated purchase of the falling down SolarCity, the Solar Roof was indicated to be a vital differentiator in an increasingly commodity-priced solar sector.

Source: Tesla

While CEO Elon Musk ensured investors at the time that the Solar Roof prepared to go into automation almost right away, it swiftly became clear that the modern technology was much from ready.

Still Waiting On The Solar Roof

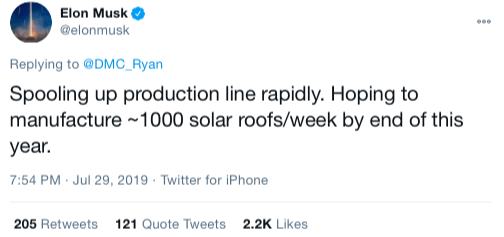

For several years, Musk has repeatedly assured financiers and also clients alike of the Solar Roof's imminent arrival. In late July 2019, he took to Twitter to pronounce that Tesla was at last getting ready for automation, with production predicted to reach a price of 1,000 devices each week by the end of the year. Yet 3 months later on, fully 3 years after the initial product introduction, barely a handful of installations had actually been finished. As well as Tesla has actually continued to be uncharacteristically reserved to divulge the actual number of installations to day.

Source: Elon Musk, Twitter

The effectiveness of Solar Roof deployments shows up to have boosted gradually. From the eleven days it reportedly absorbed late 2019, observed deployment times had actually been up to as low as four days by October 2020, while Tesla declares it can now complete a setup in less than 2 days. Improved installation speed has likely boosted implementation volume, which tripled in Q3 according to Tesla.

In spite of clear signs that the Solar Roof is seeing larger distribution than ever before, couple of experts have confirmed willing to predict as to actual setup quantities. After all, 3 times a very handful is still an extremely handful. Sadly, Tesla has not released any kind of concrete installation numbers thus far, and the company has actually had a tendency to demur whenever doubted on the topic.

Narrative Collides With Reality

For several years, Elon Musk has spun the narrative that Tesla is not merely an electrical vehicle service. Rather, Musk insists, it is an energy company that also makes electric automobiles. Musk highlighted this concept yet once again during Tesla's Q2 incomes call in July:

" I can not highlight [sufficient] I assume long-term, Tesla Energy will be approximately the same dimension as Tesla Automotive."

Musk's efforts to place Tesla as an energy business have actually been sustained by a host of influential commentators and financiers. Social Capital's Chamath Palihapitiya, for example, has been an especially ardent evangelist for Tesla's power sector. Speaking with CNBC on July 23rd, Palihapitiya laid his setting out fairly simply:

" This stock is currently mosting likely to represent the completeness around decarbonization and also sustainability, so it was actually wonderful to have this point around autos for the initial few years, I get it. Now I finance this stock as a push toward decarbonization, in the direction of unregulated power, as well as in the direction of the ability for everybody to become our little micro energies."

By successfully placing Tesla as an energy disruptor, its supply rate can be uncoupled from the extra prosaic incomes multiples gathered by other automakers. So far, Musk and also his supporters have taken care of to shape the narrative rather successfully, which has played an important part in raising Tesla's appraisal to its present astonishing level.

In truth, however, Tesla's solar organization has stopped working to meet Musk's guarantees of fast development. Also the much delayed advent of Solar Roof has actually fallen short to raise implementation numbers significantly. That can barely be taken as an appealing sign for the future.

Investor's Eye View

Tesla has actually gathered a market capitalization over of $600 billion thanks to exceptionally reliable narrative management. The business has sold the market on its energy future. Yet the release numbers do not lie.

So far, Tesla's share cost has handled to leave unharmed. Whether it can continue to do so will certainly depend on financiers' continued determination to believe what they are informed rather than what the monetary results reveal.

In the future, truth constantly wins. However it can be a long haul.