Solar's service warranty threat

- The service warranty threat of solar must be dealt with early in the growth stage of PV projects, as it is not possible to buy warranty insurance policy later on throughout the operational phase.

Choices taken by designers at this phase will certainly remain important for the following 25 years. Fortunately is that a sector common exists, and also it can be conveniently and cost-effectively applied to most PV projects, writes Ronald Sastrawan from Munich Re.

Solar PV project designers have to attend to several threats as well as locate options to numerous issues. During the growth stage, a designer will certainly be greatly taken part in acquiring funding, the correct PPA, EPC and also O&M contracts, called for licenses, land leases, and more. Offered this, "warranty-related dangers" for PV modules are probably not at the top a designer's concern list. Nevertheless, it goes to this phase that service warranty danger ought to be attended to, and also there are options handy.

Module service warranties

The due diligence on the PV module focuses on an essential inquiry: "Will the modules perform according to the service warranty, and will my project receive indemnification in case of module underperformance?"

Therefore, the warranty itself must be studied. A common standard is an assured yearly degradation of not more than 0.7% for 25 years. Double-glass modules can come with guaranteed annual degradation of less than 0.5% for 30 years. The two essential opportunities for indemnification are (i) substitute of the modules, or (ii) compensation-- either via modules or monetarily-- of the missing out on Wp of the underperforming modules. Of course, fixing of the modules is likewise an alternative. Expense of transportation, installment, and screening might or may not be covered under the warranty.

PV module guarantees are a very important and also solid guarantee, from the vendor to the project proprietor, for the next 25 or 30 years. Financial versions heavily rely on them therefore. But who is in fact responsible if a supplier eventually fails?

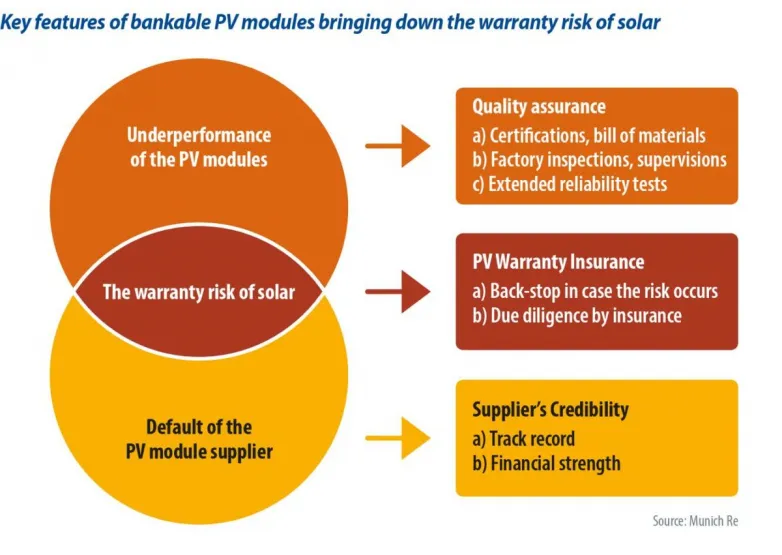

Service warranty threat

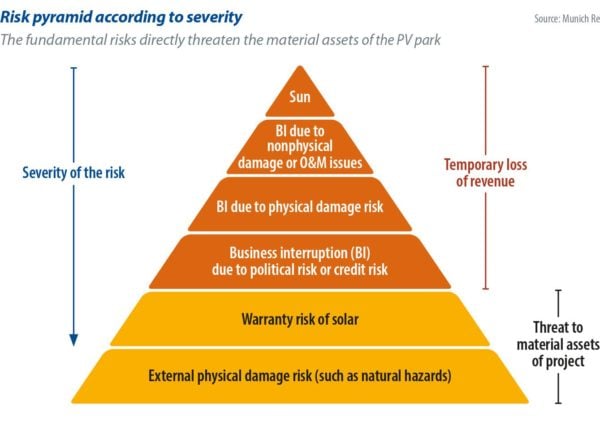

A warranty threat event is defined as the incident of a warranty insurance claim in mix with the occasion that the PV module distributor has stopped operations. The long service warranty duration of PV modules poses an one-of-a-kind opportunity, however likewise a distinct risk to the PV market. There is a very genuine chance that a designer or project proprietor may be left alone with the useless guarantees of a financially troubled module vendor throughout the lengthy functional stage of the project. PV warranty insurance policy is placed to cover this danger.

Service warranty danger is an essential threat in PV projects. It is on a comparable degree as physical damages as a result of all-natural threats, a direct danger to the PV elements themselves. Nevertheless, unlike all-natural threats, it can not be insured against on an annual basis, since the threat adjustments over time, and also normally boosts in later years. There would certainly be no warranty of yearly renewal while when it is most needed.

For that reason, PV guarantee insurance-- as one vital feature of sustainable PV projects-- is a long-lasting contract as well as needs to be addressed early: during the procurement procedure of the modules. It must be noted that warranty insurance does not change the due diligence procedure on the PV modules. It is simply one crucial attribute, to name a few, of de-risking PV guarantees.

First layer

The very first layer of PV service warranty insurance coverage comes with sourcing warranty-insured PV modules and requires to be asked for directly from the PV module provider. One location to discover suppliers that are eligible to offer warranty-insured PV modules is Munich Re's PV Warranty Partner List. To end up being qualified, the detailed distributors must regularly pass a due persistance procedure and insure at the very least 100 MWp every year-- normally far more is insured.

However even if the distributor is not listed, a solar PV developer can-- and should-- demand warranty-insured modules. The provider can after that make an application for assessment or provide an option from another insurance coverage supplier. At this stage, because of the long-lasting tail of the coverage, it is of particular relevance to be knowledgeable about the monetary rating of the (re-) insurer.

Furthermore, as warranty insurance can be found in different sizes and shapes, it is important to understand the fundamentals of just how the service warranty insurance coverage of the part distributor is structured. One of the most essential inquiries are:

" How much insurance capability (in USD) comes from the particular project on which I am functioning (the limit)?" This restriction will be the optimum payment to the project from the insurance coverage and also is normally far below 100% of the modules' sales worth.

" Is the insurance coverage capacity solely committed to my project, or is my project among many with access to a shared swimming pool?" The latter would certainly result in a "first come, initially offered" trouble. This "common pool" structure exists on the market, as well as while viable from the PV module vendor's perspective, it needs to be prevented from the project developer's perspective. It is essential that a solar programmer "has" its limitation.

" Do I obtain a true 25- or 30-year cover, or is the limit lowered after year 10 or 12?" A 10- or 12-year cover period-- with a limitation decrease in later years-- may be acceptable for sure projects, but as a whole, the insurance policy should cover the complete service warranty period.

" How high is the deductible for the specific PV project?" The insurance deductible must relate to the dimension of the park. The deductible is a crucial specification to keep the insurance policy costs low by filtering system non-critical (small) claim situations.

" Does the service warranty insurance policy transfer to me, the project proprietor, in case of the supplier's default?" Certainly, this is a bottom line, and created confirmation with the name of the project proprietor (beneficiary) should be offered by the insurance company (using the supplier) for each and every project proprietor independently. This confirmation letter can then be shown to the various stakeholders. If ownership of the project adjustments, the adjustment of beneficiary have to be reported to the insurance provider to update this details.

It works, to specify the most vital conditions in the relevant documents, such as purchase contract or term sheet (see the box to the right).

The majority of module providers have the ability to provide warranty-insured modules with the above conditions, as this is a criterion out there. Presently, a limitation of not less than 5% yet not greater than 10% of module value for the full 25 or 30 years cover is common in the market. An insurance deductible of not more than 5% is common.

These criteria go through alter as market problems alter. Depending on the limit as well as the marketplace conditions, this initial layer needs to not influence costs way too much, if in any way.

2nd layer

Particular projects require a higher limit than is given by the provider's warranty insurance policy Under existing market conditions, it is not possible for module providers to offer higher insurance coverage restrictions, and for a lot of projects, a limit of 5% to 10% has proven acceptable.

Nonetheless, optional top-up cover is required for certain projects. A top-up cover is intended to increase the limit and has the alternative to include expense of transportation, installation, and also screening. The opportunity of covering loss of profits due to the underperforming modules also exists.

The top-up cover can be put in an extremely simple as well as quick process, considered that the underlying very first layer is already positioned. However, it requires to be tailored to the details requirements of the project, so these ought to be reviewed directly with the insurer.

The insurance costs for the very first layer is paid by the distributor and must not affect expenses too much, if in all. The 2nd layer is usually paid by the project developer and strongly depends on the specific demands, generally the limit. When the premium is paid, the cover is energetic for the whole responsibility duration of 25 or 30 years.

If the supplier is operating typically, all warranty cases need to be resolved to the distributor. The distributor will certainly deal with all the guarantee asserts with the project proprietor and also with the insurance coverage. The insurance will pay indemnification to the vendor and may get involved in validating the guarantee insurance claim.

If the supplier is in default or has stopped operations, the insurance provider ought to be gotten in touch with directly. Depending upon the situation, a 3rd party expert might get entailed to confirm the claim. Financial indemnification will certainly be paid directly from the insurance company to the beneficiary specified in the verification of insurance policy.

Guarantee and also insurance coverage.

The service warranty risk of solar can be reduced quickly as well as cost-effectively by appropriately using existing insurance coverage criteria during the procurement procedure of the modules. PV service warranty insurance is one key function of de-risking PV warranties, and essential to cut financial losses of a warranty threat occasion.

Guarantee insurance coverage does not change the project programmer's due diligence and also is no alternative to routine surveillance, inspection as well as testing of the PV modules throughout the functional phase. These act as very early detection mechanisms for potential guarantee claims. Precautionary activity is constantly the best alternative, as the optimum insurance policy payment-- with or without top-up cover-- may not cover all losses.

Along with providing indemnification throughout a guarantee threat occasion, PV service warranty insurance coverage can be a benefit when a project is being offered or re-financed. Especially if the PV module provider has actually since ceased procedures, or quality concerns of similar PV modules in other projects have actually been reported, an existing PV service warranty insurance, specifically with a solid top-up cover, can make a large distinction.

Concerning the author

Ronald Sastrawan is director of environment-friendly tech services at Munich Re, guaranteeing lasting dangers for providers and also programmers of tidy modern technologies. Sastrawan developed Munich Re's PV Warranty Partner program. The program won the APVIA honor for the very best financial as well as financing initiative. It offered greater than EUR100 countless insurance capability in support of roughly EUR1 billion of solar investments within the initial year of its rollout. Sastrawan has greater than 15 years of experience in the solar industry. After his PhD in physics at Fraunhofer ISE, he established manufacturing facilities for solar cell manufacturing in Asia and also the United States. Prior to joining the Munich Re Group, he headed an R&D team in the solar production equipment industry.

Also read