Solar perovskite start-up Evolar bags brand-new financial investment to target rapid commercialisation

- Solar perovskite start-up Evolar has actually sourced investment from Norwegian renewables investor Magnora as it targets rapid commercialisation of the technology.

Evolar has been spun out of Uppsala University's thin film solar cell research collection as well as has actually been released by the same research study group behind Solibro, the Copper Indium Gallium de-Selenide (CIGS) solar module specialist acquired by Q CELLS in 2006.

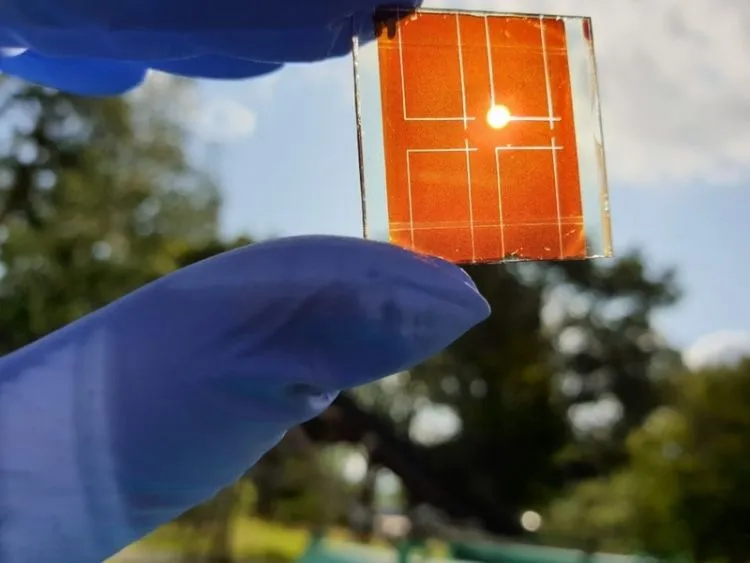

That team has actually recently been investigating the development of perovskites in solar cells, as well as Evolar now intends to aid commercialise the innovation. Evolar's method is to add a perovskite-based thin-film layer to cells to create a tandem solar cell, which the business stated is expected to boost module efficiency by 5 portion factors.

Magnora claimed Evolar possesses R&D prototype line tools that permits the team to range and also test solar cells as well as modules, aiding reduce time-to-market for new advancement by as high as three years.

The business currently prepares to work together with mainstream module manufacturers to examine and scale the technology, ultimately generating profits via style, engineering, software application and also aristocracies.

Funds elevated through the share concern are to be utilized to scale Evolar's technology and also boost its throughput.

Erik Sneve, CEO at Magnora, said the chance that perovskites possess stand for a "critical inflection point for the solar market".

"Perovskite innovation is without a doubt the fastest-advancing solar tandem modern technology for all crystalline solar cells worldwide. It has the prospective to change the whole global solar cell market, which is craving an item that provides considerably greater efficiency but without adding considerable production expenses.

"Conventional solar cell innovation is close to its sensible restriction, so we are delighted to end up being the bulk shareholder of Evolar with its special team as well as item road-map," Haakon Alfstad, investment supervisor at Magnora, added.

Magnora will first of all take a 28.44% risk in Evolar for an undisclosed, all-cash factor to consider that consists of alternatives to get a stake of as much as 63.5% of the firm under a turning point development plan.

Evolar might also consider providing the business on a controlled market in the future, which Torstein Sanness, exec chairman at Magnora, stated would certainly be taken at "the suitable time" as well as with the goal of fast-tracking the business's development.

Magnora said its intent to develop a "strong and viable calculated setting" with the solar market originates from a bigger strategy advancement process launched last year, which likewise saw it take aim at the wind sector through its possession of designer Vindr.

Also read