German PV manufacturing tools suppliers see worst sales slump since market hit rock bottom

- Industry body the VDMA stated company fell 55% from the final three months of in 2015 to the very first quarter of this year for the most awful resort since 2012. The nature of the order book and sales numbers can both be clarified by the international progression of Covid-19, according to the organization.

The German profession body for solar production devices manufacturers has said the downturn in sales experienced during the very first 3 months of the year, and also dropping order consumption from Europe as well as the U.S. in the current three-month window, are both to the effects of the spread of Covid-19.

Although China has actually long been the leading source of orders for solar production lines, the Verband Deutscher Maschinen und Anlagenbau (VDMA) claims the near-90% of Asian orders on guides right now-- of which 90% are from China-- is abnormally high. The association says the pattern is a sign of a healing in Covid-19-interrupted industrial activity in the Far East while at the same time demonstrating the impacts of coronavirus closures in the U.S. as well as Europe, which each account for only 5% of company currently.

" As in the entire mechanical design industry, the worldwide interlinked worth chains revealed major disruption and also substantial changes pertaining to different sales markets affected by the corona [infection] pandemic," stated Jutta Trube, manager of the VDMA's photovoltaic or pv devices division. "With an export ratio of over 90%, German PV machinery producers are greatly depending on operating supply chains."

Renewal

The evident Asian organisation rebirth a minimum of deals hope for German tools producers after total sales fell 55% from the last 3 months of in 2014 to the opening quarter of this-- and 57% by a first-quarter, year-on-year contrast. That totaled up to the most awful business hideaway because the German solar market struck "record low"-- in the words of the VDMA-- in 2012.

The profession body stated its members expect Asian sales to recover by 18% on the depressing degrees posted in the first quarter, with China remaining to dominate after accounting for greater than 90% of Asian orders logged in the January-to-March period, ahead of Malaysia, which provided 4% of company. Those Chinese queries contributed to a 37% increase in orders in the very first 3 months of the year, compared to the last quarter of 2019.

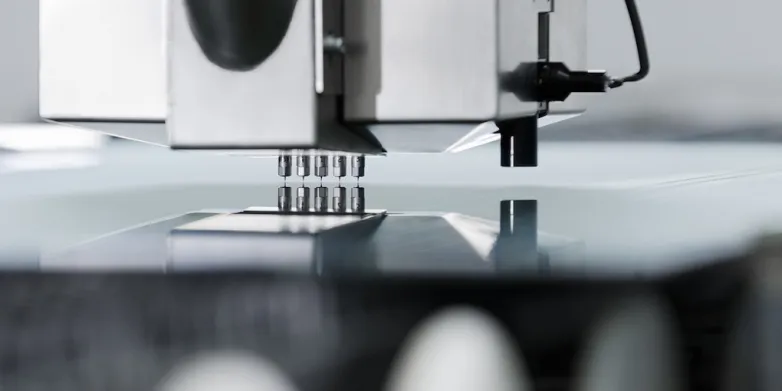

Thin-film as well as solar cell production equipment remain to provide basically all of Germany's PV assembly line organisation, accounting for 54% and 45% of orders, respectively. Devices for the manufacturing of polysilicon, ingots, wafers and components added the staying 1% or two in between them.

Also read