Fitch: Taiwan to install 20.4 GW of solar and wind by 2030, offsetting coal shutdowns

- Greater than 20GW of non-hydro capacity is expected ahead online in Taiwan by 2030, according to a new report, driven by solar installments as well as overseas wind.

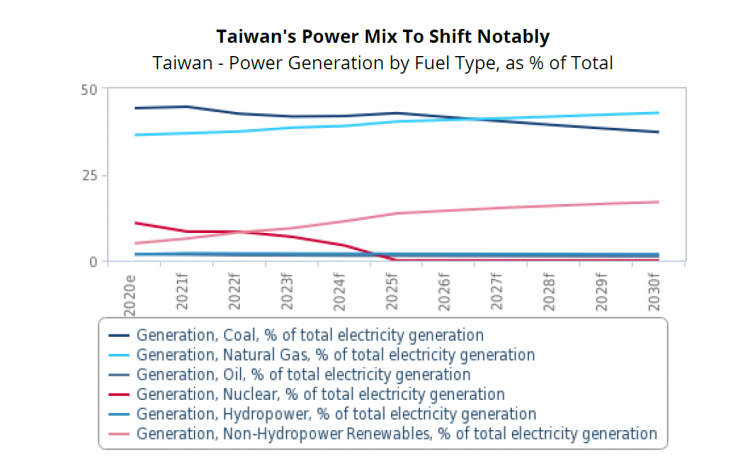

Although it obtained a sharp shock at the start of last year, the speed of Taiwan's change to solar and also wind power might still go a long way to alleviating the loss of coal plants, declares a brand-new report from market analyst Fitch Solutions. It forecasts that coal power generation in the power mix will certainly drop from a projected 44% in 2020 to 37.3% by 2030, yet remain a key generation resource. At the same time, the country might also hold near 60GW of mounted non-hydro renewables capability by the end of 2030.

Solar programmers in the nation were forced to extend PV power project conclusion days last February as a result of the COVID-19 episode in China and subsequent interruption across the continent. Before that, the Taiwanese government had set out setup targets in which solar played a central duty. In October 2019, Economic Affairs preacher Shen Jong-Chin said the federal government would aim for 6.5 GW of solar by 2020, as well as 20GW by 2025, although some project managers in Taiwan had currently cast doubts on this target before the pandemic hit, pointing out deficiency of arrive on the densely-populated island and low power prices as essential barriers.

The report from predicts that Taiwan will certainly see an added 20.4 GW of combined non-hydro renewables ability set up within the following years. This, experts stated, would certainly be "driven mostly by solar as well as overseas wind."

Fitch claims that the supply-chain disruption of last year will certainly "abate in the longer term" because of ongoing investor rate of interest in the renewables market across most markets. A report released by BloombergNEF earlier this month disclosed that tidy energy efforts brought in just over US$ 500 billion last year, with the majority (US$ 303.5 billion) earmarked for renewable resource ability, regardless of COVID-19's international impact. Although an incipient market in within Asia, Taiwanese tidy energy campaigns received US$ 6 billion of financial investment right into energy shift efforts, an agent told PV Tech. Roughly US$ 2.3 billion of this remained in solar ability.

The federal government has targeted a 25% renewables energy supply by 2025, with 27% coal by 2025. Fitch's report predicts that preachers will look for to "accelerate" the tidy energy objectives over the next couple of years.

In addition, Fitch's analysts anticipate the country's nuclear phase-out to continue regardless of some ask for plant projects to be rebooted. A mandate is to be kept in August this year over the dormant Lungmen Nuclear Power Plant project, however the report declares it would certainly not come online till at least 2030 even if reactivating its building was given the go-ahead. A more four nuclear plants are anticipated to be shut down by 2024, amounting to 2,921 MW of nuclear capability extracted from the grid. Nevertheless, the report suggests that non-hydro renewables installments might substantially counter the loss of nuclear and coal.

" President Tsai Ing-wen has actually announced a brand-new goal to establish Taiwan into a regional renewable energy hub, and also to come to be a global player in the sustainable room," the report notes, including that stronger legal structures are being created alongside easier investment treatments and mechanisms for renewable energy.

" Strong federal government support has currently equated into robust capitalist rate of interests and also the project pipeline has strengthened accordingly, specifically for offshore wind, which support our favorable ability development forecasts over the coming decade."