Daqo has ideal year as polysilicon rates continued to rise

- Major China-based polysilicon producer Daqo New Energy Corp reported record production and also revenue in the fourth quarter of 2020, resulting in record yearly figures, driven by greater manufacturing levels and also ASPs as polysilicon supply restrictions got worse.

As anticipated, Daqo maximised its polysilicon production capacity in the 4th quarter of 2020 just beating the high-range guidance numbers, because of capacity constraints.

Polysilicon production quantity was 21,008 MT in Q4 2020, compared to 18,406 MT in the previous quarter and also the greatest in the year.

Longgen Zhang, Chief Executive Officer of Daqo New Energy, commented, "During the quarter we generated 21,008 MT of polysilicon, a record-high in our business's background. Our production price was decreased by 2.7% in RMB terms, primarily as a result of our efforts in added energy savings, balanced out by a more than expected increase in the expense of silicon raw material in the 4th quarter."

Daqo reported polysilicon sales volume of 23,186 MT in the reporting quarter, up from 13,643 MT in the previous quarter, a brand-new record for the firm.

" Throughout the months of November and also December 2020, we saw considerable pick-up in polysilicon need from our clients to fulfill their increasing manufacturing requires to serve the expanding solar end-market," included Zhang.

The firm reported polysilicon ASPs of US$ 10.79/ kg in the reporting duration, contrasted to US$ 9.13/ kg in Q3, US$ 7.04/ kg in Q2 and US$ 8.79/ kg in Q1 2020, enhancing 22.8% in the year.

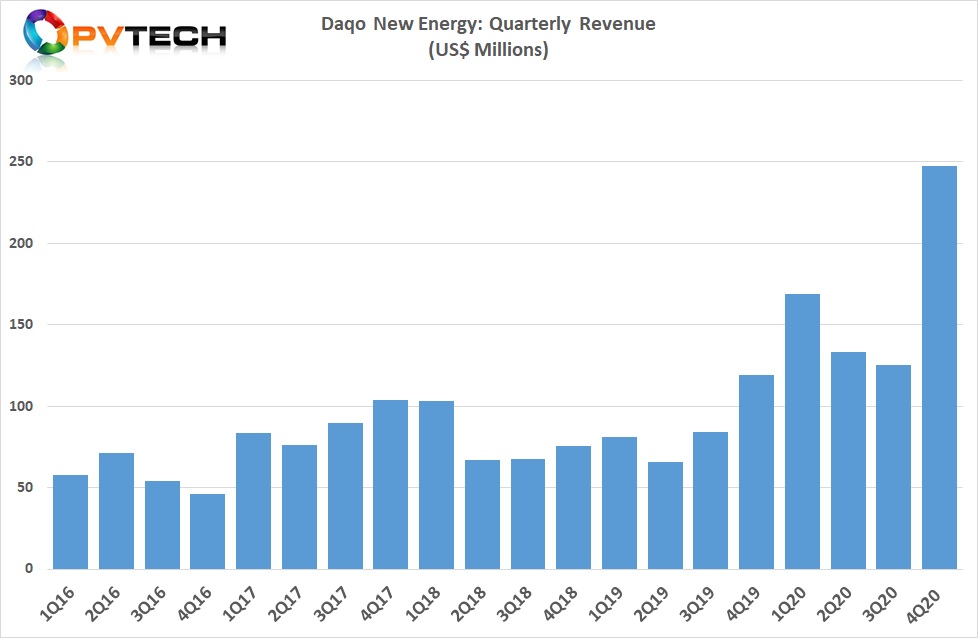

As a result, revenue in the 4th quarter of 2020 got to a record US$ 247.7 million, compared to US$ 125.5 million in the prior quarter, which was impacted by center upkeep and also decreased manufacturing.

Gross profit was US$ 109.5 million in Q4 2020, compared to US$ 45.3 million in the previous quarter. Gross margin was 44.2% in the reporting duration, compared to 36% in the third quarter of 2020.

With strong market need driving ASPs up and maximising production, Daqo reported record annual polysilicon manufacturing volume of 77,288 MT in 2020, compared to 41,556 MT in 2019.

Polysilicon sales volume got to a record 74,812 MT in 2020, compared to 38,110 MT in 2019.

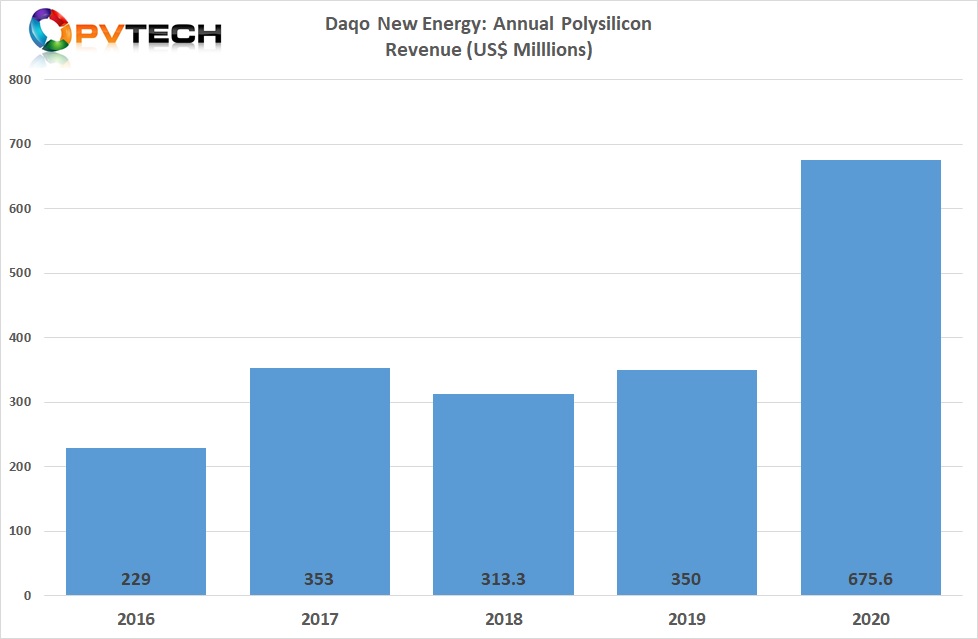

Full-year revenue was US$ 675.6 million in 2020, one more brand-new record, contrasted to the previous US$ 353 million profits record embeded in 2017. Polysilicon ASPs are essentially back to mid-2017 levels.

Guidance

Daqo stated that it expected to produce about 19,500 MT to 20,500 MT of polysilicon and also market about 20,000 MT to 21,000 MT of polysilicon to exterior customers during the first quarter of 2021.

In the full-year 2021, Daqo said it expects to produce roughly 80,000 to 81,000 MT of polysilicon, compared to 77,288 MT in 2020. The minor rise will certainly be because of debottlenecking tasks.

"Given that the start of 2021, we remain to see rising polysilicon market value, and most lately market poly ASP has actually reached a variety of $15/kg to $16/kg. As our mono-wafer consumers proceed their ability expansion prepares sustained by robust downstream market need, our team believe that the supply of polysilicon will continue to be very limited throughout the year given really minimal additional polysilicon supply this year," kept in mind Zhang.

The firm also kept in mind that its Phase 4B polysilicon project with a yearly capability of 35,000 MT was anticipated to begin building in mid-March 2020 and was expected to be completed by the end of 2021 and also ramp-up to full capacity by the end of Q1 2022. This is dependent on its production subsidiary having a successful IPO, due soon.

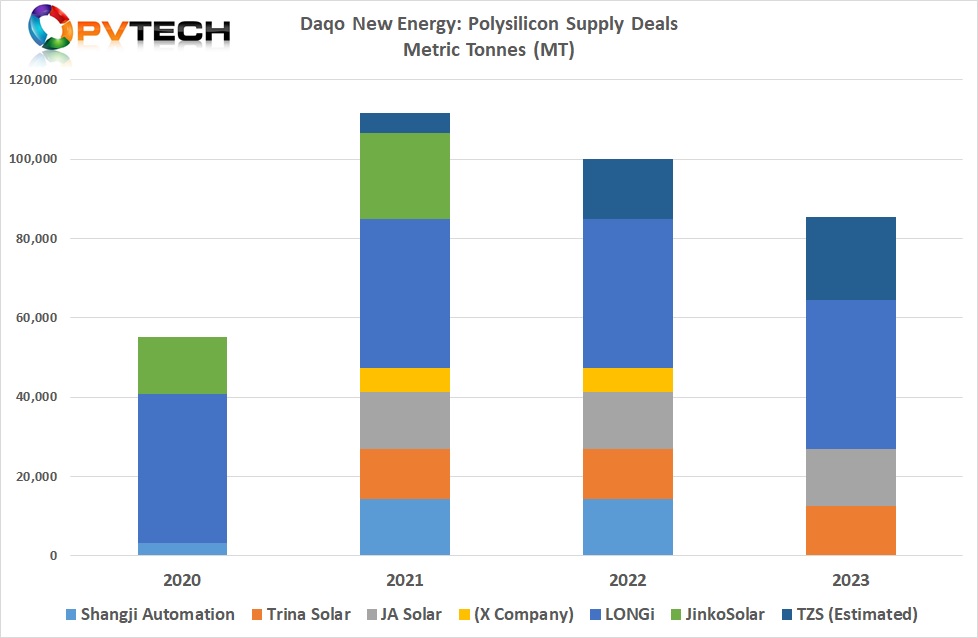

Daqo has authorized a variety of essential supply contracts that restricted extra supply through 2021.

Also read

- Biden to Close Solar Trade Loophole, First Solar Soars

- Sunmaxx Leads Europe with 50-MW PVT Module Factory

- Revolutionary MESK Bridge Boosts Perovskite Solar Cell Efficiency

- Queensland's Solar Panel Recycling Scheme: Turning Waste into Opportunity

- Poland's Renewable Energy Oversupply Forces Production Cuts