Asia to Continue To Be 'Mother of Batteries', Making 1 TWh by 2025: Rystad

- In its monthly energy shift report, Rystad Energy has actually found that Asia, is, and also will continue to be the mother of batteries over the coming decade.

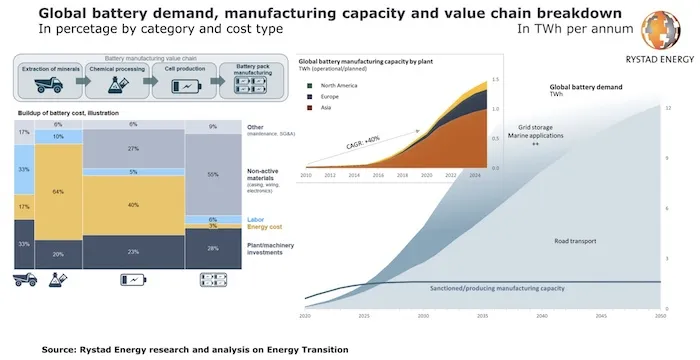

The report information that the globe's current total battery cell production ability will leave 2020 at around 617 gigawatt-hours (GWh) each year. Most of this capability, 516 GWh, comes from generating centers in Asia. Europe adheres to with 61 GWh and also North America with 40 GWh of manufacturing capacity.

Existing sanctioning is readied to develop a boom in capability for Europe and North America in the direction of 2025, while Asia's ability is likewise readied to expand, towering over other continents, and also safeguarding its location as the 'mom of batteries'. In 2025, Asia's manufacturing capacity is readied to double to around 1 terawatt hr (TWh) per year. Europe will adhere to with around 0.33 TWh and also North America with around 0.14 TWh.

The report then takes place to include that presently, the world's battery cell generating capability without a doubt surpasses international need, which is limited to around 140 GWh annually. However, as the electrification of roadway transportation speeds up and also with added battery need from grid storage space projects and also marine applications, the world is now ahead of a ground-breaking need boom, which will currently produce a battery cell supply shortfall from 2026, unless even more manufacturing projects are approved worldwide.

It anticipates a well balanced battery cell market in 2025, with both supply as well as demand at just under 1.5 TWh per year. Demand nonetheless, will certainly continue to grow moving forward as well as is forecast to get to nearly 2 TWh in 2026, including a lot more in the adhering to years. Unless more battery cell manufacturing projects are sanctioned worldwide, the globe is in for a deficiency as well as buyers will need to complete for restricted supply.

According to the projection, road transport demand for battery cells alone will reach almost 12 TWh each year by 2050.

At the price point of battery cells, the report mentions that offered the trajectory of battery prices over the past decade, it would be simple to assume that this decrease will eventually flatten out.

The report writers believe that this case is additional corroborated by the fact that the price of raw materials stands for an increasing share of the total expense for battery cell producers, as well as currently stands at 50-60 percent of the cost of products sold (depending on chemistry as well as form factor). "One could think this leaves minimal space to more enhance economics. Yet if we broaden the evaluation to take a look at the different cost elements of the entire value chain for batteries, we might get to a different verdict."

Looking throughout the whole value chain, the report locates that 34 percent of the cost of battery manufacturing is linked to energy usage. As well as a lot of this includes electrical power used for drying out procedures in the chemical processing as well as cell production stages. With new and improved methods, these prices could be vastly minimized-- a capacity that will likely soon be become aware in cell manufacturing. Furthermore, it anticipates a change towards more vertical combination in the battery sector, with battery producers relocating upstream in order to better optimize the mining and handling part of the value chain.

As both battery cell and battery pack layouts become more been experts and also optimised for their intended applications, there is additionally the prospective to minimize expenditures related to non-active materials, to reduce labor prices through automated manufacturing processes, and also to reduce up front financial investments with improved manufacturing center layout.

Also read

- Pace Digitek switches on 2.5-GWh battery-storage plant in Karnataka

- CATL-led Indonesia Battery Integration Project breaks ground—US $6 billion for a full value-chain hub

- EDF Acquires 500-MW Gate Burton Solar Project from Low Carbon

- Atmos Finalizes Funding for 100-MW Merredin Battery Project

- RPC, Greenfield Win Approval for Vale of Glamorgan Battery Storage