3 Top Solar Stocks To Acquire Now

- The recent selloff in solar supplies has actually opened possibilities; here are 3 leading business in the field to consider.

- 2 massive short-term and long-lasting tailwinds are thrusting solar equities up.

- I profile these 3 leading solar firms and also note regarding why they will likely flourish over the following numerous years.

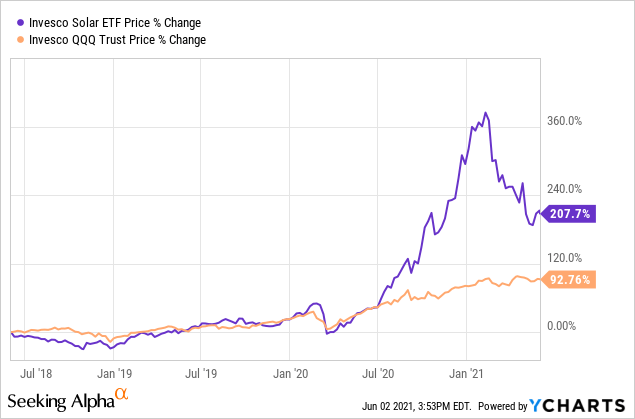

Solar supplies, as evidenced by the Invesco Solar ETF (TAN), skyrocketed last year. Because February, however, they have actually been remedying as well as have actually currently retraced some 30% off January highs. This presents a chance for capitalists in the sector.

The improvement might or might not be over. However regardless, financiers thinking about solar now have entry points at substantially even more affordable evaluations.

Two strong tailwinds driving solar

Why has solar strongly outperformed other markets over the last year? I assume markets are beginning to understand 2 points: First, when all prices are thought about, solar and also wind energy is, in a lot of markets, now less expensive than nonrenewable fuel sources Second, we are seeing expanding, and extremely real, is afraid that climate change, caused by the burning of fossil fuels, will detrimentally impact everybody.

Plunging expenses currently make solar competitive with nonrenewable fuel sources.

Solar and also wind are currently often the go-to source for new power generation. Yes, new fossil fuel-powered plants are still being developed, especially in Asia, however the pace is slowing annually.

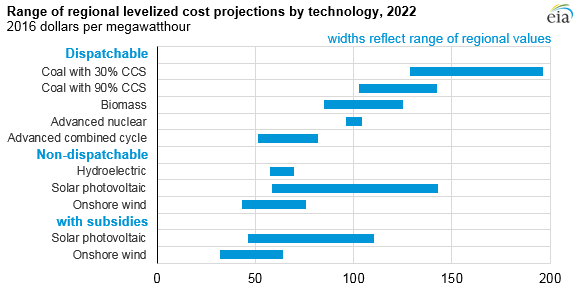

It can be tough to contrast renewable and nonrenewable fuel source energy generation expenses. Several specifications make it simple to predisposition disagreements one way or the other. One method to be somewhat fair and also exact is to use the LCOE (levelized cost of energy) statistics. LCOE takes a look at the total cost to build, gas, operate, maintain, as well as decommission energy generation centers. It after that takes that worth and separates it by the total generation over the facility's life time.

The LCOE graph below programs just how cost-effective solar-generated electrical energy currently is. As noted above, in numerous markets currently it's the cheapest resource for new and also substitute power. It is essential to keep in mind that external nonrenewable fuel source costs such as greenhouse gas discharges are either NOT consisted of or significantly low-balled in the chart listed below - a significant oversight in my opinion.

Resource: EIA

The future looks also much better for solar when you think about that solar prices are promptly falling while those for fossil fuels are either stagnant or climbing (commonly because of source deficiency).

The intermittency problem is being resolved

One of the largest disagreements against solar (and also wind) is that they are periodic and also hence can not be relied upon. That's only partly real however.

Severe weather as well as computer hacks have actually taken down power grids in Texas and also the southeastern UNITED STATE this year. It's time to reassess which is truly much more trusted? The sunlight turning up in the early morning to radiate on your ranges or the availability of fossil-fuel obtained grid energy from distant (commonly foreign) resources.

Intermittency workarounds consist of: solar and wind power being combined. When the sun does not beam the wind often strikes as well as vice-versa. And also what occurs if the sun isn't shining as well as the wind not blowing? Well, that's the factor battery usage is expanding tremendously. As a last hope, there are those costly gas-fired "peaker" plants.

Climate Change: the elephant in the space most do not wish to talk about

Expense is a typical, rational, and commonly debated method for comparing solar as well as nonrenewable fuel source expenses. Yet there is an elephant in the space, one which endangers all of us - specifically climate change brought on by greenhouse gases launched from the burning of nonrenewable fuel sources.

If you pay attention to researchers and also take note, red flags are flashing everywhere: Glaciers as well as polar ice caps are swiftly melting, warming up oceans are eliminating reef and also adversely influencing fish supplies, the arctic environment is warming up and in disarray, as well as severe climate is now typical around the world. It's no longer academic and financial implications are intensifying.

Sadly, the only metric that actually matters - GHG degrees - program little or no sign of reducing their lengthy, steady higher climb. The IEA, identifying the severity of the situation, has an unique report which suggests an end to fossil fuel investment.

However, for capitalists, below are 3 top business most likely to profit; business that are currently correcting and also giving better entry factors.

SolarEdge (SEDG).

SolarEdge is an Israel-based solar part producer. The business markets inverters, power optimizers, interaction tools, and also smart energy management solutions for residential, commercial, as well as grid markets. The company has done very well over the last five years - the supply has risen from around 20 to 250 at the time of creating. The firm has actually expanded tremendously and is currently expanding, offering batteries, grid solutions, EV charging and also much more.

SolarEdge's growth potential customers.

Seeking Alpha provides SolarEdge a B+ with a 5Y quote of earnings growth (fwd) of 24.6%, however also a D- for (YoY) revenue development which dropped 9.56%. In the firm's incomes call records, they blame the revenue falloff in the commercial market on the pandemic - order hold-ups and also higher international freight expenses. However, SolarEdge has actually expanded income approximately 41% each year over the last 5 years and also the business sees revenue going back to pre-pandemic degrees in the 2nd as well as third quarter of 2021.

With a market cap of $13.4 billion, SolarEdge is still a reasonably little business in a worldwide market with big potential. If the company and also analysts are right, revenues will certainly recoup quickly and afterwards continue their march upward.

Just today a new Looking for Alpha write-up details why there is now opportunity in this firm.

Acquire the dip?

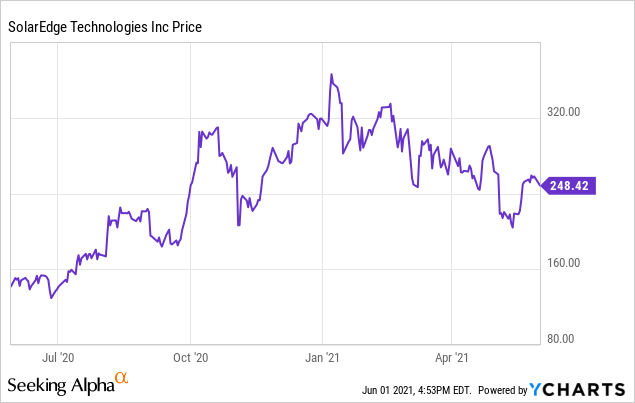

SolarEdge's cost graph over the last year shows a late January optimal at 377. Ever since, the stock has fallen 34% to $248 (at time of creating).

Since the company remains in a fast-growth sector as well as COVID-19 anxieties are fading, I anticipate SEDG to do effectively over the following a number of years.

Financials.

SolarEdge's financials reveal $868 million in cash money, a current ratio of 4, and total debt to equity at 63%.

The price/sales proportion is 8.8, price/book is 11.74, as well as price/cash circulation is 99. The existing PE is 105; analysts see an ahead PE of 40. Price to cash per share is 12.12, and price/free cash flow is 92.9.

Total debt to equity is 63% Debt was mostly non-existent up until the firm provided $550 million elderly notes in the autumn of 2020. SolarEdge intends to utilize the earnings for general business objectives.

My take on SolarEdge.

SolarEdge has a proven performance history and revered management; the business is among my leading holdings. Like the majority of analysts, I anticipate the present income and price dip to turn around soon. Currently perhaps a great time for financiers to include in or initiate a position in the firm. As always, maintain your portfolio well-diversified both within the sector and also in your profile as a whole.

Enphase Energy (ENPH).

Enphase, like SolarEdge, makes and markets equipment that make solar arrays much more effective. The business's primary item is semiconductor-based microinverters which convert electrical power from DC to AC at the panel degree. Microinverters on private panels can be extremely valuable as they lower color issues, a frequent concern.

The company has a mobile app and also e-mail reports so customers can see the number of kWhs their panels have actually created on a day-to-day, regular monthly, as well as annual basis.

Lately the company started supplying battery storage space with their microinverter-equipped solar arrays. Batteries are essential. With them, if the grid goes down your residence or business can keep the lights on and also extra. Enphase's batteries take on Tesla (TSLA) Powerwalls as well as it stays to see just how that will certainly all play out. It's my understanding that both business are having a hard time meeting demand.

On a personal note: I have a little 4.08 kW solar array with Enphase microinverters on my own house as well as have actually been extremely satisfied with it.

Enphase's development prospects.

Enphase was near personal bankruptcy a few years back yet brand-new administration altered points around in a big means. Any individual who had also a small placement and also maintained it would have done incredibly well.

Seeking Alpha provides Enphase an A+ for revenue growth (fwd) yearly of 21.8 % in the following 5 years. Quarterly yoy, most recent quarter incomes, were up 19.31%. Unlike SEDG, solid growth continued throughout the pandemic.

With a market cap of $19.4 billion, Enphase, with its top-of-the-line microinverter modern technology, shows up to have virtually unrestricted future market possibility.

Buy the dip?

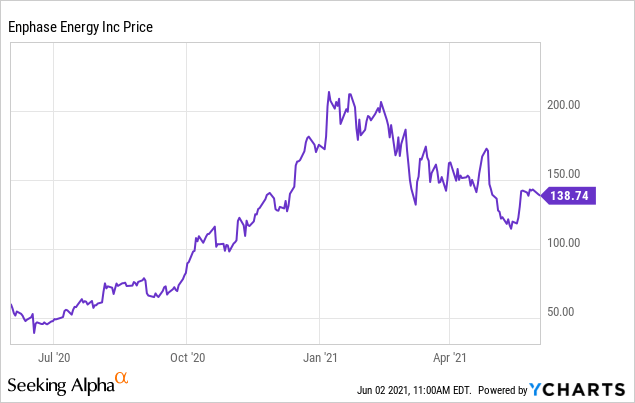

Enphase's rate chart over the last year reveals a late January peak at 229. Ever since, the supply has actually fallen 39% to $139 sometimes of writing. The falloff below seems primarily from overvaluation worries.

This is a fast-growing business, with top solar modern technology, as well as the future shows up wide open for the business to proceed its torrid rate of development - specifically if its storage system batteries come to be as preferred as its microinverters.

Financials.

Enphase's financials reveal $1.49 billion in cash money, a current ratio of 5.2, as well as total debt to equity of 139%. This is a company that has greater debt than SEDG but additionally one which has a greater development price and cash money setting.

The price/sales proportion is 20.4, price/book is 25.8, and also price to capital is 74.8. The current PE is 207 and also experts see a forward PE of 52. There is $11 in cash money per share.

Total Debt to Equity is 139%.

My take on Enphase.

This firm might (or might not) be misestimated. All of it relies on if Enphase maintains its sizzling growth. A falloff in the development price will likely bring the share price down substantially. On the other hand, if the widespread growth continues Enphase's value will likely raise by jumps and bounds.

If you open or have a setting in this company, see future income very carefully. It's extremely unpredictable.

Canadian Solar (CSIQ).

Chief Executive Officer Dr. Shawn Qu established Canadian Solar in 2001 and also under his leadership, the firm has expanded to become one of the biggest (by sales) solar firms worldwide. The firm has actually marketed solar modules, inverters, packages, and storage space to thousands of consumers in over 150 nations. Canadian Solar is up and down integrated and also associated with practically every aspect of the solar industry.

Investors should realize: The firm's name is a little a misnomer. Although headquartered in Guelph, Ontario, much of its raw material, manufacturing, and sales have a strong Chinese part. The CEO hails China. A deterioration in U.S. Chinese relations would likely be detrimental.

Canadian Solar's growth leads.

Overshadowed by its faster-growing peers, Canadian Solar has been mostly overlooked regardless of its large income stream. Seeking Alpha, nevertheless, offers CSIQ an A- for earnings development (fwd). Additionally, note that CSIQ's sales were up 5.6% this year in spite of the pandemic.

Various other analysts additionally see Canadian Solar's development getting. Finviz sees quarterly earnings development YoY of almost 32%.

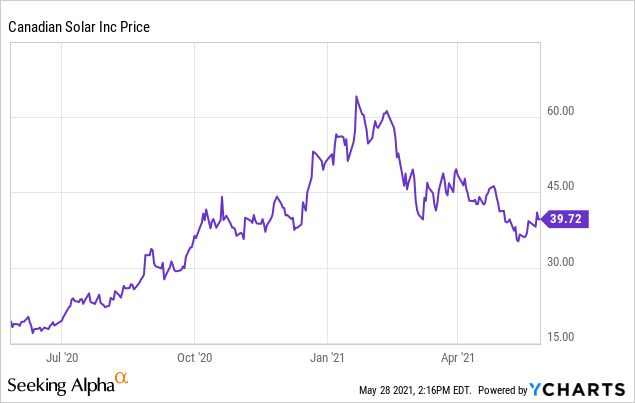

Purchase the dip?

Canadian Solar's rate graph over the last year shows a late January height at 67. Since then, the supply has fallen 40% to around $40 at the time of creating.

Other Seeking Alpha writers likewise see above-average potential in CSIQ. Spending Hobo penciled an article on April 9 in which he notes that though CSIQ is one of the largest companies in the solar sector, it still trades at a single-digit normalized incomes several.

Probably CSIQ is a turtle keeping up hares.

Financials.

Canadian Solar's financials reveal $981 million in cash. Money per share of $16.3 mores than 40% of the current stock price of 39. The current proportion of 1.14. Total debt to equity of 117%.

The price/sales ratio is a low 0.64, price/book is 1.53, as well as price to cash flow is 2.42. Finviz reveals current PE of 42 and also a forward PE of only 11.6. Internet operating cash flow is -$ 121 million.

My tackle Canadian Solar.

Canadian Solar seems among the most effective values in the solar industry. When you contrast P/S, P/B, and P/C Canadian Solar's financials are significantly better. Not so with cash flow though.

The business has a 20-year tested performance history of regular yet not magnificent development and also administration performance. Adding all of it up though, for risk-averse financiers, I feel CSIQ provides a much better worth than other stocks in the field.

One caution: Canadian Solar, like most Chinese-based companies, is prone to UNITED STATE Chinese partnership disturbances. I believe the current U.S. management comprehends that and will do its finest to prevent difficulty.

Verdict.

There is currently a huge change away from nonrenewable fuel sources as well as right into renewables such as solar for energy generation. Driving this are 2 major tailwinds: Falling prices for renewables and also expanding awareness of the hazard to the earth caused by the proceeded burning of fossil fuels.

Even as solar expenses continue to fall, federal governments are likely to progressively penalize "filthy" energy such as nonrenewable fuel sources increasing their expenses. Whether this is removing fossil fuel subsidies, gratifying clean energy individuals, or using federal government requireds as China is, the overview for clean energy is considerably brighter than that for fossil fuels.

As to he environment crisis: In the U.S. President Biden is rejoining the Paris Accord and also is expected to make use of the environment dilemma to stimulate the US economic climate, producing millions of new work.

The 3 companies profiled in this short article, SEDG, ENPH, and also CSIQ are all most likely to benefit from this big worldwide change. SEDG and also ENPH are extra speculative development plays while CSIQ is the much more traditional investment.

As always, you wish to be branched out both within spent sectors and also your portfolio. We stay in amazing times as well as the future is much from particular.