Xinte Energy intending 200,000 MT 'eco-friendly' polysilicon complex in Inner Mongolia

- Major China-based polysilicon producer Xinte Energy is planning the globe's solitary largest polysilicon manufacturing complicated.

The facility, slated for growth near the city of Baotou, Inner Mongolia, would generate 200,000 MT of polysilicon per year.

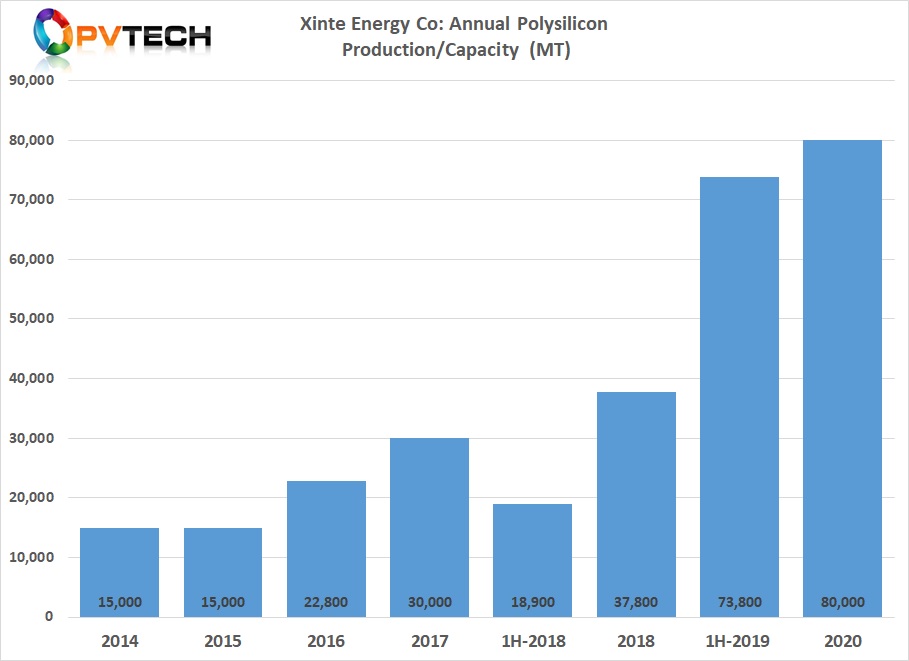

Xinte Energy's existing major hub for polysilicon manufacturing is an 80,000 MT facility in Urumqi, Xinjiang.

The plans, which have yet to go through website selection as well as authorization with the Baotou Municipal Government, include a first polysilicon plant with a yearly capacity of 100,000 MT, requiring an investment of RMB8.0 billion (US$ 1.24 billion).

Should the project be validated this year, Xinte does not anticipate any significant impact on the business's operating performance in 2021.

Nevertheless, after confirmation of the project as well as building and construction approval procedures are agreed, groundbreaking and also building and construction might start within one month. The Phase I forecast is anticipated to take approximately 18 to 24-months to finish.

With worldwide solar need forecasted to increase dramatically in 2021, getting to anywhere between 150GW to 200GW, polysilicon supply in China is restricted with all major cost competitive producers having safeguarded near-term supply contracts and are capacity-constrained up until brand-new polysilicon plants are constructed and also ramped.

Market forecasters anticipate only around 150,000 MT of new polysilicon ability to find on-stream in 2021, with bigger amounts not due till later on in 2022 as well as past when worldwide solar end market demand could be much surpassing 200GW per annum.

Typical polysilicon prices (ASPs) have actually dramatically boosted since the second-half of 2020 as a result of capability restraints. In reporting third quarter 2020 financial outcomes, polysilicon manufacturer Daqo New Energy said its ASP was US$ 9.13/ kg in Q3 2020, compared to US$ 7.04/ kg in Q2 2020.

Spot market ASPs have hit US$ 14/kg to US$ 15/kg in 2021. The solid prices has actually resulted in higher wafer as well as solar battery costs, impacting margins for PV module manufacturers currently being impacted from dramatically higher PV glass expenses, once again because of capacity restraints in China.

Carbon impact

The Stage I intends by Xinte consist of developing its very own power plants to feed the 100,000 MT polysilicon plant. Xinte has actually previously built coal-fired power stations near coal mines and sent power to the neighboring production plant.

Nevertheless, Xinte noted that the Baotou plant would call for around 10GW of PV as well as wind power plants to give power, which would certainly be built in tandem with the plant needs.

Not remarkably, Xinte noted that the 2nd 100,000 MT polysilicon plant would certainly be developed according to market demand after the initial plant was operational.

The carbon footprint of polysilicon production can end up being a major issue in relation to downstream PV nuclear power plant bidding process and also potential government policies in the EU, US and various other nations, which would certainly impact China-based PV module makers abilities to compete on major overseas projects in the future under 'Environment-friendly New Deals'.

Also read