Why Solar Stocks Are Rallying Versus All Probabilities

- Viewing the news is among the most hazardous things you can do as an investor. I recognize it's counterproductive. Nevertheless, many financiers wish to be as informed as feasible. But enjoying CNBC or any other monetary media electrical outlet won't give you an "side.".

Most information is "valued in" long before the chatting heads cover it. To put it simply, investors that act upon information are usually late. The mainstream media also fixates on trouble. And also it's obvious why: anxiety offers. However it's not simply the speaking heads on TELEVISION that you need to worry about.

The news you review online can be just as damaging to your wide range. You most likely would have sold all your supplies back in March if you paid attention to all the adverse headlines! This is why I never ever view the news.

I Concentrate on "Cost Action" Instead.

Cost activity tells me exactly how supplies are behaving. It lets me know if they're ready to rip higher, or accident. You can see this habits by checking out graphes.

As an investor, I take a look at numerous graphes on any offered day. I do this due to the fact that price is unbiased. It does not have a schedule or political prejudice. Instead, it reflects what capitalists are really finishing with their money.

Which's the only point that matters. Every little thing else is just noise. Today, I'll show you how focusing on cost alerted me to a substantial opportunity in solar supplies. I'll inform you why solar stocks are most likely headed a lot higher.

Solar Stocks Belong To the "Eco-friendly Energy" Change.

This is just one of today's largest megatrends. Megatrends improve the world. They commonly play out over years, sometimes decades.

The increase of the net, the "digitization" of cash, and also the explosive growth in social media are a few of the greatest megatrends of the last years. Wise financiers who participated these megatrends early made an outright killing.

Online seller Amazon (AMZN) has actually increased more than 12,000% because going public in 1997. Bitcoin, the world's most preferred cryptocurrency, has actually soared greater than 2,000% given that the beginning of 2015. As well as social media sites titan Facebook (FB) has spiked 400% considering that its 2012 IPO. 5 years from currently, solar companies will be discussed in the very same breath with these "hall of popularity" stocks.

As well as Yet, the Solar Market's Been Getting Only Criticism Recently.

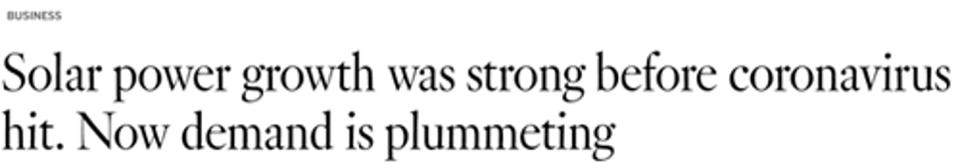

Check out this heading that the Los Angeles Times released last month.

RESOURCE: LOS ANGELES TIMES.

Morgan Stanley (MS) analysts additionally projected a 48% decrease in residential solar need for the 2nd quarter! For the 3rd as well as 4th quarters, it's projecting declines of 28% and 17%, specifically.

Research study firm Timber Mackenzie is similarly cynical. It just recently warned that residential solar need could dive 34% this year.

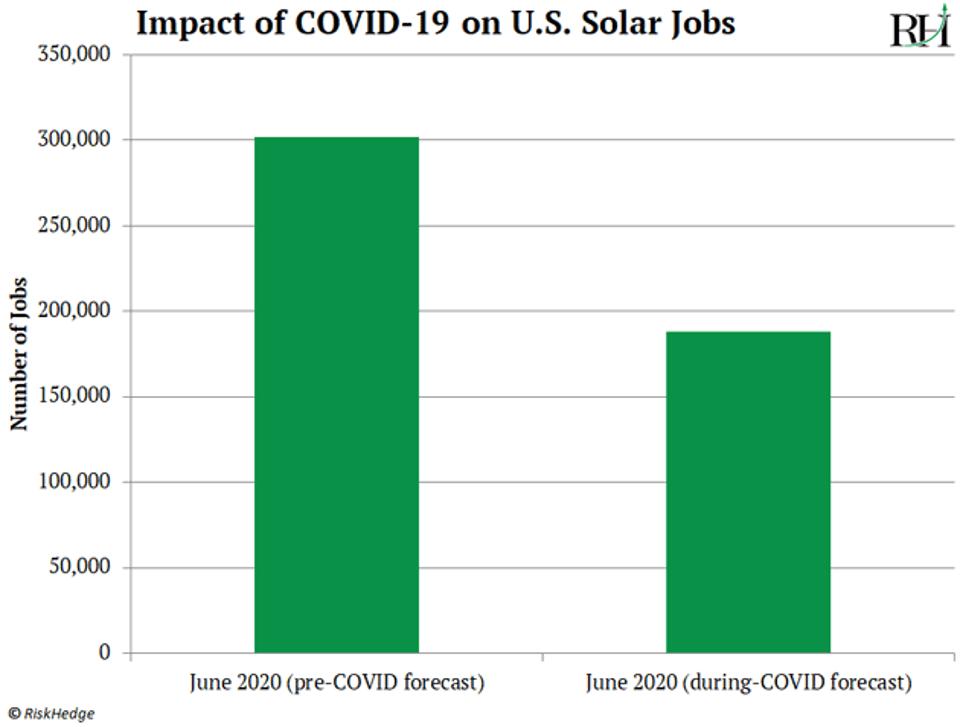

Not just that, the Solar Energy Industries Organization (SEIA) forecasts the US solar market can lose virtually 114,000 tasks with June due to a "considerable contraction in the household installment industry." That would certainly get rid of five years of job growth for the market!

Source: RiskHedge.

Google "solar supplies" and you'll find dozens of terrifying tales similar to this.

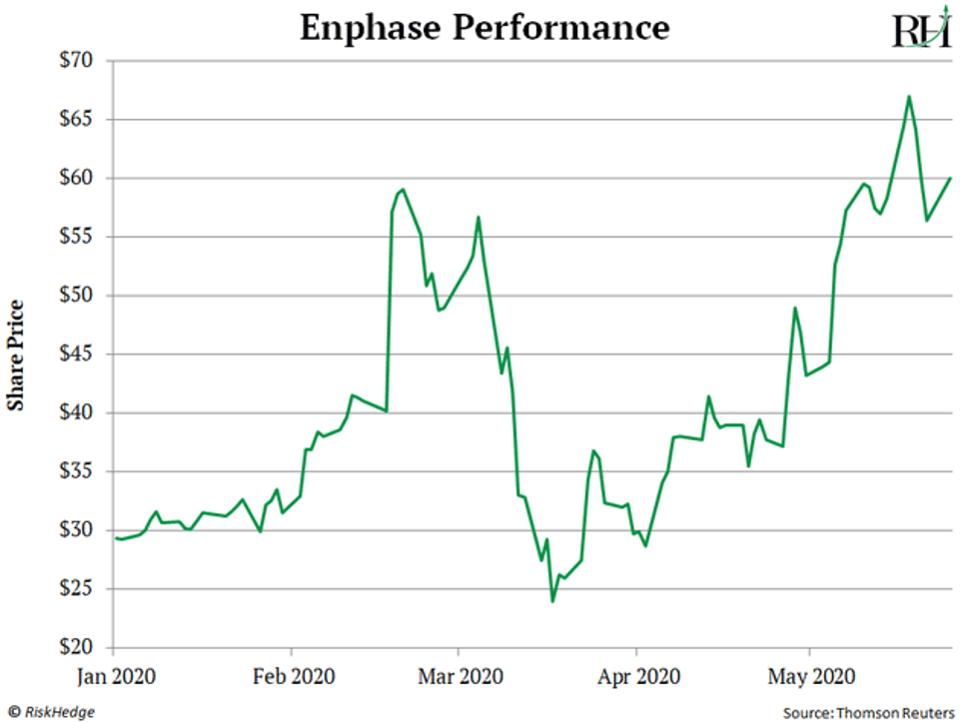

So, you 'd may believe I'm avoiding solar supplies like the plague. But I really invested in Enphase (ENPH) a couple of weeks back. Enphase is just one of my top solar supplies as well as among today's best supplies duration. Its stock cost has risen nearly 9,500% given that 2017!

Enphase isn't just leading a megatrend. It's also an incredible service. Its sales and also earnings are both expanding at more than 100% each year.

Still, I didn't buy Enphase for any of those factors. I bought it since its price action was so favorable. After selling off in March, Enphase promptly reclaimed its 200-day moving standard.

Simply put, Enphase was still in an uptrend in spite of the marketplace crisis as well as consistent stream of trouble about the solar industry. Because bottoming in March, Enphase has risen greater than 170%! That's almost five times the S&P 500's return over the very same duration.

Source: RiskHedge.

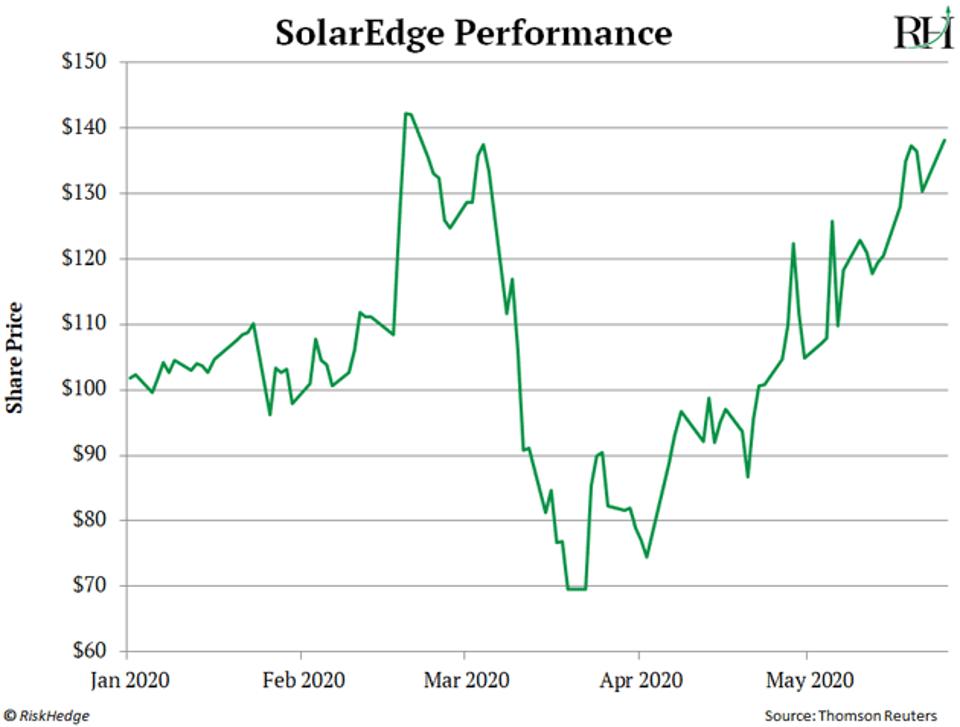

Enphase Isn't the Only Solar Stock That's Rallying.

Take a look at this chart of SolarEdge (SEDG)-- an additional one of my leading solar energy stocks. It's soared 100% greater given that March! It's trading currently within 1% of all-time highs.

Resource: Thomson Reuters.

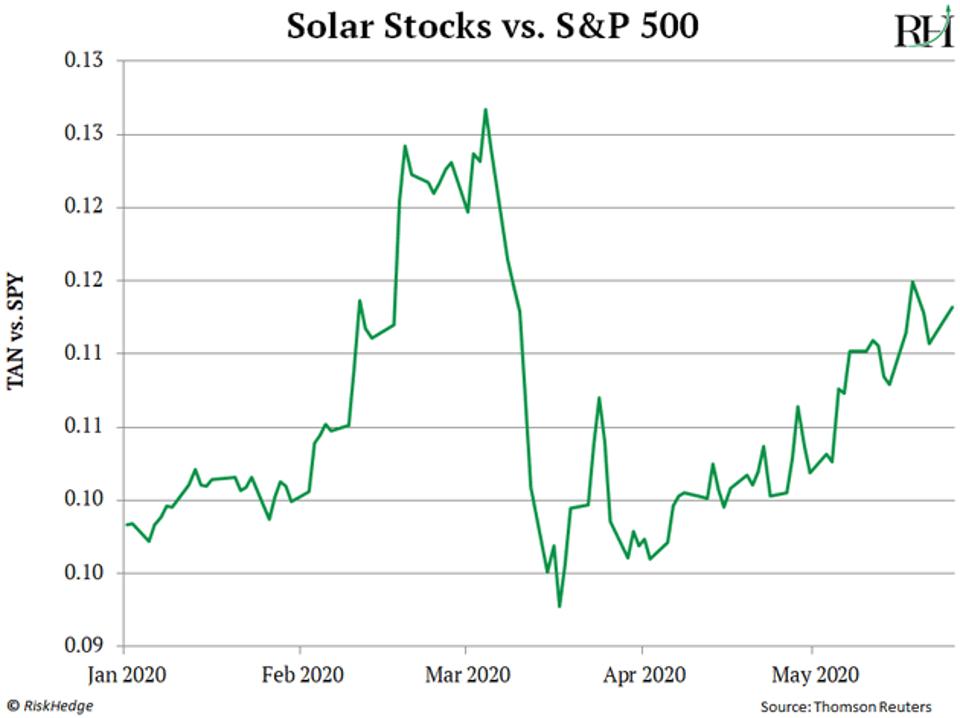

Solar stocks aren't simply delivering huge gains. They're crushing the marketplace. Below's a graph of the Invesco Solar ETF (TAN) versus the S&P 500. TAN buys Enphase, SolarEdge, and also 23 various other solar supplies.

When this line is increasing, it indicates solar stocks are outperforming the S&P 500. When it's dropping, solar stocks are delaying the market.

Resource: Thomson Reuters.

Solar supplies have actually left the broad market in the dust because US supplies bottomed in March. They're leaders in every sense of the word. And those are the only supplies I want to have. Obviously, you're most likely asking yourself:.

Why Would Certainly Solar Supplies Be Rallying in the Face of All This Trouble?

Have capitalists shed their minds? Absolutely not. Rather, the "smart money" sees the big picture. They comprehend that it's still the very early days for solar power.

Solar panels cover simply 6% of the globe's roofs worldwide! In the US, solar represent simply 1.5% of US electrical power. That will alter in a large method.

Because 2009, the expense to produce electrical energy utilizing solar has actually plunged 90%. It's now cheaper than lots of "dinosaur energy" resources. By 2022, the price of solar is projected to fall by as long as 34% more!

This is a large reason the SEIA expects the overall capability of photovoltaic panels to greater than fold the next five years. Not just that, the International Power Agency (IEA) anticipates green projects to roll out at the fastest price in four years. To put it simply, this market isn't slowing down. It's speeding up!

Solar power is now anticipated to be the fastest-growing part of the renewable resource market for the following three decades. And the US Bureau of Labor Data claims photovoltaic panel installments will be the fastest-growing US work market over the following 8 years.

The smart money sees where things are headed. That's why it made the most of the recent sell-off by loading up on solar supplies.

Sadly, several day-to-day investors did the exact opposite. They stress marketed their solar stocks since they paid attention to all the criticism. They forgot the big picture.

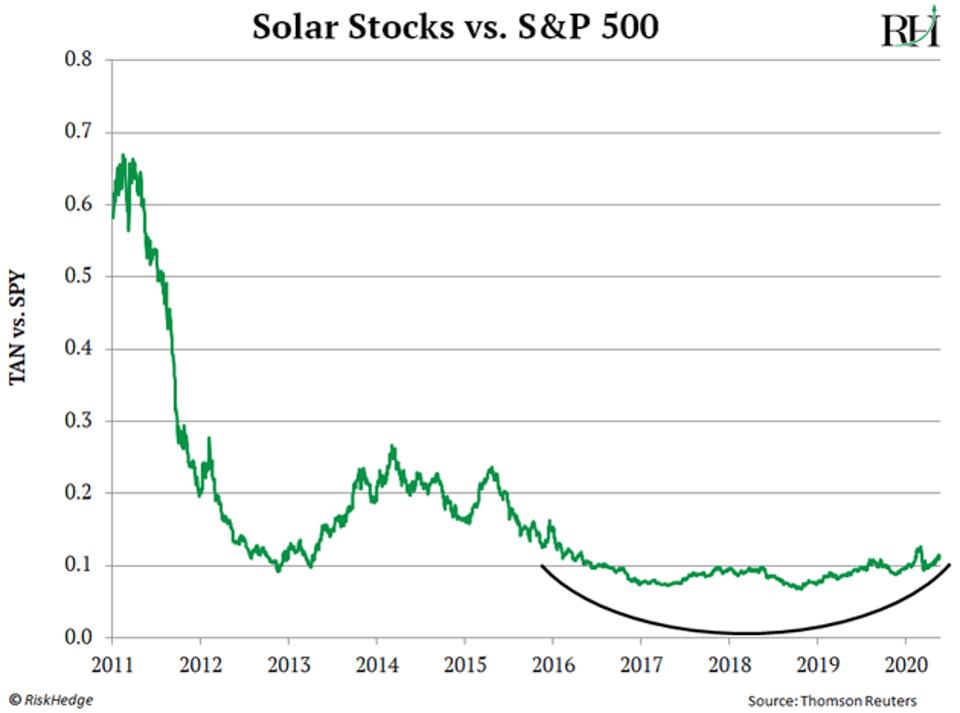

However don't fret if you missed out on this preliminary surge. The future of solar energy stays as bright as ever before. Actually, I expect solar stocks to crush the broad market for several years to find. To comprehend why, check out this chart. It compares the efficiency of TAN with the SPDR S&P 500 ETF (SPY).

Source: Thomson Reuters.

You can see that solar stocks underperformed the S&P 500 for nearly a decade. It had not been up until late 2018 that the trend turned. Ever since, TAN has actually defeated the S&P 500 by more than five-fold!

That's considerable outperformance. Yet this crucial proportion remains to print greater highs and higher lows. This is extremely favorable. It tells us solar stocks should outmatch the S&P 500 for several years ahead.

Also read