Why Green Supplies Are Slumping During an ESG Boom

- Regardless of long-term development leads, there seems to be less excitement for the industry, according to experts.

In spite of a drop in clean-energy stocks and escalating problems regarding extensive greenwashing, the market for investment products sold as being ESG-related had another record year by the majority of yardsticks.

Issuance of sustainable loans and also bonds, where profits are allegedly earmarked for environmental projects or to advance a business's social objectives, surpassed $1.5 trillion, consisting of about $505 billion of green bond sales; ESG-focused exchange-traded funds drew in almost $130 billion in 2021, up from $75 billion a year ago; and investment in early-stage climate technology firms came close to $50 billion.

It additionally was a year of large costs for united state managers of sustainable funds, with profits climbing to almost $1.8 billion from $1.1 billion in 2020, according to information compiled by researchers at Morningstar Inc

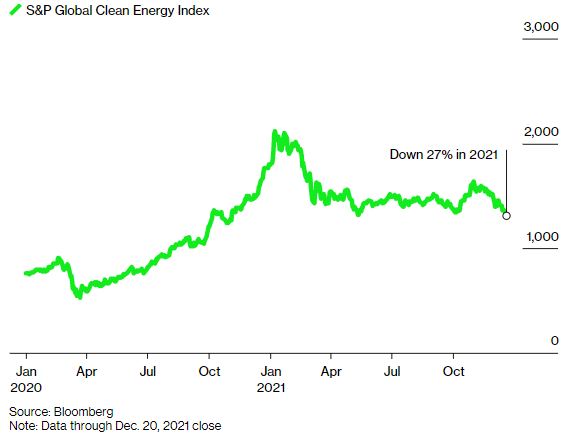

But not everything went one way. The S&P Global Clean Energy Index, which includes business like wind-energy huge Orsted AS, Spanish utility Iberdrola SA and Sunrun Inc., the largest united state residential-solar company, has declined 27% so far in 2021, after greater than increasing in value last year.

Underperforming Year

Global clean energy index has actually shrivelled after 138% gain in 2020

The outlook for green stocks is testing because of stress over increasing rates of interest linked to rising cost of living, unforeseeable U.S. national politics as well as governing maneuvers like The golden state's decision to sharply lower aids as well as add brand-new costs for home solar customers, claimed Sophie Karp, an analyst at KeyBanc Capital Markets.

" In spite of long-lasting development prospects, there is subsiding interest for the market," she claimed.

Adeline Diab, head of ESG research study for EMEA and the Asia-Pacific area at Bloomberg Intelligence, agreed. On Dec. 21, she wrote: "Despite mounting drivers with the united state framework plan and also EU taxonomy requirements, the clean-energy market might continue to be subjected to unpredictability linked to government assistance such as stimulus delays or incentives-cuts statements, the most current remaining in California."

Shares of renewable energy supplies hit an additional speed bump this week when united state Senator Joe Manchin, a conservative Democrat from coal state West Virginia, shocked his very own party by announcing his resistance to President Joe Biden's financial plan, that includes a site financial investment in the battle versus international warming. Manchin, whose enact an evenly-split Us senate was required when faced with global Republican opposition to considerable initiatives to combat international warming, has weakened Biden's bid to deal with the climate crisis.

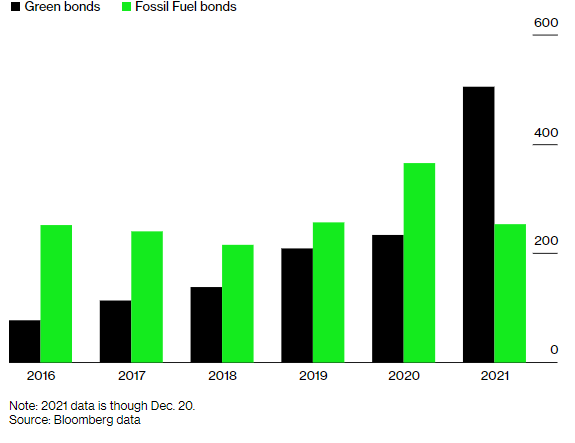

Green Bond vs. Fossil-Fuel Bond Issuance

Despite having the stock exchange slide, this year was still the initial considering that the Paris climate contract in late 2015 that even more cash went into green bonds than debt issued by oil, gas and also coal firms.

And also following year is shaping up to be larger. Analysts at Morgan Stanley estimate that green bond issuance will come close to $1 trillion in 2022, led by sales from the European Union.

Bank of America Corp., the most significant business provider of united state bonds sold as being connected to environmental, social as well as administration factors, likewise is anticipating one more big year for global sales of the financial obligation.

" Will ESG main issuance market double once more in 2022? We're not making that forecast," stated Karen Fang, the bank's international head of lasting finance, in a meeting recently. "Yet we do think it will certainly grow very, extremely highly given the momentum behind the worldwide net-zero change and also financier need."

Sustainable financing briefly

- Pimco and Fidelity shun net-zero alliance that was welcomed by BlackRock.

- This quant investor uses expert system to see if company execs speak the truth regarding sustainability.

- Microsoft and also Tesla fuel ESG gains for 32-year-old Fidelity fund.

- Goldman Sachs says that it plans to slash its financed exhausts.

- Wall Street banks deal with new pressure to reduce fossil fuel financing.

Also read