What's the Future of Solar Development in Latin America?

- Wood Mackenzie experts provide an overview as well as solar pricing for the Latin American market.

In spite of coronavirus-related troubles, 2020 will be just one of the largest years for solar demand in Latin America. The duration 2020-2025 will certainly see utility-scale dispersed solar expand in several nations in the area, led by Mexico, Brazil and also Chile, with distributed solar broadening most swiftly in Brazil.

But in spite of dropping system costs, development in the area will certainly be rather constrained, and also a lot of it will be balanced out by traffic jams in Mexico reducing its pace of renewable resource growth. Programmers in the area will likewise encounter enhanced competition in the market due to reduced system prices as well as minimized power prices.

Country demand as well as system cost trends

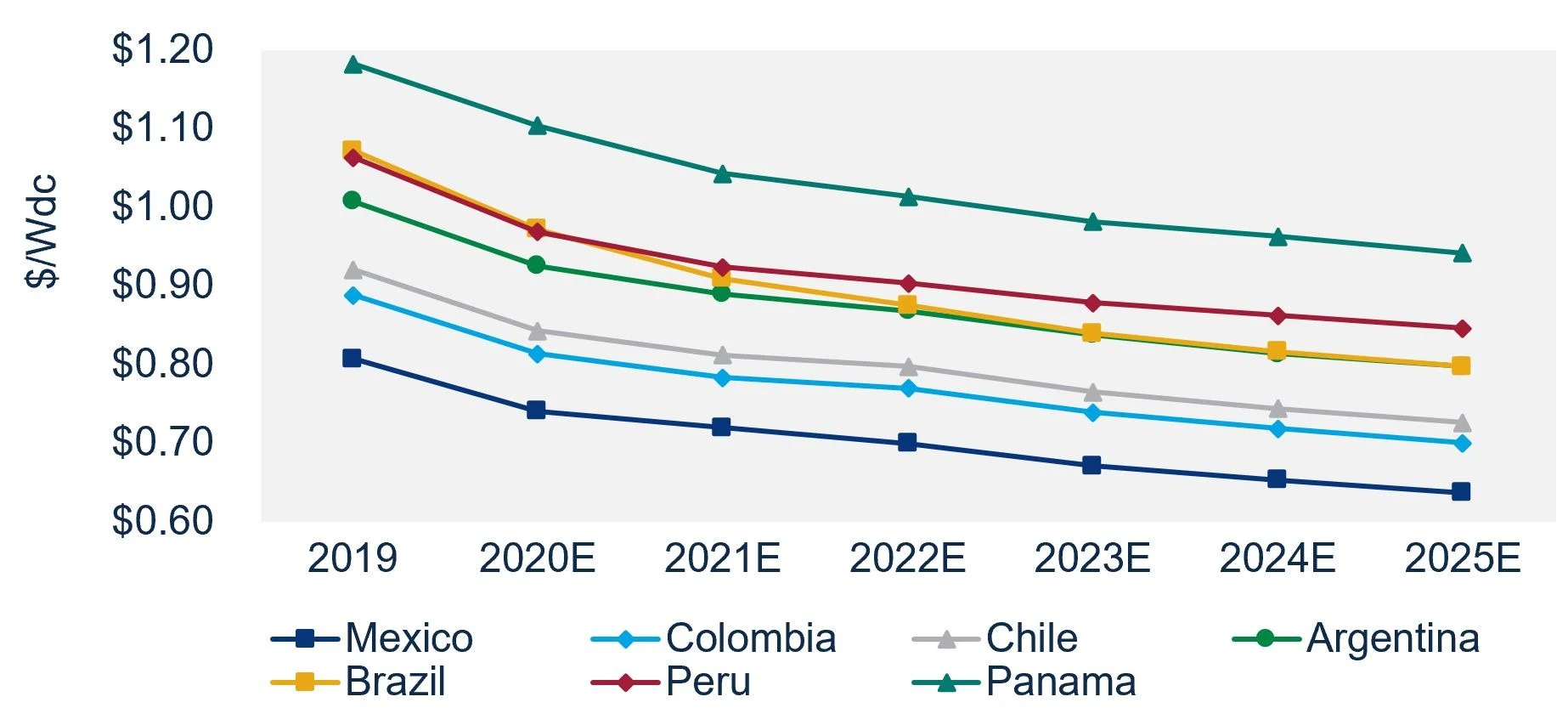

As utility-scale solar need climbs up in 2020, system prices will certainly drop. According to new study from Wood Mackenzie, average utility-scale system prices in significant Latin American countries are expected to decline 9 percent from 2019 to 2020.

Mexico will have the most affordable system prices of all the major markets analyzed, with Colombia and Chile close behind. Dropping module costs, in addition to increased competitors among developers and design, purchase and building and construction (EPC) providers, will contribute to minimized system expenses. Enhancing component power thickness will certainly likewise drive down prices.

All-in utility-scale PV system expenses by country in Latin America, 2019-2025E ($/ Wdc).

Source: Wood Mackenzie.

Wood Mackenzie approximates solar PV installments in Mexico will certainly expand by just 7 percent this year contrasted to 2019, a slowdown that is linked to enhancing political as well as regulatory uncertainty and high development expenses because of pandemic-related delays.

The slowdown will continue into the 2020s. No brand-new public auctions are intended in the direct future because of an unfavorable shift in plan from Mexico's government and also brand-new actions that do not motivate exclusive financial investment in the eco-friendly electrical energy field.

Brazil's expanding utility-scale pipe deals with a somewhat different set of difficulties. Although Brazil's pipeline of utility-scale projects keeps growing, these projects' operational and also financial feasibility depends upon a boost in energy need, which in turn can jeopardize their operational timelines. Capability enhancements will certainly slow by around 2023 when the federal government is expected to get rid of transmission price subsidies for renewable resource projects.

On the other hand, Brazil has actually incentivized growth in its dispersed solar sector, which expanded 266 percent between 2018 and 2019. Internet metering as well as low-interest-rate funding from exclusive as well as public financial institutions are anticipated to fuel additional development through 2025.

Chile's solar market will experience extraordinary growth in 2020 and also 2021, driven in component by its Pequeños Medios de Generación Distribuida (PMGD) regime as well as an audio policy framework targeted towards renewable energy investments. The PMGD plan warranties designers a steady rate for projects approximately 9 megawatts (Air Conditioning). However, this prices framework is anticipated to transform in the very first fifty percent of 2022, when developers go through varying costs.

Challenges to solar development.

Power oversupply and a reduction sought after in both Brazil and Chile have actually challenged solar project economics as well as boosted the competition of reciprocal power-purchase arrangements. Delays as well as troubles in getting governmental authorizations have come to be an extra concern for designers in countries like Brazil and Mexico. In Mexico, the procedure of acquiring correct allowing as well as affiliation contracts has come to be progressively testing for programmers under the existing government, as well as the COVID-19 pandemic has actually just made issues worse.

Designers in Mexico face various other difficulties, including securing financing and long-term power-purchase agreements, due to the threats related to regulative uncertainty. The Mexican federal government likewise calls for a social effect assessment for new project growth, which can increase programmer expenses. Social consult demands have actually likewise been a cause for setbacks in Colombia, particularly in the north where neighborhood areas have substantial impact and are vital in the advancement of projects. Relying on their degree of experience operating in Colombia, programmers may opt to hire external experts to navigate the local processes and variables, which can raise costs.

Nevertheless, while dropping costs will be a chauffeur of future solar demand, significant Latin American nations will encounter headwinds that will certainly feat market development over the following five years.

Brazil faces a few of the greatest system costs in Latin America, partially because of regional material demands and import tolls. Even though the import tolls on solar components were gotten rid of earlier this year, system expenses stay greater than standard.

Brazil additionally experiences unstable foreign exchange rates, and designers may hold back on acquiring devices if prices negatively impact a project's success. Like Brazil, Argentina also chooses regional web content, which can enhance system costs. Better, the political as well as financial unpredictability in Argentina has developed an unfavorable atmosphere for brand-new solar growth.

If solar demand slows down year-over-year, system costs may drop at a slower price as a result of decreased EPC and also developer competitors.

Past 2020.

Even as utility-scale solar development is hindered in some countries past 2021, system prices are still expected to fall. High demand for bifacial module modern technology will remain to drive down soft costs; the very same trend might appear with system costs as these component rates come to be affordable with monofacial module prices. In addition, complete solar demand in these major Latin American nations will certainly likewise be driven by the distributed generation segment as prices remain to drop, particularly in Brazil and Chile.

Chile's new PMGD cost framework, slated to roll out in 2022, will likely increase need for projects to be finished before that time but could prevent growth after the rollout, provided the fluctuations baked right into the new rate system.

Regarding domestic solar, Chile, Mexico as well as Brazil all have appealing expectations. Mexico maintains the lowest average residential system rates at $1.04/ Wdc in 2020, while several projects report complete prices well under $1.00/ Wdc. Both Mexico and Brazil have reduced barriers to access for household installers, which enhances competitors and also will certainly contribute to future domestic rate declines.

Sound monetary placements as well as local expertise will certainly be crucial for brand-new market participants as markets mature as well as competitiveness boosts. While hardware element prices remain to drop, programmer expenses remain elevated with really little room to reduce year-over-year.

There will be an increased concentrate on lowering these developer costs as nations in the area make progress with their eco-friendly developments.

Strong market conditions and plan frameworks will be most importantly important to sustain boosted growth.

Also read