Wafer dimension shift in the midst of Covid-19

- As the Covid-19 pandemic takes the globe by tornado, worldwide supply chain procedures stay interrupted, as well as solar events that were kept in the very first quarter of the year saw less producers showing their most recent items.

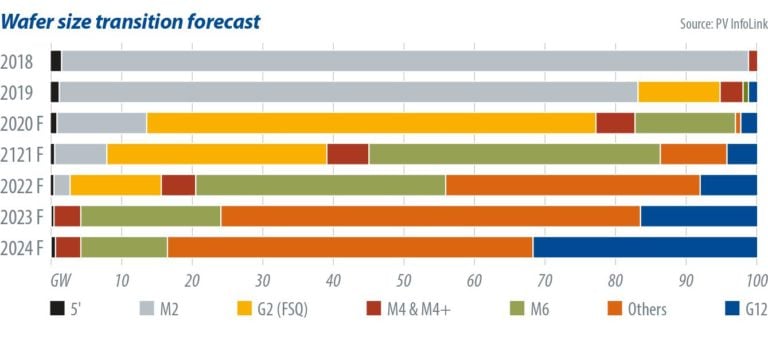

Regardless of the recurring pandemic, innovation in innovation has actually not reduced one little bit. Several Chinese producers revealed brand-new ability development strategies after the conventional Lunar New Year break, while some have actually relocated online to present brand-new items as well as modern technology roadmaps. The modification in wafer dimension is a typical style, as well as continues to be among the warm concerns of the year.

Projects safeguarded under China's 2019 tender system are anticipated to maintain need throughout the very first fifty percent. Nevertheless, the timing has actually been postponed to the 2nd to 3rd quarters because of the infection break out. As the majority of these projects were made to utilize components based upon M2 (156.75 mm) wafers, providers of M2-sized mono cells are experiencing an absence of need, thus speeding up cell makers' button to G1 (158.75 mm).

In the module field, just a few suppliers took on the M6 (166mm) style in the initial quarter. A huge quantity of M6 cell ability included considering that the 2nd fifty percent of 2019 has actually been left underbooked therefore. Some cell manufacturers that generated M6-sized cells for that reason went back to G1 dimension previously this year. That raised the share of the G1 style to greater than 60%, making it the mainstream style of the year.

Numerous module manufacturers intend to begin generating M6-cell components in the 3rd and also 2nd quarters, as the bigger wafer aids enhance the module power result as well as lowers the price per watt. It's anticipated that the marketplace share of the M6 style will certainly begin to expand in the 2nd fifty percent, as well as level with G1 as 2 mainstream items in the marketplace by the end of the year.

500 W components

Zhonghuan Solar and also Trina Solar are advertising the G12 (210mm) layout. Risen introduced that it will certainly begin generating some G12-cell components in the 2nd fifty percent of the year. With producers presenting G12-cell components in on the internet seminars held after the Lunar New Year and also the capability of this item to bring module power result to 500 W, there is an expanding passion in G12 in international markets.

As several ingot drawing heating systems have actually been mounted given that in 2015, wafer producers can generate bigger wafers without needing to manage issues such as not enough capability, return prices, and also damage prices. Nonetheless, cell as well as module producers require to take numerous problems right into factor to consider, from damage prices as well as module weight limitations to the opportunity of updating older assembly line, along with price/performance and also end market approval. These problems develop unpredictability around bigger wafers and also the development and also instructions of growth.

The change to bigger wafers is anticipated to happen throughout the 2nd fifty percent of this year and also will certainly proceed right into 2021. It is not most likely to be accomplished at one time, like the earlier changes from slurry to ruby cable saws or from M0 to M1 to M2. There may be 2 or 3 mainstream layouts on the marketplace by the end of 2022.

Tools choice is one more difficulty dealing with suppliers, as well as currently with the Covid-19 pandemic interrupting the market, this year's ability development ends up being a lot more vague. On the cell side, if cell makers take on 210mm for brand-new lines, returning to smaller sized dimensions will certainly sustain added expenditures as well as might influence manufacturing effectiveness. So, lots of producers with strategies to broaden ability have not called a layout. Furthermore, it's unsure which tools these makers will certainly make use of, as their routine for bringing brand-new ability online has actually been postponed by the pandemic.

On the module side, lots of suppliers are selecting tools that works with measurements as much as 210mm, considered that wafer dimensions are altering swiftly as well as 166mm and also 180mm+ layouts could be made use of throughout the two-year shift duration.

Generally, up and down incorporated firms have actually counted on contend on wafer dimension. Throughout the 2020-21 duration, the leading 5 module makers will certainly create and also create partnerships wafer dimensions of their very own. These growths will certainly figure out the mainstream wafer dimension in the future.

Causal sequences

Many Chinese makers closed manufacturing down or reduced application prices in very early February in action to the coronavirus break out, damaging the solar supply chain. As procedures began going back to regular from completion of February forward, capability application throughout the supply chain rose to 80% in March, maintaining the supply of components slowly. Nevertheless, the ongoing spread of coronavirus endangers a recession, as well as the influences will certainly surge via the production field and also bent on worldwide need in March with April.

On March 10, China's National Energy Administration (NEA) launched "Notice on the Measures connected to Wind as well as Solar Power Generation in 2020," which lays out a clear regulative structure for PV growth this year. It specifies that the solar aid for this year completes CNY 1.5 billion ($211.4 million) and also the entry due dates for projects under the public auction regimen have actually been held off till the center of June. This recommends that end-market need in China will certainly transform cynical.

At the time of creating, the Chinese federal government had yet to determine whether grid-connection target dates need to be expanded past March 31, June 30, and also Dec. 31. Nonetheless, it has actually been claimed that the March 31 as well as June 30 target dates could be expanded for one more quarter. Versus this background, expected need will not grab the slack up until Q2-Q3 in China, as well as any kind of enter need will certainly rely on China's choice on the Dec. 31 target date expansion. In the meantime, Chinese need is forecasted to drop a little less than 40 GW this year.

As the coronavirus dilemma gets worse in Europe and also the United States, ripple effects on abroad need will certainly start to arise, however to what level need will certainly be impacted relies on when the break out can be included.

Also read