Volatile European power markets may be obscuring substantial cannibalisation risk

- High power prices in Europe may be obscuring the impacts of cost cannibalisation that intimidates the future earnings of renewable energy on the continent, with a 'belt of doom' observed in Germany and Spain at risk of 30% cannibalisation prices by 2030.

That's according to renewables advisory company Pexapark's most current report, The Cannibalization Effect: Behind the Renewables' Silent Risk, which urged renewable energy business to consider price cannibalisation right into their factors to consider.

" As renewables' payment to the energy mix continues to boost, predominantly providing power on a periodic basis, there is a risk that generators will certainly be eating into their own revenues," claimed Pexapark, which looked at Germany, Sweden as well as Spain for its report.

The firm discovered that in Spain, capture prices were at risk of "constantly dropping listed below the baseload rates", potentially leading to cost cannibalisation of up to 30%.

" As the nation is additionally leading the European PPA Market, offtakers have highly decreased rates of Pay-as-Produced (PAP) PPAs, due to worries of future cannibalisation," said the report.

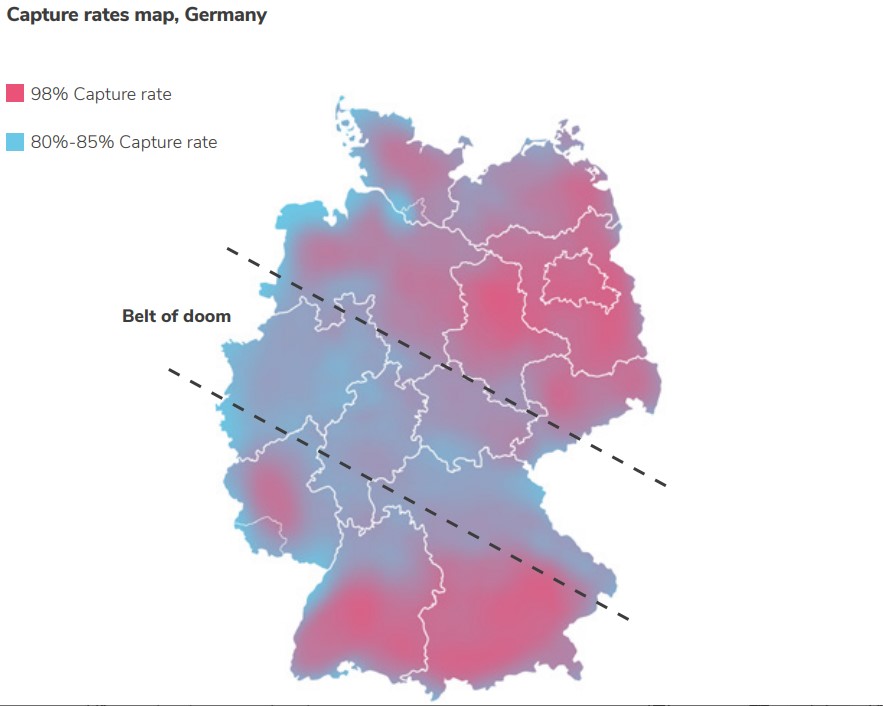

Somewhere else, in Germany, Pexapark has demarcated a 'belt of doom' throughout the middle of the nation in which capture rates are the lowest, nearly 20% less than various other locations. It offers the instance of the mountainous south of the country in which wind power release is lower, causing capture rates being higher.

Although it does keep in mind exactly how "when approximating earnings, it's not only the capture rate that matters, however also expected volume" and that "when such data are combined with location-specific production yield evaluations, investors can become aware an extra exact monetary design around the investment case of a new project."

Pexapark recommended: "Better exposure of capture elements is one of the essential elements in the energetic management of cannibalisation.

" Historic and also forecasted capture rates are a vital input consider PPA analytics thereby helping decision support on PPA frameworks, energy risk coverage and the quantification and modelling of cannibalization offsetting methods like investment in energy storage space."

Its COO and also co-founder Luca Pedretti claimed that "while the current emphasis for renewable resource investors and operators is around unmatched degrees of market prices and also rate volatility, the energetic monitoring of cannibalisation risk has come to be similarly vital as part of detailed eco-friendly income and also risk administration."

Speaking to PV Tech back in February, Pexapark claimed that European eco-friendly power business should begin signing much shorter PPAs as volatile European power prices throw the market right into uncertainty and also disarray.

Also read