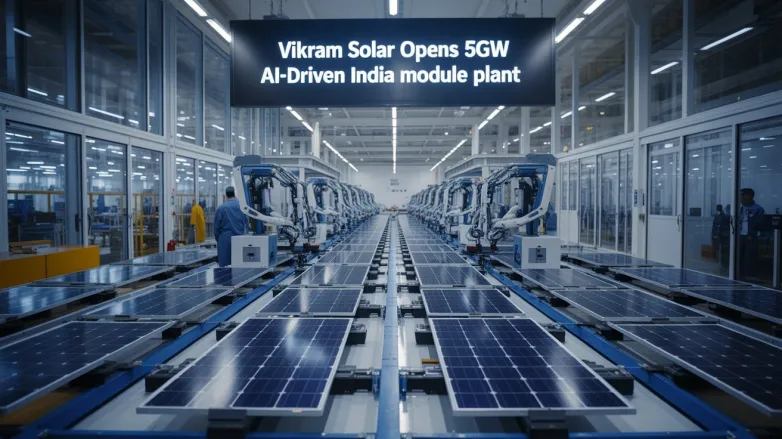

Vikram Solar Opens 5GW AI-Driven India Module Plant

- Vikram Solar’s 5 GW Vallam plant debuts advanced, AI-driven module manufacturing, slashing costs and boosting domestic TOPCon/HJT output—powering India’s PLI-fueled push for competitive, import-light solar growth.

Vikram Solar inaugurated a 5 GW solar module plant in Vallam, calling it among India’s most advanced. The fully automated line uses robotics, precision handling, and AI-driven quality checks to boost consistency, cut waste, and lower production costs. The move aligns with India’s push to curb reliance on imported panels and deepen domestic PV capabilities.

Backed by Production-Linked Incentive schemes, the facility will produce high-efficiency modules for utility-scale and commercial projects, targeting rising demand for TOPCon and HJT products. The launch underscores India’s rapid solar expansion and signals growing manufacturing maturity and global competitiveness across the country’s renewable-energy supply chain.

How will PLI-backed automation boost Vikram Solar’s TOPCon/HJT output and cost competitiveness?

- Higher throughput: robotics and high-speed stringers/layup cut takt times, lifting effective line capacity for TOPCon/HJT beyond nameplate via improved OEE and faster recipe changeovers.

- Yield gains: AI EL/PL inspection and closed-loop process control catch microcracks, PID/LID precursors, and metallization defects, pushing cell/module yields toward 98–99%—critical for fragile HJT thin wafers.

- Consistent binning: tighter IV and electroluminescence variance improves power-class uniformity, raising average W/module and ASPs without extra material cost.

- Metallization savings: automated fine-line printing/sputtering and paste deposition control reduce silver consumption for HJT and enable SMBB/copper plating pathways, cutting $/W.

- Wafer handling precision: vacuum/gripper robotics reduce breakage on M10/G12 thin wafers, lowering scrap and improving bifaciality retention for TOPCon/HJT.

- Inline process optimization: real-time thermal/pressure tuning in lamination and low-temp HJT steps enhance passivation, boosting efficiency by 10–30 bp and throughput simultaneously.

- Predictive maintenance: sensor-driven uptime management minimizes unplanned stops; higher utilization spreads fixed costs over more output, reducing conversion cost per watt.

- Material utilization: precision cutting, foil interconnect control, and glass/EVA nesting reduce waste, lowering BOM cost and environmental footprint per watt.

- Flexible platform: software-defined tooling switches between TOPCon and HJT recipes (including different busbar counts and wafer formats), supporting demand swings without retooling downtime.

- Energy intensity reduction: optimized annealing/PECVD/sputtering sequences cut kWh/W, improving operating margins and PLI-linked performance metrics.

- PLI leverage on capex: incentives de-risk advanced tools (ALD/PECVD, sputter lines, laser contact opening), accelerating adoption of TOPCon/HJT nodes that deliver higher efficiency and incentive multipliers.

- Local value-add: PLI encourages backward integration (cells, wafers, glass, EVA/backsheets), trimming logistics and import duties, stabilizing input costs, and improving delivery times.

- Price competitiveness: combined yield, throughput, and BOM savings lower ex-factory $/W, while higher efficiencies shrink BOS/LCOE for buyers—supporting premium positioning against imports.

- Faster ramp and scale credibility: automated QA with traceability shortens customer qualification cycles, unlocking utility-scale orders and export opportunities.

Also read