US probe right into solar imports threatens almost 2/3 of prepared capacity additions in 2022: Rystad Energy

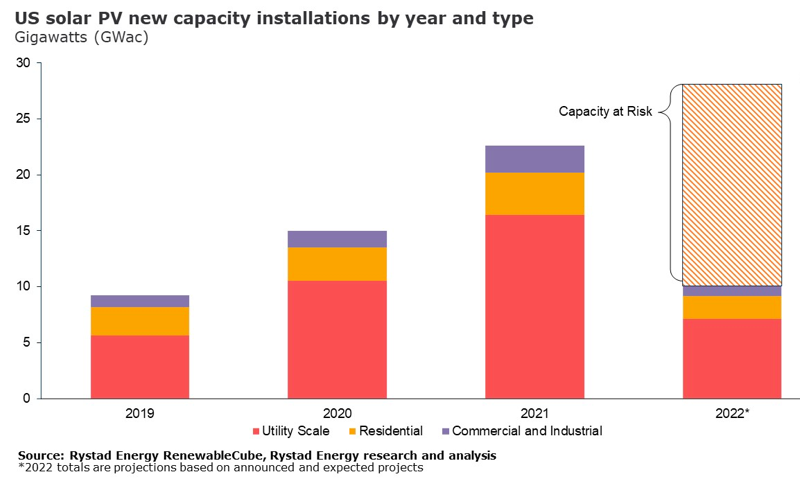

- The US was expected to mount 27 GWac of solar power capacity in the utility, household, as well as commercial and also industrial (C&I) markets this year, yet with rising commodity rates and this brand-new threat of tariffs on vital imports, 64% of those additions are currently in jeopardy.

As much as 17.5 gigawatts (GWac) of intended United States solar capacity setups in 2022 are in doubt after the Department of Commerce (DOC) opened up an examination right into panel imports from southeast Asia, Norway-based Rystad Energy research study programs.

The US was anticipated to mount 27 GWac of solar power capacity in the utility, household, and also commercial as well as industrial (C&I) markets this year, yet with increasing commodity costs and this brand-new hazard of tariffs on vital imports, 64% of those additions are currently in jeopardy.

The recent launch of an Antidumping and also Countervailing (ADCV) examination by the DOC has US providers worried about prospective penalties on panel imports, which would likely be backdated. In feedback, Chinese panel producers are stopping shipments to the United States till the results of the investigation and also any type of retroactive activity by the DOC is exposed. A preliminary reasoning is scheduled for August, with a final decision due by January 2023.

The investigation comes as residential US solar companies are worried concerning the increase of Chinese suppliers making use of affordable basic materials and changing cell as well as panel setting up to southeast Asia to circumvent an existing ban on Chinese imports. With imports iced up while the examination is pending, annual capacity additions might plummet from 22.6 GWac in 2021 to 10.07 GWac this year, the lowest annual total amount because 2019.

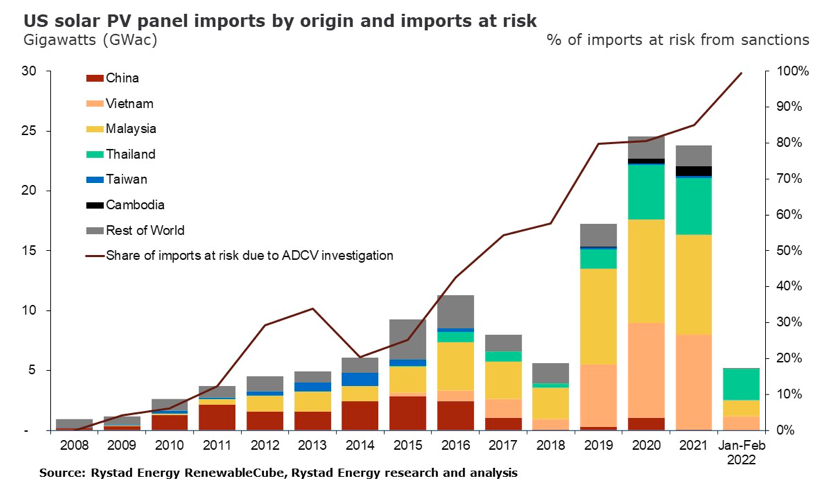

The DOC is examining imports from four Southeast Asian nations that play a pivotal role in the US market-- Cambodia, Malaysia, Thailand and also Vietnam. Imports from these nations accounted for 85% of all solar panel capacity brought right into the US in 2021, amounting to 21.8 GWac. In January and February of 2022, their total share of imports was 99%.

" In an effort to restrict affordable Chinese solar panels going into the market from southeast Asia, as well as with one eye on the goal of fortifying a residential supply chain, the United States has seriously dented its solar capacity forecast for 2022 and past. This could be the most turbulent event ever to deal with the US solar industry," states Marcelo Ortega, renewables expert with Rystad Energy.

Just how the freeze took place

On 25 March 2022, the United States DOC chose to examine a petition by residential PV supplier Auxin Solar concerning composite silicon (cSi) solar PV panels sourced from Cambodia, Malaysia, Thailand and also Vietnam. Auxin declared that Chinese panel suppliers circumvent ADCV rules by offshoring cell and panel assembly procedures to the 4 countries while still utilizing affordable Chinese basic materials.

In a 2012 examination into Chinese suppliers, ADCV tariffs were eventually used at different rates to various suppliers. One of the most common rate was 30.66%, however some rates dropped as reduced as 24%, while other distributors were penalized a 250% tariff. If the DOC chooses a tariff extension is required, devices imported after the examination statement would be allowed, but tariffs could be backdated on imports as far back as November last year. In between November 2021 and February 2022, United States purchasers imported $1.46 billion of solar panels from the 4 southeast Asian nations under examination, indicating Chinese suppliers could be collectively responsible for anywhere between $365 million and also $3.6 billion in added tariffs. Chinese panel makers hesitate to risk such excessively high penalties, and also lots of have decided to totally stop panel exports to the US.

The probe is not limited to cSi PV panels but additionally includes PV cell imports. This is significant for the United States residential panel manufacturing market as its 5 GW of capacity is mostly panel assembly and also counts heavily on cell imports from abroad. Last year, 46% of imported cells originated from the nations under examination. United States producers are additionally feeling the effects of the examination. Although the threat of assents may incentivize providers to build United States PV production centers, it would certainly take a minimum of 18 months to develop a residential supply chain from polysilicon to assembled panel. If financial investment decisions are made after August 2022, when initial outcomes are to be announced, this capacity would be functional in January 2024 at the earliest.

Antidumping probe includes extra anxiety to US market

Also prior to the probe, the United States PV market started 2022 in a tough place. More than 7 GWac of solar PV was delayed last year by more than 6 months due to high commodity prices, federal tax obligation credit uncertainty and unfavorable policies. This included the US government's December 2021 decision to outlaw imports containing goods from China's northwest region of Xinjiang because of reported human rights misuses dedicated against the Uyghur people. With 40% of the world's silicon production based in Xinjiang, this policy successfully halved the number of panels that can be imported to the United States, interrupting the already ropy supply chain.

Theoretically, if panel manufacturers can confirm they resource silicon and also elements from beyond Xinjiang, their exports will certainly be unaffected. Nevertheless, before the ban, suppliers did not need to track the origin of their inputs, as well as any traceability system takes time to implement. In practice, the rules lay out in the brand-new expense are ambiguous and involve unidentified risks for vendors as well as investors. Although the regulation imposes a ban on all Xinjiang products, the US currently has a partial ban on panels with silicon sourced from this area. In June 2021, United States Customs and also Border Protection (CBP) outlawed imports of photovoltaic panels containing silicon produced by 4 Xinjiang-based silicon manufacturers. This caused CBP detaining imports until the polysilicon source could be shown. Chinese panel vendors assert between 40 megawatts (MW) to 100 MW of panel capacity has actually been restrained, though the specific degree continues to be unknown.

Rystad Energy is an independent energy research as well as organization intelligence business giving information, tools, analytics and working as a consultant solutions to the worldwide energy market.

Also read

- Emeren Brings In Boralex Veteran for U.S. Arm, Flags $20 Million Q2 Impairment

- Congress Clears Trump-Backed Bill Slashing Clean-Energy Tax Breaks

- BSR Secures €400M for UK Solar and Storage Expansion

- ARENA Backs Luminous Robots for Solar Innovation Boost

- TotalEnergies Expands Caribbean Renewables, Divests Half Stake of Portuguese Portfolio