US Crackdown on Solar-Tariff Dodgers Endangers Biden's Green Ambitions

- Commerce Department's trade probe findings threaten to chill planned US solar panel projects.

The US federal government's searching for that some Chinese solar producers are escaping decade-old tariffs threatens to undermine initiatives to fight climate change worldwide's greatest economic climate.

While President Joe Biden's landmark climate law is currently stimulating a resurgence in domestic clean-energy production, the US stays heavily depending on imported photovoltaic panels. And also the preliminary trade probe searching for launched Friday by the Commerce Department might chill planned solar projects nationwide, by revealing imported panels from Southeast Asia to tariffs as high as 254% as quickly as June 2024.

The turmoil might jeopardize Biden's green ambitions, including his push to decarbonize the country's electrical field by 2035. The action can indicate higher prices for panels and threats stifling solar setups in one of the globe's largest renewables markets. That would certainly hold up the worldwide press to move from fossil fuels to cleaner-energy options.

" There is no question that this will certainly slow setups in the United States," Joe Osha, an analyst at Guggenheim Stocks, said in a meeting. "Project developers will have to take a much more holistic view at their supply chain and think about points like geopolitics and also civils rights-- not what's cheapest."

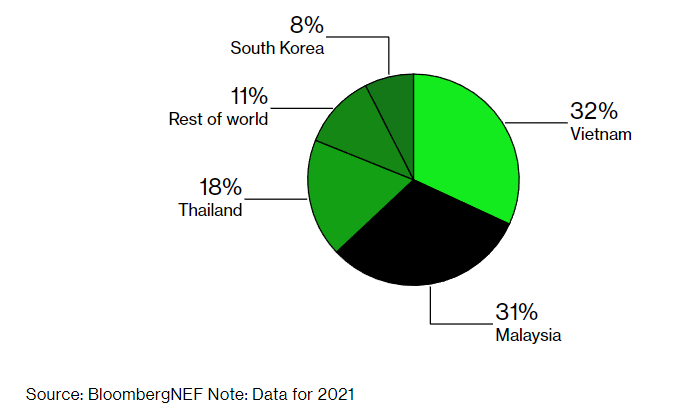

United States Solar Imports

Vast majority of panels are shipped from Asia

The Commerce Department said in its initial finding that some Chinese solar makers had actually escaped decade-old anti-dumping as well as countervailing duties by finishing panels in Cambodia, Thailand, Malaysia and also Vietnam. The agency is continuing its probe, which is meant to be quasi-judicial and also without political disturbance, with a final decision expected in May.

" A reasonable and also equal opportunity is critical as firms start considerable expansion plans," claimed Mike Carr, executive director of the Solar Energy Manufacturers for America Coalition.

Although slammed by solar programmers as well as some advocacy teams, the ruling was narrower in scope than some had expected. Business that were not specifically identified by Commerce-- however have procedures in the four nations-- can prevent new tariffs by officially attesting their products are "not made making use of wafers created in China."

Still, the US firm's move presents yet one more obstacle for a supply chain still reeling from Covid-related obstacles. Solar programmers expect higher administrative expenses therefore, injuring their competition versus various other power sources consisting of gas.

The searching for likewise produces new difficulties for the Biden management, which is attempting to stabilize 2 oft-competing objectives: improving clean-power installments that depend on imports while attempting to restore domestic manufacturing.

Commerce selected 4 suppliers as having actually been originally located evading anti-dumping as well as countervailing duties on China by finishing production in the region: BYD (H.K.) Co. Ltd. in Cambodia, Canadian Solar Inc. in Thailand, Trina Solar Scientific Research & Technology in Vietnam and also Vina Solar Technology Co. in Vietnam, a unit of Longi Green Energy Technology Co.

Longi, the globe's biggest solar firm, claimed in an emailed declaration to Bloomberg that the searching for will not impact its procedures nor will certainly it transform its plans for the American market. Reps for the other business didn't respond to requests for comment. Another 22 companies were likewise regarded to be evading tariffs since they did not accept the probe.

If the preliminary finding is settled, the US would begin gathering cash deposits as high as 254% for damaged imports beginning June 6, 2024, though most business would undergo rates below 35%.

Effects will be felt long before the tariff moratorium lapses because "solar business are making important 2024 procurement decisions now," claimed JC Sandberg, interim head of the American Clean Power Association.

Biden formerly sought to soften the blow by freezing new tariffs for affected solar imports via June 2024, however it's unclear that moratorium will certainly survive possible lawful scrutiny. And experts highlighted the United States market is most likely to remain heavily reliant on solar imports also after that point.

" Domestic manufacturing is not likely to offset overseas supply," Timothy Fox, a ClearView Energy Partners analyst, claimed in an interview. "You can not develop a module without inputs, as well as those originated from overseas."

Also read