United States boom in the darkness of a black swan

- Supply-chain restrictions connected to China's coronavirus episode might weigh on the efficiency of the U.S. solar market in 2020, composes SPV Market Research's Paula Mints.

In 2019, the implementation of solar applications took off throughout the United States. For safe harbor objectives, programmers acquired ahead of the Investment Tax Credit (ITC) decline. At the same time, need started to grab for tiny as well as domestic business installers amongst customers excited to make the most of the 30% ITC.

In spite of the intro of tolls, demand-side market individuals appreciated the advantages of fairly reduced module costs. While they were associated with the video game of tariff-exclusion whiplash, individuals were delighted when bifacial components got, shed, as well as gained back exemptions from tolls. As numerous solar battery kinds offer themselves to bifaciality-- IBC, HIT, HJT, as well as PERC-- the bifacial exemption makes tolls moot, offered the gigawatt degrees of capability that are readily available. When the ITC testimonial is wrapped up, tolls might be securely back in position for bifacial cells and also components.

And afterwards a "black swan" jumped down over the worldwide solar sector that triggered makers to downsize or shutter ability throughout practically the whole PV production supply chain. The black swan occasion was the coronavirus pandemic, which has actually confirmed to be the undesirable present that goes on offering.

The coronavirus pandemic has actually quit some Chinese PV production cold (pp. 44-47), and also it has actually begun to drip right into various other markets. It will certainly take greater than one quarter to recuperate, as all module parts-- consisting of basic materials, consumables, and also completed items such as backsheets, glass, cells, structures, and also wafers-- have actually been impacted.

Supply restrictions as well as greater rates are encountering yet one more ITC decline. The U.S. solar sector can anticipate tighter materials and also greater costs throughout 2020. Safe harbor purchasers might locate it testing to meet safe harbor demands with solar components, and also maybe, with balance-of-system parts. Those wanting to set up systems entailing any kind of application this year might wind up missing out on a couple of due dates. Developers, installers, module assemblers, and also thin-film producers throughout the nation will certainly require to make some challenging choices moving forward.

Residential manufacturing

The U.S. solar market hasn't been self-dependent considering that the 1990s. Presently, there is no crystalline cell manufacturing in the nation. First Solar, which generates CdTe-based slim movie, is the nation's key cell supplier. Module setting up in the United States is expanding, with greater than 3 GW of setting up capability in the nation at the end of 2019, omitting First Solar.

The United States is an import market. The cells that module assemblers need to be delivered in from abroad. The nation requires to import 10 GW or even more for residential module setting up in order to please need. The majority of the solar glass is imported. A lot of backsheets are imported. The majority of light weight aluminum and also steel are imported. The present misstep in the international PV supply chain can conveniently come to be a situation for the U.S. solar market.

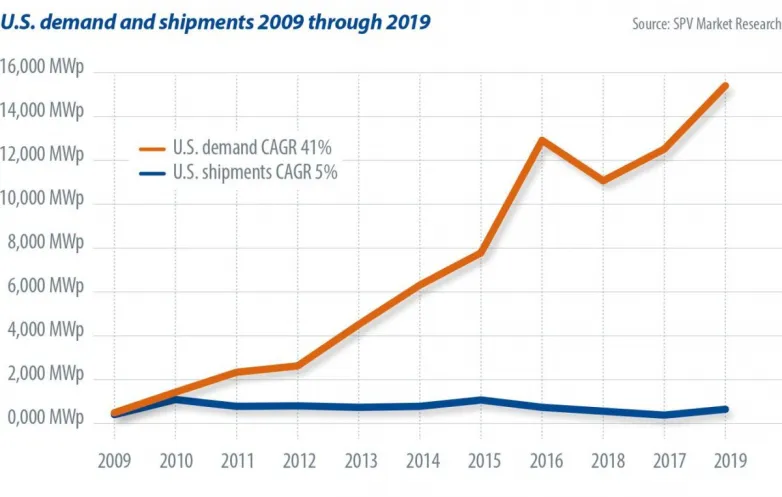

The graph to the left (base) information U.S. need as well as deliveries from 2009 via 2019. It highlights why it is clear that the existing black swan occasion is a trouble for the U.S. solar market.

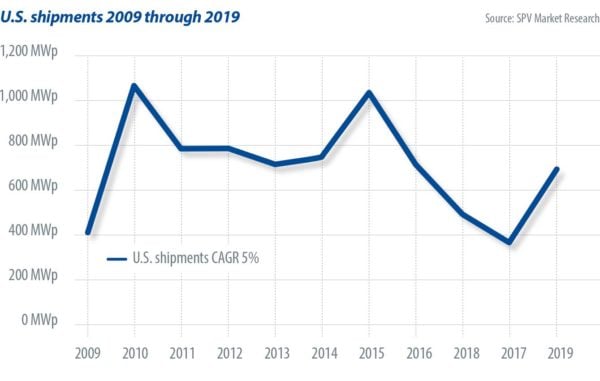

The graph to the right (top) provides a more detailed take a look at U.S. deliveries from 2009 with 2019. The uptick in deliveries in 2014 was primarily as a result of First Solar's boost in making capability.

Core final thoughts

At the end of 2019, U.S. demand-side individuals were expecting a market pick-up driven mostly by yearly reductions in the ITC. Individuals expecting Congress to restore the 30% credit rating ought to solidify their hope with the realities: This is a political election year, as well as Democrats as well as Republicans are a lot more partial than ever before.

Assumptions for a solid 2019 proceeded right into 2020, till supply-chain disturbances ended up being difficult to disregard. Genuinely, a dip ought to be anticipated in 2020 in the capability to meet need, which is most likely to continue to be constricted for a long time. In the meantime, anticipate greater costs for components.

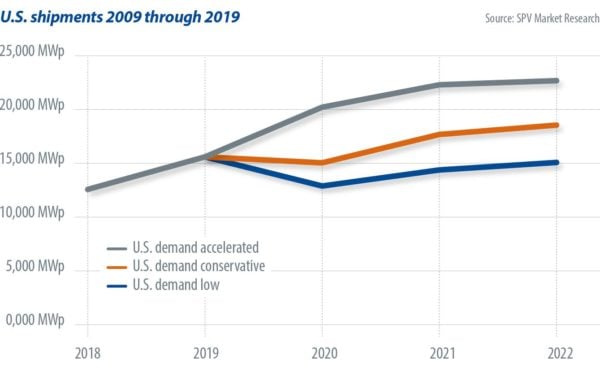

The graph to the appropriate deals U.S. need from 2018 with 2022. Keep in mind that need ticks down in 2020 for both the traditional and also reduced circumstances.

Also read