Ukraine's legislation on FIT restructuring has passed: The specialist sight

- Ukrainian renewable resource lawyer Svitlana Teush takes a look at the legislation which will certainly specify the cuts to be used in Ukraine after extensive negotiation between federal government as well as the clean energy sector.

Yesterday, long-awaited draft law No. 3658 On the Amendments to Certain Laws of Ukraine on the Improvement of Support for the Production of Electricity from Alternative Energy Sources (Law), was adopted by the Ukrainian parliament following its second and final analysis. Adoption concluded a lengthy negotiation procedure regarding restructuring the feed-in tariff (FIT) support device for renewables in Ukraine, with the stated objective of enhancing the FIT's sustainability and also supporting market liquidity.

The negotiations entailed vital policymakers and also market players and were facilitated by the Energy Community Secretariat via an official arbitration treatment which generated a memorandum of comprehending that supplied the basis for explanation of the law. The regulation essentially shows the key arrangements found in the memorandum, standing for a compromise in between the government and the sector. Notably, terms for those solar projects which are under construction and also hold authorized preliminary power purchase arrangements (PPAs) have been boosted by the legislation, compared to the memorandum, making it possible for those projects to be advanced fairly acceptable terms.

The complying with summary is preliminary as well as based on the text submitted to the parliament for the 2nd analysis and also talked about throughout the parliamentary hearing. However, adjustments are still feasible throughout prep work of the final text before its signing.

The regulation will certainly become efficient following its signing by the head of state and also official publication.

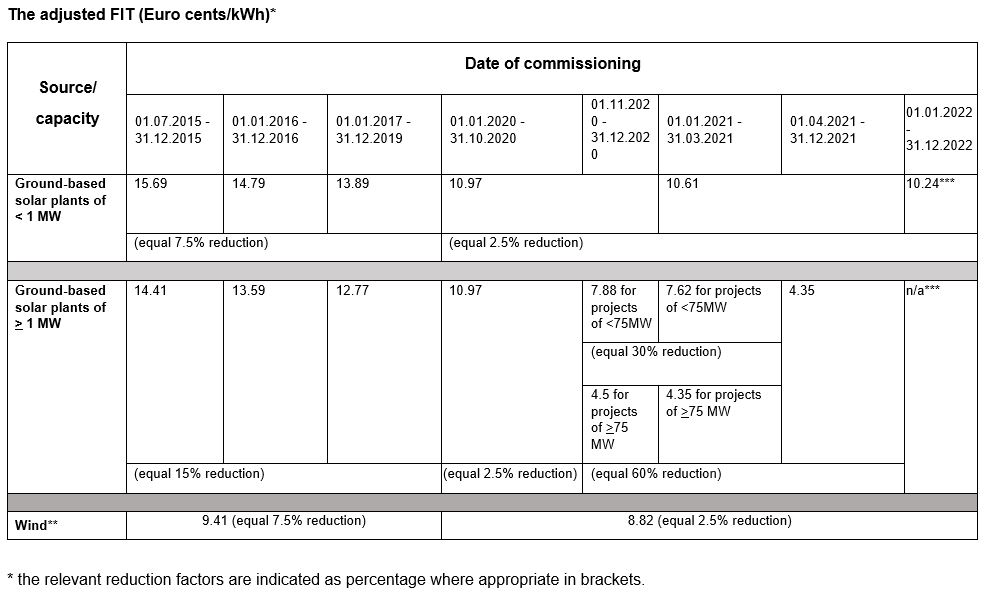

1) Reduction of the FIT. The legislation attends to decrease of the FIT, which need to be carried out via the appropriate choices of the energy regulatory authority based upon the decrease factors-- reducing coefficients-- developed by the law. These decrease aspects rely on the resource of energy, set up capacity and also date of commissioning of a center, as laid out in the table below. A manufacturer can not opt out of the reduction aspects as they are mandatory for projects under the FIT. The reduction puts on projects on a positive basis.

** Where the installed system capability of a wind generator amounts to, or surpasses, 2 MW.

*** The FIT is no more readily available after 2 years from the signing of a pre-PPA for solar of more than 1 MW generation capacity. The FIT for solar with a capability of less than 1 MW will be EUR0.042/ kWh as well as will be further reduced relying on the day of appointing of a plant. For simpleness, we do not consider more reductions of the FIT for tiny solar as well as wind power projects in the table above.

For all power generated from renewable resource resources (RES) under the FIT that were commissioned on or prior to June 30, 2015, the FIT must be capped at about EUR0.24/ kWh. If lower than or equal to the optimum cap, the FIT is increased by a coefficient of one.

The same coefficient applies to all RES not stated above, including, among others, biomass, biogas as well as hydropower projects. As a result, the FIT prices relevant to such other RES have actually not been transformed with the fostering of the law.

2) The regard to the FIT. The regulation does not provide for extension of the regard to the FIT, although this choice had actually been previously talked about. As a result, the FIT will certainly continue to apply until December 31, 2029, as formerly established.

3) Local web content bonus offer. The law boosts the local material bonus to 20%, payable as an increment to the FIT or the public auction cost, as pertinent, where a manufacturer uses a minimum of 70% of in your area generated equipment. This is in enhancement to the existing regional content benefit of 5% for projects utilizing at least 30%-- and less than 50%-- of locally produced devices; and 10% for projects using a minimum of 50% of locally generated equipment. In public auctions, a 20% neighborhood material incentive will just be offered for the very first five years from appointing of a project, adhering to which the local content bonus is capped at 10%.

4) Balancing responsibility. The regulation speeds up the balancing duty for nuclear power plant with a capacity of more than 1 MW as follows:

- 50% from January 1, 2021; and

- 100% from January 1, 2022.

This is subject to resistance margins of 10% for wind and also 5% for solar.

For plants with a capacity not surpassing 1 MW, the balancing obligation will certainly be progressively introduced, starting at 10% following year and also boosting by 10% every year until it gets to 100% in 2030; the tolerance margins specified above are likewise applicable.

The federal government should, within three months of implementation of the law, send the draft legislation entitling RES manufacturers to stop the offtaker's stabilizing team-- in which group, RES manufacturers under the FIT or public auction price have to presently participate-- and also to easily sell electrical energy as well as be compensated for the difference in between the FIT or public auction rate and also the market rate, yet not less than the price on the day-ahead market.

5) Compensation for curtailment. Presently, Ukrainian regulation does not give thorough support to curtailment-related procedures, including compensation for curtailment as well as the assigned body in charge of it.

To resolve the issue, the law presents a mechanism of provision by RES producers of lots reduction services to the power transmission system driver (TSO). The cost of such solutions need to amount to the FIT or the public auction rate, as proper, payable to RES manufacturers for the volumes of under-supplied electricity following TSO curtailment orders. The relevant costs of the TSO, payable to RES producers, need to be included in the transmission tariff of the TSO. As a result, it needs to be the TSO which will certainly be in charge of the settlement of curtailment compensation to RES producers at the FIT or auction price.

The procedure for the stipulation of such services-- including the order of priority in the acceptance of deals for lots decrease solutions-- in addition to the method of estimation of power volumes under-supplied by RES manufacturers complying with the TSO orders for curtailment, must be approved by the power regulator as well as included out there regulations within a month of implementation of the law.

The above payment mechanism for curtailment through the price of pertinent load decrease solutions of RES manufacturers, does not apply where curtailment is purchased by the TSO for power system restrictions brought on by force majeure.

6) Stabilization condition. The regulation considers particular adjustments to the legislation of Ukraine On the Regime of Foreign Investment with regard to the state guarantee and the stabilization, or "grandfathering", condition. It is kept that the legal rights and also responsibilities of parties to PPAs under the FIT ought to be regulated by regulations reliable as of the date of implementation of the appropriate legislation, save for changes in legislation associating with protection, national safety, tax obligation regulation, public order or environmental protection. The state guarantees that from July 1, 2020 until December 31, 2029, the FIT will not be transformed or terminated, and also the decrease aspects to the FIT will not be transformed or used in such a way entailing damage or losses or deprivation of a capitalist's legitimately-expected profits.

The state guarantee of foreign financial investment pertaining to the FIT shall look for the entire period of the FIT.

7) Financing offtaker payments of the FIT. As a procedure made to improve the offtaker's liquidity, the regulation prolongs the checklist of potential resources of funding for the offtaker's prices pertaining to repayments of the FIT to RES manufacturers. Currently, they include funding at the cost of a special surcharge to the transmission tariff payable by the TSO to the offtaker for its services, related to the increase of the RES share in electrical power production.

The government will certainly be able to offer funds in the state budget for the financial support of the offtaker in a quantity of not less than 20% of the approximated power production from RES in the relevant year. This would certainly be possible based upon the budget requests submitted by the Ministry of Energy, along with the supporting computations of the power regulator.

It additionally allows the short-lived allotment of 70% of the earnings raised by the TSO from the allocation of cross-border abilities as at July 1, 2020 for paying the offtaker; the offtaker has to then allocate 50% of these funds to pay RES manufacturers under the FIT.

The plan is to create as well as submit to parliament, within three months adhering to implementation of the legislation, draft laws pondering issuance of government domestic bonds to support offtaker settlements with RES producers.

8) Changes to the auction system. The legislation changes the governing framework for renewable resource public auctions, which are expected to be introduced next year. These modifications are mostly developed to boost market competitors and access to public auctions, along with to provide the government with the better versatility needed for decision-making-- for example, when determining and also allocating allocations. Public auctions will supply yet another assistance mechanism for renewables, the vital attraction being the auction price will certainly be fixed for 20 years and referenced to the euro.

The general pattern noticeable behind a lot of the changes above, is towards diversification of assistance systems for renewables in Ukraine; boosting market competitors, liquidity as well as sustainability in the long-term; and also reducing expenses sustained in electrical power manufacturing, system balancing and also the integration of renewables. This complies with worldwide market patterns as well as is key to completing, and maintaining, new pledge for renewables in Ukraine.

Svitlana Teush, PhD, is counsel for energy, building and infrastructure at the Redcliffe Partners independent law office, which previously operated as the Kyiv office of global company, Clifford Chance. She has actually practiced legislation for greater than 15 years, supporting projects in the power, building and construction and infrastructure markets. Considering that the introduction of the FIT in Ukraine in 2009, Teusch has been supporting renewable resource projects in the nation as well as has recommended on associated concerns of land use; building; grid connection; regulatory licenses and also licenses; contracts for design, purchase and construction as well as procedures and also upkeep services; and also application of the FIT, bonus offers as well as other aspects of state assistance for renewables. She is a contributing expert of the Ukrainian Wind Energy Association; a participant of the managerial board of the Bioenergy Association of Ukraine as well as a participant of the nationwide ICC Commission on Environment as well as Energy in Ukraine.

Also read

- Congress Clears Trump-Backed Bill Slashing Clean-Energy Tax Breaks

- UK Solar Roadmap Targets 47 GW Capacity, Fuels Rooftop Revolution Nationwide

- French Lawmakers Overwhelmingly Dismiss Bid to Freeze Wind, Solar Permits

- GOP Tax Bill Threatens Clean-Energy Credits Over China Supply Links

- US Senators Target China Solar Firms in Tax Credit Ban