UKIB to provide ₤ 200m in storage financing

- Bank will invest ₤ 75m in SIRES fund in addition to ₤ 65m from Centrica and also ₤ 125m in Equitix UK ES Fund

UK Infrastructure Bank has released plans to invest as much as ₤ 200m across 2 mutual fund to increase the development as well as deployment of energy storage innovations.

The bank will invest ₤ 75m on a match financing basis into Gresham House Secure Income Renewable Resource & Storage LP (SIRES) alongside a ₤ 65m financial investment from Centrica.

UK infrastructure Bank has also devoted to invest ₤ 125m on a match-funding basis right into Equitix UK Electricity Storage Fund.

The deals, which represent the bank's initial investments in the electricity storage field, can assist in around 1300 jobs and will certainly unlock a minimum of a more ₤ 200m in match-funded private sector capital.

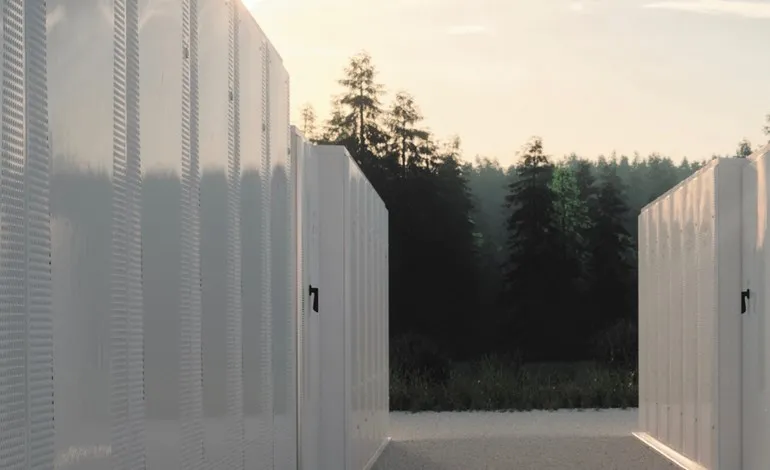

Gresham House's fund will concentrate on creating the junction of renewable generation and short period electricity storage facilities to aid increase grid links.

Centrica will be a keystone capitalist, and also this marks the first time the business has put money right into in such a fund.

The ₤ 65m injection will certainly be made use of to fund the construction of the seed asset, a collocated solar and battery energy storage project in Hartlepool, County Durham, with 50MW solar capacity and also 75MWh of battery energy storage.

Centrica's Energy Marketing & Trading organization will seek to provide a route-to-market for the assets in the fund once they come to be operational.

The fund is anticipated to produce and also support 400 jobs throughout the UK with the construction, procedures and also supply chain.

Equitix UK Electricity Storage Fund has an asset portfolio across the UK electricity value chain which provides it with understandings into electricity storage project possibilities addressing the much more intense constraints within the UK electricity network, in addition to a tactical companion network that can assist supply these projects.

The fund will certainly concentrate on a mix of business models throughout both short as well as long period of time storage.

Short period approaches may consist of installment in homes as well as at underutilised industrial premises, as well as co-location (combining both the battery storage as well as renewable energy generation at the very same site).

The fund will also intend to deploy a variety of long period of time storage innovations, such as pumped-hydro. It is expected to assist in 900 jobs across the UK.

John Flint, CEO of UK Infrastructure Bank, claimed: "The bank's financial investment into these new funds will aid break down the barriers to higher, long-term financial investment throughout a series of storage field and also renewable energy chances."

Also read