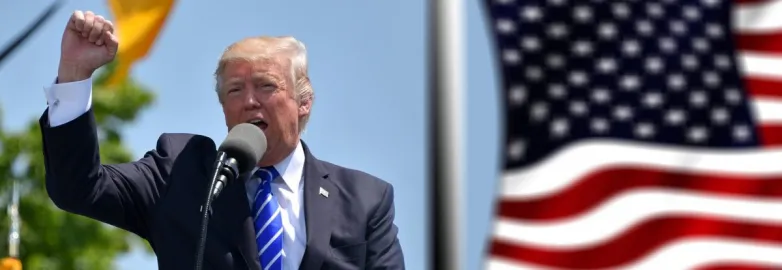

Trump ratchets up tariffs on Chinese products – including batteries

Aug 29, 2019 07:36 PM ET

- While the damage is largely done for cells, modules and inverters, increased tariffs on U.S. module components and 15% measures on lithium-ion batteries are not good news for either sector.

Under President Trump, the tariffs just keep on comin’.

On Friday, the U.S. Trade Representative (USTR) announced its latest increase for a range of tariffs imposed on Chinese goods, including a rise from 25% to 30% on $250 billion worth of Chinese imports, effective October 1. That applies to the first three tranches of Section 301 tariffs – including the September round, which started at 10% and increased to 25%.

Those three waves cover PV cells, modules and inverters but are unlikely to have a major impact on imports. U.S. shipments of Chinese cells and modules are already limited due to the combination of anti-dumping, anti subsidy – countervailing duty or CVD – Section 201 and now new Section 301 tariffs, all of which add up to a hefty price tag.

As for inverters, the damage has already been done and supply chains have shifted. Sungrow has a 1 GW factory in India to supply U.S. customers, Enphase is making products in Mexico through its manufacturing partner Flex, and Huawei has pulled out of the U.S. entirely.

Ironically it is U.S. module manufacturers – those for whom the measures were theoretically introduced – who may be worst hit than other sectors, as Section 301 duties also apply to components they need, including aluminum frames and backsheets which are commonly imported from China for module assembly on U.S. soil.

Batteries are included

The USTR is also raising tariffs – from 10% to 15% – on the latest round of Section 301 items, with the new measures to take effect on Sunday. The goods affected include lithium-ion batteries. That could have a much more significant impact as two-thirds of the world’s lithium-ion battery manufacturing takes place in China, and Tesla’s factory in Nevada is the only gigawatt-scale production facility in the United States.

As such, there is likely to be intensified demand for lithium-ion batteries from Korea, Japan and Poland – the nations with the largest manufacturing capacity after China and the U.S.

Energy Storage Association CEO Kelly Speakes-Backman told pv magazine:

"We’ve communicated to the U.S. Trade Representative and other policymakers our deep concern that tariffs on Chinese lithium-ion batteries and related equipment would have an immediate and adverse effect on grid energy storage deployments in the United States. This rate increase adds to those concerns, introducing even more commercial uncertainty in our markets.

The administration and both parties in Congress have shown broad support for energy storage. The best way to help, instead, is to enact positive, forward-thinking policies such as the inclusion of standalone energy storage projects in the federal investment tax credit."

Also read