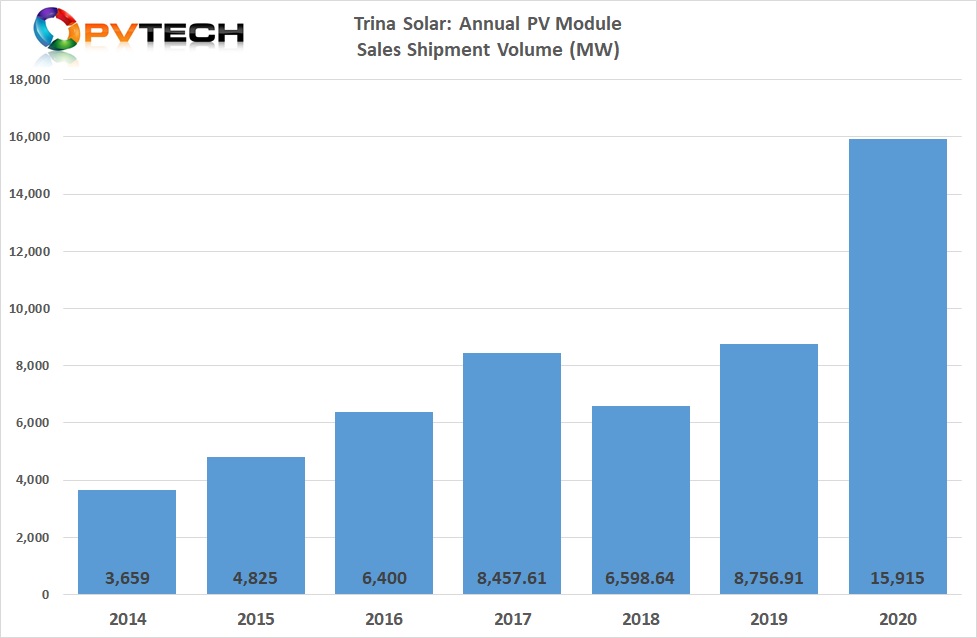

Trina Solar's module deliveries skyrocket to 15,915 MW in 2020

- ' Solar Module Super League' (SMSL) participant Trina Solar has reported overall module shipments in 2020 of 15,915 MW, a rise of over 81% compared to the 8,756 MW shipments recorded in 2019.

This rise represents an extraordinary surge in shipments from a solitary firm in the PV sector.

PV Tech just recently reported that fellow SMSL participant JA Solar had tape-recorded PV module deliveries of 15.88 GW in 2020, up from 10.26 GW in 2019, a 54.8% boost, year-on-year, establishing new records for overall shipments and also delivery development.

In its initial year back as a publicly detailed firm, Trina Solar had formerly reported H1 2020 module deliveries of 5,840 MW, a rise of 37% over the prior year duration.

Overseas shipments, predominantly what the company referred to as 'high-margin regions', had enhanced substantially and also added majorly to the growth of net profit in the initial half of 2020. Trina reported shipments of 1,071 MW to The United States And Canada, a boost of over 238%, from the previous year period, while shipments to Europe had reached 1,720 MW, a rise of 60% year-on-year.

Shipment growth in the second half of 2020 consequently stood at an unbelievable 172.5%.

Consisted of in the full year PV module shipment figure was around 2,630 MW delivered to its PV power plant systems organization, perhaps including shipments to its turnkey client organization 'Trina Pro'.

The company had actually kept in mind that its Chinese domestic nuclear power plant system company exceeded assumptions, acquiring virtually 1GW of PV bidding projects compared with the previous year.

A lot of the project related company shipments were primarily in the second half of the year.

The distributed PV system shipments and income both increased by more than 200% year-on-year, according to the business.

At the end of 2020, Trina Solar" s complete module production capacity had actually reached around 22GW.

Financials

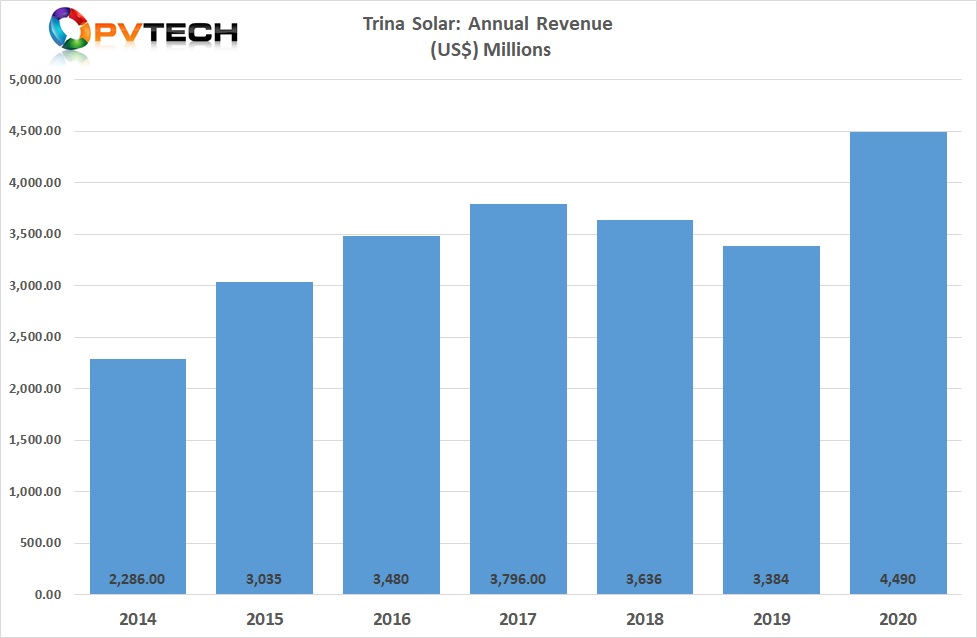

Trina Solar's earnings (operating revenue) for the full-year reached RMB29.418 billion (US$ 4.49 billion) in 2020, a year-on-year rise of 26.14%. Overseas markets represented 70.30% of operating income in 2020.

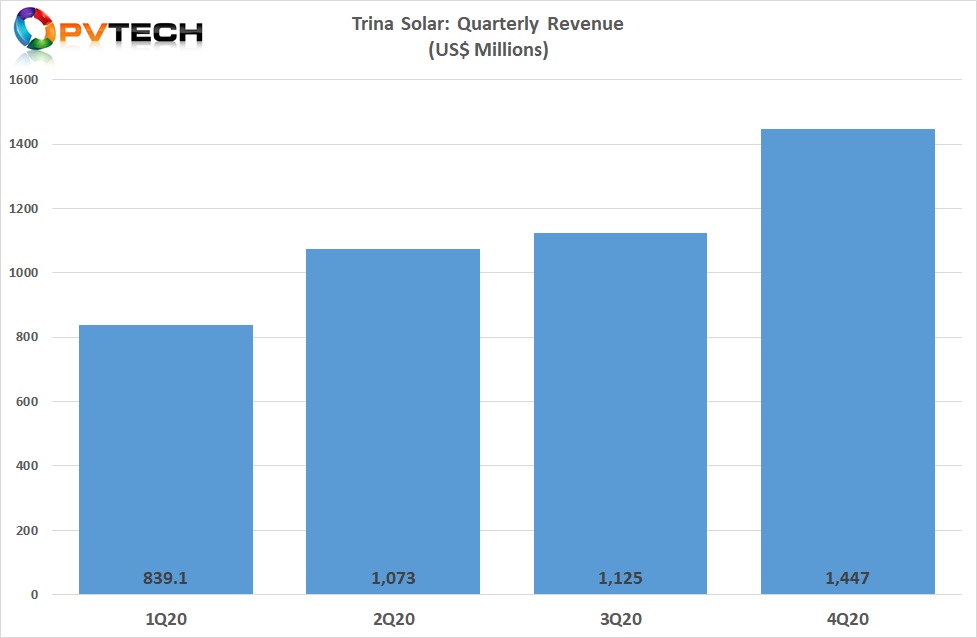

As with several PV suppliers in 2020, Trina Solar was influenced by COVID-19 in the initial quarter of the year. Sales in the first quarter were around US$ 839 million, the most affordable quarterly figures it would report in 2020.

Profits stayed above US$ 1.0 billion in the 2nd and 3rd quarters, coming to a head at US$ 1.44 billion in the fourth quarter of 2020.

Enhanced PV project company revenue along with revenue attributed to its new TrinaTracker company unit, which was stated to have actually accomplished deliveries of around 2GW in 2020, contributed to the record income in the reporting duration.

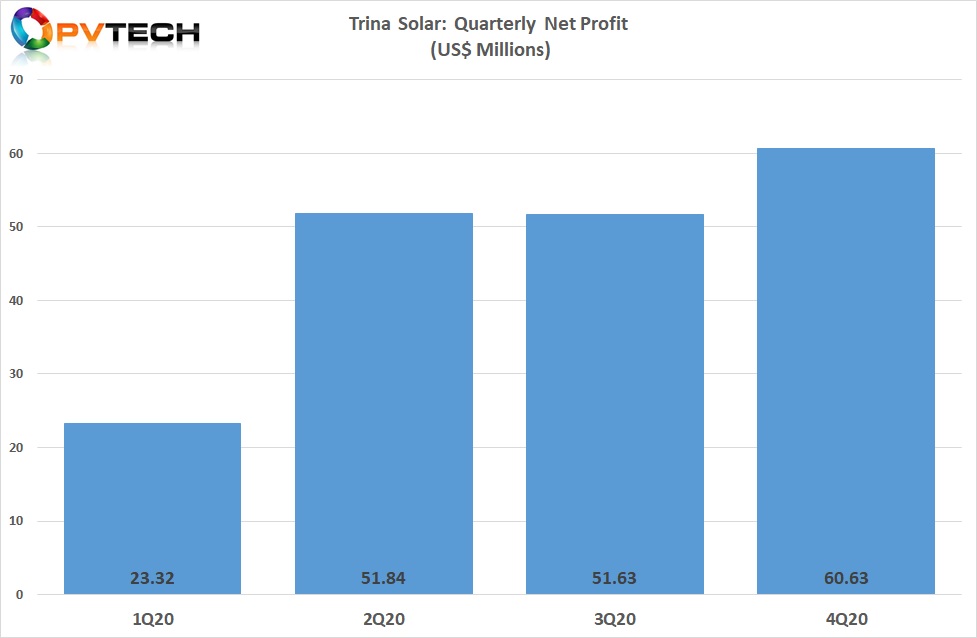

The SMSL manufacturer reported internet profit of RMB1.229 billion (US$ 186.99 million), a year-on-year boost of 91.90%. The company's net sales profit margin in 2020 was 4.18%, up from 3.01% in 2019.

According to Trina Solar, the gross profit margin of PV modules was 14.90% in 2020, or 19.31% leaving out the influence of higher logistical costs and also assorted expenses.

Trina Solar's fourth quarter net revenues surpassed US$ 60 million on revenue of just over US$ 1.44 billion, contrasted to a net revenue of US$ 51.63 million in the previous quarter on revenue of US$ 1.12 billion.

Like its close rival, JA Solar the business was influenced by hikes in product prices as well as transport prices along with rising wafer as well as solar cell rates.

Trina Solar also reported an uncollectable loan stipulation for balance dues of over US$ 557.6 million (US$ 84.82 million) in 2020. In comparison, JA Solar had introduced asset disability charges in 2020 of roughly RMB169.1 million (US$ 25.74 million).

Also read