Total Corporate Funding for Solar Up 34% Year-Over-Year

Oct 9, 2019 08:52 AM ET

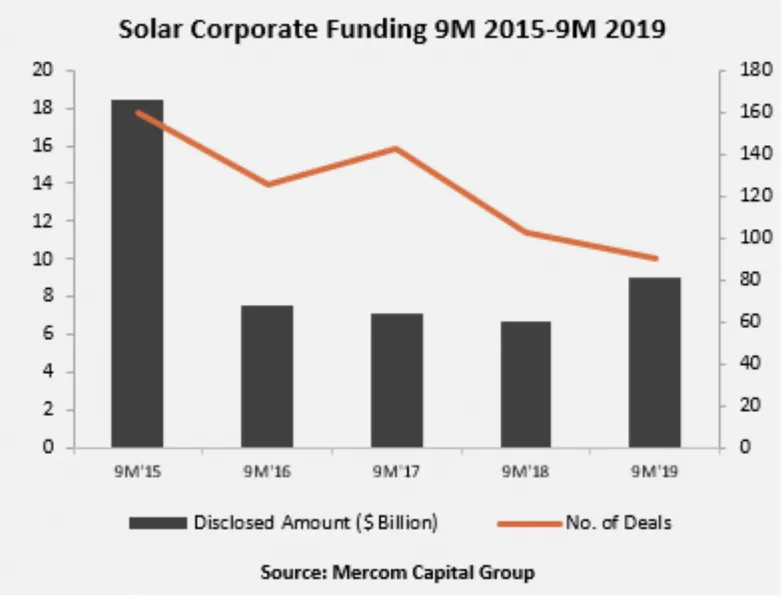

Total corporate funding in the solar sector (including venture capital/private equity, public market, and debt financing) for the first nine months of 2019 was up with $9 billion raised, compared to $6.7 billion in for the same time period in 2018, a 34% increase year-over-year. Mercom Capital Group released its report on funding and merger and acquisition activity for the solar sector in the third quarter and the first nine months of 2019. Corporate funding came to $3 billion in Q3 2019, compared to $1.3 billion in Q3 2018.

In the first nine months of 2019, global VC funding in the solar sector was 13% higher with $1 billion compared to $889 million raised in the first nine months of 2018. The top VC deals in Q3 2019 were: $50 million by BBoxx, $42 million raised by Oxford PV, $40 million by Solaria, and $30 million by exeger. A total of 88 VC investors participated in solar funding in the first nine months of 2019.

Solar public market financing for the first nine months of 2019 came to $2.25 billion in 13 deals, 25% higher compared to $1.8 billion in 14 deals during the first nine months of 2018. A total of five IPOs in the solar sector have brought in $1.3 billion during that time.

Announced debt financing for the first nine months of 2019 ($5.8 billion in 37 deals) was 43% higher compared to the same time period of 2018. There were six securitization deals for $1 billion during the first nine months of 2019. Cumulatively, $4.7 billion has now been raised through securitization deals since 2013.

In the first nine months of 2019, there were a total of 57 solar M&A transactions compared to 64 in for the same time period last year.

Also read