Tongwei treks PV cell costs, indications polysilicon deals worth US$ 18 billion

- Tongwei has actually ended up being the latest upstream solar maker to raise costs as the cost of basic materials remains to spiral.

Late recently Tongwei boosted the rates for its entire cell variety, while likewise capitalising on high polysilicon rates by safeguarding a major supply manage Shuangliang Silicon Material and Meike Silicon Material worth an estimated US$ 18 billion.

Tongwei's cell costs have jumped by between 5-- 7 RMB cents per watt, or around 6%, suggesting the scale of stress and anxiety within the PV sector's supply chain presently.

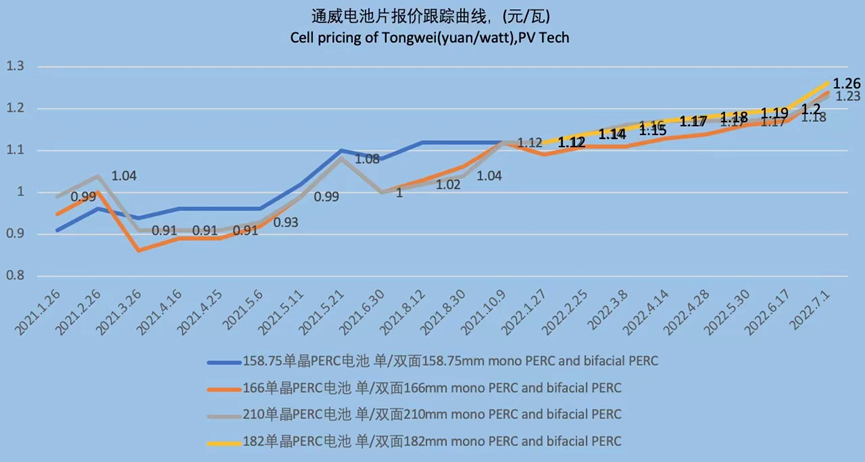

A complete list of rates as of 1 July 2022, and also the equivalent cost from 17 June 2022, can be seen in the table below, while the following graph highlights how rates have hit a new high.

| Publishing date | Product | Type | Unit Price (Yuan/W) | Unit price (US$/W) |

| 07-01-2022 | Mono PERC cell | 166 (160μm) | ¥1.24 | $0.185 |

| 07-01-2022 | Mono PERC cell | 182 (155μm) | ¥1.26 | $0.188 |

| 07-01-2022 | Mono PERC cell | 210 (155μm) | ¥1.23 | $0.183 |

| 06-17-2022 | Mono PERC cell | 166 (160μm) | ¥1.17 | $0174 |

| 06-17-2022 | Mono PERC cell | 182 (160μm) | ¥1.20 | $0.179 |

| 06-17-2022 | Mono PERC cell | 210 (160μm) | ¥1.18 | $0.176 |

Aiko Solar and also various other solar cell manufacturers are likewise recognized to have raised rates, Aiko's 182mm cell climbing to RMB1.27/ W (US$ 0.18/ W), as an example.

It can likewise be kept in mind that Tongwei has reduced the density of its 182mm and 210mm cells from 160μm to 155μm, welcoming the pattern established by wafer carriers Zhonghuan Semiconductor and also LONGi for lowered wafer as well as cell thickness as polysilicon becomes extra expensive.

Last week PV Tech reported how a fresh wave of rises to polysilicon costs had backfired down the value chain, sending out wafer, cell and also module prices upwards.

Tongwei additionally validated that it had authorized 2 new long-lasting polysilicon orders with an estimated combined value of RMB120.4 billion (US$ 18 billion).

It has actually signed the handle Shuangliang Silicon Material, which is to acquire some 222,500 metric tons (MT) of polysilicon over the following four years, while Meike Silicon Energy will certainly buy just over 256,000 MT of polysilicon between 2022 and also 2027.

Also read