There's a Ton of money to Be Made in the Obscure Metals Behind Clean Power

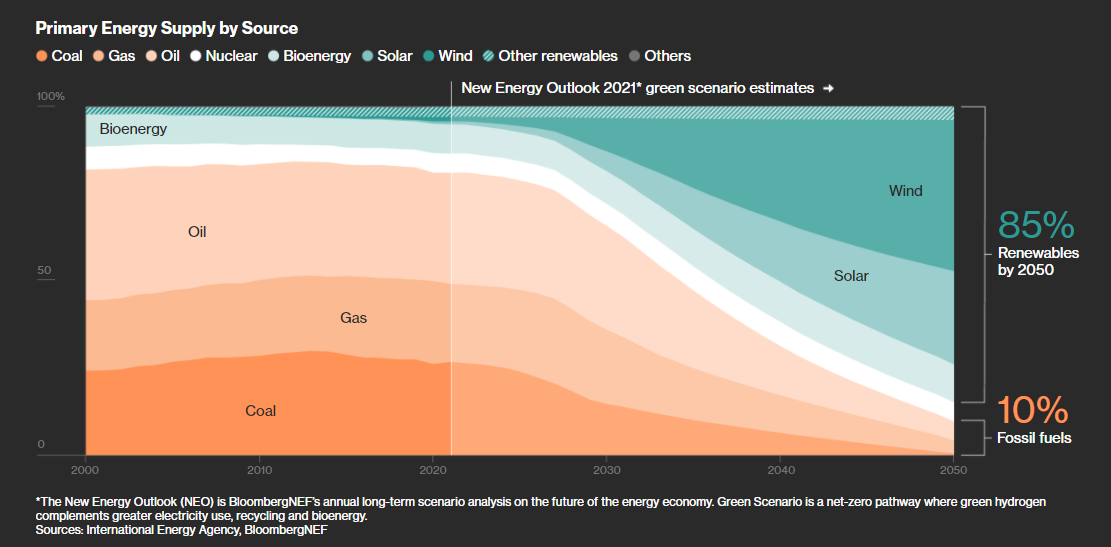

- The era-defining shift from fossil fuels to clean energy will certainly supply an unmatched brand-new boom for assets-- as well as an opportunity for financiers-- as a variety of relatively unknown materials come to be essential to supplying emissions-free power, transportation and also heavy industry.

The transition could call for as much as $173 trillion in energy supply and also facilities financial investment over the next 3 decades, according to research service provider BloombergNEF, and will resound from lithium-rich salt flats in Chile to polysilicon plants in China's Xinjiang area.

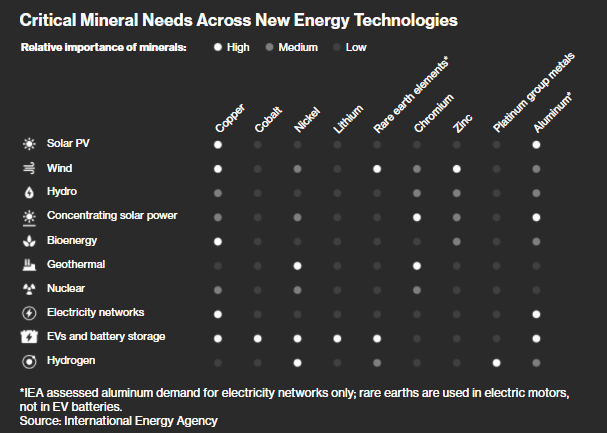

As electric vehicles replace gas guzzlers, and solar panels and also wind turbines replace coal and also oil as the world's most important energy sources, metals like lithium, cobalt and rare earths are on the brink of quickly speeding up need, along with even more familiar commercial materials like steel as well as copper.

" The energy shift is driving the following asset supercycle," stated Jessica Fung, head planner at Zug, Switzerland-based Pala Investments Ltd., which funds extracting projects connected to decarbonization. "It is a decades-long transition, yet the time to invest as well as earn money is this decade. The moment is currently."

Leads for modern technology makers, steels manufacturers and energy traders are enormous, while normal investors are currently profiting. Various clean-energy supplies have greater than doubled in worth considering that the begin of 2020, and the appearance of futures contracts for battery materials and a proliferation of going publics in the sector will certainly expand options to gain exposure.

Though changing need patterns are being signposted far in advance, project designers urgently require to secure capital for brand-new mines or assembly line. Initiatives to lift materials of key raw materials-- which can need years of exploration and also building-- have to start now to keep pace with future demands. That stress could be most pronounced for EV billing facilities and also lithium-ion batteries, which deal with high development curves, though even more well established solar as well as wind sectors have actually been tested this year by costlier assets.

Falling short to act fast enough can even take the chance of a financial shock comparable to the oil dilemmas of the 1970s, claimed Robert Johnston, an adjunct senior research scholar at the Center on Global Energy Policy at Columbia University in New York. Issues concerning future bottlenecks are mirrored in the eye-watering gains of some eco-friendly supplies. "I do not see a simple remedy because these supply chains don't magically show up over night," he claimed.

4 key components of the energy shift-- photovoltaic panels, wind turbines, lithium-ion batteries, and EV billing devices-- reveal the intricacy of supply chains called for to assist the world gave up fossil fuels, as well as how the need for vast amounts of crucial metals need to stimulate prices higher.

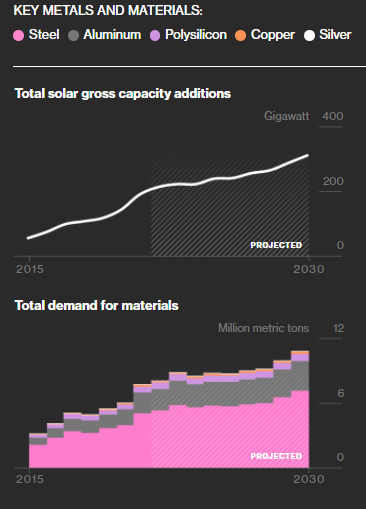

Solar Panels

Photovoltaic panel with the power capability of a gigawatt demand regarding 18.5 tons of silver, 3,380 lots of polysilicon and also 10,252 tons of light weight aluminum, according to BloombergNEF quotes.

An unanticipated enter need for solar panels in late 2020 following Joe Biden's victory in the U.S. political election and Head of state Xi Jinping's pledge that China would end up being carbon neutral by 2060 captured manufacturers off-guard.

A surge in the cost of polysilicon aided throw a decade of dropping solar expenses into opposite, threatening to reduce uptake just as several big governments were putting their weight behind it. Numerous brand-new polysilicon plants, mostly in China, are currently being constructed to attempt and also stay up to date with need.

That supplies a foretaste of what might take place in the coming years if the supply of resources isn't sufficient.

Solar also uses an example of exactly how geopolitical fault lines can hinder the energy transition. China currently dominates production of solar tools and also White House permissions pertaining to Beijing's claimed treatment of the Uyghur ethnic group in Xinjiang are currently threatening projects in the U.S.

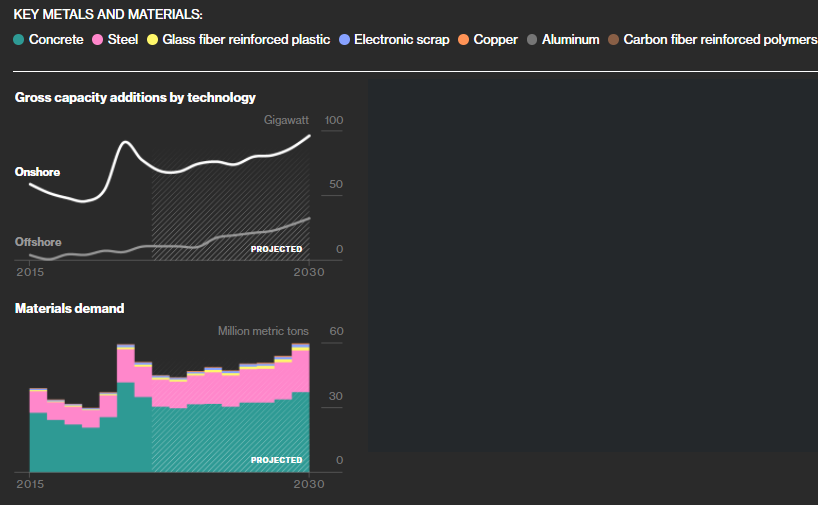

Wind Turbines

Wind turbines as well as framework with the power ability of a gigawatt demand concerning 387 lots of light weight aluminum, 2,866 tons of copper as well as 154,352 lots of steel, according to BloombergNEF price quotes.

Climbing price stress have begun to impact the roll-out of wind projects, and also the expiration of crucial aids in China implies ability additions are anticipated to drop this year from a record in 2020, according to the Global Wind Energy Council.

Denmark's Vestas Wind Systems A/S, one of the globe's biggest turbine manufacturers, has cut its overview for the remainder of 2021, citing climbing raw materials prices and interruptions to provide chains. Rates of steel-- a vital ingredient for the skyscraper-sized towers-- have actually entered the U.S. this year and likewise progressed in China as well as Europe. Also as installments decline from last year's high they'll stay strong and surge again to reach 129 gigawatts by 2030.

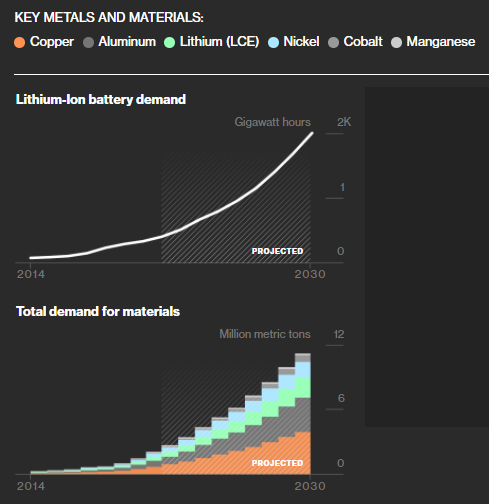

Lithium-Ion Batteries

Lithium-ion batteries able to keep 1 gigawatt hr of energy need concerning 729 lots of lithium, 1,202 lots of aluminum and 1,731 lots of copper, according to BloombergNEF estimates.

Supply of lithium resources will continue to be limited via 2022 as demand from the battery field builds, BNEF claimed in a June report. Lithium hydroxide, the chemical preferred for costs cells, might see shortages by 2027.

Minimal schedule of various other products is already intimidating the battery industry's capacity to equal the EV boom, said Yang Hongxin, basic supervisor of SVolt Energy Innovation Co., which has an arrangement to supply Jeep-maker Stellantis NV. Lithium chemicals as well as copper foil are a certain issue, while all key battery steels have seen rates advance because mid-2020.

Battery active ingredients nickel as well as manganese could see a few of one of the most serious scarcities later on this decade, said Kwasi Ampofo, head of steels and also mining at BNEF. There suffices extracted material, yet a lack of capacity to process those metals into specialist chemicals could pose troubles, he claimed.

Cost swings are a bigger problem in the battery market due to the fact that EVs are still approaching price parity with combustion engine vehicles and also greater costs can have an impact on fostering, said Daniel Quiggin, an elderly research study other focused on energy, atmosphere and also sources at London's Chatham House.

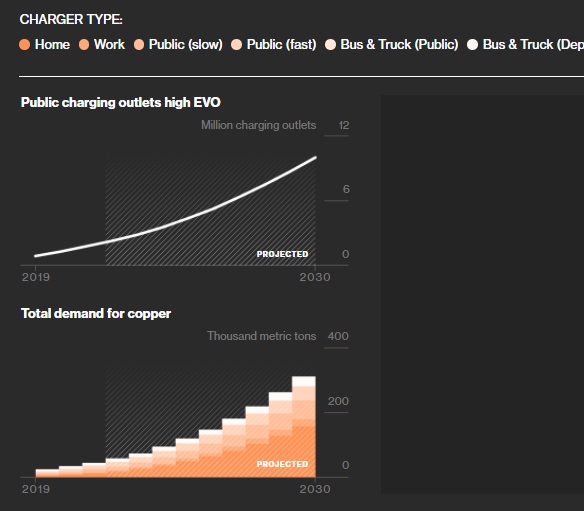

EV Chargers

A quick, public electrical vehicle battery charger normally requires 25 kilograms of copper, while a smaller sized battery charger to make use of in the house needs around 2 kilos of copper, according to BloombergNEF estimates.

Automakers see EV billing devices as key to persuading motorists to ditch combustion engines, yet suppliers entrusted with supplying the equipment are being squeezed by rate increases as well as a worldwide shipping crisis.

Installations of public battery chargers-- along highways, in grocery store parking lots or at fleet depots-- leapt more than a 3rd last year to bring the international total to 1.36 million nozzles. Today's cost stress pale in contrast to what may happen later this years, with copper demand for chargers anticipated by BNEF to rise.

Battery charger installations are set to enhance swiftly to get to 309 million connectors by 2040, when the industry's annual financial investment will certainly top $590 billion.

EV billing framework could be most exposed to resources shortages, BNEF's Ampofo stated. China-- which has extra public ports than the rest of the globe integrated-- is adding battery chargers at a breakneck speed, while the latest UNITED STATE framework plan assigned costs in that instructions and also companies consisting of Tesla Inc. as well as BP Plc have actually made large dedications, he stated.

As the energy change supercycle obtains more detailed, a significant inquiry is whether miners, financiers as well as federal governments can set in motion enough capital fast sufficient to prompt new materials in line with demand. That suggests basic materials as well as the firms that generate them must offer greater returns-- though also even more threat-- than part producers, equipment manufacturers or electrical automobile manufacturers, according to Pala's Fung.

" It matters not what battery chemistry you have, lithium is required throughout every one of them, and nickel is required in much of them," she said. "If it's solar or wind or EV charging systems, you require copper to connect all of it together-- that's why we such as looking at these commodities."

The globe's biggest mining companies, including BHP Team and also Glencore Plc, are emphasizing their links to clean energy, while smaller sized competitors are surging. Lithium producers including Pilbara Minerals Ltd. and also Orocobre Ltd. are progressing faster this year than battery giants like Contemporary Amperex Modern Technology Co. and are amongst the leading performers in the Bloomberg Electric Vehicles Total Return Index.

Still, green-focused equities have stumbled before. Evaluations of solar tools manufacturers dove from a 2007 optimal, and lithium miners endured greater than 2 years of losses through early 2020 before resuming gains.

Investors require to meticulously time transfer to add direct exposure to the energy transition motif, said Camille Simeon, a Sydney-based financial investment manager at Aberdeen Requirement Investments, which manages worldwide assets worth regarding $635 billion. They must also be planned for intermittent cost swings that affect mostly all products, as well as watch out for frothy evaluations.

" It's extremely clear that demand is increasing for the raw materials that enter into those products," she said. "You also require to think about, since we are chatting such a long-dated duration, how possible and reasonable is that, as well as just how much do you want to spend for that now in time?"

Also read