There's a Fortune to Be Made in the Obscure Metals Behind Clean Power

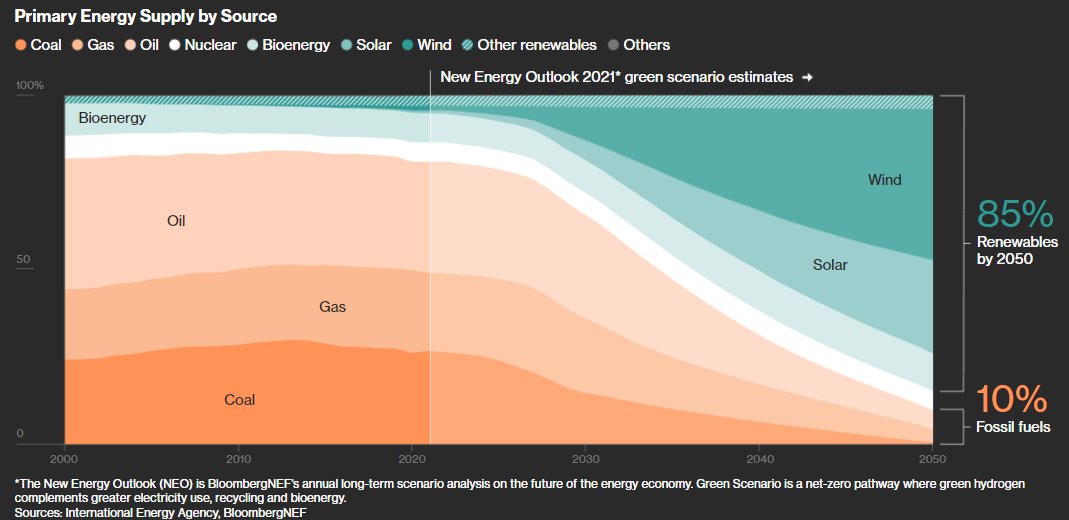

- The era-defining shift from fossil fuels to clean energy will supply an unprecedented new boom for commodities-- and also a possibility for financiers-- as a series of fairly obscure materials become important to providing emissions-free power, transport as well as heavy industry.

The shift can need as long as $173 trillion in energy supply as well as framework investment over the next 3 decades, according to research company BloombergNEF, and also will certainly resound from lithium-rich salt flats in Chile to polysilicon plants in China's Xinjiang region.

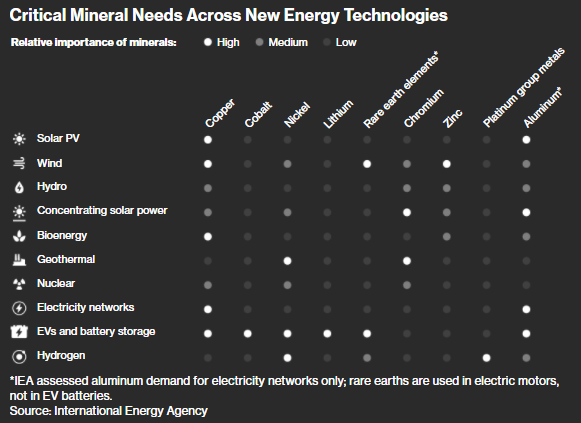

As electric vehicles supplant gas guzzlers, as well as photovoltaic panels and wind turbines replace coal as well as oil as the globe's essential energy sources, steels like lithium, cobalt and rare earths are on the edge of swiftly speeding up demand, together with more familiar commercial materials like steel and also copper.

" The energy change is driving the next commodity supercycle," said Jessica Fung, head planner at Zug, Switzerland-based Pala Investments Ltd., which funds mining projects connected to decarbonization. "It is a decades-long shift, yet the moment to spend and earn money is this decade. The moment is now."

Prospects for technology manufacturers, metals manufacturers as well as energy traders are immense, while routine capitalists are currently profiting. Many clean-energy supplies have greater than increased in worth given that the begin of 2020, and the development of futures contracts for battery materials as well as a proliferation of initial public offerings in the field will certainly extend alternatives to gain exposure.

Though changing demand patterns are being signposted far beforehand, project developers quickly require to secure funding for new mines or production lines. Initiatives to lift products of essential raw materials-- which can call for years of exploration and also building-- need to start currently to equal future demands. That pressure could be most obvious for EV charging facilities as well as lithium-ion batteries, which encounter high development contours, though more recognized solar and wind industries have been tested this year by pricier commodities.

Failing to act quickly enough can also risk an economic shock comparable to the oil crises of the 1970s, claimed Robert Johnston, a complement elderly research study scholar at the Center on Global Energy Policy at Columbia University in New York City. Concerns about future traffic jams are reflected in the eye-watering gains of some green supplies. "I don't see a simple solution since these supply chains do not amazingly appear overnight," he said.

By 2030, need for cobalt, made use of in lots of battery types, will leap by around 70%, while intake of lithium and nickel by the battery industry will be at the very least 5 times higher, according to BNEF. There'll be a need for even more manganese, iron, phosphorus and also graphite, while copper, required in clean energy technologies as well as to broaden electricity grids, will also be a significant recipient.

Four vital parts of the energy shift-- photovoltaic panels, wind turbines, lithium-ion batteries, and EV charging devices-- reveal the intricacy of supply chains needed to help the globe gave up fossil fuels, and how the requirement for large amounts of essential metals ought to stimulate prices higher.

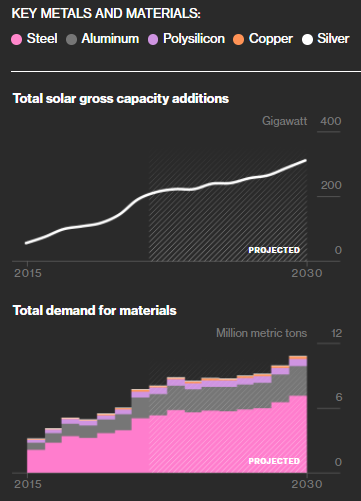

Solar Panels

Solar panels with the power capacity of a gigawatt demand regarding 18.5 tons of silver, 3,380 tons of polysilicon and 10,252 tons of aluminum, according to BloombergNEF estimates.

An unanticipated jump in demand for photovoltaic panels in late 2020 adhering to Joe Biden's triumph in the united state political election and also President Xi Jinping's pledge that China would certainly end up being carbon neutral by 2060 caught producers unsuspecting.

A rise in the price of polysilicon assisted throw a decade of dropping solar prices into reverse, intimidating to reduce uptake equally as numerous big federal governments were placing their weight behind it. Numerous new polysilicon plants, primarily in China, are now being constructed to attempt and stay up to date with demand.

That provides a foretaste of what might happen in the coming years if the supply of raw materials isn't adequate.

Also read