The largest private coal company in the United States just went bankrupt

Oct 31, 2019 04:38 PM ET

- Despite promises by President Trump to save the coal industry, the crisis in the sector is clear. Solar, wind and batteries have the world to gain.

Two-and-a-half years ago, Bob Murray was hugging energy secretary Rick Perry and giving him an “action plan” to save the U.S. coal industry. On Tuesday, the coal company Murray founded filed for bankruptcy and he was set to step down as president and CEO of the business.

Murray Energy, described by S&P Global Market Intelligence as the largest privately-held coal company in the United States, voluntarily filed for Chapter 11 bankruptcy in federal courts on Tuesday morning. In a press statement, the company noted the move allowed it to enter a restructuring support agreement with lenders who own the majority of the $1.7 billion in claims against it.

The company’s main operating subsidiaries joined the parent company in filing for Chapter 11 bankruptcy.

Crisis in U.S. coal

Coal’s share of the U.S. electricity generation market has been falling for decades. Even before the rise of solar and wind as significant rivals, cheap, fracked gas was eating coal’s lunch and the capacity utilization factors of coal plants have fallen sharply, undermining their economics.

Those financial realities have been reflected in infrastructure choices. While the United States has put online a vast amount of gas-fired power plants in the last 20 years, the nation’s coal-fired power fleets have been shutting down – and new coal facilities are not being built to replace them.

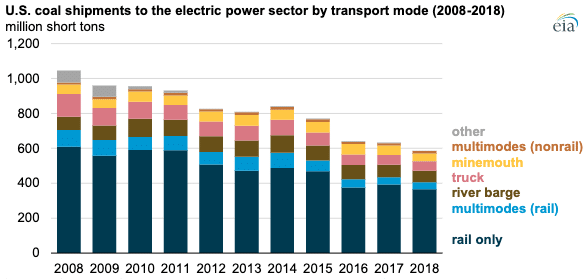

Fewer operating coal plants means less coal being shipped. According to the U.S. Department of Energy, less than 600 million tons of coal were shipped to the U.S. power sector last year, the lowest volume since 1983.

Despite an increase in exports, companies along the value chain of U.S. coal have felt the heat. Murray Energy is the sixth major American coal company to file for bankruptcy this year, with three others having filed in 2017 and 2018.

The decline of coal presents opportunities for solar, wind and battery storage. However thus far, most of the market share coal has relinquished has been filled by cheap natural gas from shale plays in Appalachia, Northern Louisiana, Texas and across the front range of the Rocky Mountains.

As always, geography plays a role. While utilities in the west such as PacifiCorp are increasingly planning rapid retirements of coal in favor of renewable energy, much of the nation’s coal capacity is not in the west, but rather the South, Midwest and mid-Atlantic regions.

Many of those places are not as windy or sunny as the west or the Plains States, meaning renewable energy productivity is lower and the levelized price of electricity from solar and wind is higher, making it harder to compete with gas. Regardless, in much of the United States, solar and wind are still the least expensive forms of new generation per unit of electricity delivered.

Superior economics not enough

Even in places where solar and wind could cost-effectively replace coal-fired generation, utilities and regulators are often tipping the scales in favor of gas. Examples include Michigan, where regulators are declining to seriously consider alternatives to a gas-fired plant DTE Energy chose to build; Deep South power firm Entergy hiring actors to fake support for a gas plant – and boo solar; and New England, where the grid operator is proposing measures that would hinder the participation of renewables in the region’s wholesale market.

And the list goes on, with electric company Duke Energy releasing modeling which failed to even consider shutting coal plants early, and Ohio recently approving a bail-out of coal and nuclear generators.

It appears superior economics for renewables alone will not be enough for solar and wind to fill the void left by failed coal companies, that outcome will also require a policy environment which offers a level playing field for the competing generation technologies.

Also read

- Zelestra Clinches $282m Financing for 220-MW Aurora Solar-Storage Hybrid Project

- Enfinity Boosts US Credit Facility to $245m for Solar Growth

- Ellomay Offloads Nearly Half of Italian Solar Portfolio to Clal

- Valeco Secures Solar Power Deal with French SMEs

- Eurowind Energy Commits EUR 175M to Romanian Solar Park