The Following 10 Big Green Stocks

- 3 asset supervisors provide their leading choices for investors seeking to pour money into the clean energy transformation.

It's been called "a lot of sizzle, no steak." "Great marketing." "Overhyped as well as oversold."

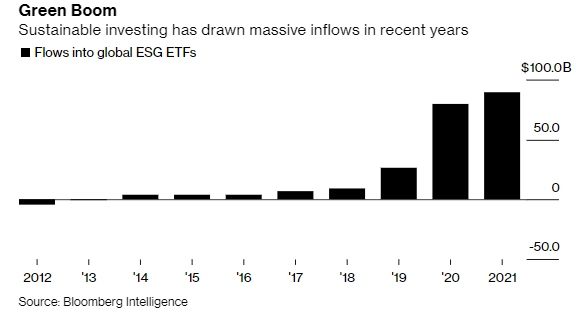

The ESG label-- short for environmental, social and also governance-- has been added a great deal of financial items, and cash is pouring into funds that explain themselves as aligned with sustainable ESG techniques. Learning everything can be challenging.

Investors concentrated on the "E" in ESG can want to business positioned for growth that are working with real options to mitigating and also adjusting to climate change now. Below's exactly how 3 cash managers, releasing greater than $1 billion bucks in overall, claim they evaluate investments that assist fight climate change. Along the way, they give us a few of their top supply picks.

Garvin Jabusch, primary financial investment policeman, Green Alpha Advisors

Jabusch likes to build his portfolios by focusing on business with their very own intellectual property, or IP, to "ensure they own the concepts aiding the world solution itself."

That leads Jabusch into traditional-- and really untraditional-- climate change plays. On the traditional side: Vestas Wind Systems A/S, which is the globe leader in onshore wind turbine production, possesses a great deal of licenses and has overseas wind operations.

On top of the reality that Vestas creates clean energy at an affordable rate, Jabusch likes the service contracts it has with rival wind farms-- "revenue that expands every year as turbines proliferate." Vestas has been "getting batter as a result of supply chain problems, as well as associated cost boosts that are injuring their margins, and also is a good value," he stated.

Jabusch's non-traditional plays are biotech business Crispr Therapeutics AG as well as Caribou Biosciences Inc. While the firms are understood for their technology's potential to transform medication with genome modifying, Jabusch sees the capability to modify hereditary attributes for the better as something able to impact every field of the economy.

" There are possibly significant repercussions for farming in food that can grow anywhere, that might require less water or could grow on salt water," Jabusch stated. "Or what regarding parts of the economic situation where electrification won't function, like long-haul transportation? What about a gene-hacked biofuel that is carbon-negative since it is so effective?"

Crispr and Caribou, which trade around $88 as well as $21, specifically, don't have much income currently. "I state just take a look at the IP, as well as where the incomes could be in five years," Jabusch said.

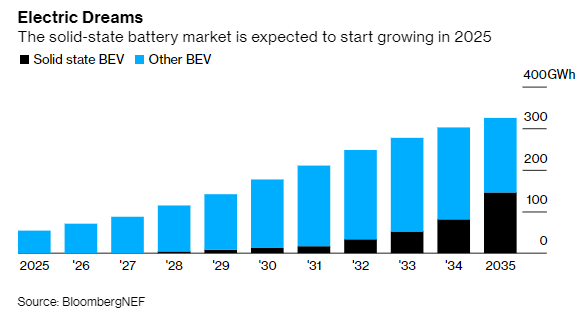

A company fairly brand-new to the general public market that Green Alpha's Jabusch identifies "very speculative" is Volkswagen AG-backed QuantumScape Corp. The deceptive firm is servicing next-gen battery technology that can be released at range to replace today's lithium-ion batteries with a more durable, trusted solid-state option.

The problem isn't whether their technology will work, Jabusch said, but whether they can scale up in an affordable way. "If they can, they could end up selling to all the electrical lorry manufacturers in the world, all the stationary storage service providers," he stated. "They are in the early stages as well as are in manufacturing heck, but it has enough possible that I 'd feel a small bit of direct exposure would be appropriate." The supply professions around $34.

Lucas White, portfolio supervisor, GMO Climate Change Fund

Biofuels already around are amongst climate solutions that Lucas White, of the GMO Climate Change Fund, buys. "With a lot of clean energy remedies, this huge accumulation needs to occur to make it possible for those technologies to have higher infiltration," White stated. "Biofuels can make an effect today, and also their discharges profiles are 80% to 90% less than those of fossil fuel-based choices."

To make biofuels, companies refine "feedstock" such as utilized cooking oil, pet fat, and oil. Darling Contents Inc., which trades around $78, has a competitive advantage over peers, White said, because it can leverage its own waste collection business in the manufacturing of biofuels, in addition to animal feed.

White views Darling as trading at a fairly economical level, "with incomes capacity and productivity potential much greater than what they're creating now because they're dramatically broadening production."

An even more speculative play in biofuels is Finnish company, White said. It's an oil refining firm, however White sees a lot of the worth in its biofuel service.

" It's a big, early moving company in lasting aeronautics gas and renewable diesel, as well as it has the greatest research and development budget plan," White said. Neste is servicing next-gen feedstocks consisting of algae as well as used plastics, White stated. The GMO Climate Change fund has a little position in the stock, which trades around 47 euros ($ 55) on the Helsinki Stock Exchange.

A technology that can also have a large impact targets the steel production sector. "Traditional steel production, using blast heating systems, is a really carbon-intensive, nasty process," White stated. "It's been among the particular niches of the international economic situation where clean solutions have actually been extremely tough to come by."

That's why White's invested greatly in GrafTech International Ltd. The company produces ultra-high-power graphite electrodes used in a sort of heater-- an electrical arc heater. Those furnaces have concerning a 90% reduction in carbon exhausts compared to blast furnaces and "every one of the development in steel-making over the following 20 to 30 years is anticipated to be in electrical arc heating systems," White said.

The $12.50 stock, which trades around six times forward incomes, "is an amazing possibility," White said. Possible risks could stem from China, both in the electric arc heating system location generally, if government suppressions on specific sectors spread out via the economic situation, and if the electrodes China generates, which White claimed are currently inferior, reach GrafTech.

Mark Bruinooge, primary financial investment police officer, 2040 Fund

Bruinooge states he positions his portfolio to take advantage of the positive and also destructive pressures behind climate change. Among his favored plays is getting in touch with as well as engineering company Tetra Tech, Inc.

"They are the suggestion of the spear, responding to natural catastrophes in remediating and in building a lot more durable facilities after extreme weather condition events," Bruinooge said. The enhanced intensity of tornados and also precipitation contribute to the business's prospective upside, something that hasn't gone unnoticed: The supply, currently around $176, is up nearly 55% in 2021.

Bruinooge also likes Xylem, Inc., which is pressing new sophisticated water metering, water administration and also leakage detection. But it's the wise use deep sea that goes to the heart of one more company Bruinooge has actually purchased, salmon farmer Atlantic Sapphire ASA.

Global warming has injured ocean-based salmon, and it's really carbon-intensive to fly in fish from Scandanavia or Chile to North America. What Atlantic Sapphire carries out in its united state plant is take advantage of deep sea aquifers in southern Florida to produce a large tank-based facility for salmon. "You placed the fish better to the market as well as expand it in a more effective means," Bruinooge said.

The firm, which went public on the Oslo Stock Exchange in mid-2020, "is an extremely transformational business," Bruinooge claimed. However the supply, which trades at about $5, has actually been unpredictable. The business has had operational issues, including a lack in the supply of liquid nitrogen for its Florida center that suggested the fish really did not grow as long as projected.

Also read

- ACWA Power, Danantara ink $10bn Indonesian green energy landmark pact

- Ardian Appoints Bruno Bensasson as Akuo's New CEO

- Emeren Brings In Boralex Veteran for U.S. Arm, Flags $20 Million Q2 Impairment

- Congress Clears Trump-Backed Bill Slashing Clean-Energy Tax Breaks

- BSR Secures €400M for UK Solar and Storage Expansion