Texas will outshine California in 2020

- The Covid-19 pandemic remains to cast a cloud on sectors worldwide, but the U.S. utility-scale solar segment is still growing, writes IHS Markit solar analyst Maria J. Chea. Around 3 GW of solar PV is set to be installed this year in Texas alone, however opportunities additionally are plentiful across several other southerly U.S. states.

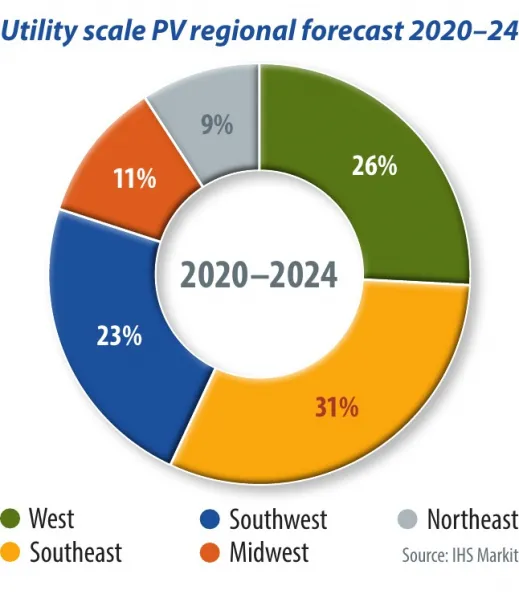

In the southern United States, solar PV project installations have surged, mostly with utility-driven need. IHS Markit forecasts that the southeastern and southwestern parts of the nation will certainly account for 31% and 23% of overall utility-scale demand from 2020 through 2024, respectively. Opportunities for big utility-scale PV projects in the south are large, provided the region's solid solar resource and also the availability of land. Throughout the 2020-- 24 period, need will continue to originate from big procurement programs routed by energies, along with demand produced by the Public Utility Regulatory Policies Act (PURPA) systems in states like North and South Carolina.

In 2020, utility-scale growth in the southeastern U.S. market will be led by Florida as well as Virginia, with each state set to set up greater than 1 GW in 2020. Growth in the southwestern market, meanwhile, will certainly be dominated by Texas, which is forecast to set up a record 3 GW of PV this year.

Texas vs. California

Texas established a voluntary objective in 1999 of 10 GW of renewable energy generation by 2025. The state had the ability to surpass that objective in 2009 because of the multitude of wind projects place online. Like lots of southerly states, Texas does not have a statewide policy to promote solar. Historically, need for PV has actually come from the state's two huge public utilities, Austin Energy as well as CPS Energy, both of whom have actually mandated RPS objectives. This has actually altered in the past few years, with huge designers leading the development of large utility-scale PV plants.

As the mounted base of PV has actually expanded in Texas, a flurry of investors has ended up being active out there. At the end of July 2020, Japanese utility Tokyo Gas introduced its acquisition of a 631 MW PV ranch in Texas. It is anticipated to find online in 2021. At the start of August, J-Power and AP Solar claimed they had actually entered into a joint endeavor to establish a 400 MWac project in the state, with an anticipated conclusion date in 2023. Lately, state utility CPS Energy said it would look for to mount 1 GW of solar to bring it closer to its 50% by 2040 goal. Financial closings have actually also been taking place during Covid-19, with Recurrent Energy protecting funding in July for its 327 MW plant in west Texas, which will certainly supply power to beer brewing huge Anheuser-Busch under a power acquisition arrangement.

Declining PV system prices, the state's decontrolled electrical power market, a structured permitting as well as link procedure, transmission lines made to handle renewable power, and large amounts of land and also strong solar sources have actually made Texas an ideal place for solar to prosper.

Building has continued to move on throughout the state given that lockdown procedures started in March, as it was rapidly regarded a necessary solution. Although a handful of projects have reported hold-ups as a result of Covid-19, the majority of the Texas PV pipeline is expected to be completed this year. IHS Markit expects utility-scale projects in Texas to represent 96% of massive PV setups in 2020, totaling 3 GW. By comparison, California is expected to mount greater than 2 GW of utility-scale projects in 2020.

Market toughness

The resiliency of U.S. solar lies not just in federal as well as state plan. The sector's toughness is also due to reducing capex expenses, eye-catching wholesale power costs, and also voluntary cost-competitive procurement by utilities that have additional motivated the growth of PV in the country.

IHS Markit estimates that by the end of July 2020, the United States had actually installed nearly 6 GW of large solar installations-- 4 more than was installed by July of last year. More than 6.5 GW of projects are incomplete, all expected to be completed this year. Nevertheless, the toughness of this segment has actually not translated to domestic and also commercial setups. Dispersed PV in the United States is anticipated to be affected one of the most by Covid-19 as a result of its in-person sales strategy. Numerous individuals as well as businesses will additionally push out making long-lasting investments in PV because of the unpredictable financial setting.

The PV market in the United States has not just needed to deal with the challenges brought by Covid-19, however also protectionist policies that have enhanced tariffs on basically all parts that make up a PV system. For example, in the second quarter, the average list prices of a monofacial PERC component in the U.S. market stood at $0.35/ W, while the price outside the country was up to $0.23/ W. Notwithstanding the premium in the U.S. market, the nation is still among the leading solar markets on the planet, with advancing installments going beyond 76 GW to date.

Corporate procurement

While the Investment Tax Credit (ITC) has actually been a crucial motivation for tax obligation equity investors to finance renewable energy, investor-owned and also public utilities have actually seen the possibility and price advantages of solar. With Integrated Resource Plans (IRPs) as well as Request for Proposals (RFPs), many states have actually preserved a durable PV pipe. Solar is additionally appealing to investors searching for low-risk as well as stable-yield chances.

Utilities across the country have set varying objectives with 2050, indicating that PV will certainly remain to grow even as the ITC steps down in 2024. As an example, Duke Energy Corp. is looking for to reduce its carbon emissions at least 50% by 2030, while Xcel Energy is aiming to decrease company-wide exhausts by 80% by 2030. Rule Energy intends to achieve 100% net no greenhouse gas discharges by 2050, and also in its newest IRP, the utility is wanting to add 7- 19 GW of solar in the next 15 years.

Firms have actually likewise aided the expansion of massive solar in the United States. At the end of 2019, Google introduced it was partnering with AES Corp. to push renewables projects ahead in the United States. Lately in its most current RFP, AES is seeking to honor contracts for as much as 1 GW of brand-new sustainable power. Likewise, Facebook and also Rocky Mountain Power announced they would collaborate to construct almost 700 MW of solar projects in Utah.

The impetus of the utility-scale PV market in Texas and also across the United States confirms that the appetite for solar remains strong in the close to term. According to IHS Markit's Solar Deal Tracker, the United States overall is estimated to have a utility-scale PV advancement pipe of over 85 GW from 2020 through 2024.

By IHS Markit solar expert, Maria J. Chea

Also read