Texas moves closer to merchant solar

Sep 25, 2019 09:15 PM ET

- Intersect Power has gone live with news the company has 1.7 GWdc ready for construction in Texas and California, including a project which holds a hedge and no power purchase agreement.

Solar developer Intersect Power says it has reached late-stage development for five utility scale solar projects in Texas and California with a combined generation capacity of 1.7 GWdc. All the projects are “shovel ready” and construction should begin by October next year, said Intersect.

That means contracts have been signed – and indeed they have, with customers including utilities and other wholesale energy buyers under 10 to 15-year power purchase agreements (PPAs). One of the projects, however, holds a contract for renewable energy certificates and a hedge with a bank for the power sold, instead of a PPA. A hedge contract typically stipulates the guarantor will make up the difference if the energy sold dips below a certain level and will bank the profits if electricity is sold above a specified rate.

That particular Intersect facility is at least the third project with a hedge instead of a PPA pv magazine has seen in Texas. Given shorter PPAs mean a longer “merchant tail”, such arrangements support a move to merchant power. Duke Energy Renewables acquired the 200 MW Holstein project which holds a 12-year hedge agreement with a subsidiary of Goldman Sachs and the Misae 1 solar project in Childress County, Texas, also holds a hedge and no PPA.

What is known about the Intersect Power projects so far? All the projects have a generation capacity of at least 250 MWdc:

- Juno, Borden County, TX: 425 MWdc; scheduled to begin construction February.

- Titan, Culberson County, TX: 375 MWdc; scheduled to begin construction March.

- Aragorn, Culberson Country, TX: 250 MWdc; scheduled to begin construction June.

- Athos I, Riverside County, CA: 350 MWdc; scheduled to begin construction June.

- Athos II, Riverside County, CA: 300 MWdc; scheduled to begin construction October.

We know the components that will be used and the engineering, procurement and construction (EPC) service providers. First Solar will supply the modules – more than 3.7 million Series 6 thin-film products over a multi-year deal and NEXTracker will provide its NX Horizon solar trackers equipped with TrueCapture intelligent control software. In terms of the EPC, that job goes to Signal Energy. There is no indication yet any if of the projects will be paired with energy storage.

According to Georges Antoun, chief commercial officer of First Solar, the 3.7 million panels represent the largest order to date for Series 6 modules.

It is estimated the projects will power almost 357,000 homes and they will all be on former agricultural and grazing land, which begs the question, will any of them use sheep grazing to keep vegetation under control?

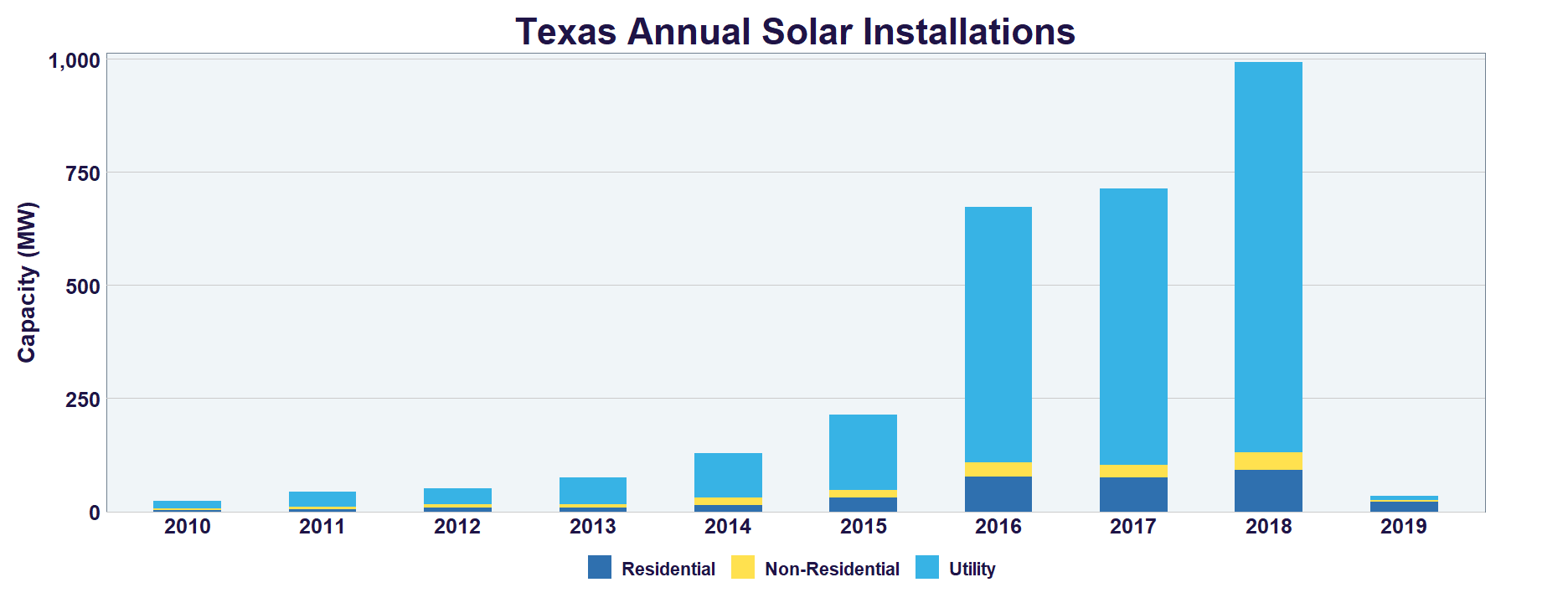

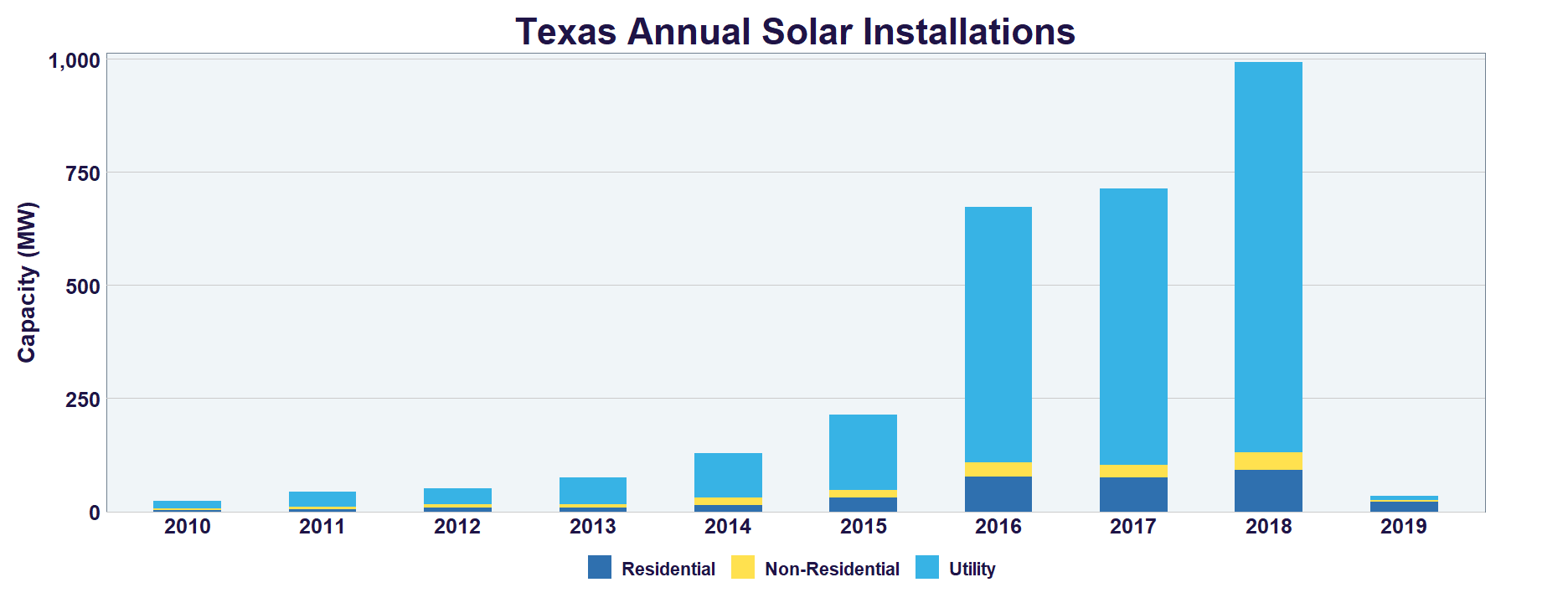

Some 650 MWdc in California is impressive enough but it is the 1.05 GWdc headed to Texas that exemplifies the explosion in that state’s utility scale solar market. The three Texan facilities will be the equivalent of roughly a third of all the solar installed in the state to date. That number is set to keep multiplying rapidly, though, as the vast majority of Texas’ solar installations have come in the last three years.

All numbers current through Q2, 2019 Image: SEIA

Also read