Tesla solar growth continues however 'significant blunders' in roofing evaluations holding back Solar Roof development

- Tesla's household solar growth has continued into Q1 2021, yet Chief Executive Officer Elon Musk has admitted to running into major concerns in roofing system evaluations, which have put on hold installs of its Solar Roofing system product.

Late the other day Tesla reported its Q1 2021 outcomes, validating that throughout the three months ending 31 March 2021 the company had actually set up 92MW of solar, its strongest quarter in two-and-a-half years. That figure is a 162% increase on the 35MW it mounted in Q1 2020 and also a close to 7% increase sequentially.

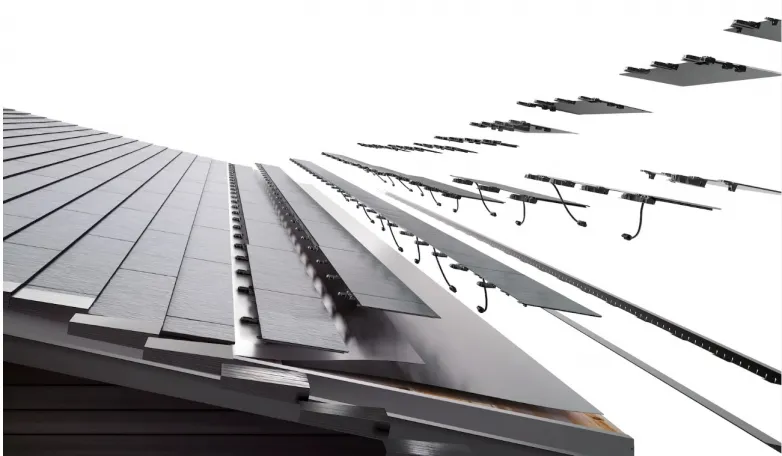

The business noted that demand for its Solar Roofing system product, released to much fanfare in late 2016, was up nine-fold year-on-year, need which Musk called strong and "dramatically in excess" of the firm's capability to meet. The product has actually been a very long time in the making, having actually encountered numerous hold-ups in ramping.

But Musk likewise emphasized that the firm had recognized that it had actually made some "substantial blunders" in the assessments of installation trouble in particular roofing systems, including that the "intricacy of roofs differs substantially".

"Some roofing systems are essentially 2 times or three times easier than various other roofings. So, you simply can not have a one size fits all situation.

"If a roofing system has a lot of protuberances or if the ... core framework of the roofing system is decomposed out or is not strong sufficient to hold the Solar Roofing, after that the cost can be double, often three times what our preliminary quotes were," Musk told analysts.

There had been numerous reports connecting Tesla with a substantial increase in price walks for its Solar Roof covering product, some quotes-- as Musk kept in mind in the call-- had been double or treble the first quote. This had actually motivated problem by customers, nonetheless Musk did qualify yesterday that clients can select to have their deposit reimbursed in this scenario.

Further reports had recommended Tesla was beginning to make up customers that had experienced significant rises in estimated rates for Solar Roofing system installs with cost-free Powerwall batteries, straightening with the firm's new effort to just sell solar together with its Powerwall as a solitary, incorporated product. Musk tweeted regarding this modification in policy recently, nonetheless little understanding was provided at the time.

Tesla disclosed the other day that the reasoning behind this step was partially due to a significant, multi-quarter backlog of Powerwall orders, with need remaining to much outstrip production prices. Musk even more attributed this to "outrageous troubles" in its supply chain.

But the move likewise plays into a broader shift from the firm to connect into bigger energy transition patterns around transforming house solar-storage setups, both individual and also aggregated, into mini power stations in their own right.

Tesla likewise kept in mind throughout its results disclosure that the relocate to just market solar and power storage as an incorporated item might yet verify to be momentary, depending on product accessibility moving forward.

At the same time, Tesla noted that power storage installments stood at 445MWh in Q1 2021, up around 70% on the 260MWh mounted in Q1 2020, however down about 70% on the 1.5 GWh installed in Q4 2020.

This efficiency, alongside solar installs, added towards profits from its power section of US$ 494 million for the quarter, an increase of 68% on the department's earnings efficiency in Q1 2020. Price of incomes credited to the section stood at US$ 595 million, causing the division reporting an adverse gross margin (around -$101 million) for the second quarter running.

Zachary Kirkhorn, primary financial officer-- or 'Master of Coin' as Tesla has lately designated that role-- said the unfavorable margin was attributable to continued high ramp expenses related to the Solar Roofing system product as well as winter season seasonality impacting the lease BPA company.

Also read