Tesla Q3 solar installs get to 83MW, targets improved energy division earnings

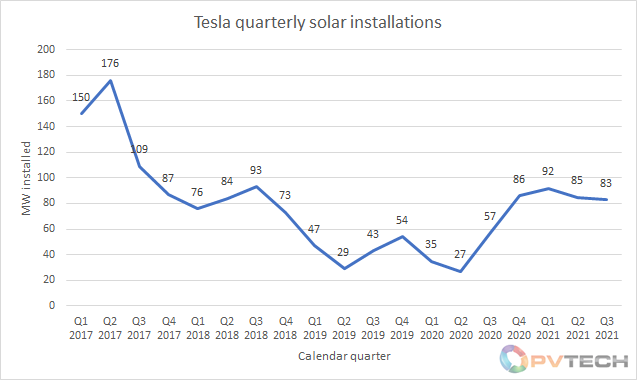

- Tesla solar installments leapt by 46% year-on-year but dropped somewhat sequentially to 83MW in Q3 as the clean technology giant targeting better earnings from its energy division.

Tesla further kept in mind in its Q3 2021 results launch that almost all solar implementations were catered for by cash/loan acquisitions as opposed to other financing mediums, which setups of its Solar Roofing product more than increased year-on-year and additionally expanded sequentially, nevertheless no specific figures for the product were disclosed.

Energy storage space on the other hand appreciated another solid quarter, with deployments climbing up 71% year-on-year to 1,295 MWh. Tesla said it was "extremely excited about the wider possibility" of its Megapack product having recently exposed plans to develop a Megapack factory with a capacity of 40GWh to cater for need.

Tesla did, nonetheless, state that it was continuing to make cost improvements to its power division, targeting the installment side particularly, to increase its profitability.

Total earnings from Tesla's energy division stood at US$ 806 million, up 36% year-on-year, while its price of profits stood at US$ 803 million, leading to a division profit of around US$ 3 million for the quarter.

Through contrast, Q2 2021 energy department earnings stood at US$ 20 million.

However supply chain challenges remain, particularly a scarcity of semiconductors and also blockage at ports, which had stopped Tesla from totally using manufacturing facility capability, the company said. Earlier this year Tesla chief executive Elon Musk lamented the "crazy problems" the business was experiencing in its supply chain and the business noted within its Q3 results that it believed the business's engineering and also production teams had been handling constraints "with ingenuity, dexterity as well as adaptability".

Also read