Tariffs, equipment detentions caused united state solar market to decrease 16% in 2022

- The USA added 20.2 GW of new solar capacity in 2022, a 16% decrease from 2021. This was most likely attributed to an examination into new anti-circumvention tariffs by the U.S. Dept. of Commerce, as well as equipment detainments by Customs and also Border Protection under the Uyghur Forced Labor Prevention Act.

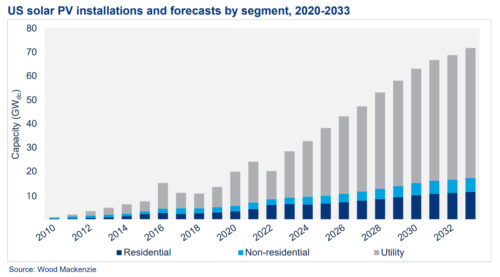

According to the "U.S. Solar Market Insight 2022 Year in Review" launched today by SEIA as well as Wood Mackenzie, utility-scale setups fell by 31% year-over-year to 11.8 GW, the field's cheapest overall since before the COVID-19 pandemic. Commercial as well as neighborhood solar setups also fell by 6% as well as 16%, respectively. Backlogs for attaching new solar projects to the electrical grid remain to limit implementation in each market segment.

Projections for this and next year show a broad market recovery with growth across all sectors balancing 19% per year up until 2027.

" Business are aggressively moving their supply chains, assisting to make sure that solar installed in the united state is fairly sourced as well as has no link to forced labor," claimed SEIA president and chief executive officer Abigail Ross Receptacle. "While the solar and storage space sector acts swiftly on supply chains and also developing a more powerful residential production base, ongoing threats of high tolls are holding back the capacity of the historical Inflation Reduction Act."

The report features upgraded 10-year standard forecasts, in addition to high and low implementation situations based on solar module supply and also residential manufacturing, Inflation Reduction Act (IRA) support and also sector-specific variables such as labor accessibility, tax equity supply and also affiliation timelines.

The complete difference in between the high- and also low-case outcomes totals up to 40 GW of new solar deployment in the next five years. In the base case, the United States is expected to add over 570 GW of new solar capacity in the following years, bringing mounted solar capacity from 141 GW today to over 700 GW in 2033.

" While 2022 was a difficult year for the solar industry, we do anticipate a few of the supply chain issues to ease, moving 2023 development to 41%," said Michelle Davis, primary expert at Wood Mackenzie and also lead author of the report. "With significant unpredictabilities ahead of the sector, our high- and low-case scenarios can assist the industry benchmark prospective outcomes. In each scenario, there is approximately 20 GW of benefit or disadvantage danger over the next 5 years-- the same amount of capacity set up in 2014."

The property solar market experienced a 40% boost in mounted solar capacity in 2022, as well as now 6% of all homes in the USA have solar. By 2030, that number is anticipated to grow to 15%.

In 2022, 783 MW of new residential, industrial as well as area solar capacity released was coupled with power storage systems, a new record. By 2027, 33% of new residential solar capacity as well as 20% of new commercial as well as neighborhood solar capacity will be paired with storage.

California, Texas, and Florida were the Top 3 states for new solar capacity enhancements for the third consecutive year, with California reclaiming the top spot after Texas led the nation in 2021.

Even as supply chain restraints reduced the marketplace, solar made up 50% of all new electric creating capacity enhancements in 2022. Today, solar represent nearly 5% of united state power generation.

Also read

- India Slashes Solar GST, Developers Eye Cheaper Tariffs And Restarts

- U.S. Tariffs Deepen India’s Solar Glut, Exports Face Squeeze Today

- ABO Energy wins tariffs for first Polish solar park in latest RES auctions

- Trump Clampdown Tightens Rules on Wind and Solar Tax Credits

- US Imposes Steep Tariffs on Southeast Asian Solar Equipment Imports