Supply Squeeze Dangers Are Pushing Lithium Higher and Higher

- Pre-holiday upkeep in China, virus risks tighten up market

- Battery prices to stay flat if upstream provides in a timely manner: EVE

Lithium has ruptured into 2022 with a fresh price spike that hands electric-vehicle makers more caution of also sharper cost pressures to find.

Materials of the essential battery product face a series of near-term risks that intimidate much deeper shortages equally as need speeds up with climbing international EV adoption. An already-tight market is being roiled by everything from plant upkeep and Winter season Olympics curbs in China, to pandemic-related labor shortages in Australia.

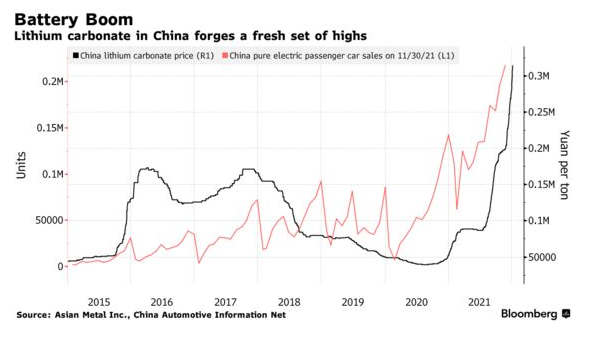

That's readied to ratchet up the squeeze on EV manufacturers after a year that saw global lithium prices nearly quadruple. Lithium carbonate in China is up 13% currently this year at a new record, adding to a gain of greater than 400% in 2021.

" The lithium market is very limited currently, so area prices are very sensitive to any supply disruptions," Alice Yu, expert at S&P Global Market Knowledge, wrote in an email.

Lithium's magnificent beginning to the year echoes wide expectations for more price gains. Short-term supply interruptions include in a longer-term picture in which a fast-expanding international lithium market is having a hard time to keep pace with crackling demand from its clients.

Gains for various other products imply battery costs this year might climb for the first time since 2010, according to BloombergNEF. Nickel, likewise a crucial battery ingredient, simply rose to a nine-year high.

Near Term

In China, a collection of lithium plants are on regular upkeep, while some manufacturers in northern districts like Shandong as well as Hebei face anti-pollution curtailments around the Wintertime Olympics, according to Shanghai Metals Market. The Games start early February. The arrival of Covid-19's omicron variation in China just contributes to threats.

Ahead of the week-long Lunar New Year break in China, refinery upkeep job is readied to heighten, while buyers will seek to stockpile, S&P's Yu stated.

Virus-related difficulties have impacted miners in Western Australia, for example with labor shortages coming from state-border restrictions. Pilbara Minerals Ltd. just recently slashed its forecast for shipments of spodumene concentrate, an intermediate item that can be refined into battery chemicals.

Maintaining

Beyond those short-term problems, there are difficulties for lithium to broaden quickly sufficient in coming years. Supply doubters can indicate Rio Tinto Group, which faces environmental demonstrations in Serbia, and also there are expanding issues around the sustainability credentials of South America's brine-based production.

" Customers are understanding that new supplies are really tough to cause," claimed Tony Ottaviano, CEO at Australian lithium miner Liontown Resources Ltd. His firm agreed to deliver lithium to South Oriental battery giant LG Energy Solution from 2024, when its project is set up to start.

In the meantime, downstream gamers are expecting some alleviation later this year from the current wave of higher prices.

" If those capacity plans from the upstream companies can be executed on time in the middle of 2022, prices for resources and battery will hold stable," Jessie Cai, vice president at EVE Motor, an unit of Chinese battery maker EVE Energy said by e-mail. "Otherwise they might raise even more."

Also read