SunPower (SPWR) Vs Enphase Energy (ENPH): Which Solar Stock Is A Much Better Buy?

- Do You Have These Top Solar Stocks On Your Watchlist For 2021?

- With President Joe Biden making environment modification a top priority in his management, solar stocks might see brighter days in advance.

Recall that the Head of state outlined a $2 trillion tidy energy and also infrastructure strategy, with a target for zero web exhausts by 2050. The President has been instead loud as well as clear with his intentions to go environment-friendly. Rejoining the Paris Climate Accord was among the signals from the White House. In addition, the president authorized an Executive Order that would certainly battle the climate situation both across the country and also globally. One example of this campaign involving fulfillment is to replace all federal government cars and associate electrical lorries.

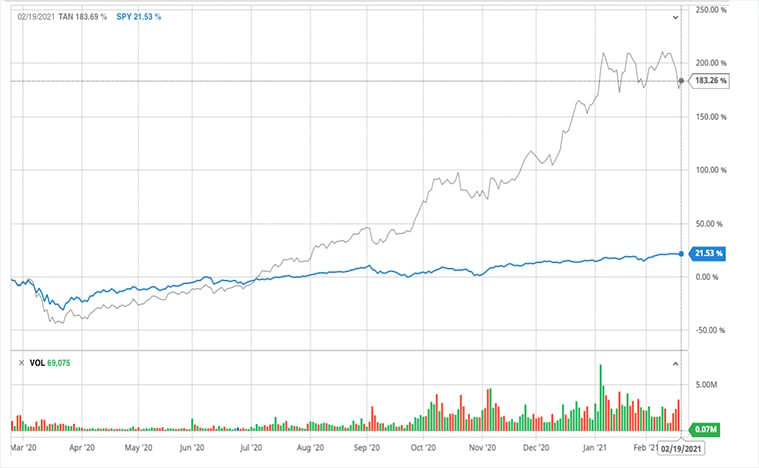

Apart from the modification in administration, minimized costs and technological advancement within the solar industry are a number of tailwinds sending leading solar supplies higher. One of the most effective means to study a particular sector would certainly be getting a market exchange-traded fund (ETF). The expanding need was evident in the allegorical increase of the Invesco Solar ETF (NYSE: TAN), which tracks renewable energy supplies.

Yet what if you are only looking to purchase some of the best-performing supplies in the solar industry as well as not an ETF? SunPower Company (NASDAQ: SPWR) as well as Enphase Energy (NASDAQ: ENPH) conveniently leading the checklist. Both have actually reported their profits lately. As well as if you think that the renewable resource industry is not likely mosting likely to slow down anytime quickly, then these 2 solar stocks deserve a more detailed look.

SunPower Firm

SunPower is a California-based solar energy firm. Briefly, the business develops and also produces PV cells as well as photovoltaic panels. SPWR stock has been on a tear for the past year, increasing by greater than 1,000% considering that the market sell-off in March.

It is still a ten-bagger stock despite falling by double-digit percentages on Thursday. The drop in SPWR stock came after the firm reported its fourth-quarter revenues.

At first glimpse, capitalists would certainly have assumed that SPWR succeeded, uploading a 65% boost in industrial as well as industrial installments contrasted to its previous quarter. Nevertheless, earnings can be found in 15% reduced year over year. Incomes per share dropped 40% from the year-ago period. With solid assumptions from investors, it is not unusual to see why they could really feel disappointed.

Boosted Need For Residential & Commercial Storage Solutions

A velocity of solar fostering in the UNITED STATE has been predicted with the new administration. This includes growth in solar-storage services in which the firm takes part in. The firm claimed it expects to record losses throughout the very first quarter of 2021. Nevertheless, it is positive that its full-year 2021 outcome will have the ability to fulfill or go beyond advice.

The business's substantial run-up in its supply price is not baseless. To some customers, the company provides several of the most effective electronic remedies that encourage homeowners to create and handle their very own planetary systems without leaving house. Being number 1 in resilience and also giving a 25-year full system guarantee absolutely instill consumer self-confidence in the business. Residential as well as business solar will certainly continue to grow rapidly as customers as well as companies alike continue to shift to renewables.

To cover it all off, the company also ordered headings in the direction of the end of December, by protecting a $56 million project at JFK Flight terminal in New York. This marks the biggest solar cover power project in the state to day.

Enphase Energy

Enphase is a name most renewable energy financiers are familiar with. For the inexperienced, the firm creates and also makes house energy services. The business has actually delivered over 30 million solar microinverters and also approximately 1.3 million residence energy systems to over 130 countries.

Clearly, Enphase is no beginner to solar energy. ENPH supply resting at gains over 600% because the market sell-off in March 2020.

The top dog in solar power reported a solid quarterly report last week. Revenue came in 26.09% greater year over year to $264.84 million which conveniently defeated the quote of $254.8 million. In addition, the incomes per share also enhanced 30.77% year over year to $0.51, handily covering the estimate of $0.4. The strong financials together with the growing collaborations as well as clientele appear to suggest that ENPH may be a lasting buy.

An Expanding Solar Inverter Market To Bode Well For ENPH Stock

According to Marketing Research Institute, the solar inverter market is anticipated to rise 15.45% at a compound yearly growth price. Enphase made a name for itself in June 2008 when it established the very first microinverter system. In laymen's terms, microinverters sit listed below solar panels as well as transform sunshine to electrical energy for houses and also various other structures. Unsurprisingly, they are crucial to the solar power sector.

Taking into consideration the fact that solar houses are now mandated in California for brand-new house building and construction (potentially more states moving forward), one can anticipate a surge in these microinverters in the foreseeable future. For capitalists, this can mean huge gains as more individuals look to the company for their house energy demands.

SPWR Supply Or ENPH Stock?

Offered the strong sector tailwinds and also continued government plan assistance, you can never ever really fail with either SunPower and Enphase Energy. That said, both are top solar stocks to buy if you have a long-term perspective and do not mind the volatility in the process. For long-term capitalists, the dip in SPWR stock might be a terrific purchasing possibility. Obviously, the business's leading line may be less encouraging today. However if you are comfortable and also have lots of persistence, SPWR stock could be eye-catching.

Nevertheless, if we are to take a look at its current quarterly reports from both business, ENPH stock appears to be the clear champion. As its microinverter continues to get traction, it's not shocking if the stock continues to climb in the near-term. Although the profit margin looks a fair bit slimmer than the numbers in 2020, its company's income forecasts are stellar, with a potential 41.5% growth in the existing quarter. As the supply was taking a little dip in addition to the wider market, would you be getting some ENPH stock for its long path ahead?

Also read

- MN8 Energy Secures $575M for Solar, Battery Projects

- BNDES Admits Arctech to FINAME, Boosting Solar Trackers Across Brazil

- Huawei, Sungrow Extend Decade-long Lead in Global Inverter Race Again

- Niteroi Starts Work on 2,700-Panel Solar Park, Boosting Sustainability Drive

- Quadoro, EB-SIM Acquire German Solar Parks for QEEE Fund