Solid Q1 for First Solar, Enphase, Sunrun

- UNITED STATE household solar installer Sunrun reported solid solar implementations and also profits to begin 2020, despite having orders decreasing by as long as 40% for durations in March. Micro-inverter maker Enphase's first-quarter earnings went beyond assumptions as the business established an all-time gross margin document as well as revealed prepare for a brand-new production place.

First Solar's revenues period as well as there's a clear, non-surprising style: The initial quarter was mainly unimpacted as well as solid by the pandemic, yet the 2nd quarter as well as 2020 overall doubts.

We've currently listened to that tale today from Sunrun, Enphase as well as SolarEdge as well as currently it's First Solar's turn.

Financial highlights from the American solar maker's very first quarter:

- Internet sales of $532 million, below $867 million in Q4

- Take-home pay per share of $0.85-- contrasted to a bottom line per share of $( 0.56) in Q4

- Internet cash money of $1.1 billion

- 1.1 GW of reservations considering that previous profits telephone call, consisting of 0.7 GW of systems reservations

- Fleet-wide capability usage of over 100% throughout March as well as April

- Previous 2020 support taken out

" Despite the unpredictable financial setting, need for our Series 6 item stays solid, as confirmed by the 1.1 GW of internet reservations considering that our previous revenues phone call," claimed the CEO.

First Solar's Ohio center has actually been allowed to run as a necessary company-- as has its Malaysian center. There was a reduction in March and also April producing ability yet May is seeing a go back to complete capability at Ohio 2, according to the business.

The lockdown has actually sped up the Series 4 module closure-- as well as manufacturing will certainly not reboot in Malaysia.

The firm has actually seen a "minimal effect" in supply chain of incoming resources and also providers, while consumers are experiencing hold-ups in allowing and also the EPC procedure.

First Solar provided some reason for positive outlook:

- The firm still sees the essential financial stimulants for driving utility-scale solar infiltration remaining to expand.

- Its Series 6 capability growth strategies are the same led by its 12.3 GW in gotten stockpile

- The thin-film leader's mid-term 500 watt module target is unmodified

- The manufacturing facility logged 435 typical watts per module throughout April

While First Solar's economic outcomes have actually not yet been materially affected by Covid-19, because of "the considerable unpredictability pertaining to the extent and also period of the Covid-19 pandemic," the company is withdrawing its full-year 2020 support.

Below's a minimal assistance First Solar "thinks is mainly within its control currently."

- Module manufacturing: 5.9 GW, consisting of 5.7 GW of Series 6 as well as 0.2 GW of Series 4

- Operating costs: $340 to $360 million

- Capital investment: $450 to $550 million

First Solar's earlier, pre-Covid support was for deliveries of 5.8 GW to 6.0 GW.

While not quite as solid as the means the firm finished up 2019, Sunrun, the biggest domestic solar business in the United States, had an additional effective quarter to begin 2020, also while running in among the hardest-hit markets of the solar sector.

In Sunrun's Q1 2020 economic outcomes, the firm discloses that it released 97 MW to begin 2020, down 17% from Q4 2019's record-setting 117 MW, however up 13% from Q1 2019. Sunrun has actually currently released simply under 2.1 GW of solar to day, standing for 26% development from the exact same factor in 2014.

When it comes to Sunrun's total client base, that number leapt to 298,000, up 5% on the Q4 mark of 285,000. Year-over-year, that 298,000 mark benefits a 23% upgrade in Sunrun's consumer base.

When it comes to one of the most traditionally challenging element of being a household solar firm, Sunrun reported $210.7 in profits in Q1, down about 14% from Q4's $243.9 million, however up almost 8% from the Q1 2019 mark of $194.5 million. As is constantly the instance, functional costs exceeded earnings, can be found in this quarter to the tune of $273.7 million, which is down approximately 6.5% from Q4's mark of $292.3 million, however up 13% from Q1 2019's $238.6.

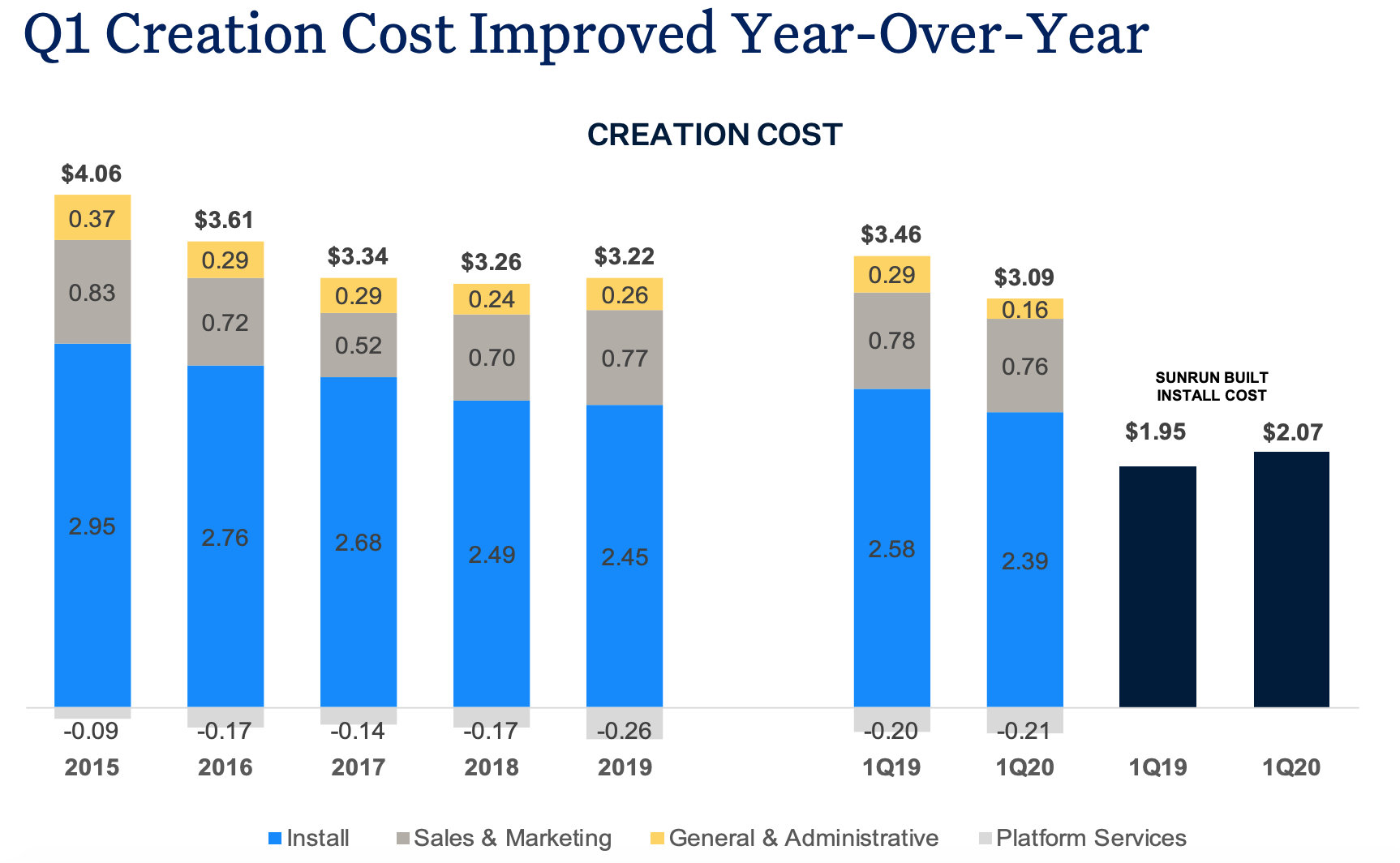

As held true in Q4, operating budget are increasing together with a reducing "development expenses" for systems funded by Sunrun This number stands for the per-watt price the business sustains for each and every brand-new system set up, as long as Sunrun funds claimed system, and also can stand for a considerable part of each quarter's functional expenditures.

Photo: Sunrun.

In Q1, production prices rose to $3.09/ watt, up from $2.87/ watt in Q4 2019, yet still down year-over-year from $3.46 in Q1 2019. When it comes to the specifics of the production price increase, while management and also basic expenses was up to $0.16/ watt from $0.23/ watt in Q4 2019, both mount sales and also expenses as well as advertising expenses rose to $2.39/ watt and also $0.76/ watt, up from $2.25/ watt as well as $.069/ watt, specifically.

While domestic solar business were anticipated to be struck the hardest by the Covid-19 pandemic, Sunrun has actually had the ability to weather the tornado until now, The business experienced order decreases by as high as 40% in March, though CEO Lynn Jurich ensured individuals on the outcomes call that these order reductions were quick. Sunrun additionally proclaims that orders got to a single-day perpetuity high at the end of April.

Additionally shared on the call was the quote that sales in Q2 could be down 30% to 50%, yet Jurich stated that she thinks the number will certainly be a lot closer to the previous. Motivating self-confidence, the business promoted that greater than 60% of Bay Area installments in Q1 consisted of Brightbox battery accessories.

The outcomes call likewise validated some business information, with the tip that Tom vonReichbauer will certainly be signing up with the firm as its brand-new CFO, efficient May 11. vonReichbauer will certainly be changing Bob Komin, that is entrusting to invest extra time with his relations as well as sustain his passion in college.

Enphase PV microinverters beam in Q1

Enphase Energy reported as well as went beyond assumptions $205.5 million in income last quarter. Year-over-year, Enphase's initial quarter profits increased 105%. On the other day mid-day's phone call, Enphase additionally disclosed that it will certainly be introducing a brand-new microinverter production area in the 4th quarter.

" We are pleased with the initial quarter, thinking about Covid-19," Badri Kothandaraman, CEO of Enphase Energy claimed. Throughout Q1, the worldwide solar microinverter distributor's capital from procedures was available in at $39.2 million and also GAAP gross margins boosted from 37.1% in Q4 2019 to 39.2% for Q1 2020.

In Q1, Enphase delivered 2 million microinverters, yet Covid-related shelter-in-place regulations suggested that it was not able to deliver its Encharge battery storage space system as prepared; deliveries of Encharge are currently slated to start in June.

Despite the fact that issues concerning supply interruptions from China occurred in mid-February, Covid-19 really began to put in descending stress on the property solar sector throughout the last 3 weeks of the initial quarter as well as throughout the very first month of Q2. In April, the U.S. market, as an example, saw a 30% to 50% industry-wide decrease in domestic setups; California and also New York signed up the steepest declines.

For the property solar market, Covid-19 has actually instated a couple of favorable lasting fads, nonetheless. Digital allowing has actually begun to settle, as well as self-sufficiency goes to the center of individuals's minds, Kothandaraman stated, keeping in mind that a drive towards self-sufficiency can stimulate higher rate of interest in power protection as well as power financial savings. Additionally, with cooking area table sales off the table, installers are beginning to accept electronic devices as well as online marketing, he claimed.

With this last change in mind, Enphase is starting a multi-year strategy that will certainly include creating an electronic system that can be made use of throughout a whole property solar sales as well as client service procedure-- from organizing visits and also developing agreements, to allowing, intending and also activation, and so on. The suggestion is that this kind of effective end-to-end system can assist Enphase offer even more of its solar and also storage space items, while likewise sustaining its client base and also its network of moderate and also tiny installers, which are under boosted stress to digitize.

Throughout the other day's profits telephone call, Enphase explained that its solid annual report places it in a placement to buy not natural as well as natural development. However Kothandaraman likewise kept in mind that money is king now. "We wish to make certain that we are not investing cash unless we need to," he included. Enphase's cashflow generation stays solid; it ended up Q1 with a money equilibrium of $593.8 million

Enphase claimed that it is still on training course to launch its IQ8 microinverter, its IQ8D double inverter and also its Ensemble in a Box items throughout the 2nd fifty percent of this year. It likewise stated that it still anticipates to attain a 5% battery accessory price by year's end.

Also read