Solid growth in Asia's non-hydropower renewable industry will assist satisfy rising power demands but coal still major player

- Major capacity enhancements in Asia's non-hydropower renewables sector will facilitate the area's capability to provide electricity in the middle of rising power intake needs, which look set to exceed all various other areas as economic situations continue to expand after the easing of COVID-19 limitations, according to a Fitch Solutions' report.

The study firm located that the continent was rotating toward renewables such as solar and also wind for power generation over the use of hydropower and coal that has generally controlled Asian markets, although coal will certainly still play a substantial component in the area's power mix for several years to find.

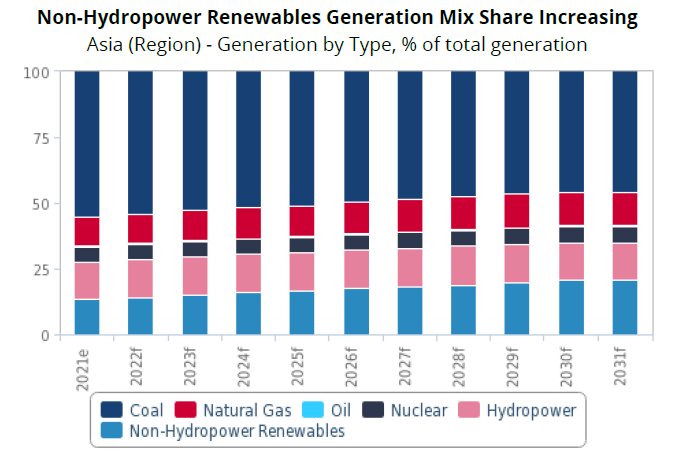

" This surge in net capacity additions of non-hydropower renewables will be able to help with a robust growth in electricity generation," claimed Fitch Solutions, including that this played into its forecast that non-hydropower renewables' share of the generation mix will certainly raise by about 7.3%, from 13.3% at end-2021 to 20.6% in 2031.

" This increase in non-hydropower renewables generation will certainly have to do with 2,060 TWh at an annual typical development of 8.4% from 2022 to 2031," stated the report.

The report indicated a number of examples of Asian nations prioritising non-hydro renewables, such as markets in the Mekong region expanding into solar as well as wind over hydropower, Thailand spending heavily in floating solar projects-- which are on the surge worldwide-- and also Vietnam using solid state support for renewables development.

Source: Fitch Solutions

The development in non-hydro renewables is expected to supply Asia's growing power requirements, with the continent projected to comprise over half of worldwide power need. "We approximate Asia's share of international power intake to be 50.7% and also will boost to 55.0% by 2031," said Fitch Solutions. "This represents a boost of 4,501 TWh at an annual ordinary development of 3.1% from 2022 to 2031."

Nevertheless, Asia will certainly continue to depend on its well-established coal power sector in addition to its growing non-hydropower renewables sector to provide power to its economies as they boost activity adhering to the pandemic-induced slowdown.

Coal-fired power generation remains Asia's dominant power kind, approximated at 56% of the region's generation mix since end-2021, according to Fitch Solutions. "This is mainly due to the region's strong coal industry, with major power markets like China and India that will certainly still call for years to wane their heavy dependence on coal."

In other Asian news from Fitch Solutions, the Philippines looks readied to substantially increase its solar release in line with a rapidly-expanding project pipeline and expanding regulatory assistance.

Also read