Solar module rates in the United States to rise by 15.3% in Q2 because of the Covid-19 episode

- The episode of Covid-19 has actually triggered considerable interruptions to markets worldwide, consisting of the United States as well as has actually motivated the United States Senate to pass a $2.2 tn emergency situation alleviation bundle, targeted at increasing its stumbling market.

In spite of being a sophisticated economic climate, the United States is at risk to worldwide disruptions, as their economic situation is greatly service-oriented that subsequently depends on assets created in establishing countries such as China, India, as well as various other Asian nations. Covid-19 has actually considerably nicked production ability in China, an essential gamer in the international supply chain, leading to a downturn in business task for numerous big United States business based on Chinese materials. As the break out remains to spread out, adjustments in customer practices are anticipated, which is most likely to stem the nation's financial development. What is even more, solar module rates are currently being influenced.

Particularly, the United States power sector has actually been at risk to the worldwide interruptions. Dive in gas costs, decrease in international need, and also cost battle in between Saudi Arabia as well as Russia have actually supplied an extreme impact for the oil and also gas sector; regardless of best shots by the federal government to open up brand-new markets such as China, India, as well as the UK, to sustain its huge manufacturing result that has actually surpassed residential need. In a similar way, given that 2018, the renewables industry has actually remained to experience, with the intro of tolls on imported devices, which drastically increased the expense of solar module costs. However, solar remains to be cost-competitive and also is among the most affordable types of power generation in the nation. In 2019, solar arised the country's leading source of power now deals with unpredictable times, because of the continuous Covid-19 dilemma. The Solar Energy Industries Agency (SEIA) forecasts that almost 50% of the labor force used in the solar sector could be without tasks, as solar firms are most likely to deal with substantial headwinds in obtaining resources to money projects. Furthermore, numerous projects under-development and also building can fall short to get aids because of production as well as delivery hold-ups that can include in a developer's problem.

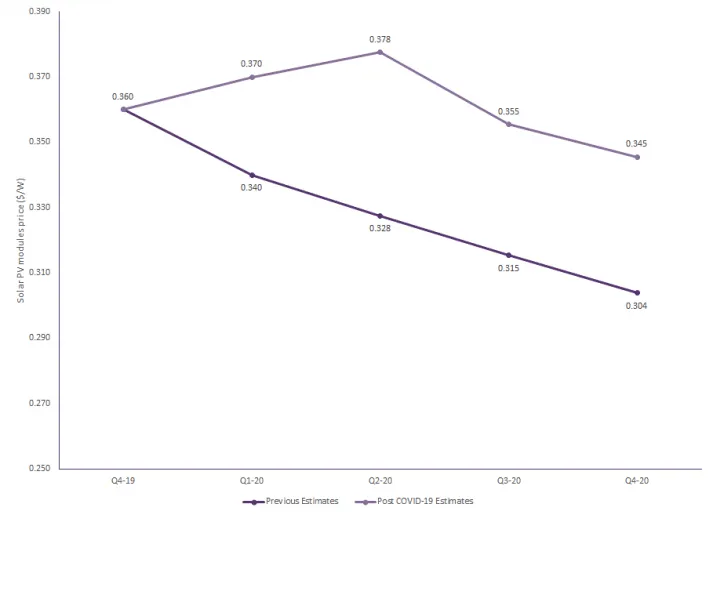

The application of tolls has actually caused reasonably high module costs however the continual market development of solar is an outcome of ongoing assistance from state federal governments. In between quarter 4 (Q4) in 2019 as well as Q4 in 2020, module rates were most likely to decrease by 15.6%, according to previous quotes. Nonetheless, with the abrupt turmoil in the marketplace as a result of the Covid-19 break out, the rate decrease is anticipated to slow-down to 4% in between Q4 in 2019 as well as Q4 in 2020. A rise in rate is most likely to be noticeable in Q2, with the rate deviating by 15.3%, in contrast to Q2 quotes before the episode. The pattern is anticipated to proceed in Q3 and also Q4, with the cost most likely to be 12.7% and also 13.7% greater specifically, post-outbreak.

Developers not just encounter part supply interruptions such as inverters and also panels, yet additionally work scarcities; as quarantine actions are being applied to obstruct Covid-19 transmission. The lack of work as well as devices is not just constrained to the United States market yet likewise in various other famous solar markets throughout the globe. Considering that the preliminary execution of tolls in 2012, the United States has actually gradually expanded its panels purchase base to relocate far from being extremely dependent on China to Malaysia, South Korea, as well as Vietnam among others. Nonetheless, with the pandemic influencing the abovementioned nations too, costs are anticipated to enhance, as a result of different conditions affecting their particular markets.

Throughout Q1, the rate is approximated to rise to $0.37/ W, with Covid-19 market ramifications coming to be a lot more remarkable. By Q2 and also Q3, the involved impacts are most likely to end up being a lot more unique and also the cost in Q2 is approximated to get to $0.378/ W. In Q3, although a decrease is anticipated, rates will certainly stay reasonably high, as a variety of designers with "harboured" projects are most likely to be driving the need in a gradually recuperating supply market. In 2018, the news of a routine phaseout of the Investment Tax Credit (ITC) reward, triggered considerable solar capability growth, which allowed designers to make use of the accessibility of greater tax obligation credit ratings than the reduced credit ratings in succeeding years. By the end of Q4, the marketplace is anticipated to have actually secured as well as the cost is anticipated to decrease to $0.345/ W.

The United States solar sector is encountering numerous obstacles, caused by the Covid-19 break out that endanger the survival of numerous services and also programmers within the marketplace. With obstacles in obtaining tools as well as work scarcities, firms with "harboured" projects would certainly encounter a lot of aggravation, enhancing their direct exposure to responsibilities and also threats. Moving on, the federal government might give help in the form of gives or fundings and also expand the government Investment Tax Credit, as well as enhance the versatility around fulfilling lawful demands, which would substantially profit the solar sector.

Also read