Solar Market Insight Report 2020 Year in Review

- The quarterly SEIA/Wood Mackenzie Power & Renewables U.S. Solar Market InsightTM report shows the major patterns in the UNITED STATE solar market. Find out more regarding the UNITED STATE Solar Market Insight Report.

1. Key Figures

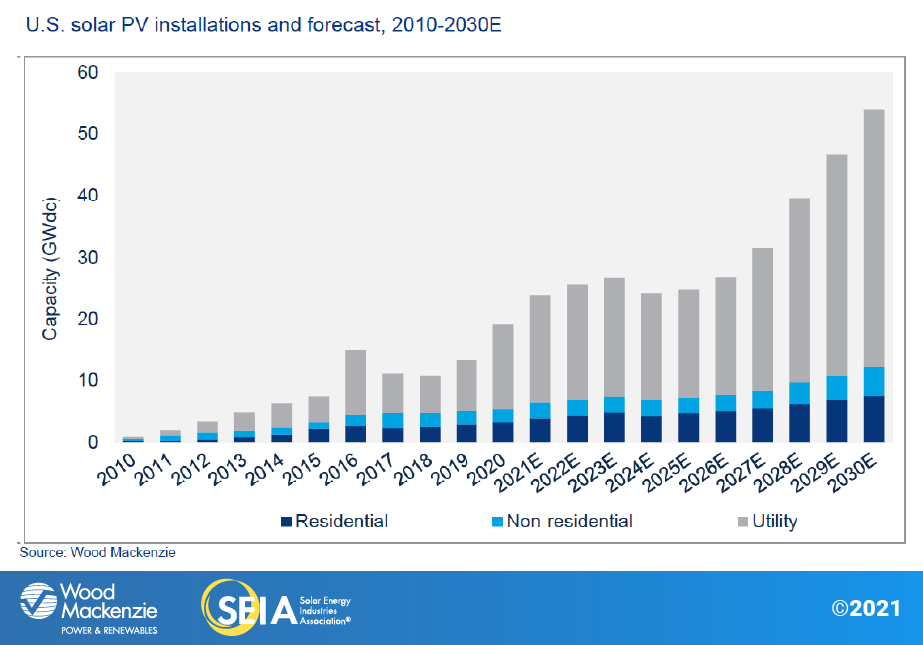

- In 2020, the UNITED STATE solar market set up a record 19.2 GWdc of solar capability, a 43% boost over 2019.

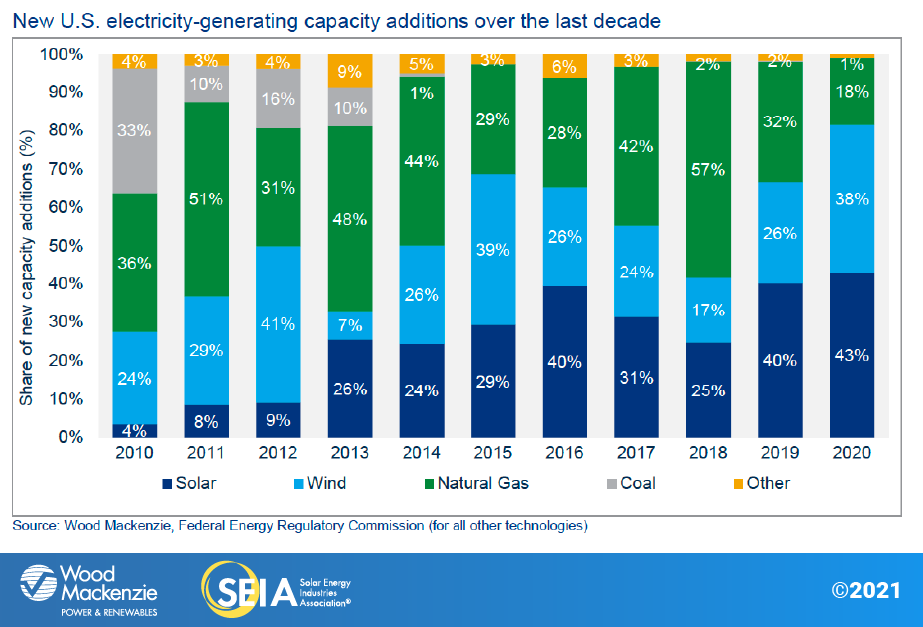

- Solar represented 43% of all brand-new electricity-generating capability added in the UNITED STATE in 2020, representing solar's largest ever before share of new creating capability and ranking first among all innovations for the 2nd year in a row.

- In Q4 2020, the U.S. solar market also established a record for quarterly setups with simply over 8 GWdc of solar PV, up 32% year-over-year. The sector resolved substantial stockpiles of projects awaiting interconnection while utility-scale projects rushed to satisfy the previously anticipated decrease in the investment tax credit history (ITC) rate.

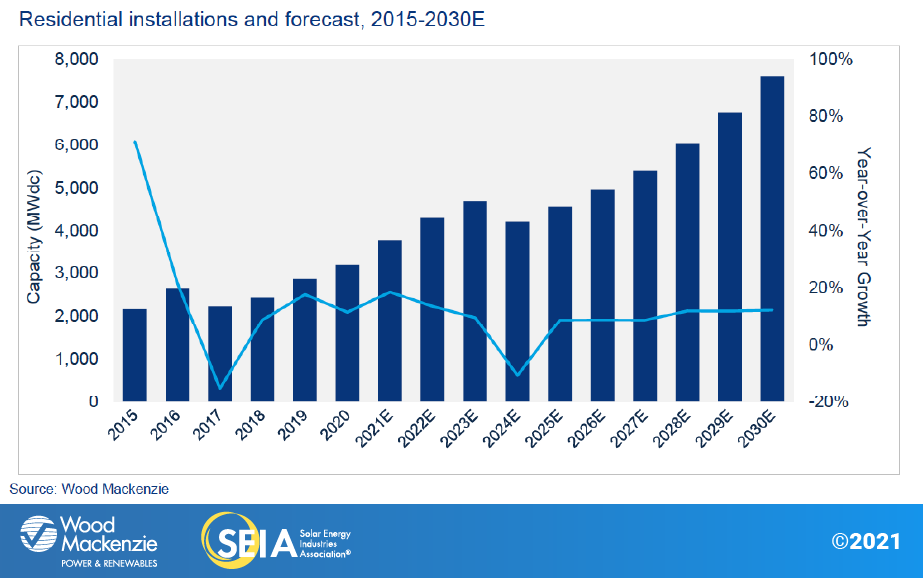

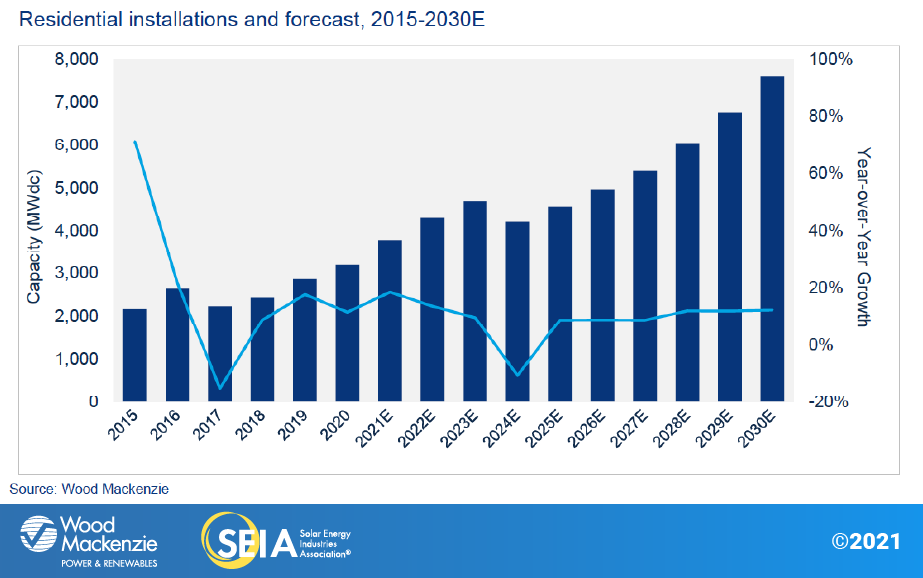

- Residential release was up 11% from 2019, getting to a record 3.1 GW. This was lower than the 18% annual growth in 2019, as property installations were dramatically impacted by the pandemic in the initial half of 2020.

- Non-residential setups decreased 4% from 2019, with 2 GW installed. The pandemic impacted this section with postponed project affiliations as well as prolonged growth timelines, however we expected a down year even prior to the pandemic as this segment has encountered challenges to sustained development for many years.

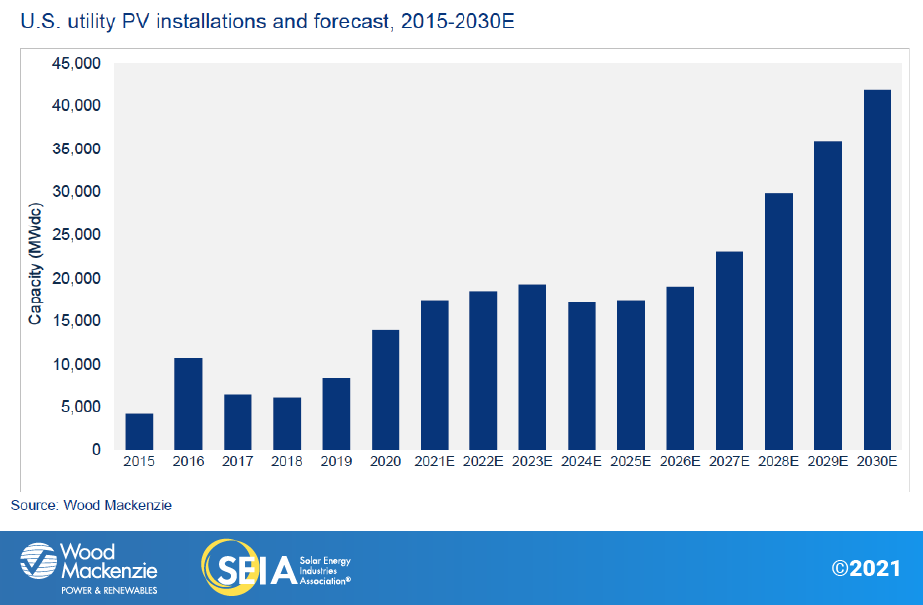

- A historical 6.3 GWdc of utility-scale projects were mounted in Q4 2020, bringing the annual total simply reluctant of 14 GWdc.

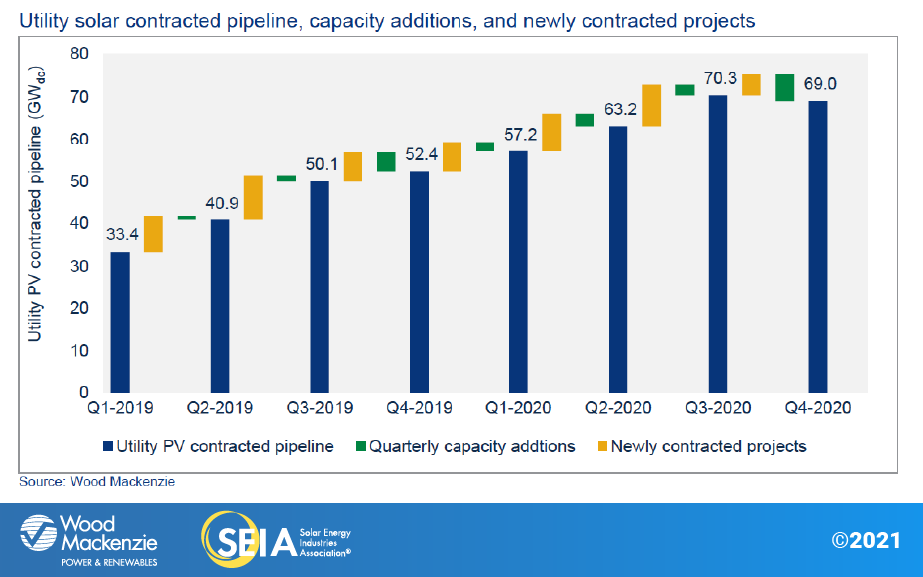

- An overall of 5 GWdc of brand-new utility solar power acquisition arrangements were introduced in Q4 2020, bringing the quantity of project announcements in 2020 to 30.6 GWdc as well as the full utility-scale contracted pipe to an overall of 69 GWdc.

- The 2-year extension of the ITC in the last days of 2020 has actually brought about a 17% increase in deployment in our 2021-- 2025 projection.

- In this 2020 Year in Review report, Wood Mackenzie has actually released 10-year outlooks for the first time. We expect a cumulative 324 GWdc of solar capacity enhancements over the following years, greater than three times above what has actually been mounted through 2020. This growth will be spread out throughout all market sections as distributed solar consumers, utilities, states, and companies push to decarbonize the grid.

2. Intro

The year 2020 was a record-setting year for the solar sector, and also it will not be the last. The 4th quarter surpassed the previous quarterly record set in Q4 2016 by 22%, with simply over 8 gigawatts-direct current (GWdc) of solar photovoltaic or pv (PV) capability mounted. The year ended with a total amount of 19.2 GWdc installed, an unbelievable 43% more than capacity added in 2019-- done in the middle of a global pandemic.

Residential solar volumes were up 28% from Q3 for a total of 963 MW. Pent up need from the second quarter (during the most awful influences of Covid-19 limitations) integrated with a rise in interest in home renovations, causing record-setting sales pipes in the 2nd fifty percent of the year. 4th quarter installments reflect those sales pipes, which are likely to carry over right into the very first quarter of 2021. Non-residential solar (that includes commercial, federal government, nonprofit and also neighborhood solar) raised 73% from Q3 as utilities made their means through affiliation backlogs. Utility solar had its largest quarter and largest year on record with annual capability enhancements up 65% from last year.

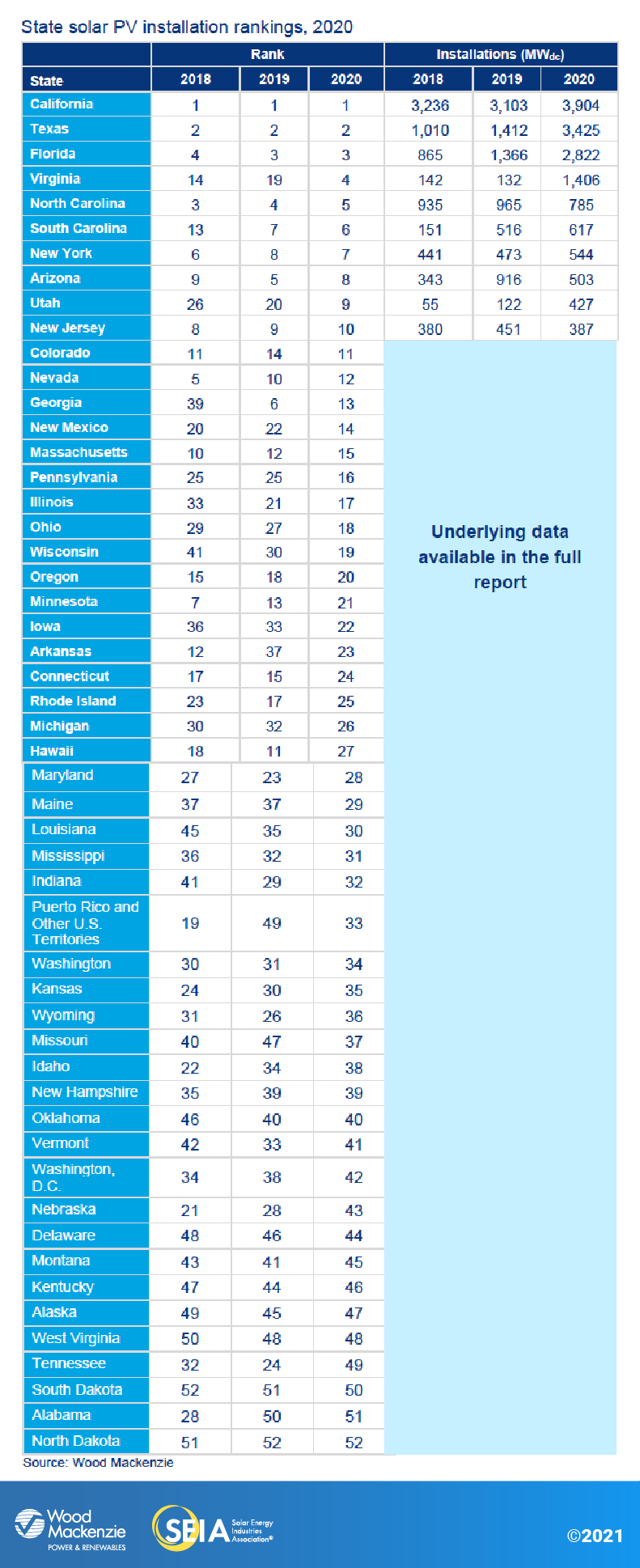

Additionally, solar PV accounted for 43% of all new electricity-generating capability enhancements in 2020, the biggest share in the market's background and also the second consecutive year that solar ranked initially amongst all generation modern technologies. Solar as well as wind comprised 81% of new ability in 2020, much more than the prior record of 68% in 2015. Finally, geographical diversity likewise remained to boost in 2020 with 27 states each adding greater than 100 MWdc.

The two-year extension of the ITC results in greater than 11 GW of additional ability

The year-end extension of the ITC came as welcome information, permitting the industry to continue the momentum from a record-breaking second half of 2020. From 2021 to 2025 (the last year that projects should be finished to get approved for ITC degrees over 10%), our expectations have actually increased by 25% for property, 15% for non-residential, and also 15% for utility scale. In general, the 5-year outlook increased by 17.7 GWdc or 17%.

The next years will see the complete operating solar fleet more than quadruple

Yet development in the U.S. solar market is only partially driven by the ITC extension. Residential solar sales remain to go beyond expectations as financing carriers roll out appealing products, passion in residence renovation rises, and also clients experiencing via power failures from extreme weather condition occasions look for power resilience. Utility solar pipelines remain to grow, driven by an expansion of decarbonization targets from a selection of offtakers. And while non-residential solar development is expected to moderate after a preliminary rise in 2021, lasting development will certainly speed up as costs decrease as well as financing choices become more extensively readily available. In total amount, the operating solar fleet is anticipated to quadruple from almost 100 GWdc of ability mounted today to more than 400 GWdc mounted by 2030.

3. Market sector outlooks

3.1. Residential PV

Key figures

- 3,194 MWdc mounted in 2020, the largest year on record

- Up 11% from 2019

Fourth quarter domestic solar set records - anticipate more of the very same in 2021

Residential solar rebounded after the first shock of the pandemic. The last quarter of the year is constantly substantial for property solar, as installers hurry to full projects before year-end motivation expirations. Offered the original ITC stepdown, massive sales pipes, and inspired consumers that were stuck at home, it's no surprise Q4 2020 struck virtually 1 GW of additions. Several significant state markets established records for quarterly volumes, consisting of Arizona, California, and Texas.

The very first quarter of 2021 could be just as huge, counter to the regular stagnation of household solar in the initial quarter. While several installers report steady progress through project stockpiles, allowing delays in some locations continue to expand project timelines, triggering some spillover right into Q1 2021. Additionally, the overall building boom and high demand for solar and storage in the last half of 2020 have actually created labor lacks and tools hold-ups, better exacerbating this overflow. And finally, high sales quantities have continued; some installers report they are more busy than ever before throughout a time when they typically anticipate a slowdown in sales. With every one of these factors in mind, Wood Mackenzie is forecasting 18% growth in household solar in 2021.

Another factor for high anticipated volumes in the first half of 2021 is a rise in demand brought on by the Texas wintertime storms in mid-February. EnergySage-- an online platform for solar sales-- reported that web traffic to its internet site from Texas raised by greater than 200% during the week of the tornado. This simulates the rise in consumer passion in California adhering to mandated power shutoffs due to the October 2019 wildfires. These kinds of events will remain to drive client rate of interest in solar as well as solar-plus-storage, with ripple effects in various other markets.

Despite every one of these higher fads, not every domestic installer had the same experience in 2020. Little and medium-sized installers (those that do less than 50 bargains each month) were more likely to experience sales decreases for the year. These installers commonly rely upon high proportions of cash sales, a financing model that fewer household clients had the ability to suit in the midst of a financial recession.

It would certainly be an oversight in addition to the intense pace of monetary product innovation in the property solar market in 2020. New solar car loan products and also terms, pricing promos, and point-of-sale modern technology enhancements have all contributed to raised domestic solar sales in 2020 as well as will remain to drive development in the coming years.

Residential solar will certainly be increased by the ITC, getting to 4.7 GW of installments in 2023

Looking ahead, we expect residential solar will certainly get to double-digit growth in each of the next three years. The majority of the marketplace will certainly be customer-owned thanks to the supremacy of domestic solar loans, as well as a greater ITC worth, makes these sales a lot more engaging. This is particularly true in the high development markets of Texas as well as Florida, where retail power rates are not as high as in The golden state or the Northeast. The most considerable increases to our overviews are in 2022 (which was formerly the initial year of ITC-related market contraction) and 2023 (which is now characterized by demand pull-in prior to the ITC phases down).

One state that defies this basic pattern is California. The governing proceeding to identify the future generation of web energy metering policy-- referred to in the industry as NEM 3.0-- has officially kicked off. We anticipate application of brand-new policies to start influencing the market in late 2022 or early 2023. As a conservative technique to our projection, Wood Mackenzie anticipates modest tightening in 2023 as the marketplace adapts to a brand-new compensation regime. This takes down nationwide household growth in 2023 to 10%, however outside of The golden state, we are forecasting 18% growth that year. As information of the follower program arise over the following 18 months, the uncertainty around the marketplace influences will certainly start to clear.

Long-term, strong domestic solar principles will lead to annual development of 9% to 12%, going beyond 7 GWdc of annual additions in 2030. The share of residences with solar will certainly grow from 4% today to 13.4% by 2030.

3.2. Non-residential PV

Key figures

- 2,074 MWdc mounted in 2020

- Down 4% from 2019

Project hold-ups result in a down year for non-residential solar

Non-residential solar is the only segment that did not set records in 2020. Installment quantities did recuperate dramatically in the fourth quarter, expanding 73% over Q3 as states fresh York and also Massachusetts made progress on adjoining stockpiles of set up projects. However compared to the various other market segments, non-residential solar experienced the most awful project delays associated with the pandemic. Developers report that hold-ups related to permitting as well as interconnection or authorization procedures at the local or county level got to anywhere from 45 to 90 days at their worst factor. Inevitably, 2020 finished a little less than 2019, however many projects targeting 2020 will certainly wind up coming online in 2021.

The good news is, the two-year expansion of the ITC will certainly aid improve economics for non-residential projects over the next couple of years. But the most prompt influence of the ITC extension was to provide designers with breathing space at the end of the year. The year-end step down generally causes a nervous thrill to safe-harbor devices, indication PPAs, or get to various other critical project milestones. The extension offered developers some alleviation within those landmarks.

Thanks to project overflow, the ITC expansion, and also the tempo of a number of state community solar programs, we anticipate 2021 to expand 25% over 2020. Our neighborhood solar expectation peaks in 2021 as projects in New York and also Massachusetts reach completion, as well as project setups get in Illinois, Maine, Maryland, and New Jersey. Onsite non-residential solar (excluding area solar) is additionally expected to expand 18%, as the ITC extension greases the wheels of projects in advancement.

Nevertheless, by 2022 growth in non-residential solar will be much more small, driven nearly entirely by state-level dynamics. Commercial solar remains extremely policy-dependent: installations swell and also agreement with the opening as well as closing of state-level programs. In 2022 as well as 2023, neighborhood solar installments in states including Illinois, Maine, Massachusetts, Minnesota, New Jersey and New york city will start to decrease as pipelines of qualifying projects are built out. The Massachusetts market will certainly experience a pause in 2022, as the second 1600 MW ability allocation of the SMART program isn't expected to open up until later this year, driving more substantial growth in 2023. (Even more details on Massachusetts characteristics can be located in the full report). ITC-driven development in onsite business installations compensates for the downturn in community solar, leading to overall non-residential growth of 3% in 2022 and also 2% in 2023.

Longer-term, non-residential solar won't grow meaningfully till expenses decrease

Unsurprisingly, non-residential solar will certainly get slightly in 2024 and also 2025 as the ITC steps down. In spite of overall lasting positive outlook in the industry, non-residential solar continues to experience several discomfort factors as well as transaction rubbing that can only be overcome with solid state-level incentive programs. Not only are area solar pipes anticipated to decrease, yet originations of typical onsite non-residential solar are expected to be depressed for a number of years following the pandemic. Business property borrowing-- a sign of industrial organization wellness-- has had credit criteria tighten within the last year, as banks fear debt top quality degradation. Also before the pandemic, the marketplace for little and also medium onsite non-residential solar (projects less than 1 MW) has actually been diminishing considering that 2017 while the ITC was still at 30%.

It's really possible that new neighborhood solar programs or state-level incentive programs will surface within the next couple of years. However provided the prolonged project timelines of non-residential solar, it would certainly take several years for any type of new programs to result in project installations.

Nevertheless, as solar costs continue to decline, and also financing remedies for non-residential solar alleviate several of the discomfort factors for these projects, development will get in the latter fifty percent of the years. The non-residential segment might have lots of challenges, however an absence of an addressable market isn't among them.

3.3. Utility PV

Key figures

- 6.3 GW installed in Q4 2020, the biggest quarter for utility PV in background

- 2020 annual capability enhancements reached nearly 14 GW, the biggest year on record

The utility PV got pipe has actually remained level at 69 GW

The utility solar sector established the record for the most capability mounted in a single year in 2020. In Q4 2020, 6.3 GW of capability was mounted, also making it the largest quarter on record, with even more capability installed in this quarter than in all of 2018 combined. The utility solar sector dropped just except an expected 14 GW in 2020, with more projects than expected pressed into 2021. In spite of 2020 being the largest year on record, utility solar is likely to beat this record once again in 2021. There are presently 11.2 GW of projects incomplete for 2021, putting the market on speed to strike 17.5 GW of annual capability additions.

In 2020 alone, there were 30.6 GW of new utility-scale projects acquired, slightly less than the 34.3 GW of projects introduced in 2019. While year-over-year decrease could suggest a stagnation, the consolidated 64.9 GW of projects acquired in these 2 years exceeds the complete quantity of all projects got before 2019. The sector is growing at a quick rate and also will likely continue to do so in response to ongoing development of state-level renewable resource targets, utilities' self-enforced carbon reduction plans, a restored focus on clean energy deployment at the federal degree, as well as huge business offtakers aiming to satisfy web absolutely no carbon emissions objectives.

The following 5 years are likely to be a momentous time for utility solar, with both upside potential and drawback dangers. Via 2020, there was a thrill to get projects signed and eligible for the federal ITC prior to it phased down to 10%. This developed a rise of demand, contributing to the record-setting 69 GW pipe.

While the two-year ITC extension provides some designers flexibility to push back project conclusion dates by a year or 2, the majority of will remain to bring their projects online as arranged as a result of offtaker needs. This will likely cause greater than 19 GW of utility-scale solar projects deployed in 2023 alone. Years 2024 as well as 2025 will certainly see lower yearly capacity enhancements as utilities start to ramp up purchase, resulting in yearly overalls above 19 GWs once again in 2026.

From 2026 through 2030, yearly capability enhancements will certainly continue to grow from 19 to 41.8 GW. The remarkable surge in utility solar in the last part of the decade is due to an assemblage of elements. Expense declines in large-scale battery storage space, boosting expense competitiveness of utility-scale solar, robust tidy energy targets from governments, firms as well as utilities, growth in economy-wide electricity need, and also the need to replace retiring coal as well as natural gas plants will drive a big volume of new solar release.

As part of this shift, we will see offtakers end up being much more innovative as they pick projects with the lowest risk. We will certainly see an expanding number of projects that provide firmed form shipment as opposed to simply produced power, particularly as the variety of solar plus storage space projects are brought online.

There is significant upside chance during this moment. Head of state Biden re-joined the Paris Climate Accord in February, which has already driven a handful of power offtakers to take another look at as well as potentially raise their renewable energy procurement targets. And also the possibility of a nationwide government policy demanding even more renewables or carbon reduction is currently driving states as well as utilities to embrace brand-new solar and also renewables mandates.

Despite substantial possibility, the sector additionally encounters some headwinds as well as drawback risks. Developers remain to report tighter access to tax obligation equity (TE) financing, especially for new entrants. While we have observed some development in the number of TE carriers, the new participants are often not able to shut bargains as fast as incumbent financiers, leading to financing hold-ups. Likewise, designers have actually remained to report difficulties in securing design, purchase, and also building (EPC) companies. While rigidity in the tax equity as well as EPC markets is unlikely to cause project cancelations, some delays might occur for less recognized designers.

Finally, there is an expanding problem concerning solar product imports made with polysilicon from the Xinjiang province, China, because of reports of compelled labor in the area and a failure to conduct independent audits. While there is still unpredictability around the extent of the influence to the UNITED STATE solar market, the situation has the possible to postpone some part of UNITED STATE projects.

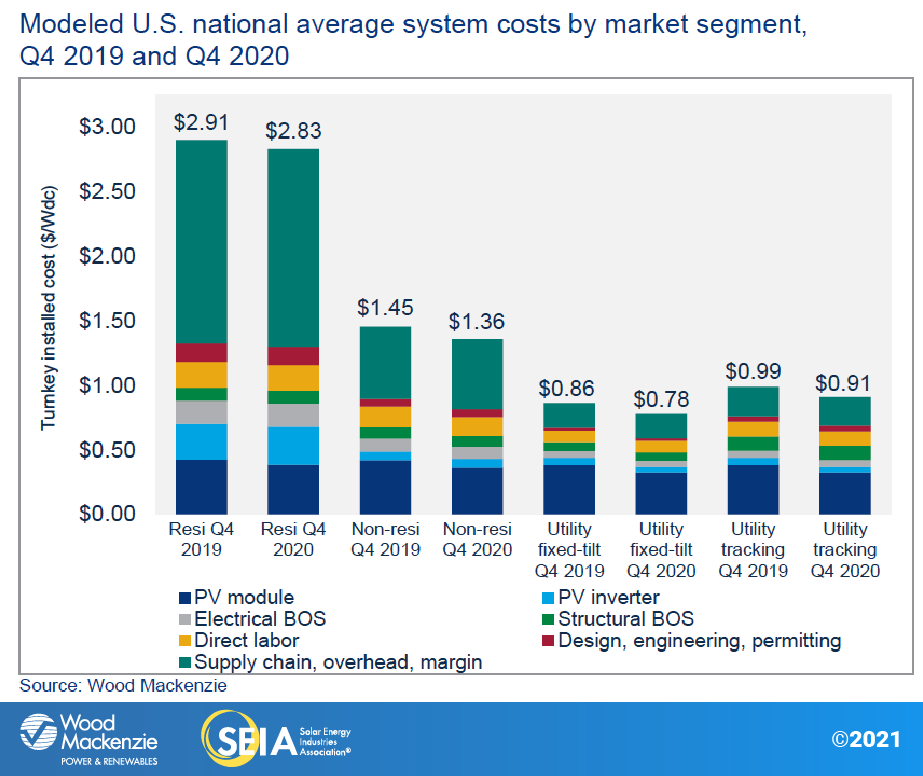

4. National solar PV system rates

We use a bottom-up modeling method to capture, track and report national average PV system pricing for the significant market segments. Our method is based on the tracked wholesale rates of major solar elements and also information gathered from interviews with industry stakeholders. We report a weighted standard of multi-silicon and also mono PERC solar modules for the property, non-residential and also utility segments.

In Q4 2020, system rates dropped throughout all market segments. System pricing fell year-over-year by 2.5%, 6.5%, 9.8% and also 7.9% in the property, non-residential, utility fixed-tilt as well as utility single-axis tracking markets, respectively. System prices fell quarter-over-quarter by 0.8%, 0.7%, 1.9% as well as 1.7% in the domestic, non-residential, utility fixed-tilt as well as utility single-axis monitoring markets, specifically.

The domestic solar sector was better positioned to manage the surge in Covid-19 situations in Q4 2020, as digital client acquisition as well as permitting procedures were more recognized than in March 2020 when the pandemic initially struck the UNITED STATE. While brand-new client purchase initiatives might have required extra investment, they also enabled firms to reach a bigger target market and also save money on traveling expenses. Therefore, typical consumer purchase costs did not raise from 2019 to 2020. Nevertheless, permitting processes were still a discomfort factor for non-residential as well as utility projects in Q4 2020, as AHJs experienced hold-ups when granting permits.

5. Component rates

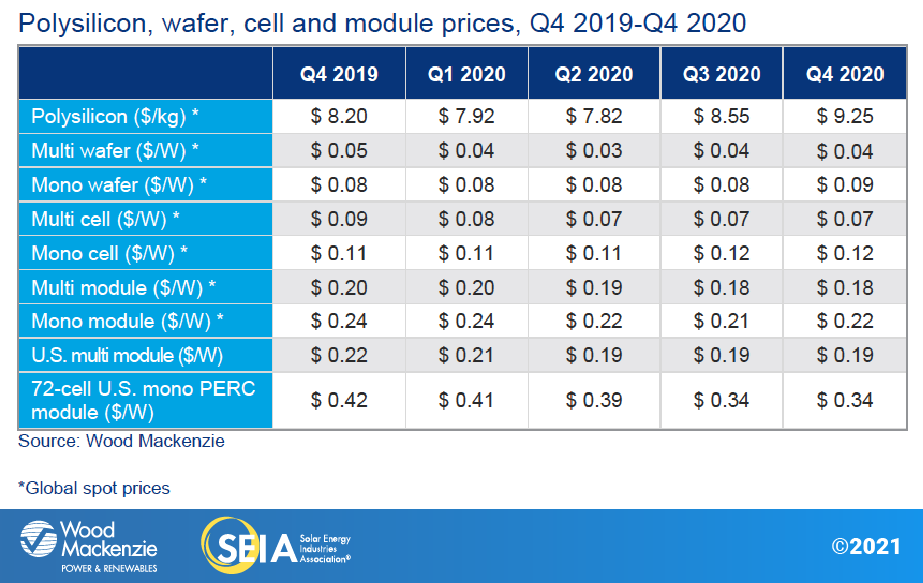

Significant module supply chain events that took place in Q3 2020 remained to have considerable impacts on module part pricing in Q4. Even though the polysilicon centers influenced by fire events and floods began to return to production in early Q4, supply continued to be constricted contrasted to require, causing a significant rise in polysilicon prices.

Mono-grade polysilicon costs practically got to $11/kg in very early Q4 and after that was up to $10/kg by December yet boosted again in the last two weeks of 2020 because of the year-end manufacturing thrill. In general, Q4 polysilicon rates saw an 8% boost quarter-over-quarter and the higher material cost dripped down as well as created mono wafer prices to climb by 7% during the exact same period. Multi and mono PERC cell prices saw little change from Q3 to Q4 2020.

Global standard prices for multi modules remained the same from Q3 to Q4 yet mono PERC module prices increased by 5% from Q3 to $0.22/ W in Q4.

In the U.S., mono PERC module prices were at $0.34/ W for utility-scale projects in Q4, a comparable level to the previous quarter. In November 2020, a judgment by the UNITED STATE Court of International Trade reinstated the Section 201 tariffs for all imported bifacial modules. Bifacial modules that arrived before 8 February 2021 will certainly deal with a 20% Section 201 tariff, and also those that get here in between 8 February 2021 and also 7 February 2022 will certainly deal with an 18% tariff.

Also read