Solar Market Insight Report 2020 Q4

- The quarterly SEIA/Wood Mackenzie Power & Renewables U.S. Solar Market InsightTM report shows the significant fads in the U.S. solar industry. Find out more concerning the U.S. Solar Market Insight Report. Released December 15, 2020.

1. Secret Figures

- In Q3 2020, the U.S. solar market mounted 3.8 GWdc of solar PV, up 9% from Q2 as the market began recouping from the worst influences of the pandemic.

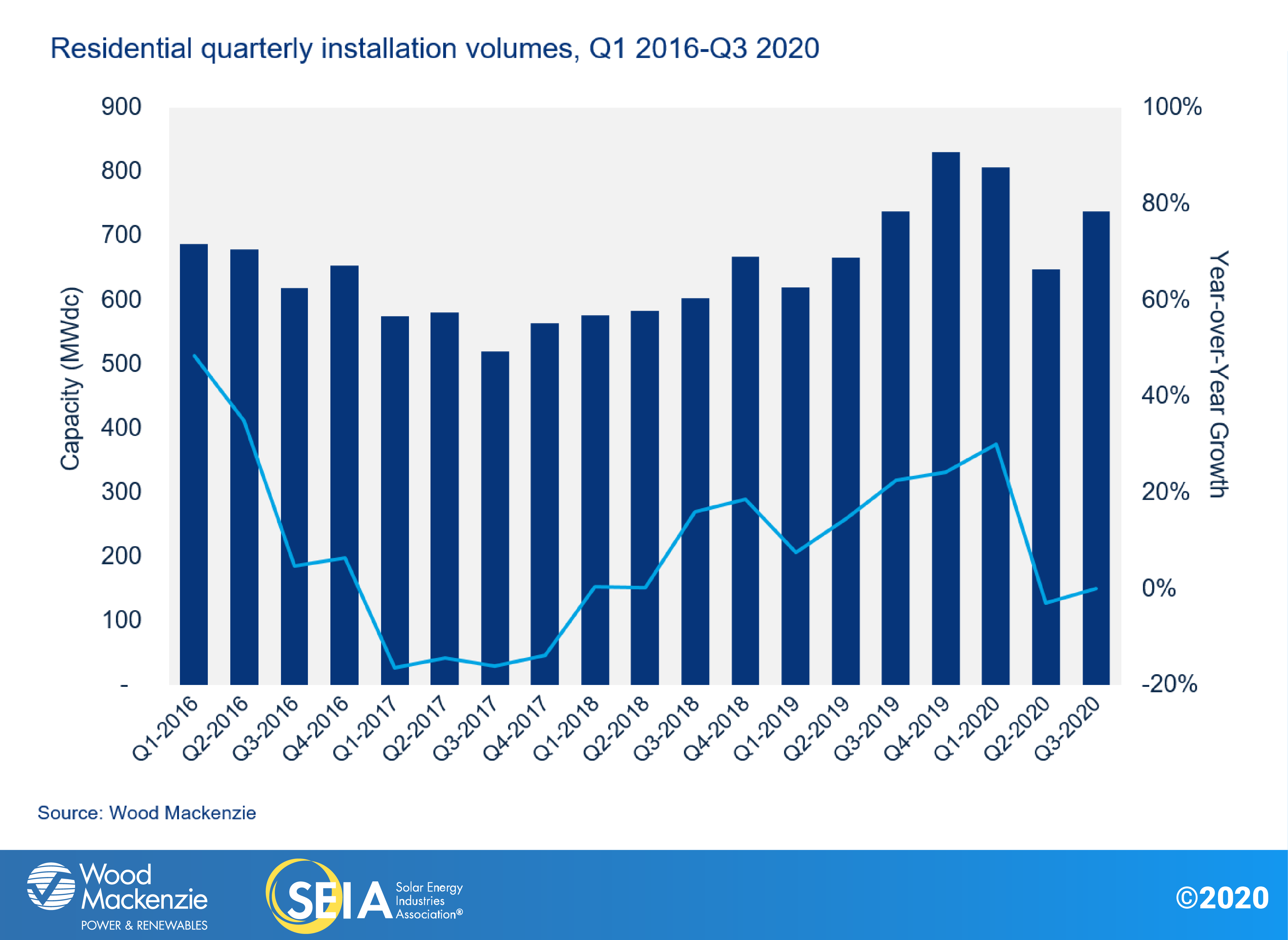

- Residential installations were up 14% from Q2 to Q3 2020 after shelter-in-place orders throughout the spring triggered the biggest quarterly decrease in history in the second quarter.

- Non-residential installations were up 8% from last quarter however still down 13% from Q3 2019. The training of pandemic-related limitations aided accelerate project completions but such limitations complicated as well as postponed development timelines in general.

- There were 2.7 GWdc of utility-scale projects mounted in Q3 2020, representing 70% of all solar ability brought on the internet this quarter. Utility solar has actually been just minimally influenced by Covid-19 relevant construction hold-ups.

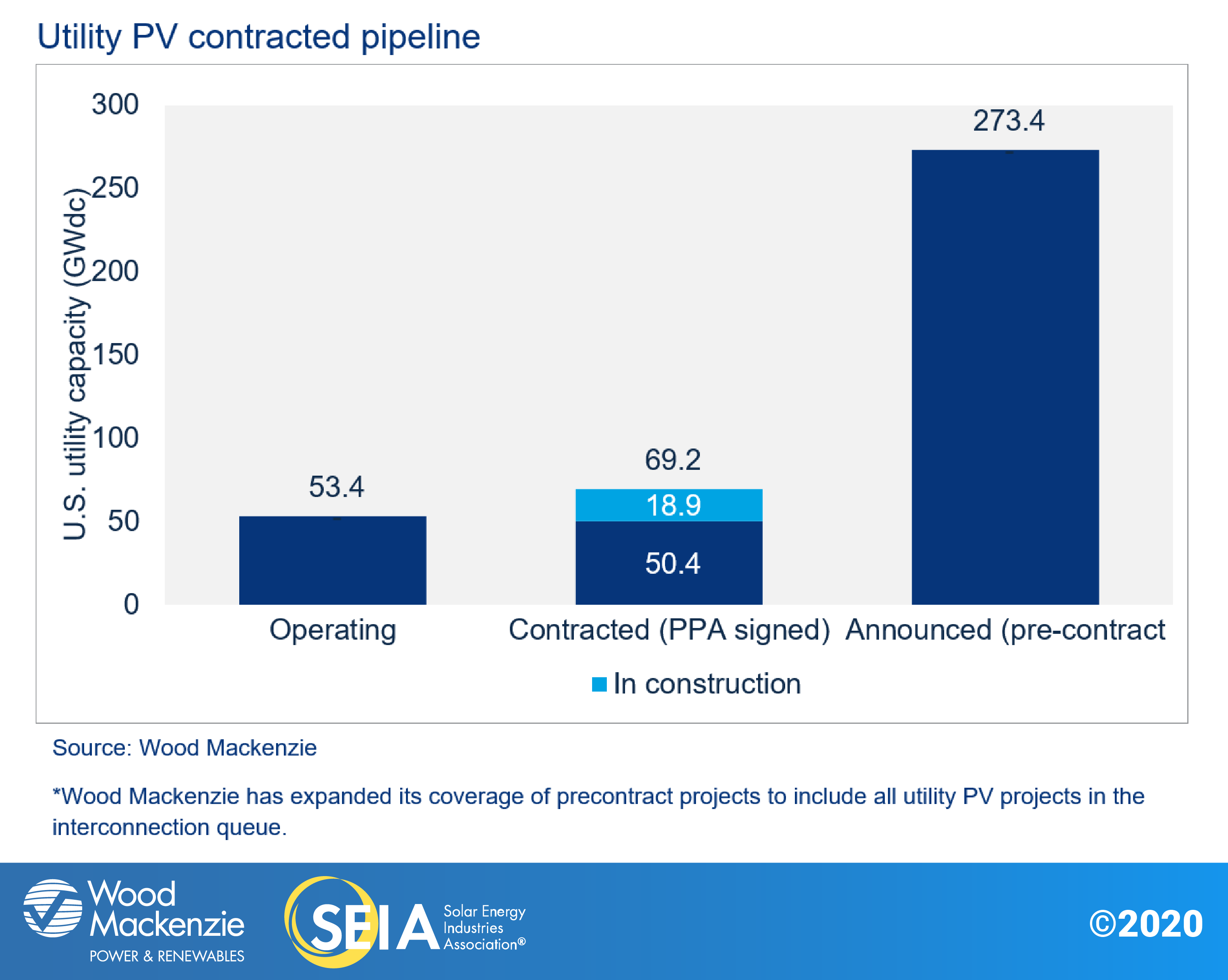

- A total amount of 9.5 GWdc of new utility PV power purchase arrangements were announced in Q3 2020, bringing the acquired pipe to a record total of 69 GWdc.

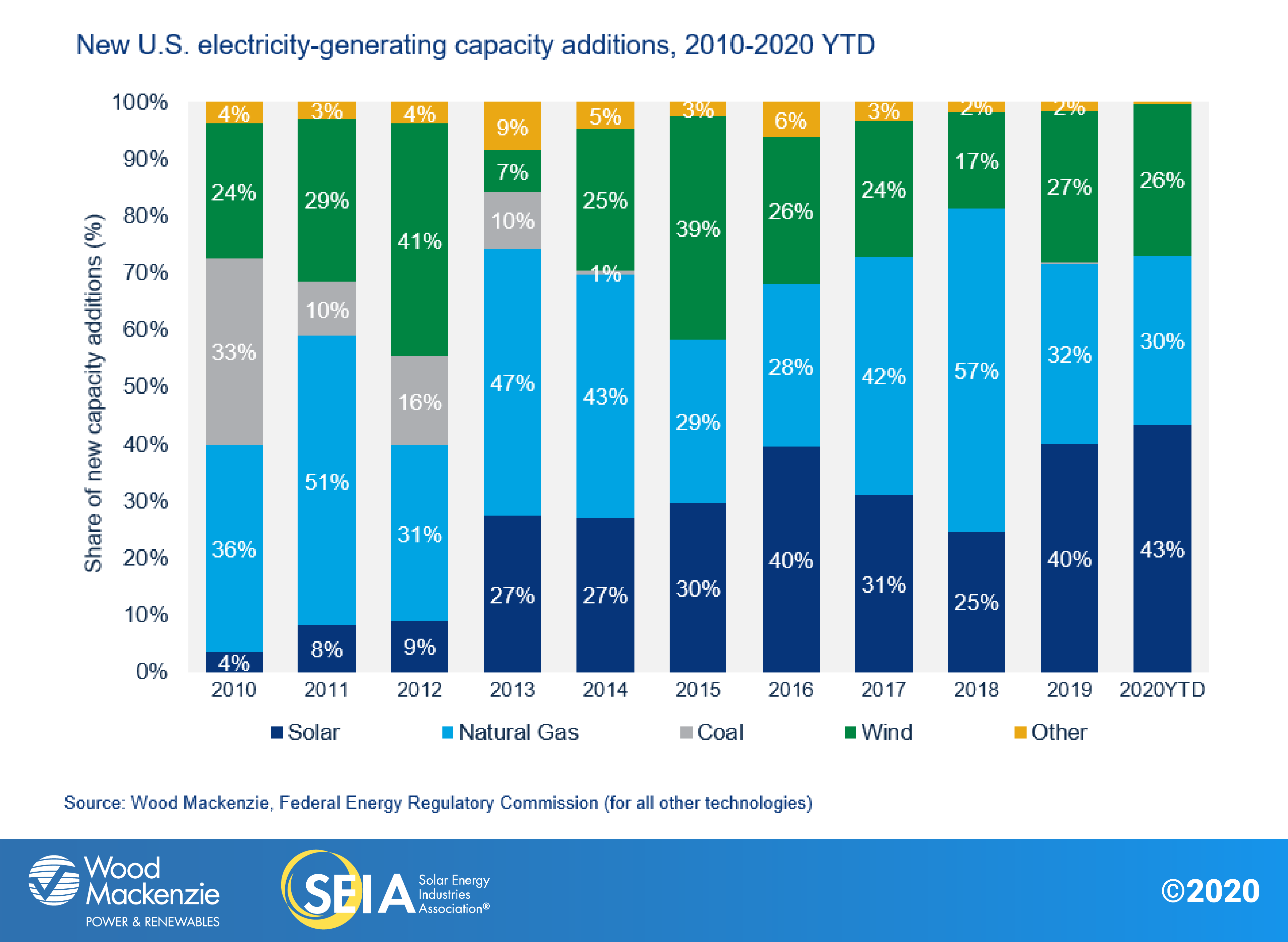

- Solar represented 43% of all brand-new electrical power producing capability included the U.S. via the 3rd quarter this year, vanquishing all various other generation technologies.

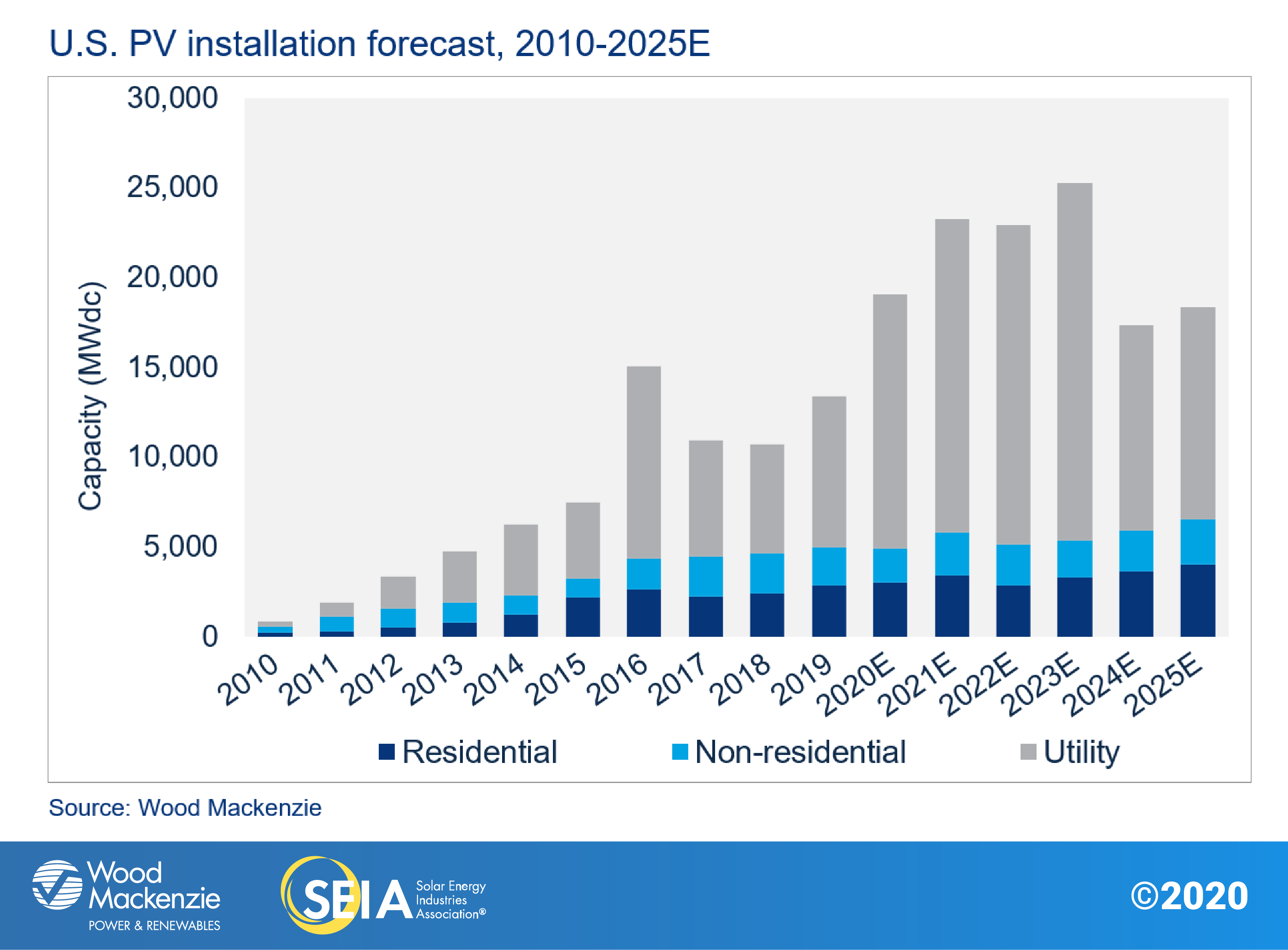

- Wood Mackenzie forecasts 43% annual growth for 2020, with greater than 19 GWdc of installments expected by year-end. As quarterly volumes demonstrate more durability to pandemic impacts than initially expected-- with a faster-than-expected recovery for dispersed solar-- our outlook for the year has actually boosted since last quarter.

- Solar Installations from 2021-- 2025 are currently forecasted to surpass 107 GWdc, a 10 GWdc rise from last quarter driven mainly by increases to the utility-scale solar pipeline.

2. Introduction

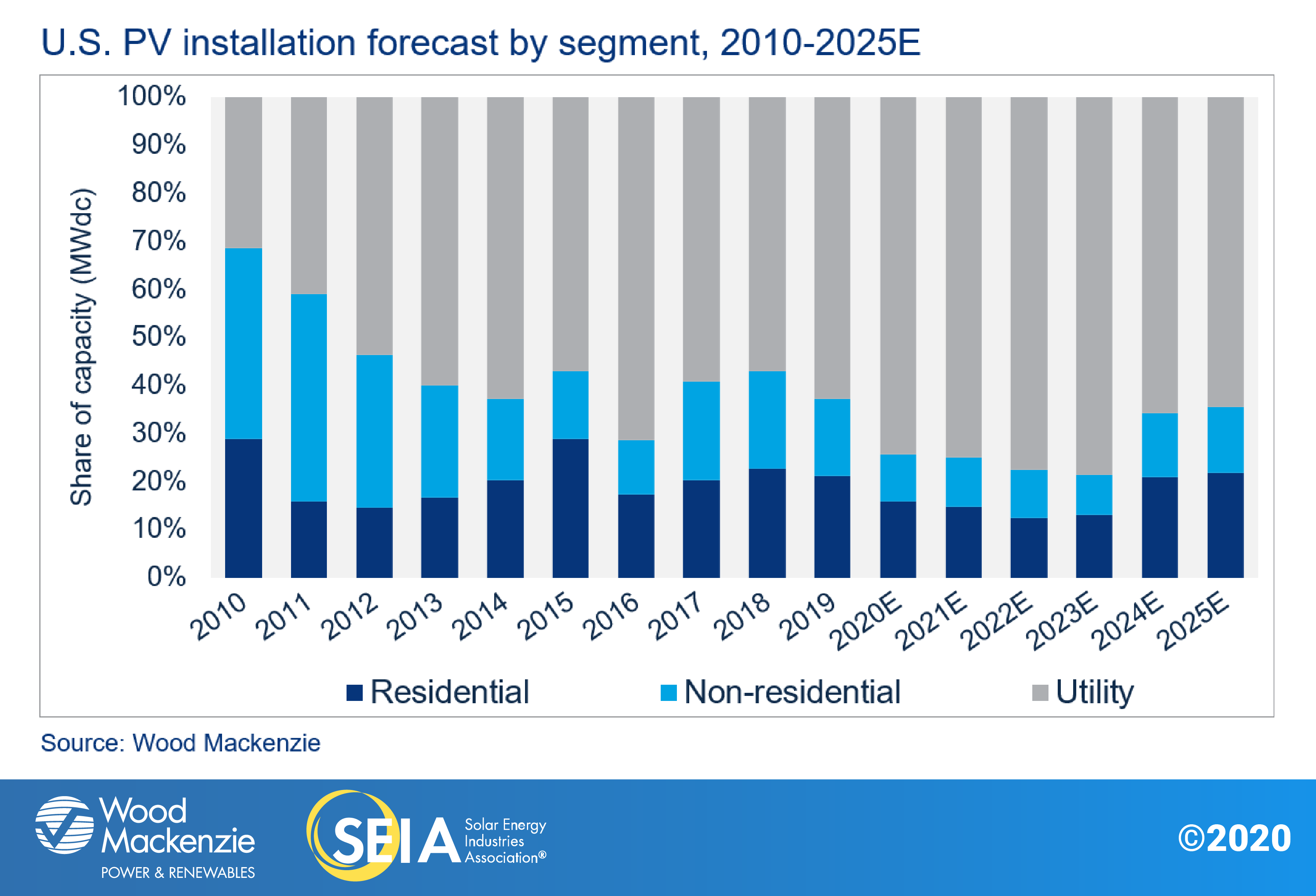

In the third quarter of 2020, the solar sector continued to recover from the worst company impacts of the coronavirus pandemic. U.S. solar companies installed 3.8 gigawatts-direct present (GWdc) of solar photovoltaic (PV) ability, a 9% boost quarter-over-quarter and a 46% boost year-over-year. Simply under 70% of capability installed in Q3 came from the utility segment, with 2.7 GW installed.

The household market bore the brunt of the pandemic influences to the solar industry in Q2 however experienced a reasonably fast recuperation with 738 MW mounted in Q3, a 14% boost from the previous quarter (though still listed below pre-pandemic levels). The non-residential PV section (that includes commercial, government, not-for-profit as well as area solar) enhanced 8% from last quarter with 429 MW, in line with volumes for the initial quarter of the year.

Despite troubles from the pandemic, a record 11 GW of brand-new solar capability was installed in 2020 with Q3, currently placing 2020 as the third-largest year ever. Additionally, solar PV represented 43% of all brand-new electricity-generating capacity enhancements with Q3 2020, the greatest of any kind of generation innovation.

Residential solar development as well as market self-confidence returns

The household solar industry experienced several of its largest variations in history over the last 2 quarters. Installment volumes in the second quarter decreased nearly 20% from Q1 - the most on record-- as states mandated stay-at-home orders that influenced sales, permitting, setup and also affiliation. The 3rd quarter then accomplished the highest possible mark for quarterly development in the last 4 years (14%) as setup and also sales task returned. A number of the larger installers are reporting record sales volumes and project pipelines, though not every household installer has recouped to the exact same extent.

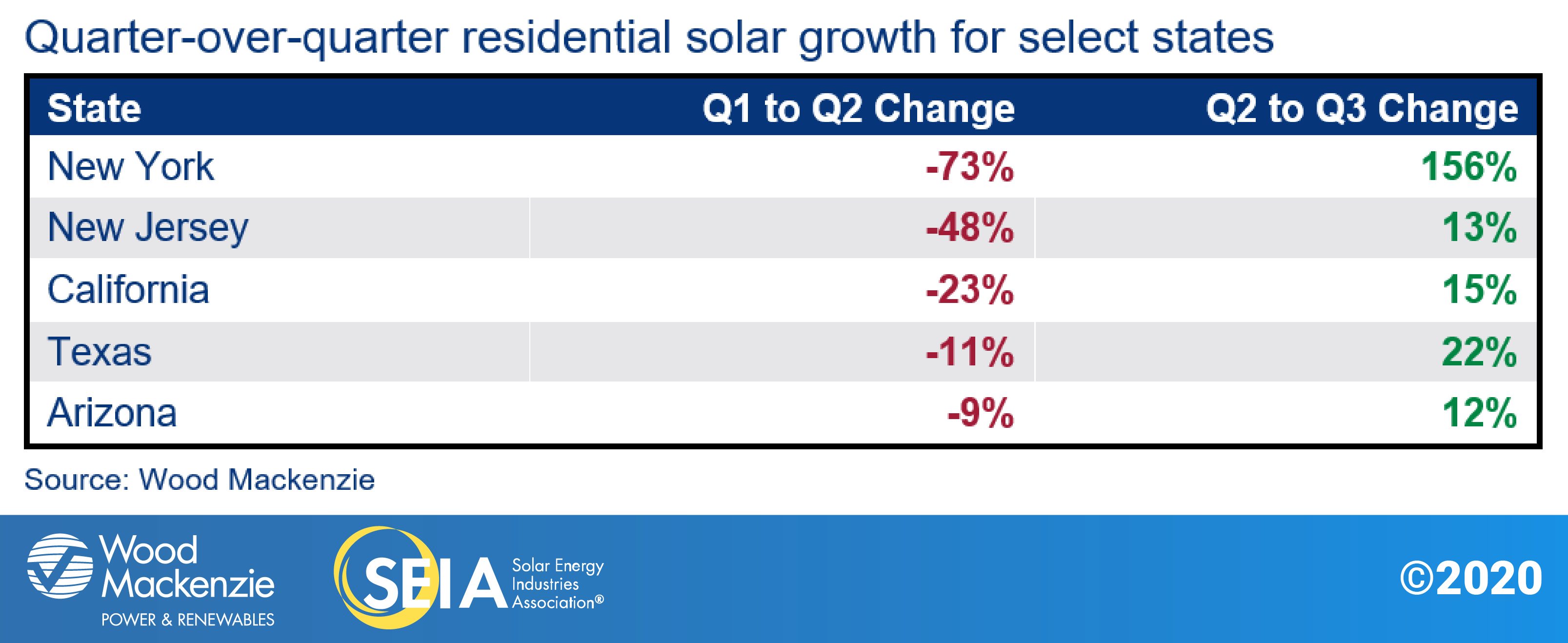

Realistically, the states that saw the most remarkable decreases have likewise seen the largest recoveries. California, the biggest property solar market, reduced 23% in the second quarter as well as expanded 15% in the third quarter. New York, which had the most strict lockdowns, reduced 73% in the second quarter and recoiled with 156% growth in the 3rd quarter. Markets like Arizona as well as Texas that put a lot less restrictive lockdown measures in place decreased slightly in the second quarter but each exceeded their very first quarter quantities in the third quarter.

The developments that numerous domestic installers brought to their business designs in Q2 remained to pay dividends via the summer and also autumn. Sales teams changed to online and also virtual sales strategies, which have proven successful for numerous business. The enhanced fostering of online permitting procedures and also digital conferences by cities as well as counties aided stop further delays. Almost every property solar installer responded to 2nd quarter decreases by offering discounts or discount rates, which has additionally assisted to improve sales. Lastly, domestic solar development continues to be sustained by finance products with increasingly compelling client business economics. Loans with 25-year terms are beginning to control sales. These funding terms enable also reduced month-to-month settlements than formerly preferred item offerings.

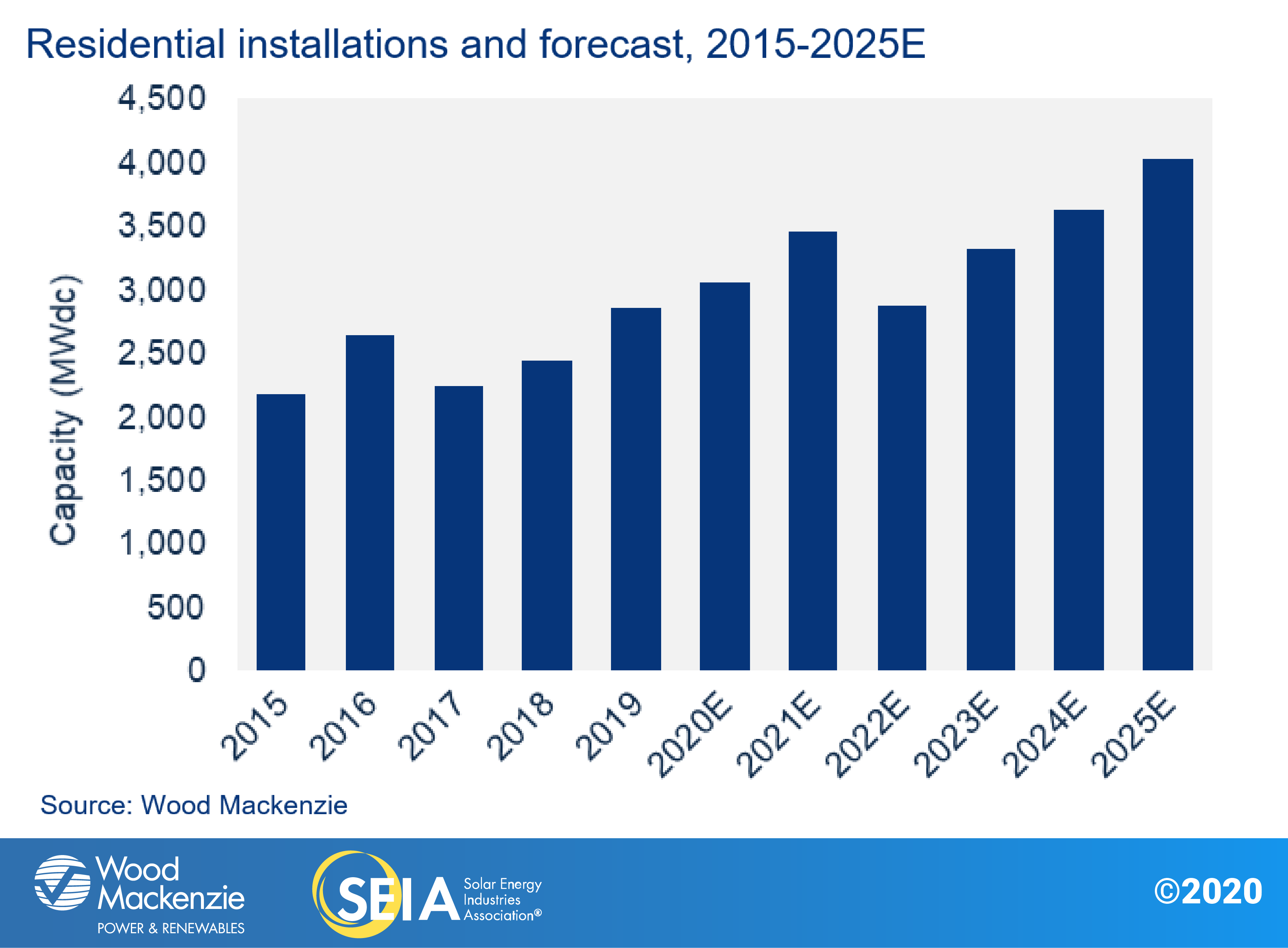

For these reasons, the projection for 2020 property setups has actually increased to more than 3 GWdc, representing 7% development over 2019. This is simply timid of our expectation before the pandemic, showing the durability of the residential solar market.

Non-residential solar also recuperates and pipes grow in essential state markets

In the 3rd quarter, the non-residential solar market went back to initial quarter levels with 429 MW installed. Development returned in key state markets like California, Massachusetts, and New Jersey. Project development as well as construction activity picked up with the late summer season and also fall, as well as pipelines boosted in expanding state markets such as Maine, Virginia, and Illinois. Considering that installment quantities were healthier than expected, our 2020 non-residential overview has enhanced by a couple of hundred megawatts.

Lots of projects are still on postponed timelines thanks to allowing as well as interconnection traffic jams that happened throughout the second quarter. This will lead to a 26% rise to expected 2021 setups as projects overflow right into following year as well as programmers rush to certify projects prior to the financial investment tax obligation credit report (ITC) goes down to 10% in 2022.

Utility PV expectation grows rapidly in the middle of increasing state and utility targets

Confidence in the U.S. utility PV segment has actually surged back after a number of months of market uncertainty caused by the coronavirus pandemic. The pandemic has no doubt produced better monetary risk as well as perilous market conditions for programmers, but the utility solar market has actually been able to weather these unpredictabilities so far and also has continued to broaden. On the whole, the 2020-2025 forecast has boosted by 8.6 GWdc. This boost results from 9.5 GWdc of new project news in Q3 2020, a rise of new utilities revealing carbon decrease or renewable energy targets, and enhanced self-confidence in project buildout.

The pandemic has actually created basically no hold-ups in utility project building, with designers as well as EPCs reporting just minor non-pandemic relevant hold-ups to this point. The pandemic has likewise caused little to no downturn in brand-new project news. Typically, utilities have proceeded increase solar purchase in anticipation of the ITC project completion due date on December 31st, 2023. Purchase from C&I offtakers seems to be the only market facing moderate downturn. New C&I offtake is expected to be down somewhat from 2019 degrees. Large corporations remain to authorize agreements with developers, such as AT&T's current statement of a 500 MWac PPA. However, little and medium corporations have actually expressed more hesitancy to obtain renewable energy offered unpredictable market conditions.

Demand for utility solar has raised with lots of regions introducing higher eco-friendly targets not only via state RPS policies but likewise from neighborhood utilities announcing solar procurement strategies or carbon reduction targets. While utilities in states such as California, Colorado as well as Washington have announced carbon decrease targets as a means of lining up with state policies, a number of utilities are likewise promoting targets above and past state policies. Integrated with affordable business economics, these brand-new news will result in growth in states like Arkansas, Indiana, Missouri as well as other states without desirable state-wide renewable resource plan.

In spite of the restored self-confidence on the market, there are some lingering risks. There remain to be concerns of insufficient tax obligation equity financing for all projects. While this does develop drawback danger, it is most likely that impacted projects will certainly see delays instead of cancellations. In a similar way, designers remain to report better difficulty in securing EPC contracts for their projects. With many programmers trying to find building and construction firms to complete projects before 2024, EPCs have actually reported being a lot more careful regarding what projects they pick as well as favoring larger companies that can provide repeat organization over smaller, much less well established designers.

Future pandemic lockdowns will have much less impact

As Covid-19 caseloads remain to raise this autumn, there is the possibility that even more shelter-in-place orders will be implemented. However the industry is better placed to handle future shutdowns, offered the abovementioned adjustments. To have major influences, future procedures would certainly have to be so restrictive that they restrict also construction tasks, like the NY PAUSE exec order. Such restrictions seem unlikely given the unfavorable financial consequences and also the expanding evidence that exterior construction projects like solar setups can be taken on reasonably securely while observing public health support. Any kind of future impacts from Covid-19 are more probable to originate from labor shortages as a result of the ailment of employees or their family members, or moms and dads requiring to look after their kids while in-person institution is not readily available.

Prospective impacts of the election

While the incoming Biden management has actually signified an intent to release even more solar, there are numerous political unpredictabilities that render quantitative market evaluation also speculative at this moment. Prospective policies regarding tax obligation credit histories, profession tolls, decarbonisation targets, as well as research and development spending could meaningfully sustain solar market growth, yet we can not anticipate market results without more quality on the range of any policy changes. Much more qualitative evaluation on the impacts of the election are given in the complete report.

3. Market sector outlooks

3.1. Residential PV

Trick figures

- 738 MWdc installed in Q3 2020

- Up 14% from Q2 2020

- Apartment over Q3 2019

The healing of the domestic solar industry this quarter has improved our 2020 overview, with installations currently expected to expand 7% over 2019. Without substantial constraints on setup task as well as adaptation to remote sales and permitting processes in several areas, several installers report that the marketplace is returning to normal-- and sales are expanding.

As talked about in the previous report, the suppressed economic situation as well as higher joblessness degrees this year have had much less detrimental effect on property solar sales than initially expected. Sales volumes had gone back to pre-Covid-19 degrees by the center of the summertime, and also ever since, many installers have actually had record-breaking sales months. While larger installers have recovered faster than smaller sized installers, the recuperation has been broad.

As a result, the biggest restriction for the industry has shifted from sales to labor supply. Installment crews have been ramping back up and working with even more team considering that the springtime, but the labor supply is tight. The market has now gone back to the labor scarcities experienced in late 2019 as well as very early 2020 prior to the pandemic.

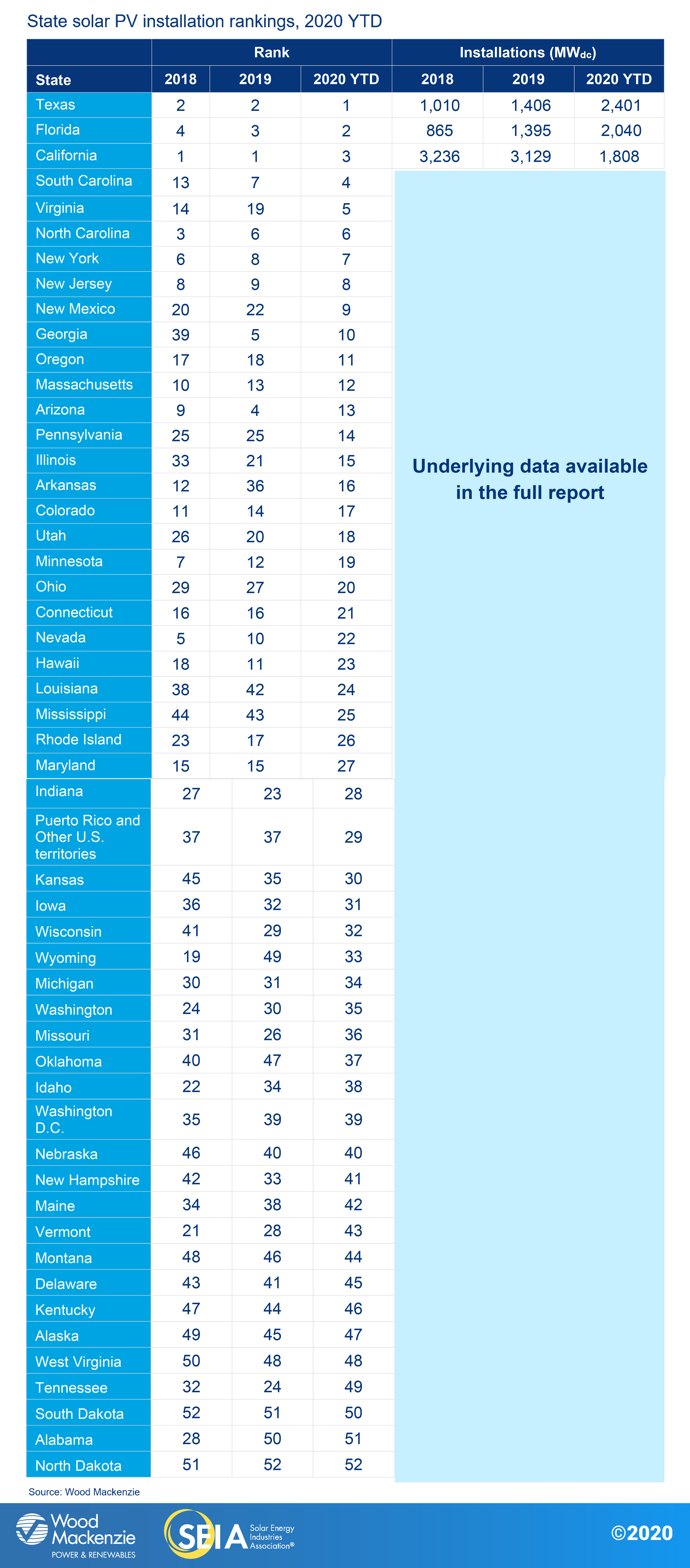

Labor lacks over the coming months will certainly cause some projects to be delayed till following year. When integrated with need pull-in pertaining to the ITC decrease in 2022, this will certainly cause 13% development in 2021 over 2020. Our 2021 outlook has been changed upwards for both Florida and also Texas, where installers remain to report expanding sales pipelines. Each of these markets is expected to set up greater than 300 MW in 2021, placing behind only California.

Although the marketplace will acquire in 2022 in reaction to the ITC stepdown (to absolutely no for direct ownership as well as to 10% for third-party-owned systems), growth will return to in 2023 and also continue right into 2025. Under current plan regimes, we expect longer-term development of 10-15% in between 2023 to 2025. This is contingent on boosting financial fundamentals after the ITC has completely eliminated, in addition to continued geographic diversification beyond recognized state markets. It likewise depends upon proceeded organization version advancement for solar-plus-storage items, which will be progressively crucial as states and utilities change their residential solar payment schemes. The degree to which President-elect Biden's management can pass their climate and energy program over the next a number of years uses considerable upside possible to this forecast.

3.2. Non-residential PV

Key figures

- 429 MWdc mounted in Q3 2020

- Up 8% over Q2 2020

- Down 13% from Q3 2019

Though the initial half of 2020 was rocky for non-residential solar advancement, market problems have boosted in the last half of the year. While there is still significant variance between local territories in changing to online conferences and also procedures, essentially designers have actually overcome these challenges as well as have actually been able to total projects as well as expand their pipes.

Another restriction for business solar this year has been protecting tax obligation equity financing. With an increase of solar projects calling for financing as well as general wariness from capitalists as a result of the current economic problems, competition for tax equity funding has boosted. Bigger projects (> 1 MW) with creditworthy offtakers will not have a difficult time discovering prepared investors. But smaller projects, or those with non-investment-grade offtakers, may have to wait up until more financing is available next year, or figure out alternative funding services.

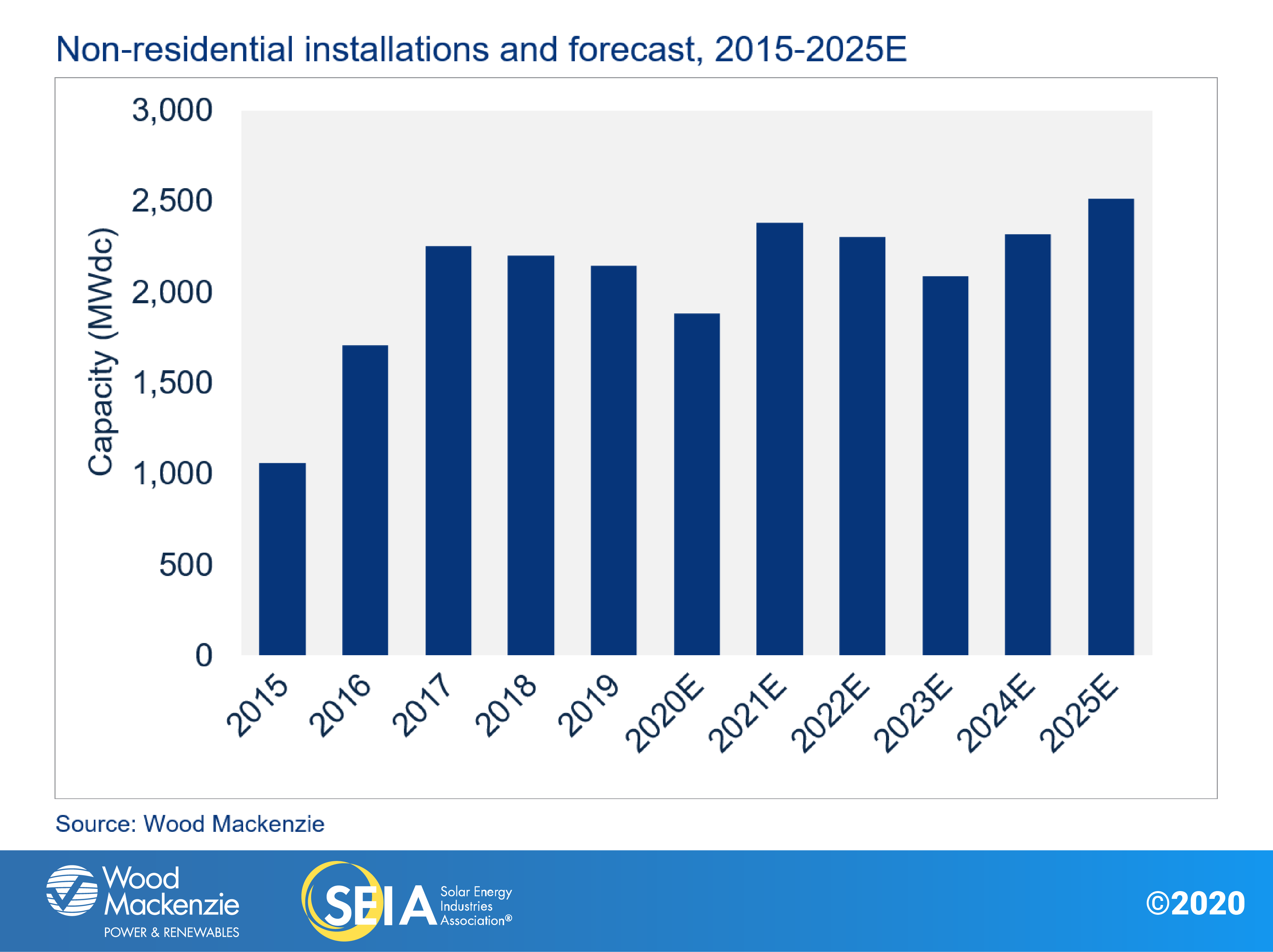

The combination of project delays and need pull-in from the ITC suggests that 2021 is expected to be a record-setting year at nearly 2.4 GWdc. Furthermore, 42% of the non-residential solar overview in 2021 is expected to be area solar (this share is anticipated to be 38% this year and was 29% in 2019). Numerous state programs-- Massachusetts, Illinois, New Jersey, etc.-- will certainly be striking their heights following year.

Consequently, 2022 will see some slight contraction as the ITC phases down and reduced source volumes in 2020 show. While programmers have actually reported that origination has picked up from the second quarter lull, total source in 2020 is still lower than it would certainly have been prior to the pandemic. Several services have limited their expenditures on capital expense as a result of unpredictable financial conditions.

The phase down of the ITC will continue to cause market tightening in 2023 as the majority of certified projects will certainly have been constructed out in the prior year. Furthermore, numerous vital state programs that support business solar will be ending or phasing down around this timeframe. Starting in 2024, market growth is expected to return to as solar expenses decrease as well as financing ends up being more commonly offered.

3.3. Utility PV

Key figures

- 2.7 GWdc set up in Q3 2020, the largest 3rd quarter for utility PV in background

- The utility PV acquired pipe has actually expanded by 7 GWdc to 69.2 GWdc

This quarter was the biggest Q3 in background for utility PV with 2.7 GWdc released, bringing 2020 advancing ability to 7.6 GWdc through the end of Q3. The initial nine months of 2020 were larger than the total capacity enhancements of any kind of year other than 2016 and also 2019. Additionally, with 7 GWdc of projects anticipated to be completed by the end of December 2020 is on rate to go beyond 2016 and also end up being the biggest ever year for utility PV. While some projects will unavoidably overflow right into 2021, we are positive that 2020 will certainly surpass 14 GWdc.

With 25.9 GWdc of new utility-scale projects acquired in 2020 alone, the stunning development of the advancement pipe has raised the projection dramatically. In addition to ongoing expansion of state-level renewable energy targets, many utilities have actually established their very own targets in reaction to stress from city governments as well as huge business offtakers. Even before the country knew which prospect would be elected president, utilities saw higher adoption of renewables as a hedge versus possible environment activity at the federal, state or local level. Along with stress from cities, company offtakers, as well as grassroots organizations, these factors have actually caused several big utilities pledging to fulfill brand-new carbon reduction or renewables targets.

Despite record installations and also procurement, some potential disadvantages remain. As economic markets remain to experience uncertainty amidst the pandemic, accessibility to tax obligation equity is becoming tighter for brand-new participants and smaller sized designers. In addition, the capacity of qualified Tier-1 EPCs has actually not kept pace with the rise in procurement. Both variables mainly affect developers with small portfolios as well as are unlikely to cause cancellations yet could cause some delays for projects wanting to come online between 2021 and 2023.

With construction of the current utlity PV pipe staying on the right track and also 6-- 10 GWdc of new projects introduced each quarter this year, our five-year forecast has grown substantially to match the rise in solar need. The 2020-2023 forecast has grown by 9.8 GWdc while the 2024-2025 projection has shrunk by 1.2 GWdc.

Near term, our 2020 projection has actually been enhanced modestly to 14.2 GWdc as we expand much more positive in projects getting to conclusion prior to the end of the year. The 2021 as well as 2022 projections have expanded by a collective 5.5 GWdc. With greater than 2 thirds of brand-new project news targeting these 2 years, we have expanded a lot more confident that 2021 as well as 2022 will certainly see robust growth.

Our expectation for 2023 has actually seen an 18% increase to 19.4 GWdc. There are two primary elements adding to this boost. Initially, the press by programmers to finish ITC-qualified projects by 2023 will certainly produce the largest single year on record. There are currently 12.8 GWdc of projects introduced with 2023 completion days. As even more PPAs are signed, we anticipate the 2023 advancement pipeline to continue to swell.

Spillover from 2023 to 2024 positions a much greater punitive damages than in previous years because of the ITC project completion deadline, so programmers will look for to develop as several projects as feasible before the ITC goes down to 10%. Second, projects that require to begin supplying power in 2024 are being pulled into 2023 to make use of the ITC. Some designers are already planning to bring projects online in 2023 that do not call for power distribution up until 2024.

The 2023 need pull-in has actually decreased our 2024 and also 2025 projections to 11.1 and 11.4 GWdc respectively. To be clear, the forecast decrease in those years is not a measure of a reduction in demand but instead a shift because of financial considerations on the part of designers and owners. Indeed, with increasing utility-driven renewable energy goals, decreasing costs in utility-scale storage, the capacity for impactful federal or state action on environment as well as expanding interest among corporates for large renewables, there is considerable advantage to our projection for the center part of this decade.

4. U.S. solar PV projections

5. National solar PV system rates

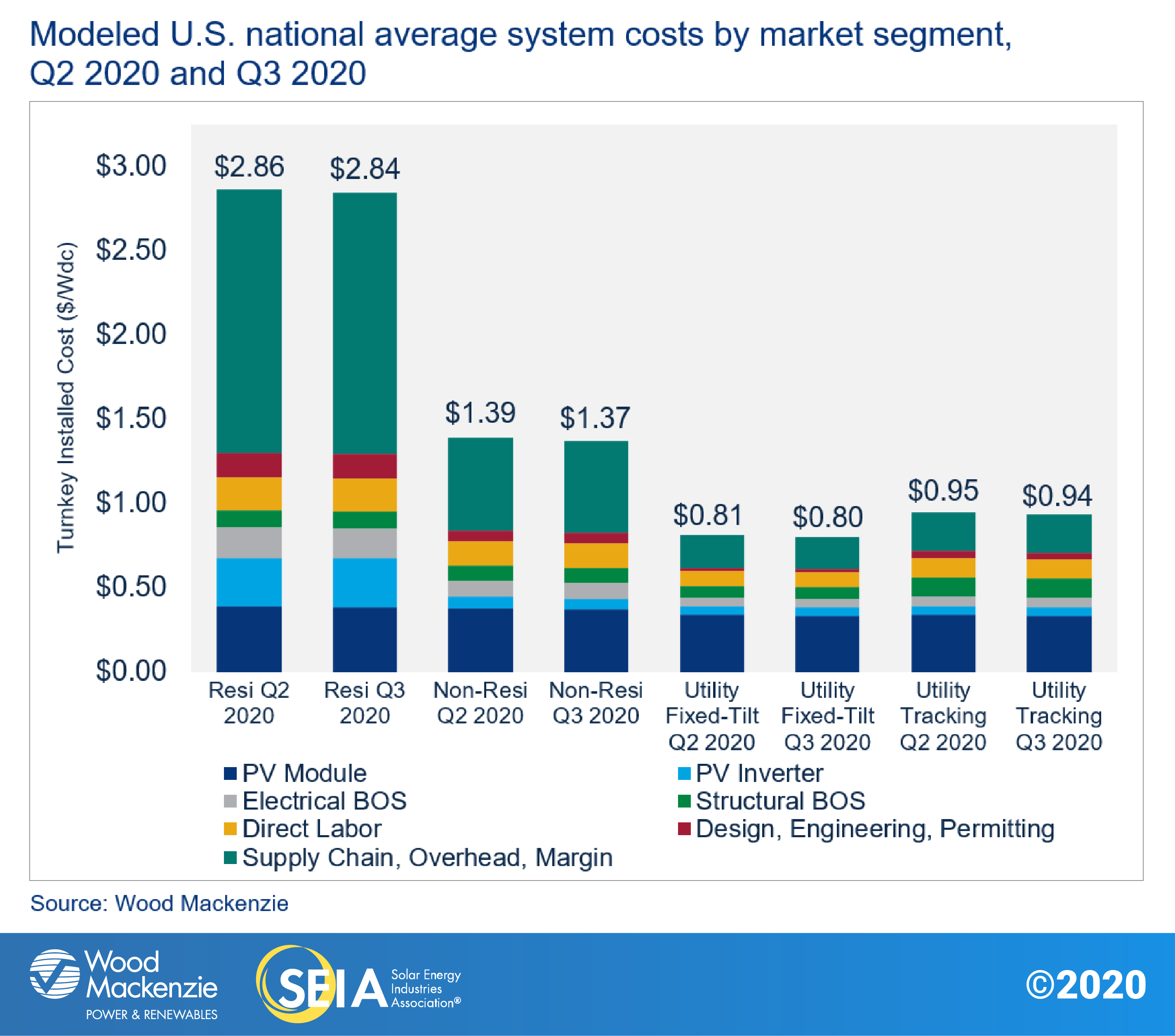

We utilize a bottom-up modeling approach to catch, track and also report national ordinary PV system pricing for the significant market sections. Our bottom-up method is based on the tracked wholesale pricing of major solar elements as well as information collected from numerous meetings with sector stakeholders. Because of increased need for mono PERC solar modules, we report a weighted standard of multi-silicon and also mono PERC solar modules for the household and non-residential segments as opposed to prices for multi-silicon modules only. Q4 2019 is the first quarter in which these new mixed system costs were used, so previous quarters for the non-residential and utility industries will certainly not be commensurable with Q4 2019 and also onward. Mono PERC solar modules are a lot more expensive than multi-silicon modules, so the brand-new blended module cost method will produce higher system rates.

In Q3 2020, system prices dropped throughout all market segments. System rates fell quarter-over-quarter by 0.7%, 1.4%, 1.3% as well as 1.2% in the domestic, non-residential, utility fixed-tilt as well as utility single-axis tracking markets, specifically. The impact of Covid-19 on utility-scale soft prices remains marginal, in spite of delays caused by allowing processes and scheduling of labor. For dispersed solar, the true influence on system costs is still not completely referred to as companies remain to take on to online sales techniques.

6. Element rates

The coronavirus pandemic's effect on the global PV supply chain decreased in Q3 2020. By July, the rate declines triggered by Covid-19 were much less pronounced compared to the previous quarter. Nonetheless, the module supply chain was much from static. An explosion at GCL Poly's center in Xinjiang, China, and also the flooding at Tongwei's facility in Sichuan, China took 68,000 lots of polysilicon capability offline. This has to do with 11% of the complete international ability, equivalent to 21 GW of wafers.

These significant incidents activated a cause and effect on the supply chain, causing substantial upstream rate boosts starting in August. Mono-grade polysilicon rates increased by 56% quarter-over-quarter. Mono wafer costs leapt by greater than 20% throughout the exact same duration while multi wafer rates enhanced for the first time in greater than two years due to provide scarcity. Mono PERC cell costs also went up by regarding one cent.

However, international average costs for multi and mono modules enhanced much less rapidly relative to the upstream supply chain for two reasons: the declining share of silicon costs in complete module production, as well as the reduced sellers' margin. Therefore, global module prices still took care of to decline compared to the previous quarter.

In the U.S., multi-silicon module rates were about $0.19/ W in Q3 2020. Mono PERC module rates went down meaningfully from $0.39/ W in Q2 to $0.34/ W in Q3 for utility-scale projects. Bifacial modules continued to appreciate the Section 201 toll exemption in Q3. The workplace of the US Trade Representative revealed its choice to reimpose the toll in April. However, the United States Court of International Trade maintained a preliminary injunction to block the toll throughout Q3.

Without the tariff, the rates of bifacial modules was, typically, competitive with mono-facial modules in the quarter. In October, President Trump issued an announcement that withdrawed the bifacial exclusion and also increased the year 4 tariffs from 15 to 18%. On 19 November 2020, the US Court of International Trade decreased to apply the Preliminary Injunction to the October pronouncement on step-by-step grounds. This paved the way for Customs to collect tariffs on bifacial modules disallowing a different order.

Also read