Solar Market Insight Report 2020 Q3

- In Q2 2020, the U.S. solar market mounted 3.5 GWdc of solar PV, down 6% from Q1

- Residential installments were down 23% from Q1 to Q2 2020, due mainly to shelter-in-place orders during the preliminary phases of the Covid-19 pandemic that imposed restrictions on marketing as well as mounting household solar.

1. Key Figures

- In Q2 2020, the U.S. solar market mounted 3.5 GWdc of solar PV, down 6% from Q1

- Residential installments were down 23% from Q1 to Q2 2020, due mainly to shelter-in-place orders during the preliminary phases of the Covid-19 pandemic that imposed restrictions on marketing as well as mounting household solar.

- Non-residential setups were down 12% from last quarter as well as 19% from the same quarter last year as Covid-19 constraints made complex project setup as well as zoning challenges postponed advancement timelines.

- Almost 2.5 GWdc of utility-scale projects were set up in Q2 2020, representing 71% of all solar capacity brought on-line this quarter. This section has seen very little Covid-19 associated building and construction effects.

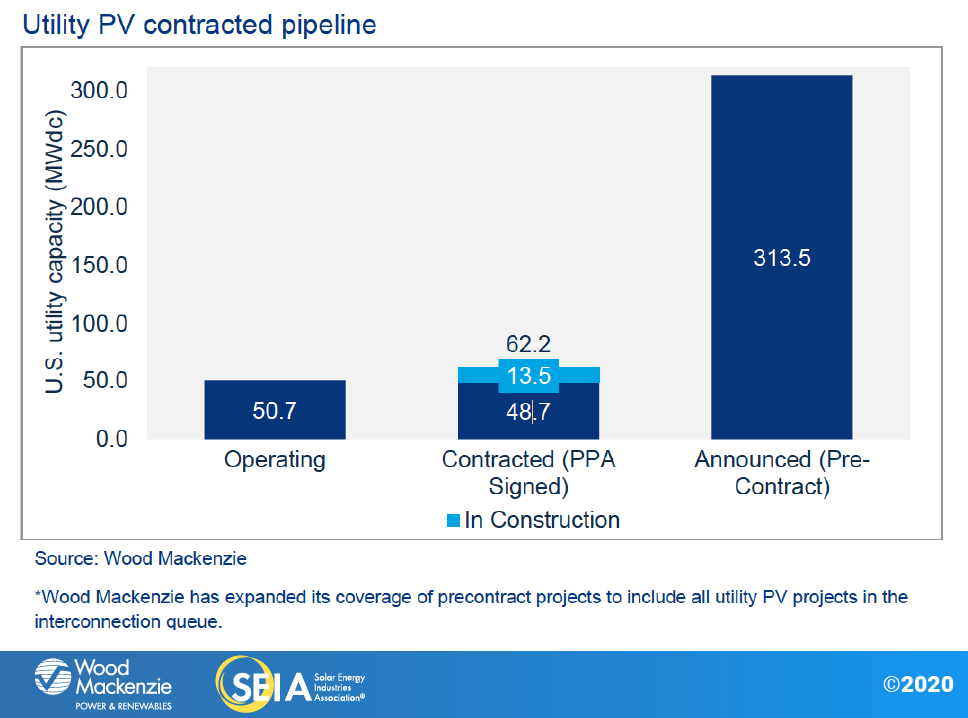

- A total of 8.7 GWdc of brand-new utility PV power-purchase contracts were revealed in Q2 2020, bringing the acquired pipeline to a document overall of 62 GWdc.

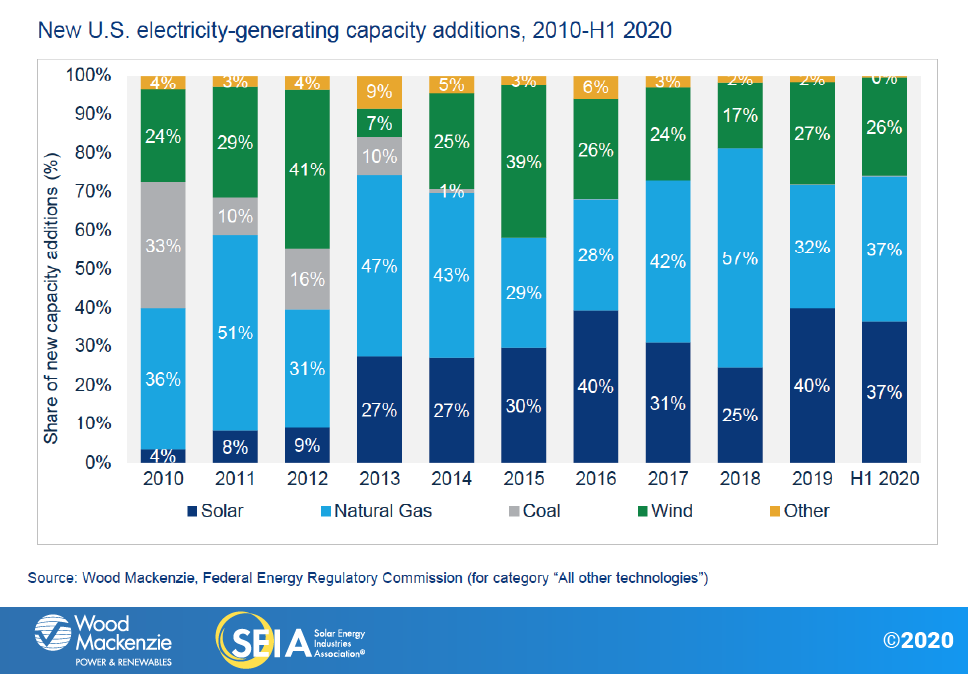

- Solar made up 37% of all new electrical energy creating capacity added in the U.S. in H1 2020, similar to the share of new ability included 2019.

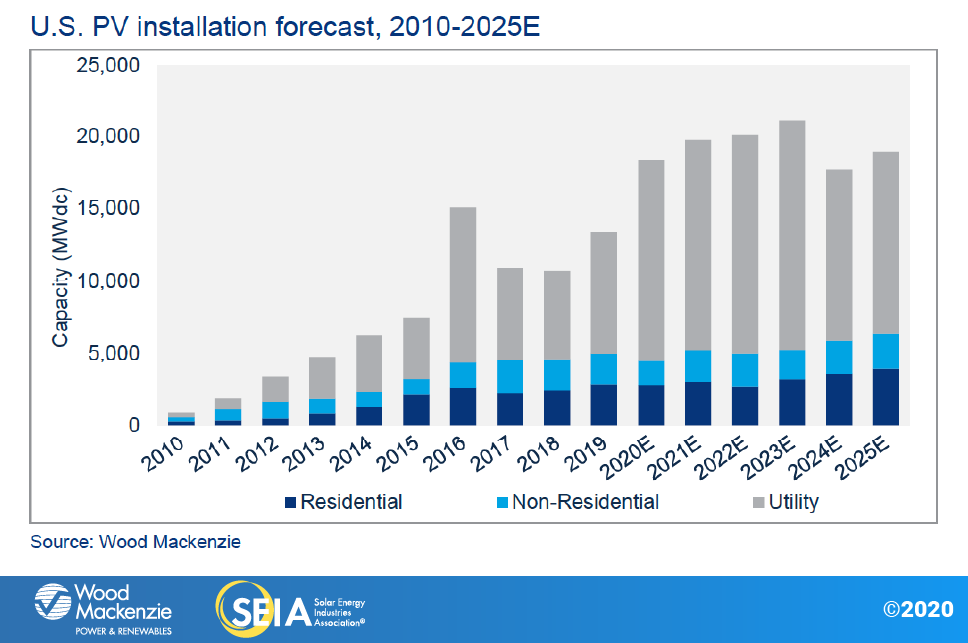

- Timber Mackenzie forecasts 37% yearly development in 2020, with over 18 GWdc of installments anticipated. Projections have raised significantly because last quarter as effects from Covid-19 have actually been less severe than anticipated, however they are still down 6% about pre-pandemic projections.

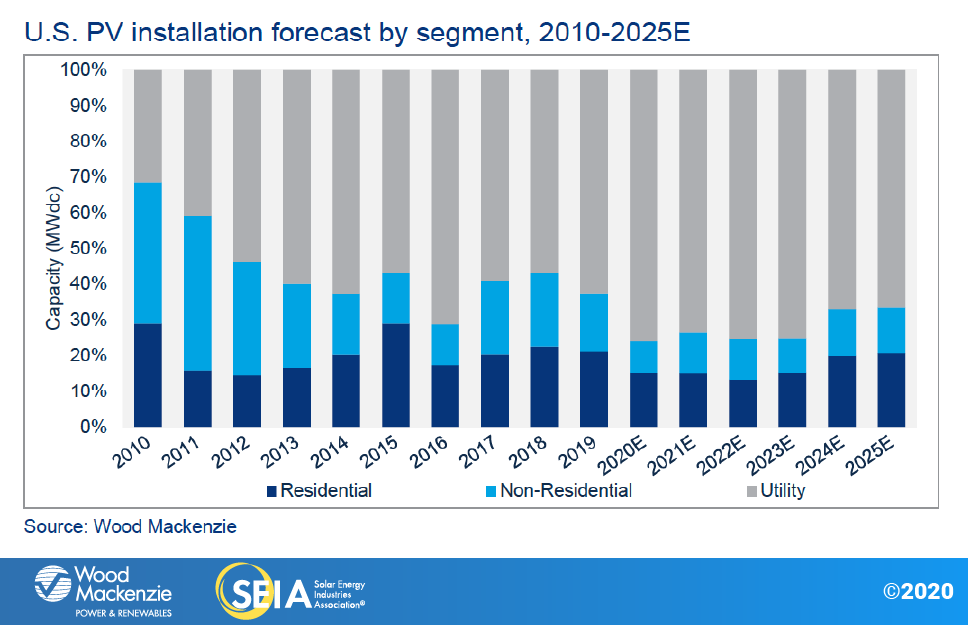

- In total, the U.S. solar market will mount nearly 100 GWdc of solar from 2021-2025, 42% more than was mounted over the last five years. By 2025, one-fifth of brand-new utility PV systems, one-third of brand-new household solar systems and also one-quarter of brand-new non-residential solar systems will be coupled with energy storage.

2. Intro

While the very first quarter of 2020 was reasonably insulated from the effects of the novel coronavirus, Q2 was the first full quarter in which the U.S. solar sector was subjected to the risks associated with the pandemic.

In Q2 2020, the U.S. solar market installed 3.5 gigawatts-direct present (GWdc) of solar photovoltaic or pv (PV) capacity, a 7% decline quarter-over-quarter yet a 52% rise year-over-year as well as the biggest Q2 ever before. More than 70% of quarterly capacity installed originated from the utility segment, which broke a Q2 document with 2.5 GW mounted. Energy PV has seen less serious construction impacts from Covid-19 than various other parts of the sector, given its minimal customer communication and also lengthier advancement timelines.

At the same time, both distributed sectors experienced much more significant obstacles as a result of the pandemic, as state-mandated work stoppages affected sales, allowing, installment and affiliation.

Residential setups in Q2 dropped 23% from the previous quarter, with the 617 MW installed standing for the lowest quarterly overall in more than a year. The non-residential PV segment (that includes commercial, government, not-for-profit as well as area solar) saw a 12% quarterly decrease and its most affordable quarterly overall in four years. Despite this, throughout all market sectors, solar PV represented 37% of all brand-new electricity-generating capacity enhancements with H1 2020, second only to gas.

The coronavirus pandemic struck the domestic solar industry the hardest in Q2

With the very first shelter-in-place orders issued in mid-March in reaction to the growing Covid-19 threat, Q2 2020 was anticipated to bear the brunt of the effect of the pandemic. As well as indeed, it did. Quarterly capacity additions fell from a Q1 document of almost 800 MW set up to 617 MW installed in Q2 2020-- a 23% quarter-over-quarter decrease. By historical standards, the decline was a little much less significant; annual capacity enhancements fell 7% relative to Q2 2019. Still, the Q2 slide broke a touch of four successive quarters of quarterly growth as well as represented the smallest setup total amount given that Q1 2019.

On a state-by-state basis, markets that imposed stricter shelter-in-place guidelines saw the most pronounced installment decrease quarter-over-quarter. Mostly, this influenced most-- though not all-- established state markets.

While the Northeast and also California were especially hard-hit by the virus-- causing quarterly solar setup decreases ranging from 25% to 75%-- some states experienced much reduced caseloads in early Q2 as well as consequently enforced fewer constraints on organizations and also consumers during that time. Though these states eventually started to see an uptick in reported instances as we got in the summer months, Arizona, Texas and also Florida ultimately imposed less-restrictive (if any kind of) shelter-in-place orders, and ultimately saw much less of an effect on domestic solar installments, which assisted support the market.

Beginning in Q2, shelter-in-place orders initially restricted several solar businesses from taking part in the in person communication that is a foundation of the property lead-generation process, such as door-to-door sales, area occasions and in-store sales.

Furthermore, shelter-in-place orders likewise inhibited in-person consultations, which are integral to any kind of household solar sales procedure despite customer-acquisition network. However, most of the much more restrictive orders were eventually lifted in major state markets in the Northeast and California as caseloads started to lower in the latter fifty percent of Q2.

In overall, the period of the stay-at-home orders, the variety of states that inevitably adopted such orders and also the severity of the private influence on the property solar market had much less of an effect than at first anticipated.

Much more importantly, the household solar sector undertook substantial organization design innovation during the pandemic. While we originally expected in-person permitting processes to offer a significant barrier, numerous jurisdictions transitioned to on the internet permitting, which saw significant renovations as Q2 advanced. Meanwhile, several property installers likewise transitioned their whole sales organizations to on-line sales, which, though a tough process, started to gain benefits as sales staff adjusted to the new setting.

This combination of business-model developments and rollbacks of restrictive shelter-in-place orders supported a gradual uptick in sales volumes as Q2 advanced. As a result, the domestic solar market was much less significantly impacted by the pandemic than we originally anticipated.

Non-residential solar pestered by permitting and also project delays, however new industrial solar origination shows up healthy in spite of broader economic worries

At 372 MW mounted, Q2 2020 saw the most affordable quarterly set up ability of non-residential solar because Q2 2016, with a quarter-over-quarter decrease of 15% as well as year-over-year decline of 21%. Shelter-in-place orders originally halted building in crucial markets; although many territories at some point designated commercial project building as a necessary task, the hold-up nevertheless pushed back building timelines. On the other hand, energy interconnection timelines were likewise postponed dramatically as utilities focused on essential features.

While a handful of problems reduced non-residential solar growth in the early months of the pandemic-- expected hold-ups in source, allowing, siting, building and affiliation-- most of these traffic jams have because been attended to. First permitting concerns have reduced as local authorities have relocated town planning conferences to on the internet venues.

Many construction and affiliation processes have actually proceeded as the marketplace adapts to current problems, with the main impact of pushing back affiliation timelines. And regardless of remaining issues regarding the state of the economic situation, project origination shows up to have mostly recovered after the initial wave of Covid-19.

Though quieter on the plan front, the results of National Grid's cluster research study in Massachusetts, along with alterations to the state's SMART motivation program, offer some minimal benefit to the non-residential expectation, while 100% eco-friendly portfolio typical legislations recently come on Virginia as well as Maine give higher assistance to the non-residential projection.

Energy PV remains to see strong growth however threats impend on the horizon

Energy PV has reached a new milestone with more than 50 GWdc now in operation. In 2011, the U.S. completed its very first gigawatt of utility-scale capability. At a 46% compound yearly development price, it has taken less than a decade to get to 50 GWdc. At the existing growth rate, it is likely to get to 100 GWdc by 2023 and go beyond 250 GWdc by 2030. In spite of the rough times triggered by the coronavirus pandemic, utility solar is competing onward. Power-purchase agreements completing an impressive 8.7 GWdc were revealed this previous quarter, driving the contracted pipeline to a record high of 62.2 GWdc. The pandemic has caused very couple of purchase hold-ups beyond what developers as well as design, procurement as well as building (EPC) companies see under normal conditions. Across the U.S., electrical power demand remains strong, and utility PV is cost-competitive with natural gas and various other forms of power generation in the majority of state markets.

Nonetheless, we are starting to see indicators of prospective headwinds. With enhancing frequency, financial institutions as well as investors are showing indications of inadequate tax obligation equity financial investment for all projects in growth. In addition, some developers have actually revealed problem that there will not suffice EPC data transfer to finish their development pipe. This is all integrated with broader financial market instability brought on by the coronavirus pandemic.

Investors have actually reported that they are having some of their most active years ever before but that some projects are just not finding the funding they need, which might result in hold-ups to business procedure days. This has actually created a distinct situation where the U.S. has the biggest development pipe in its history however with some projects encountering a higher-than-normal danger of attrition or termination.

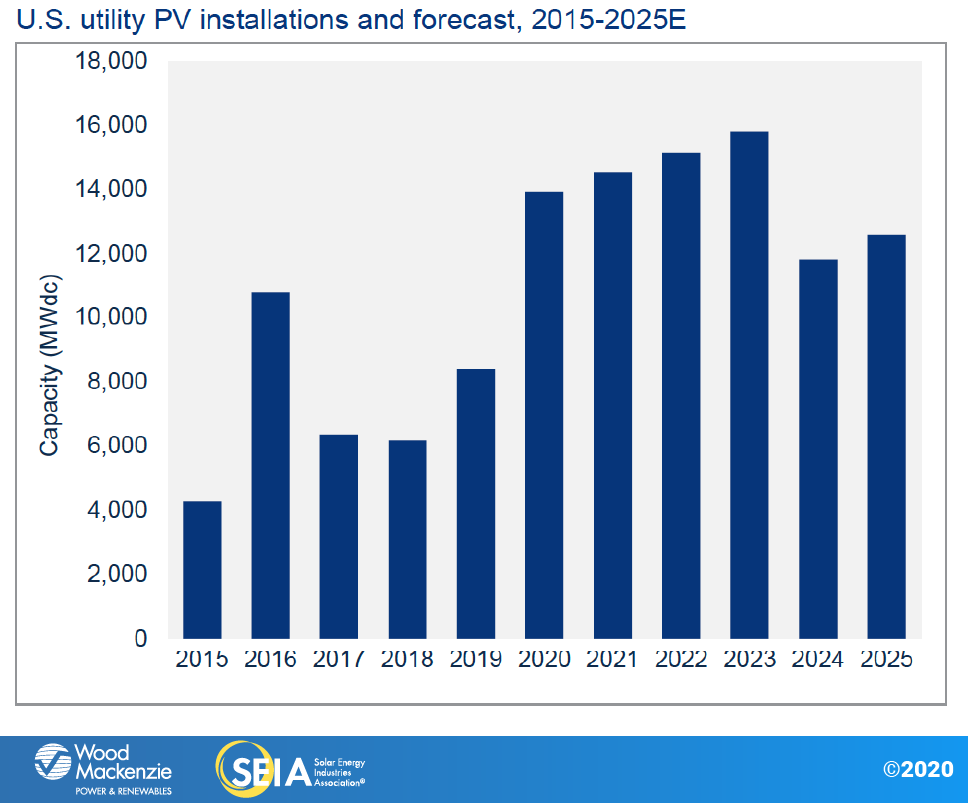

Overall, we have actually enhanced the 2020-2025 forecast by 1.1 GWdc as a result of subsiding worries concerning coronavirus effects, renewed self-confidence in the long-term overview as well as the development of the development pipe. Over the next 5 years, 83 GWdc of utility PV capability will certainly come online. Wood Mackenzie's 2020 to 2021 projections have decreased as projects get pushed out to 2022 as well as 2023 as we start to see the initial indications of project spillover to the last years of federal Investment Tax Credit eligibility. While 2024 will certainly stay strong, we are seeing the very first wave of projects begin to be drawn into 2023 shipment to maximize the greater ITC benefits.

Overall need continues to expand as utilities reveal even more solar procurement targets in their incorporated source strategies, backing aggressive state sustainable targets. Nonetheless, with financial markets still in jeopardy of a decline or economic crisis due to the pandemic, the possible lack of ability to money projects is the largest drawback danger to our projection.

Smaller sized projects deal with a higher chance of being overlooked, as well as tax obligation equity capitalists are likely to be more reluctant to deal with new or less-established programmers. In addition to the rigidity of tax equity markets, the price of financial obligation has additionally crept up a few basis points as financial obligation suppliers have ended up being skeptical of nontraditional financial investments.

3. Market Segment Outlooks

3.1. Residential PV

Key Figures

- 617 MWdc installed in Q2 2020

- Down 23% from Q1 2020

- Down 7% from Q2 2019

Despite the 23% quarterly decline from Q1 in response to the Covid-19 situation, domestic solar installation quantities in Q2 2020 were even more durable than initially anticipated. This is because of a number of elements.

First, we originally anticipated added states beyond the Northeast and also California to implement rigorous shelter-in-place orders as soon as they reached equivalent verified levels of Covid-19 situations. This would have in a similar way constrained sales as well as installations in all crucial state markets as it did in the Northeast and also California. Nevertheless, this never pertained to fruition. Florida, Arizona and also Texas-- the second, third and 4th largest state markets respectively in Q1 2020-- did not inevitably impose restrictive shelter-in-place orders regardless of rises in confirmed cases. Accordingly, they did not see the substantial installment decreases that major state markets experienced as a byproduct of limiting shelter-in-place orders.

Second, Wood Mackenzie forecasted-- and still forecasts-- a 5% tightening in yearly gross domestic product. Appropriately, our projections not only considered the predicted effect on sales due to social distancing measures, but likewise the influences of a near-term financial shock that was expected to dramatically enhance unemployment, reducing customer investing on large residence enhancement projects. However the nature of the Covid-19 recession is peculiar. While consumer costs originally reduced significantly in March and also April, it began to rebound in the summer season, aided by the added $600/week in unemployment insurance supplied by the government CARES Act that has actually because run out. A lot more notably, complete unemployment came to a head at 15% in the initial months of the pandemic prior to declining to 10.2% in July. Nevertheless, this economic downturn has overmuch displaced solution and also friendliness workers, whose unemployment rates reached 25% in July. Since a larger share of these workers either don't possess their house, are young (Covid-19-driven unemployment is greater than double for those under 25) or are listed below the normal revenue and also credit report thresholds that major installers call for to get approved for consumer financing, the expected recessionary results on typical domestic solar customer demographics (that alter more towards professional occupations) have actually been much less intense than expected.

Though the shift from mostly in-person sales processes to a full-cycle virtual sales approach had its fair share of concerns in April and May, the solar industry-- and particularly huge and also midsized local installers-- have seen lead volumes and also closed sales go back to pre-Covid-19 levels.

On the other hand, smaller business that depend greatly on referral sales have actually had a tougher time transitioning. For 2020, the near-term impacts from shelter-in-place orders will be really felt most intensely in Q2, as several big installers report healthy sales pipelines that they expect to meet throughout H2 2020. However despite sales rebounding in H2 2020, the majority of installers report installment team ability has actually decreased since the pandemic began, as the procedure of ramping back up after having furloughed crews features management as well as logistical difficulties. Installers remain careful about over-hiring provided substantial near-term economic unpredictability. As necessary, we do not anticipate staying quarterly volumes in 2020 to exceed record-breaking Q1 installment quantities.

Though Wood Mackenzie anticipates a 5% contraction to U.S. GDP in 2020, economic unpredictability has, to date, had restricted impact on sales pipelines, as lots of installers have indicated that the summer season has seen record-breaking months for sales. While rigorous shelter-in-place orders did have some influence on setup totals in specific state markets, the adjustments that firms have actually instituted considering that the very early days of the pandemic leave them better placed to get used to future closures, must states find them to be required.

In addition, Q2 installations and also sales pipelines that are mostly sold out for 2020 recommend that the effect for domestic solar will certainly be limited in the near term. Appropriately, we have raised our 2020 household forecast considering that last quarter and also are currently expecting flat development contrasted to 2019 before a 7% yearly increase in 2021 as the marketplace proceeds a warm healing.

Beyond the impact of the coronavirus pandemic in 2020-2021, the ITC stepdown in 2022 will certainly further complicate recuperation efforts, though small development will certainly return to in 2023 and continue right into 2025, based upon economic fundamentals as the market adapts to post-ITC market conditions. Lacking broader federal climate policy, long-term development in a post-ITC globe will be contingent on ongoing geographical diversity outside of well established state markets along with regulatory, technological and also business-model advancement to improve product offerings in the solar-plus-storage room. Thinking small development on these fronts, yearly property solar development is anticipated to get to low-teen percentages by the mid-2020s.

3.2. Non-residential PV

Key Figures

- 384 MWdc installed in Q2 2020

- Down 12% from Q1 2020

- Up 19% over Q2 2019

The second quarter of 2020 was the most affordable quarter for non-residential solar PV since Q2 2016. This is in large component because of postponed building and interconnection in primary markets in reaction to shelter-in-place orders. Shovel-ready, allowed projects with signed agreements could proceed construction into Q2 unless local authorities restricted programmers from doing so, such as in the case of California and also New York for minimal amount of times throughout the initial phases of the lockdown.

For much of Q2, trouble in getting licenses from regional zoning authorities developed interconnection hold-ups of 3 to 6 months, as the majority of big ground-mount PV projects need public conferences to obtain approval to construct. While some areas have actually transitioned to on the internet zoning conferences, there is no harmony to the process across territories. Though designers' capacity to get licenses has actually boosted moving right into Q3, the hold-ups that accrued with Q2 will certainly still have the impact of pressing several projects into 2021. As necessary, the near-term influence of the coronavirus pandemic on non-residential solar will certainly lead to substantial project delays-- though not always terminations-- in 2020, causing a 23% decline from 2019 volumes. Delayed projects will spill into 2021, resulting in a 35% rise over 2020.

While the near-term impact of the coronavirus episode on the non-residential room will cause project hold-ups, the long-lasting influence of GDP tightening as well as a decline in company expenditures for capital investments will certainly have some sticking around effects on brand-new source possibilities as well. Though business transitioning to the "new normal" were focused on focusing on core procedures throughout the initial phases of the pandemic, business origination seems to have actually rebooted entering into H2 2020 as services adjust to the conditions.

Accordingly, 2022 will expand just slightly over 2021 before the marketplace experiences an additional tightening in action to the ITC expiry in 2023. At the same time, recently passed clean energy regulations in Virginia and Maine will certainly start to work over the following few years. Non-residential projects coming from Maine's uncapped Net Energy Billing program have already swamped lines up as well as will come online from 2020-2022, while Virginia's 100% eco-friendly portfolio standard as well as growth of the commercial pilot power-purchase agreement program are anticipated to boost setups in our outlook.

3.3. Utility PV

Key Figures

- 2.5 GWdc set up in Q2 2020, the largest Q2 for utility PV in history

- Energy PV pipe presently completes 62.2 GWdc

U.S. utility solar PV saw its best Q2 in history, with 2.5 GWdc coming online, while the pipeline of brand-new projects has hit a new high of 62 GWdc. For several weeks via April and also May, force majeure was the hot topic of the energy solar field, with designers, offtakers and investors questioning if projects were going to be forever postponed as a result of the coronavirus outbreak. Since that time, force majeure has been hardly ever stated and also project hold-ups have actually been very little.

A total amount of 13.6 GWdc of energy PV projects are currently incomplete, 8.2 GWdc of which get on track to be completed in 2020. Regardless of the turbulence in Q2, building of energy PV projects has remained mainly on course, leading to only a minor reduction to our 2020 projection. Added minor decreases have actually been made to our 2021 forecast, due in huge component to higher uncertainty in the capability of private projects to obtain tax obligation equity funding, produce adequate revenue with the climbing price of capital, or just obtain integrated in time. It is likely that established, larger developers and large projects will have the simplest time locating tax equity funding, while smaller projects and less-established designers will have a more difficult time.

Wood Mackenzie has actually boosted its 2022 and also 2023 anticipated by 1.8 as well as 2.4 GWdc, specifically, due to spillover from postponed 2020 and 2021 projects, brand-new project news, energies' resource strategy targets, and need pull-in from the stepdown of the ITC from 22% to 10%. Of the projects revealed in Q2, 88% are targeting a 2022 or 2023 conclusion day. This has considerably enhanced our midterm forecast.

Although individual projects encounter the danger of delay or otherwise locating sufficient funding, several designers that have actually built out their development pipes and safe-harbored projects for the 30% or 26% ITC are well placed to full projects before completion of 2023. For that reason, projects with initial target commercial procedure dates (CODs) in 2021 are being pushed out right into the 2022-2023 duration. A pick few projects have currently pushed out target COD days in their affiliation queue filings or Securities as well as Exchange Commission filings, as well as we anticipate to see more do the same in the coming months.

Wood Mackenzie projections minor declines in 2024 and 2025 to 11.8 as well as 12.6 GWdc, respectively. On the whole, the lasting demand for energy PV will certainly continue to be high after the ITC stepdown. Across more than 100 energy integrated source plans, there is greater than 19 GW of need for energy solar in 2024 and also 2025, with even more expected to be revealed in subsequent IRPs arranged for launch in the coming months. However, designers have essentially no incentive to bring projects online in 2024 that could be brought online in 2023 with a greater government Investment Tax Credit.

This will certainly trigger projects to get pulled into 2023 when possible, which could leave 2024 with projects that were either postponed from 2023 or just established far too late to get approved for a 22% or greater ITC. 2025 will certainly see additional development over 2024 as need chooses back up for more solar resources, specifically systems coupled with energy storage space.

The financial competition of energy PV ultimately underpins our self-confidence in the long-term forecast. After the stepdown of the government ITC, utility solar will certainly stay cost-competitive with other renewables and with baseload power such as combined-cycle gas. As a result, energies will continue turning to energy solar for extra capability enhancements as well as to change aging coal plants.

In addition to decreases in planetary system expenses, similar decreases in the expense of large power storage are occurring, enabling solar-plus-storage implementations to increase even better. At the end of 2019, only 2% of energy PV megawatts operating the grid were paired with power storage. By 2023, that number will rise to 13%. While standalone energy storage space will certainly additionally be deployed to the grid, the enhancements of solar combined with storage will certainly make it possible for even greater degrees of energy PV, particularly in markets like Hawaii as well as California aiming to attain 100% absolutely no carbon or 100% renewable energy targets.

4. National Solar PV System Pricing

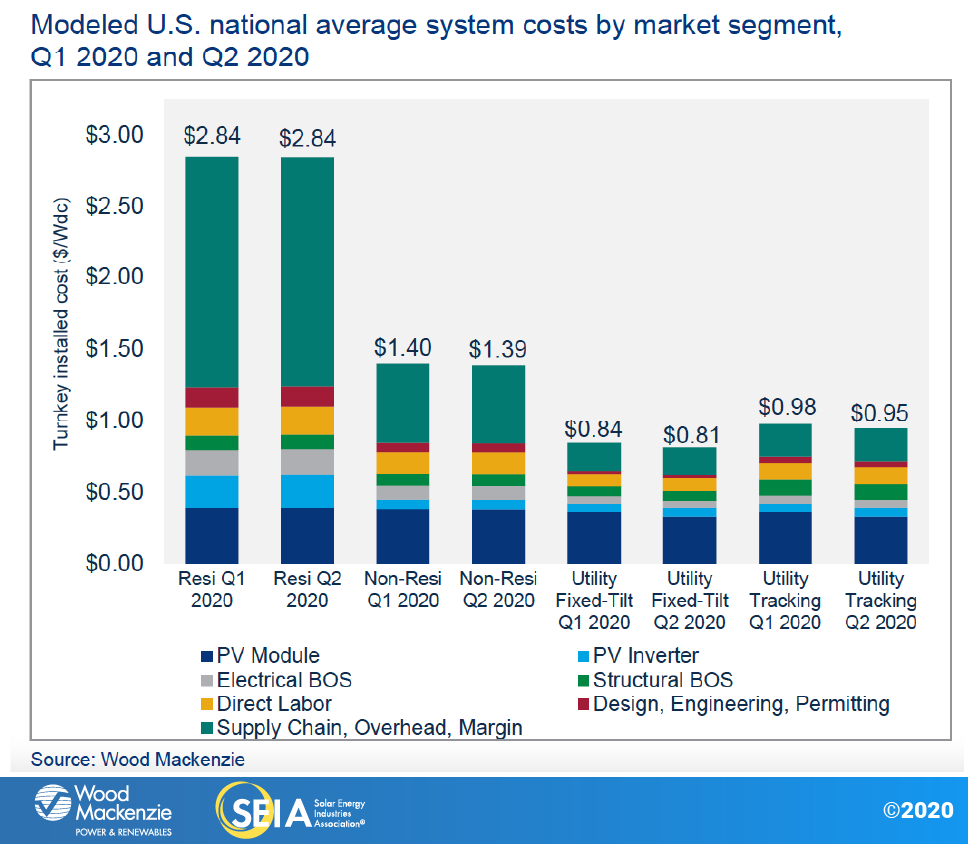

We employ a bottom-up modeling methodology to capture, track as well as report nationwide average PV system prices for the major market segments. Our bottom-up technique is based on tracked wholesale prices of major solar elements and data gathered from several interviews with sector stakeholders. As a result of raised demand for mono PERC solar modules, starting with the 2019 year in review report, we started to report combined module prices for the non-residential as well as utility market sections in addition to residential. This represents a heavy standard of multi-silicon as well as mono PERC solar modules in contrast to prices for multi-silicon modules just. Q4 2019 is the initial quarter in which these brand-new mixed system prices were used, so previous quarters for the non-residential and also energy fields will certainly not be commensurable with Q4 2019 and onward. Mono PERC solar modules are extra costly than multi-silicon modules, so the brand-new blended module rate approach will certainly yield greater system costs.

In Q2 2020, system rates fell throughout all market sections. System prices dropped quarter-over-quarter by 0.2%, 0.7%, 3.5% and also 3.1% in the household, non-residential, energy fixed-tilt and also energy single-axis monitoring markets, respectively. Costs throughout all market sections are currently at $2.84/ Wdc, $1.39/ Wdc, $0.81/ Wdc and $0.95/ Wdc for property, non-residential, utility fixed-tilt and also utility single-axis radar, respectively. Utility fixed-tilt pricing revealed the steepest decrease in quarter-over-quarter prices, contrasted to all other market sectors. Residential system prices will certainly be affected by the Covid-19 pandemic more than all various other market sectors; this is due to its shorter project cycles and more stages of project development being subjected to the pandemic.

5. Element Pricing

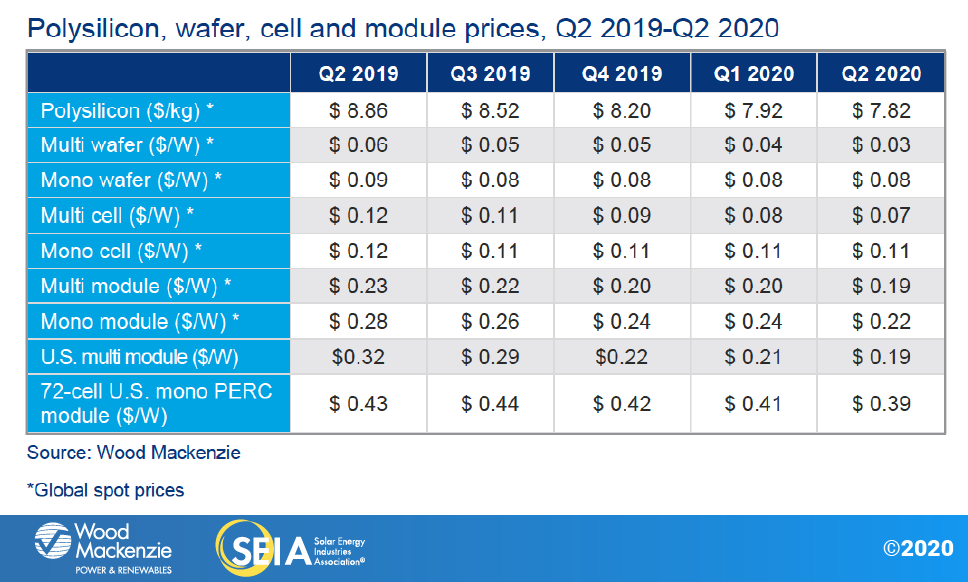

The coronavirus pandemic remained to influence the global PV supply chain in Q2 2020. Although module manufacturing in China had gone back to pre-pandemic degrees by April, manufacturing in Southeast Asia, India, Europe and also the U.S. were scaled down due to local public health measures. Nonetheless, the larger influence to the supply chain is the damage of worldwide demand due to shelter-in-place steps. Lower-than-expected worldwide solar need in the remainder of 2020 put substantial downward stress on solar component rates. Multi wafer, cell as well as module rates remained to trend lower, showing the changing market choice far from multi-silicon products to mono-silicon items. Rates of mono wafer and cells decreased slightly. Mono PERC module costs dropped significantly across the globe, led initially by European markets, complied with by the U.S. On a quarter-over-quarter basis, mono PERC module costs are 9% lower. Since completion of Q2 2020, costs along the whole supply chain continued to decline week over week.

In the U.S., multi-silicon module costs were around $0.19/ W in Q2 2020. The ongoing affordable price shows the marketplace's choice for mono modules over multi modules. Mono PERC module costs dropped meaningfully from $0.41/ W in Q1 to $0.39/ W in Q2 for utility-scale projects.

Bifacial modules continued to gain from the Section 201 tariff exemption in Q2. In April, the Office of the U.S. Trade Representative introduced its choice to reimpose the tariff. This choice was challenged at the U.S. Court of International Trade as well as the exclusion stays in position pending a decision by the CIT. Without the tariff, the rates of bifacial modules was, on average, affordable with mono-facial modules in Q2 2020.

Also read