Solar Market Insight Report 2020 Q2

- The quarterly SEIA/Wood Mackenzie Power & Renewables U.S. Solar Market InsightTM report reveals the significant fads in the U.S. solar sector. Find out more regarding the U.S. Solar Market Insight Report. Released June 11, 2020.

1. Key Figures

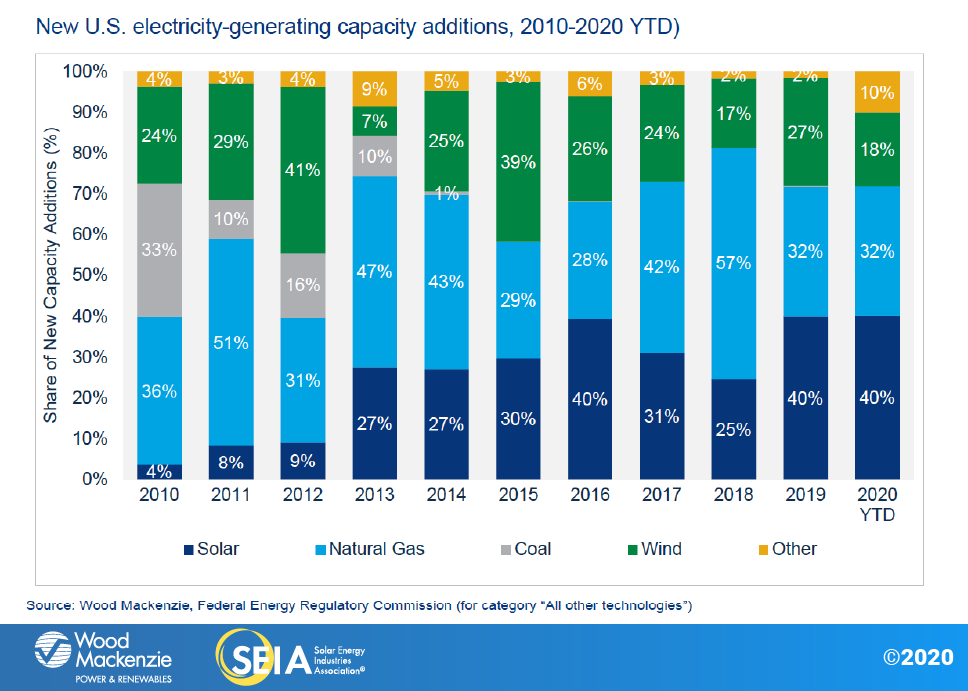

- Solar made up 40% of all brand-new electrical energy producing capability added in the U.S. in Q1 2020, similar to the share of brand-new ability included 2019.

- The initial quarter of the year was greatly unaffected by the coronavirus pandemic, but effects are expected to appear beginning in the second quarter.

- In Q1 2020, the U.S. solar market mounted 3.6 GWdc of solar PV, the largest Q1 on record by more than 1 gigawatt.

- An overall of 5.4 GWdc of new utility PV projects were introduced in Q1 2020, indicating strong demand through the initial quarter of the year.

- The influence of the coronavirus pandemic has been really felt most really in distributed solar, which is expected to see 31% fewer setups in 2020 than in 2019 as installers face work stoppages and also sales approach transitions and the approaching economic crisis reduces consumer and company hunger for big financial investments.

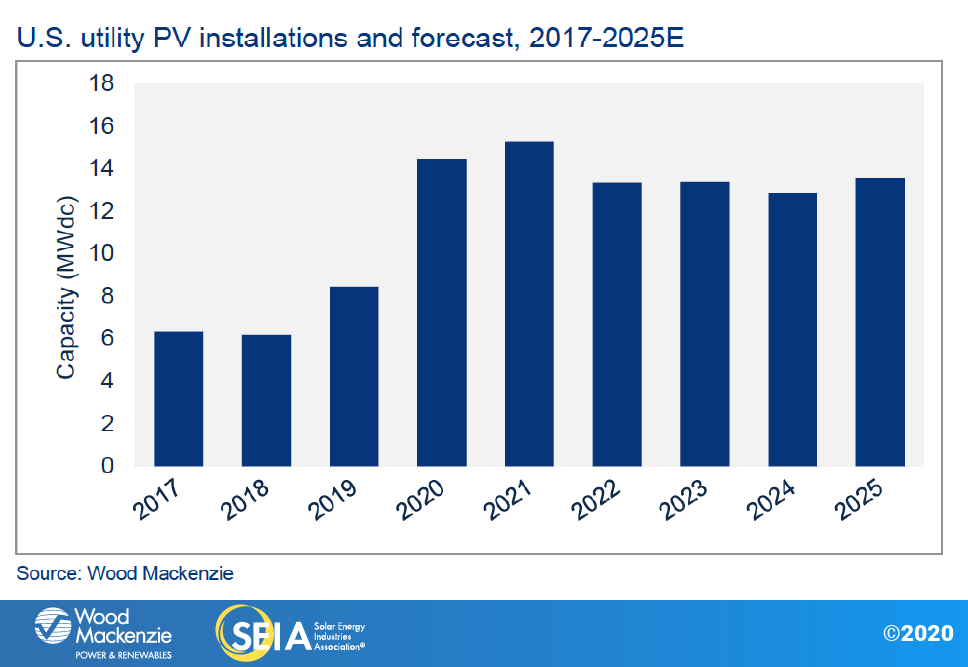

- While the U.S. energy PV sector is anticipated to include 14.4 GWdc this year, numerous projects get on delayed timelines as a result of the pandemic.

- Neighborhood solar continues to expand its geographic diversity, with New York becoming the third market to exceed 300 MWdc of community solar capability.

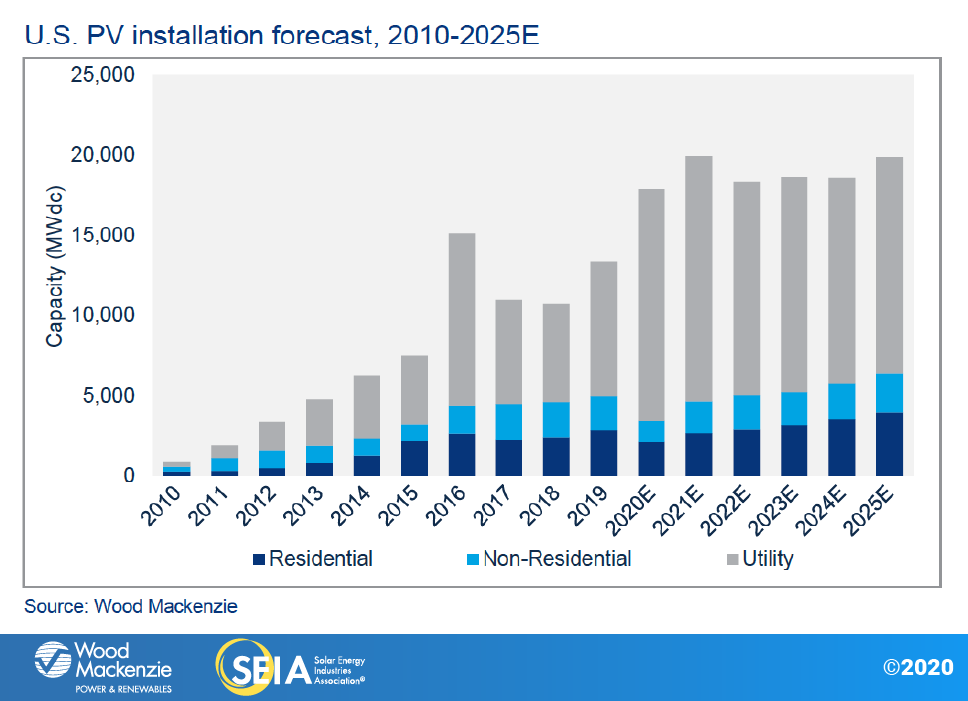

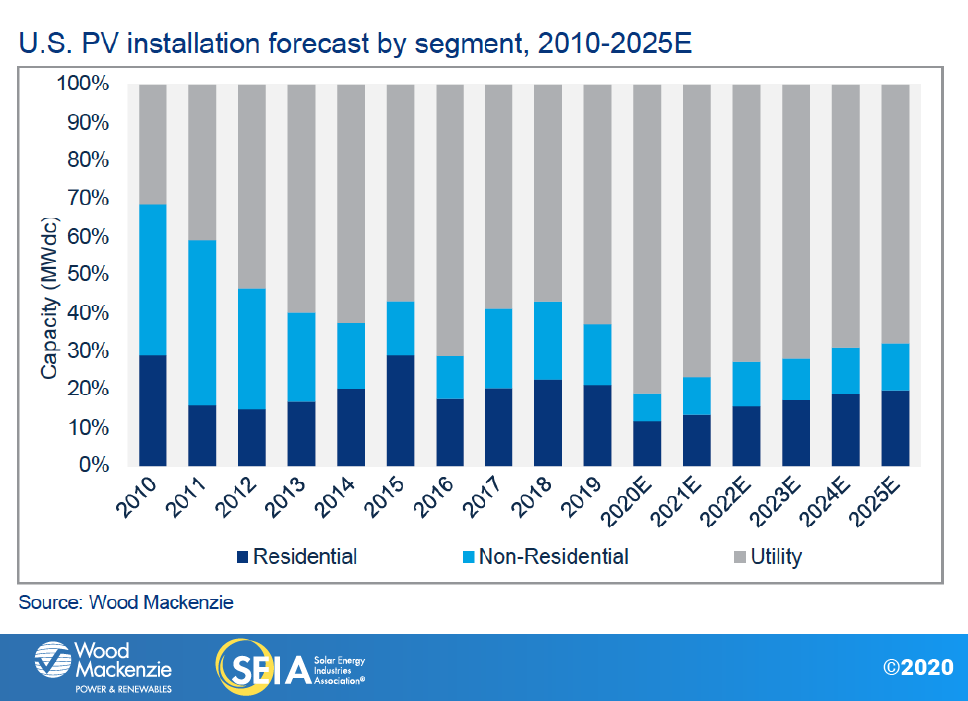

- Timber Mackenzie projections 33% annual growth in 2020, with almost 18 GWdc of installments anticipated. Due to the coronavirus pandemic, we have made a 9% reduction (1.7 GW) to our previous 2020 market overview, where we anticipated almost 20 GW of solar for the year.

- In total amount, the U.S. solar market will certainly set up 113 GWdc of solar from 2020-2025, a loss of 3.6 GW relative to our 2019 Year in Review report, a quantity virtually equal to the advancing overall of PV set up through 2011.

- By 2025, one-third of new domestic solar systems as well as one-quarter of brand-new non-residential solar systems will be coupled with power storage space.

2. Intro

A note regarding the effects of the coronavirus episode: Since our last report magazine in March, the coronavirus outbreak has actually progressed into an international pandemic with greater than 5 million cases reported around the world and also 1.7 million situations in the U.S. as of magazine. The pandemic has disrupted every possible facet of life, with state-level shelter-in-place orders and the subsequent tightening in economic activity expected to lower gross domestic product for the remainder of 2020 and also a significant possibility for longer-term effects well yet year.

The solar market is not insulated from this crisis. From early-stage customer acquisition and also task origination to commercial operation, every stage of the solar job cycle has actually been interrupted throughout all sectors. This is specifically and also most instantly severe in the near term for dispersed solar. Yet utility solar will likewise experience the impacts of the pandemic in the form of near-term task hold-ups, along with tighter monetary markets as well as disadvantaged economics because of depressed oil, gas, and also power costs in the tool to long term.

That stated, the Q2 2020 U.S. Solar Market Insight covers installation volumes in Q1 2020 in addition to forward-looking patterns. Provided the timing of the Covid-19 break out in the U.S., just a handful of states had started to execute shelter-in-place orders by the end of Q1, suggesting that the impacts of coronavirus on Q1 2020 installments were minimal. Nevertheless, the forecasts for the rest of 2020 and beyond included in this report mirror near-term influence on job and also client source, along with the longer-term implications of reduced financial and service activity for consumer as well as business acquiring and utility purchase decisions. Our market outlook is sustained by Wood Mackenzie's macroeconomic modeling that forecasts a 5% tightening in U.S. GDP in 2020, complied with by 3% development in 2021. This is still a swiftly transforming circumstance with continued potential for substantial disruption.

Q1 2020 recap: In Q1 2020, the U.S. solar market set up 3.62 gigawatts-direct current (GWdc) of solar photovoltaic (PV) ability, a 42% boost year-over-year and also the largest Q1 ever before. In spite of the coronavirus pandemic starting to materialize at the tail end of March, property solar saw its biggest Q1 on record, linking with Q4 2019 as the biggest quarter for household solar. Overall non-residential PV (that includes commercial, government, nonprofit and also community solar) setups saw an 8% increase over Q1 2019 as well as a 29% decline from Q4 2019. More than 2.3 GWdc of utility-scale PV ability came online in Q1 2020-- another Q1 document for the sector. Across all market segments, solar PV represented 40% of all brand-new electricity-generating ability additions in Q1 2020, similar to the share of brand-new ability included 2019.

Residential solar was off to a historically strong beginning prior to the coron

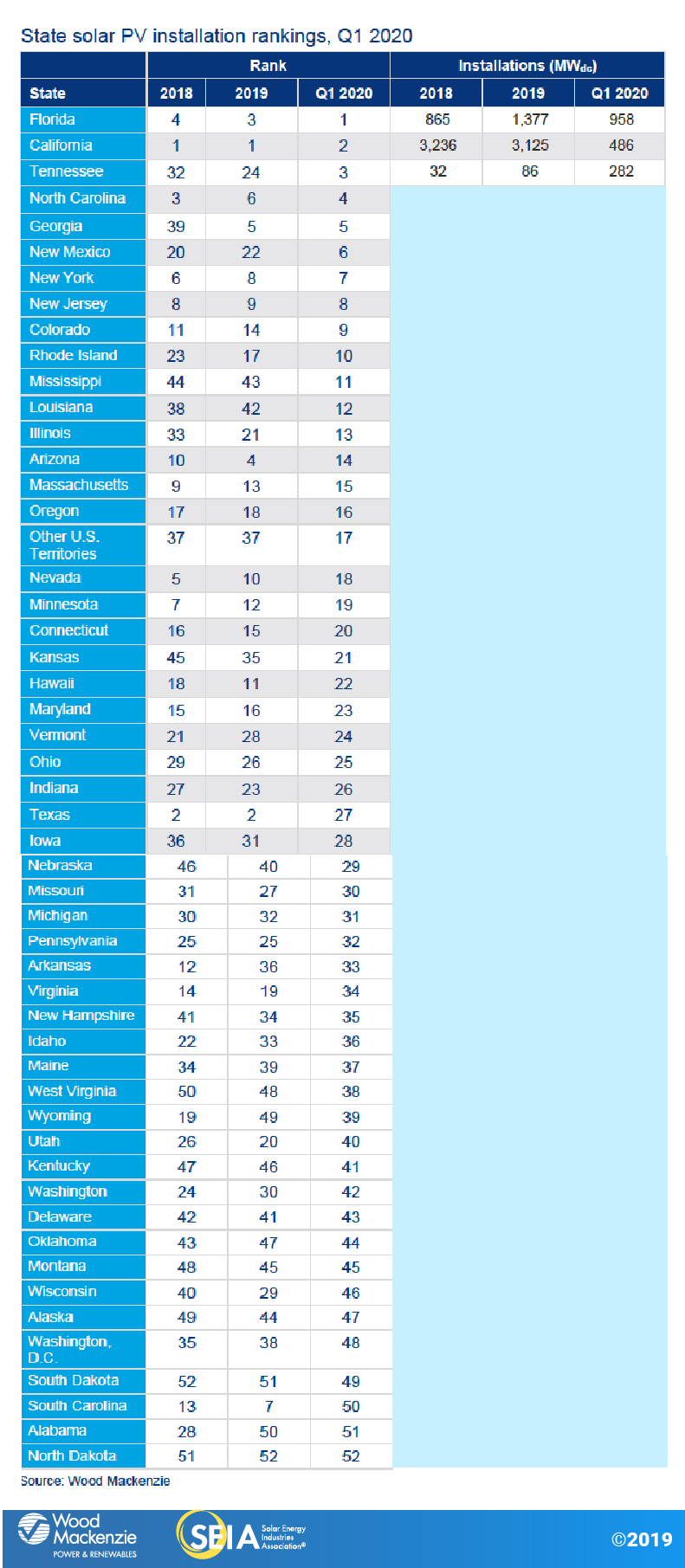

Many thanks in large part to arising state markets, household solar was off to what would certainly have been a record year for domestic PV installations before the coronavirus pandemic hit the U.S. The states of Florida, Texas, Colorado, Illinois as well as Virginia all saw record-breaking installation total amounts in Q1 as a mixture of solid solar resources, decreasing installment expenses and rewards pushed these states beyond retail parity. At the same time, well-known state markets in California, Arizona and the Northeast have actually kept stable installation volumes. Since the coronavirus pandemic did not get to the United States until completion of Q1, the outbreak had a marginal impact on Q1 setup volumes.

However, we expect household solar development in Q2 to be seriously interfered with as a result of the pandemic, as numerous states applied strict stay-at-home orders beginning in mid-March. At the outset of the pandemic, these orders were mainly concentrated on East as well as West Coasts, with the Northeast (as well as New York particularly) and California amongst the very first states to provide shelter-in-place orders, while states with lower numbers of verified cases followed suit to differing degrees over the occurring weeks.

At a standard degree, shelter-in-place orders have substantially minimal solar companies from engaging in the in person communication that is a keystone of the domestic customer-acquisition procedure. While most of the orders released made exceptions for essential service solutions, they have not been uniform in their designations of what constitutes an important service as well as whether solar building and construction and setup can proceed. On the severe end, solar building and construction has actually been stopped entirely by state authorities, such as in New York, which placed a "PAUSE" on a lot of construction work (including solar) from March 15-May 15, effectively eliminating fifty percent of the state's expected Q2 installments. Other states such as New Jersey, Pennsylvania as well as Illinois have actually applied particular limitations on solar sales, with door-to-door canvassing particularly forbade.

The first-order effect of this will be on Q2 2020 quantities, where significant state markets with much more rigid and longer-lasting stay-at-home orders will see a substantial reduction in installations. Second-order effects beyond Q2 are expected to impact adoption throughout the remainder of 2020, as the influence on financial development come to be much more wide-spread and further subdue customer investing.

Non-residential revealed signs of a turn-around in Q1, but the coronavirus pandemic has reduced brand-new job growth

The non-residential market came off of a durable Q4 2019 where several business task designers intended to bring projects online in time to catch the solar Investment Tax Credit in the 2019 , stimulating an 8% increase on a year-over-year basis.

After a number of policy changes hindered development in the core non-residential markets of California, Massachusetts and Minnesota in previous quarters, the market was off to a solid begin in Q1. In Massachusetts, non-residential release figures began to raise as interconnection delays started to abate as well as the SMART program tasks from the very first phase of National Grid's collection research study begin to come online. On The Other Hand, New York's long-awaited community solar renaissance has begun in earnest, with one more 100 MW of area solar tasks brought online in Q1 2020 complying with greater than 160 MW being mounted in Q4 2019.

That stated, the coronavirus pandemic has been an impediment to both continuous building and construction as well as to business project advancement-- largely relative to early-stage development (allowing, zoning, etc.). Stay-at-home and building stoppage orders started in March as well as April are postponing tasks that would certainly have started building and construction in Q2. Additionally, huge ground-mount projects need to undertake an allowing procedure that commonly entails public meetings in front of neighborhood zoning boards to obtain building and construction authorization. A lot of these conferences have actually been held off due to social distancing procedures, though some locations have actually transitioned to virtual platforms to perform zoning conferences.

Due to the fact that winter season problems restricted task building and construction in Q1, these hold-ups to the permitting phase are anticipated to mainly impact tasks that would certainly have interconnected in Q2-Q3 2020.

Energy PV well located as well as continues to be strong in spite of risks from coronavirus

Regardless of the disadvantage risks brought on by the coronavirus pandemic consisting of monetary market instability, postponed procurement and minimized electrical power need, the ongoing high degrees of purchase and demand for utility PV surpass a lot of the present market headwinds.

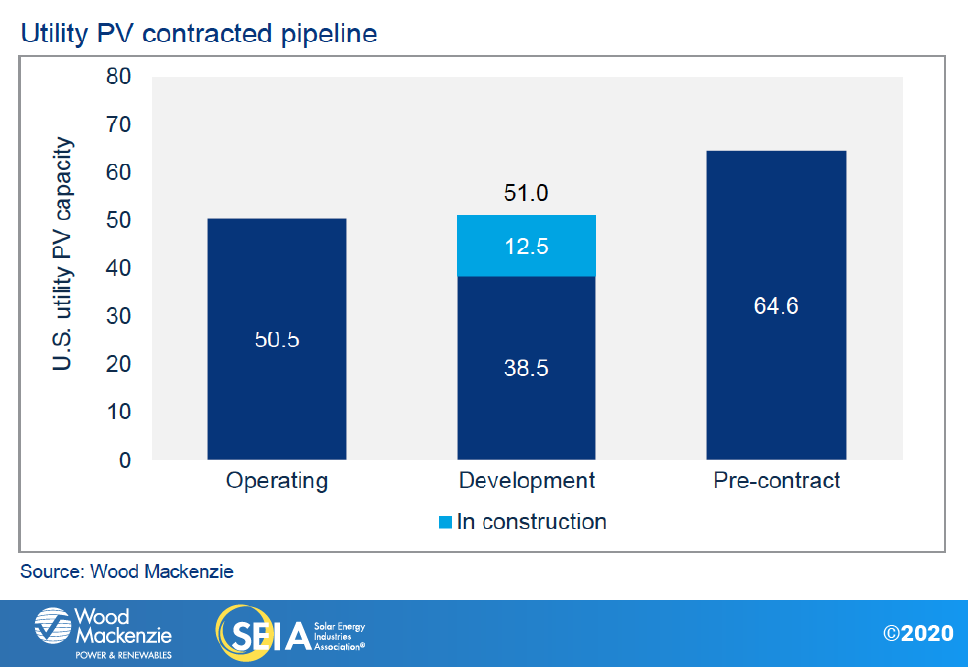

The 2020-2025 forecast has seen small decreases, however greater than 80 GWdc of capacity enhancements are still expected over that duration. Utility PV project economics stay affordable with various other sources of power generation. While impacts from the coronavirus pandemic will certainly cause less energy PV to be built than would have been feasible under normal circumstances, the 51 GWdc acquired pipeline signals that strong interest in utility-scale solar continues since the moment of magazine.

Projects slated ahead online in 2020 have actually seen very little equipment and building and construction delays as well as are moving forward. Q1 saw 2.3 GWdc of brand-new ability added, and the energy solar market is still on track for 14.4 GWdc of new capacity in 2020. This would damage the previous annual capability enhancement record in 2016 of 10.7 GWdc and make 2020 the greatest year on record for energy PV.

In the tool as well as long term, energy PV encounters a number of headwinds however is still expected to carry out well. The financial instability brought on by the coronavirus pandemic has raised the price of resources, creating a prospective increase in power-purchase contract prices, which have actually ranged from $16 to $35/MWh in current quarters. In spite of these obstacles, utility solar remains economically competitive with other generation sources, driving brand-new purchase in established markets.

Overall need for utility PV maintains growing as utilities introduce even more solar procurement targets in their incorporated source plans, backing aggressive state eco-friendly targets. However, the Covid-19 situation does existing significant risks to the market With economic markets in change, it is vague if there will suffice tax obligation equity supply to provide ITC financing to all jobs. Smaller sized jobs deal with a greater likelihood of being overlooked, as well as tax obligation equity capitalists are most likely to be more reluctant to collaborate with brand-new or less recognized programmers. In addition to the rigidity in the tax obligation equity market, the price of financial obligation has likewise crept up a few basis points as debt carriers have actually become skeptical of ultramodern financial investments. All these aspects produce substantial drawback threat in the 2021-2025 forecast, and also we will remain to very closely check developments in the monetary market.

3. Market Segment Outlooks

3.1. Residential PV

Trick figures

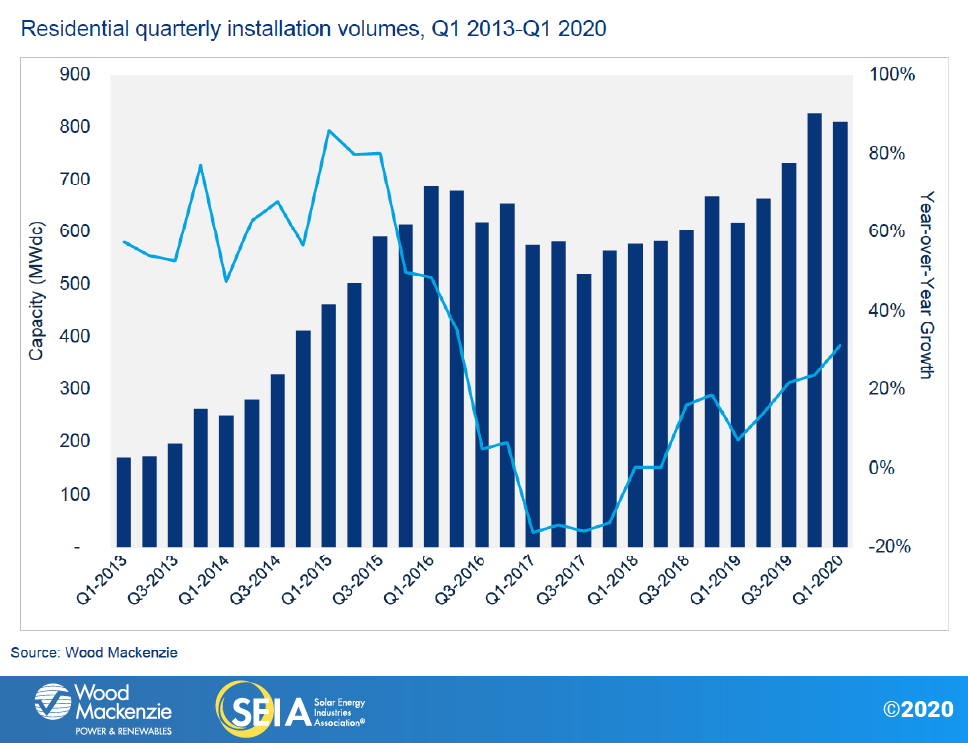

- 810 MWdc set up in Q1 2020

- Flat over Q4 2019

- Up 31% over Q1 2019

This year was expected to be a banner year for household solar PV prior to the coronavirus pandemic hit. At 810 MW set up, last quarter was the biggest in domestic solar history. It was also properly level compared to Q4 2019, bucking the historic pattern of seasonal cyclicity that underpins the household solar narrative of depressed Q1 installment quantities stemming from winter weather condition. Moreover, the delta between Q1 and a record-breaking Q4 was expected to be also better as a result of the rush of jobs seeking to get the full 30% solar Investment Tax Credit. However, significant state markets such as California as well as New York started to execute stay-at-home orders in mid-March, which hindered sales, setups as well as affiliations in the last couple of weeks of Q1. The timing of these orders likely stunted what was on track to be the largest quarter ever for household solar.

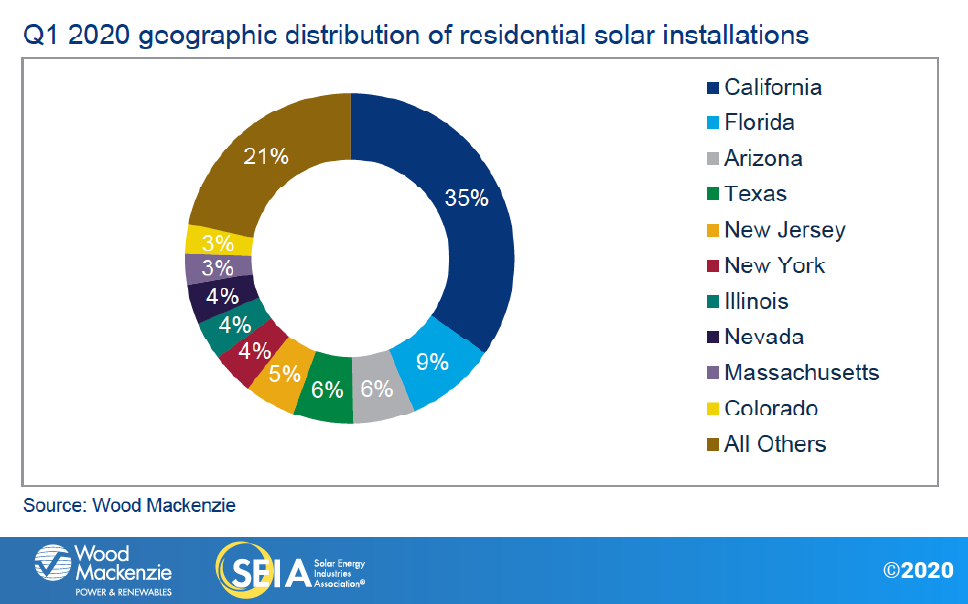

The golden state and also the Northeast remain to be the structure of the U.S. household solar market, keeping steady installment volumes on a quarter-over-quarter basis. But in Q1, these legacy state markets (CA, AZ, MA, NY, NJ, MD) accounted for simply over half of total setups as an expanding cast of emerging markets remain to scale and also add to purposeful national-level solar growth. Florida, Texas, Colorado, Illinois and Virginia all had record installation totals in Q1, accounting for virtually a quarter of Q1 setups-- likewise a record.

This growing geographical diversity is important for assessing the impacts of the coronavirus pandemic on household installments. Throughout Q2 thus far, California and the Northeast have actually released as well as kept stronger stay-at-home support that has actually reduced sales as well as installment procedures, which consequently will lead to an extra severe near-term installation decline for those states. Somewhere else, a number of the emerging state markets that led Q1 solar growth have much less Covid-19 instances than do the East and also West Coasts, and as of this creating they have started to gradually loosen up stay-at-home limitations and also open up the economic situation to limited business activity. These states will accordingly see reasonably smaller sized Q2 installment influences because of the coronavirus episode however will still be affected by the macroeconomic influences of the crisis. Continued progression in those markets past Q2 is contingent on service task continuing to be open.

Operationally, regardless of the rough transition from largely in-person sales procedures to a full-cycle online sales strategy, the solar industry-- and specifically huge and also midsized regional installers-- have seen lead volumes and also shut sales go back to pre-Covid-19 degrees, while smaller sized firms that depend greatly on referral sales have had a more challenging time transitioning. While the near-term impacts from shelter-in-place orders will certainly be felt most acutely in Q2, several huge installers report healthy and balanced sales pipes that they expect to fulfill right into Q2 and also Q3, assuming shelter-in-place orders are greatly gotten rid of. However, it is tough to state just how these observations convert to overall market performance.

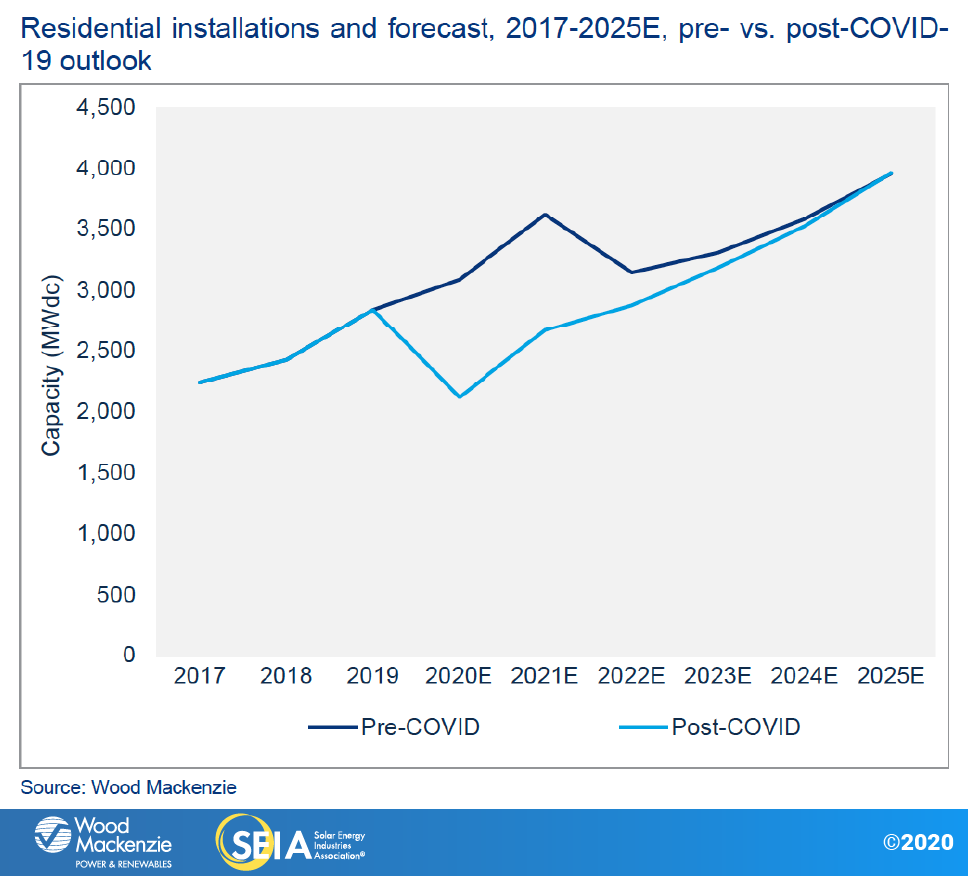

All that claimed, the longer-term effects of the coronavirus pandemic on the economy can not be ignored. Timber Mackenzie anticipates a 5% contraction to U.S. GDP in 2020. This expectation mirrors present assistance from the CDC and public health authorities, which thinks that very early reopening of the economic climate will lead to a wave of additional localized episodes that will cause extra statewide closures as well as decreased financial task. Though we have yet to see this mirrored in the near-term sales pipe, raising-- as well as extraordinary-- joblessness levels among crucial demographics of residential solar customers, incorporated with the influence of GDP tightening on customer spending, will lead to a 25% decrease in 2020 property volumes compared to 2019 prior to a 26% annual boost in 2021 as the market begins to experience a tepid recuperation. Our projections for both 2020 and also 2021 are down significantly from our pre-Covid-19 projection launched last quarter.

Beyond the influence of the coronavirus pandemic in 2020-2021, the ITC stepdown in 2022 will certainly further make complex recovery efforts, though modest growth will certainly return to in 2023 and also continue into 2025, based on economic fundamentals as the market gets used to post-ITC market conditions. Lasting development in a post-ITC globe will certainly be contingent on continued geographical diversity beyond recognized state markets in addition to regulatory, technological and business-model technology to improve item offerings in the solar-plus-storage area. Thinking small growth on these fronts, property solar's annual growth is expected to get to low-teen percents by the mid-2020s.

3.2. Non-residential PV

Key numbers

- 499 MWdc installed in Q1 2020

- Down 29% from Q4 2019

- Up 8% from Q1 2019

Q1 saw a solid revealing for the non-residential sector following its second-largest quarter ever before. This schedules partially to light winter season problems, which allowed building and construction and affiliation to continue in some Northeast markets. Furthermore, Q1 was reinforced by another quarter of strong neighborhood solar affiliations in New York, which helped the Empire State attain its second-largest quarter on document.

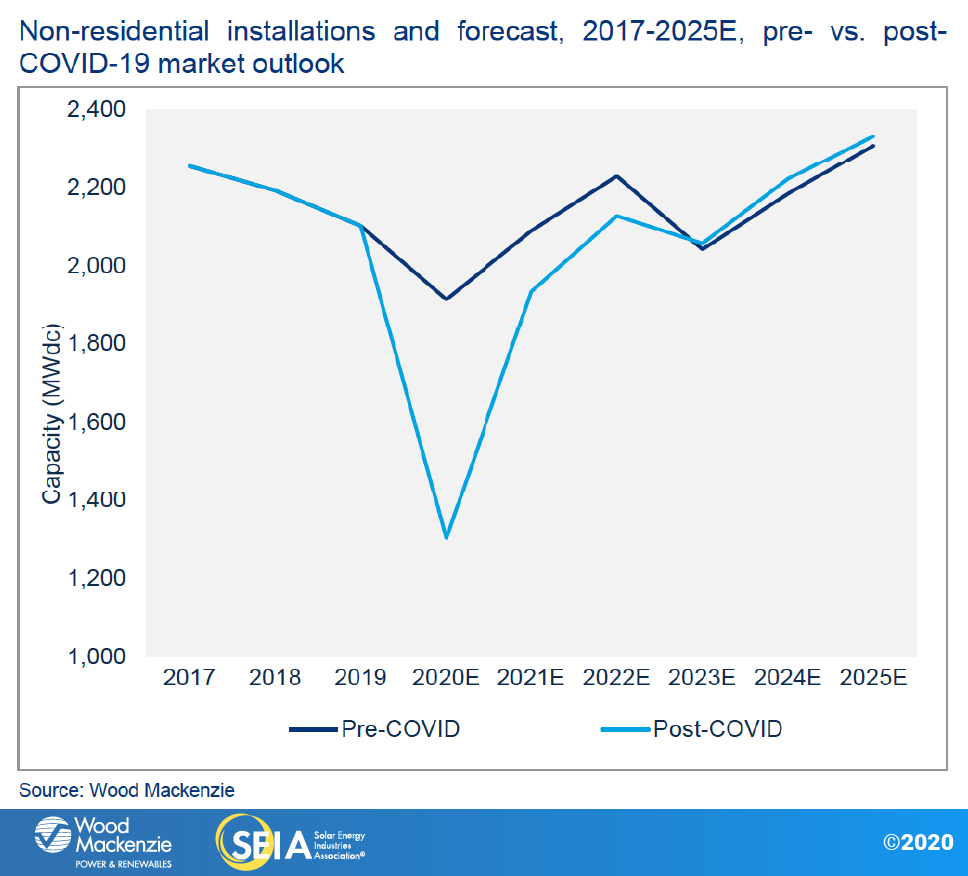

Coronavirus effect on the non-residential market will certainly be a lot more uniformly spread out throughout the year than in the residential market; this results from the longer advancement timelines of the former group of jobs. Shovel-ready, permitted projects with signed agreements can begin or proceed building, unless regional authorities have actually limited designers from doing so-- such as when it comes to California as well as New York. Yet jobs that have yet to get licenses from local zoning authorities are experiencing delays of 3 to 6 months, as the majority of huge ground-mount PV tasks need public meetings to obtain approval to construct. While some areas have transitioned to on-line zoning meetings, there is no harmony to the process across territories. As necessary, the near-term impact of the coronavirus pandemic on non-residential solar will result in significant task hold-ups-- though not necessarily cancellations-- in 2020, causing a 38% decrease from 2019 volumes. Delayed tasks will certainly spill into 2021, resulting in a 49% rise over 2020, but still well below both 2019 and also pre-Covid-19 forecast levels.

While the near-term impact of the coronavirus outbreak on the non-residential space will result in project delays, the long-term impact of GDP contraction and a decline in business expenditures for capital investments are already beginning to affect new origination opportunities. Companies transitioning to the "new normal" are prioritizing core commercial operations while deferring decisions on energy investments until there is more certainty about the future of the economy and the business environment. Additionally, lower commercial activity has reduced C&I energy consumption, which will impact the installation footprint for businesses that choose to go ahead with solar. Accordingly, 2022 will grow only slightly over 2021 before the market experiences another contraction in response to the ITC expiration in 2023.

3.3. Utility PV

Key figures

- 2.3 GWdc installed in Q1 2020, the largest Q1 for utility PV in history

- Utility PV pipeline currently totals 51 GWdc

U.S. utility solar PV saw its strongest Q1 in history with 2.3 GWdc coming online while the pipeline of new projects has hit a new high of 51 GWdc. Fully 12.5 GWdc of utility PV projects are currently under construction, 76% of which are on track to be completed in 2020. This bolsters the confidence underpinning our forecast of 14.4 GWdc in 2020. While several companies have reported issuing force majeure notices in anticipation of possible project delays, developers, utilities and engineering, procurement and construction providers have reported relatively few delays from their supply chains, and projects that have received a formal notice to proceed are facing minimal additional delays due to the pandemic. To this point, the impacts of the coronavirus pandemic on the utility solar sector have been manageable.

However, the virus does pose risks to the medium- and long-term forecast. There have been a few reports that some request-for-proposal processes have been delayed by up to 14 days. While this might have only minimal effects on expected power delivery timelines, further RFP delays will lead to decreases in long-term forecasts. Additionally, there is a growing level of project finance risk. In the near term, developers have reported an increase in the cost of capital due to riskier market conditions. Should cost-of-capital increases ultimately lead to power-purchase agreement (PPA) price increases, demand for utility-scale solar will be impacted.

There is also growing concern around access to tax equity financing. With tax equity investors uncertain of their future tax liability and uncertainty drawing some tax equity investors away from the market, there is a risk that tax equity financing supply may not be able to meet demand in the coming months. It is likely that established, larger developers and large projects will have the easiest time finding tax equity financing, while smaller projects and less-established developers will have a harder time securing tax equity.

There is also substantial downside risk for reduced demand from commercial and industrial offtakers. While the majority of C&I offtakers have indicated that signed offtake agreements seem to be moving forward unhindered by the coronavirus pandemic, many companies are facing economic turmoil, which may decrease demand from C&I offtakers in the coming years. Established C&I customers with experience navigating PPAs have reported that their internal focus has shifted to critical operations and that they expect it will be harder to achieve internal buy-in from financial, legal and executive teams to sign off on new projects. The number of potential new C&I entrants is likely to decline due to pressure from corporate partners resulting in fewer new C&I offtakers signing first-time PPAs. Finally, the creditworthiness of C&I offtakers might become a more prominent issue. While creditworthiness has always been a concern, the uncertainly in the current market may make it harder or impossible for some corporate offtakers to find financing and get deals done.

Despite increased risks stemming from financial instability, supply-chain delays and risk of lower power demand caused by the coronavirus pandemic, our utility PV forecast has been mostly unchanged by the public health crisis. Factors including the steady flow of newly contracted projects, increasing price-competitiveness in many markets, the growing number of utilities outlining utility solar in their internal resource plans, and the continued push by many states for more ambitious renewable portfolio standards have all contributed to a strong long-term outlook for utility solar. Through Q1 2020, procurement has remained strong, with 4.9 GWdc of new projects announced, the majority of which are targeting 2021 and 2022 commercial operation dates. Accordingly, we have increased our 2021 and 2022 forecasts modestly to 15.2 and 13.3 GWdc, respectively.

All utility PV projects looking to qualify for the 22% or greater Investment Tax Credit will need to complete construction by the end of 2023. When the ITC was originally expected to step down from 30% to 10% in 2016, it caused capacity additions to surge from 4.3 GWdc in 2015 to 10.7 GWdc in 2016. With the gradual stepdown of the ITC from 30% in 2019 to 10% in 2022, plus the commence-construction provision that effectively extends the credit to 2023, demand pull-in has been more evenly dispersed across the period 2020-2023. This will cause 2023 to experience less of a spike in completed projects than was seen in 2016.

Despite the ITC phasedown to 10% in 2022, demand for utility PV will remain strong, averaging 13.3 GWdc per year from 2022 to 2025. Utilities such as the Tennessee Valley Authority, Dominion and DTE Energy continue to add increasing volumes of utility solar to their long-term resource plans. Additionally, many states continue to increase their renewable portfolio standard requirements, extend pledges to meet targets outlined by the Clean Power Plan, or increase renewables commitments through the signing of executive orders. The demand for utility PV will remain strong well into 2024 and throughout the decade, due not only to policy mandates for more clean energy but also to the declining costs of utility PV that make solar the most economically competitive resource in most state markets.

While projects slated to come online from 2021 to 2025 face a great deal of risk from coronavirus impacts, the strength of the current pipeline and additional demand from utilities for new electricity generation or to meet renewable portfolio standards and carbon reduction pledges will drive significant capacity additions through this period. While there is still uncertainty in the market, our current post-2020 forecast assumes continued stability in the financial markets and an economic recovery that keeps long-term electricity demand at current projections. If the economic impacts from the current pandemic intensify and linger long past 2020, it could result in reduced availability of financing and decreased demand for power that could in turn reduce or eliminate the need for new utility solar, bringing about a reduction in the U.S. utility PV forecast for 2021-2025.

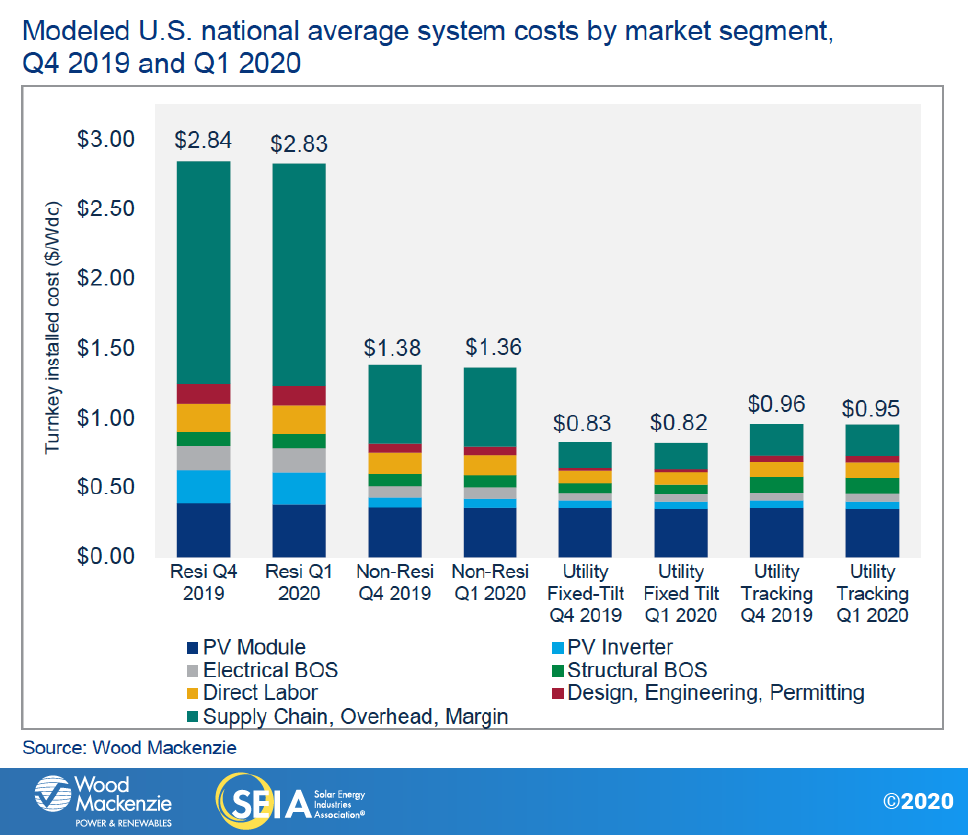

4. National Solar PV System Pricing

We utilize a bottom-up modeling technique to capture, track and report nationwide typical PV system pricing for the major market segments. Our bottom-up methodology is based on tracked wholesale prices of major solar elements as well as information collected from numerous meetings with market stakeholders. As a result of increased demand for mono PERC solar modules, beginning with the 2019 Year in Review report, we started to report combined module prices for the non-residential and also energy market sectors in addition to residential. This represents a weighted standard of multicrystalline as well as mono PERC solar modules instead of prices for multicrystalline modules only. Since the 4th quarter of 2019 is the very first quarter in which these new combined system prices were applied, Q4 2019 system costs as well as those of previous quarters for the non-residential and also energy markets will not be commensurable. Mono PERC solar modules are a lot more expensive than multicrystalline modules, so the brand-new blended component rate method will certainly yield higher system costs.

Keep in mind: Module rates from Q4 2019 and also onward mirror a combined component cost throughout all market segments. Previous quarters just showed multi-silicon component rates for the non-residential and energy segments. It is necessary to note this when making contrasts in system prices for durations prior to Q4 2019. In-depth info regarding national system prices by market sector as well as component is offered in the complete record.

In Q1 2020, system prices dropped across all market sectors. System prices dropped quarter-over-quarter by 0.4%, 1.42%, 1.5% and 0.4% in the residential, non-residential, utility fixed-tilt as well as energy single-axis monitoring markets, specifically. Prices across all market segments are currently at $2.83/ Wdc, $1.36/ Wdc, $0.82/ Wdc and $0.95/ Wdc for household, non-residential, utility fixed-tilt as well as energy single-axis radar, respectively. Utility fixed-tilt pricing showed the steepest decrease in quarter-over-quarter prices, contrasted to all various other market sectors.

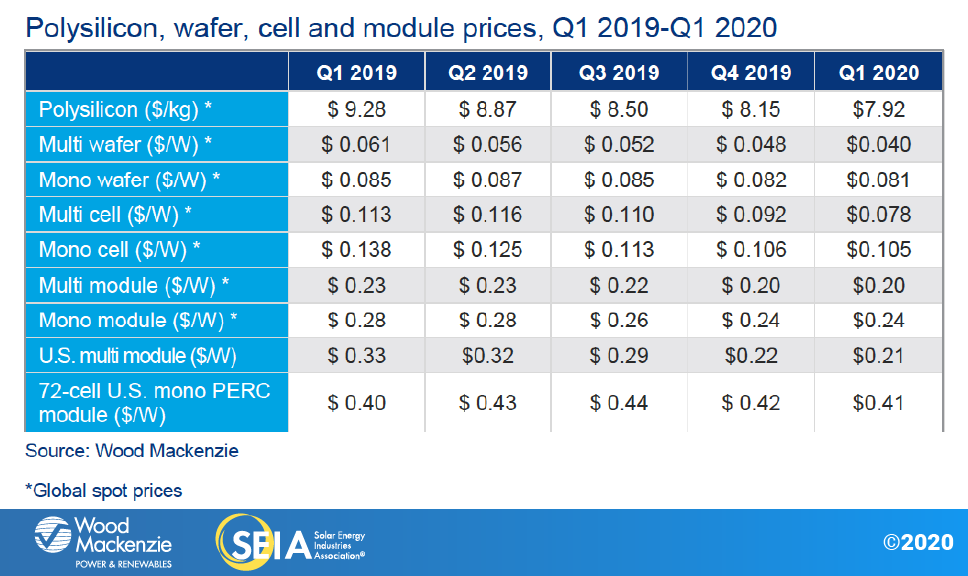

5. Part Pricing

The coronavirus pandemic affected the global PV supply chain in Q1 2020, causing a reduced production level in China as well as Southeast Asia in January and February. The supply chain saw unequal pricing impacts as multi product prices remained to trend lower while mono item rates held steady. Polysilicon costs decreased by 3.5% in Q1. Multi wafer costs declined by 17% in the exact same quarter, dramatically outmatching cost decreases for polysilicon and also mono wafers, which saw only a 1% price decrease in Q1. The driving pressure behind the divergence of multi and mono prices is the changing market choice that has made multi wafers much less popular. Because of this, multi cell as well as multi component global spot prices remained to fall for the third quarter in a row. Mono cell and mono module prices were essentially the very same in Q1 2020 as in Q4 2019. The impact of the coronavirus pandemic on solar PV production and also supply chains erased all the prospective mono product cost decreases.

In the U.S., multisilicon component prices were about $0.21/ W in Q1 2020. The ongoing small cost reflects the marketplace's preference for mono modules over multi modules. Mono PERC component costs dropped just somewhat to $0.41/ W for utility-scale projects.

In Q1 2020, bifacial modules delighted in a tariff-free duration while the U.S. Court of International Trade's momentary injunction on re-imposing the Section 201 tariff was in effect. Without tariffs, the rates of bifacial components was, generally, competitive with mono-facial modules.

Also read