Solar manufacturers, designers prompt caution over polysilicon prices volatility

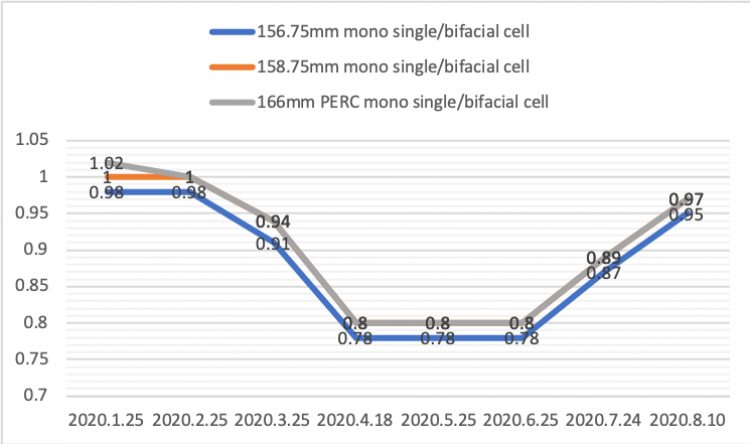

- The announcement from Tongwei on 10 August revealing new cell rate surges was a shock for the whole PV market. Contrasted to its previous quote on 24 July, the cost of poly cells increased by another 6 USD cents/W, with a more boost of 8 cents/W for 156.75 mm, 158.75 mm and also 166mm mono cells.

This was simply 2 weeks after LONGi had actually introduced its newest round of wafer prices, with wafers increasing by 3 cents and cells by 8. The start of a 'rate war' within the manufacturing chain, where upstream costs have raised considerably in a short room of time, took the industry aback, specifically in regard to solar batteries.

PV Tech has actually found out that price boosts in silicon, wafers and cells, aggravated by occurrences at facilities coming from GCL-Poly/ JZS and previously Daqo, had put wonderful pressure on module cost control. After falling continuous for over half a year, module rates seemed stabilsing and, certainly, went upwards. Starting from July, the bidding price for modules made use of in China's big ground-mount plants have actually copulated up to currently leading 1.5 yuan/W. Numerous module business have actually been renegotiating the supply price with owners since present levels have actually made shipment difficult for module plants.

Other macroeconomic factors are at play here. There is an intermittent, seasonal nature to polysilicon, wafer and also cell prices that complies with module need, frequently falling through Q1 and also Q2 prior to coming to a head again in Q3 as well as Q4 in line with utility-scale implementation patterns, especially in China. Projections by CPIA, released last month, recommended that just over 11GW of solar was installed in China in H1 2020, complied with by a "conservative" price quote for year-end installs of around 35GW. Illustratively, around two-thirds of solar implementation in China is weighted towards the second half of the year.

The priced estimate price for polysilicon rose to 90 yuan/kg, to 3.03 yuan/pc for p-type M6 175μm (166/223mm) wafers as well as 2.9 yuan/pc for p-type 175μm( 158.75/ 223mm) wafers. Cell costs also closed at the 1 yuan limit.

Official rates from Tongwei (RMB/W, 10 August).

| Polysilicon | Mono M2 | Mono G1 | Mono M6 | |

|---|---|---|---|---|

| 24 July 2020 | 0.54 | 0.87 | 0.89 | 0.89 |

| 10 August 2020 | 0.6 | 0.95 | 0.97 | 0.97 |

| Percentage increase | 11.1% | 9.2% | 9% | 9% |

Official pricing from LONGi ($/ pc, 31 July).

| G1 (158.75mm) | M6 (166mm) | |

|---|---|---|

| 24 July 2020 | 0.331USD | 0.343USD |

| 31 July 2020 | 0.365USD | 0.381USD |

| Percentage increase | 10.3% | 11.1% |

Resource: Official sites of LONGi and also Tongwei, compiled by PV Tech.

China's PV module makers, EPC service providers as well as power plant buyers have actually been essential of the widespread rate rise in polysilicon, wafers, cells, glass as well as auxiliary materials. "It's such a difficult time for module producers, and also harder for designers," one sector stakeholder informed PV Tech.

" We utilized to run lots of projects at the same time. It wasn't as challenging as it is currently," one more claimed, while a third added: "We can not move on. The estimate a moment ago is invalid one minute later on.".

Agreement terms have needed to be transformed over and over with each increase in rate, bring about 2020 being described as a miserable year for buyers.

While price wars have been heating up between upstream manufacturing titans that have the last word over price and also who flaunt massive manufacturing ability, downstream gamers have been left really feeling stifled. Module suppliers who had taken MWs of orders in H1 were captured in the center, with rates previously agreed upon altering on a near daily basis. Of course, nobody can afford to do company at a loss. Therefore, an increasing number of contracts have actually been declared invalid.

This most current round of rate rises is anticipated to push even more PV suppliers to establish incorporated and also upright organisation. A representative at one significant module producer showed that their firm would certainly broaden production capacity as necessary.

Lessons to be learned.

Speaking With PV Tech, Jing Qian, vice president of JinkoSolar, stated: "Module firms, specifically the top module gamers, will attract lessons from their existing predicament. Instead of blindly seeking higher market share, they will certainly focus much more on creating incorporated services. That's the means to achieve lasting advancement as well as better control of their very own destiny.".

JinkoSolar's PV manufacturing capability, mainly centred on modules, is expected to get to 25GW by the end of 2020. Its wafer capability has actually likewise been considerably broadened recently. According to Jinko's ability plan, wafer and also cell capability will certainly get to 20GW and 11GW respectively by the end of 2020 (poly not included).

Jing Qian yielded that, "The rate increases will, in the short-term, taxed module gamers. Thanks to Jinko's upright supply chain, we are doing better. Our strategic emphasis will certainly move to fix our weak points in capacity.".

" From the perspective of market supply, as we have already repaired all prices along the supply chain ahead of time, our long-lasting contract consumers will be the least affected. When something uncommon happens, we'll maintain our customers well informed, to ensure that they are additionally familiar with the issue in which we locate ourselves. Some projects planned for this year will be postponed as a result of the COVID-19 pandemic as well as, for place market supply, module makers have no choice yet to move a part of the climbing prices downstream.

" I assume the best damage the cost boosts have done is to residential designers, be they state-owned ventures or private power firms, specifically on projects with a fixed grid-connection day. Cost boosts in wafers will be passed onto cells, then to modules, after that to the developer, and also lastly to the end market," Jing Qian said.

In view of the existing rate climbs throughout every field of the upstream PV market, several 3rd parties are advising a wait and see technique, postponing or even terminating some projects.

Jing Qian also encouraged downstream power plant programmers to delay projects, ideally, to the following year. "This round of price boosts will be brief. For the most part, it is because of the hurried installments in the residential market in Q3 as well as Q4. We expect that, in between October as well as November, the costs will certainly fall back to typical levels, as well as decrease even better than that when the supply-demand stress is well balanced.".

However these cost rises might prove to be the final stroke for some downstream companies. To deal with the momentary price increases caused by the temporary discrepancy in between supply as well as demand, Jing Qian called for collaborations from both upstream and downstream, policy makers included, to minimise possible losses.

At the same time, she likewise recommended style institutes as well as other organisations be "extra flexible in establishing specifications in project planning".

" Downstream players usually struggle with overly rigid procurement standards. The price boosts, induced by a supplier syndicate, will lead to them losing a great deal of money. Unified requirements and also price contrasts were suggested to reduce financial investment costs at the beginning, however producers end up shedding their decision-making rights on project yields.".

With booming demand in China's end market, the PV market is anticipated to witness one more wave of rushed setups in Q3 and Q4.

The rising costs throughout the PV production chain, stemming from silicon price increases, is bound to influence H2 installments.

The cost rebound has shown to be more than plant designers can manage, it may force power plants to stop work and even freeze projects, creating significant losses to plant financiers. China's PV installation price quotes may be decreased as a result.

At the time of writing, LONGi introduced that it had actually once more changed its wafer rates. The updated rate for its mono P-type M6 175μm (166/223mm) wafers is priced quote at RMB 3.25 yuan/pc, an increase of 7.3% compared to the RMB 3.03 yuan/pc estimated on July 31, with pricing for its mono P-type G1 175μm (158.75/ 223mm) wafers up 6.9% from the RMB 2.9 yuan/pc priced quote on the exact same date. A special note from LONGi explained that silicon rates was experiencing frequent and substantial changes and that a ± ¥ 3/kg price change in silicon would correspond to a ± ¥ 0.05/ pc modification in wafer prices.

The news once again shook a PV manufacturing supply chain currently reeling from various other price rises and also incidents in the space. More turbulence is, sadly, anticipated.

Also read