Solar corporate financing nearly increases on last year, VC funding sees biggest rise of 466%.

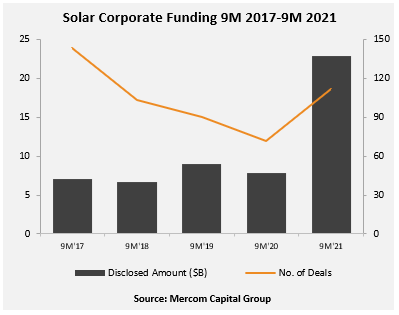

- Total company funding in solar boosted 190% in the initial nine months of this year, with US$ 22.8 billion raised in 112 bargains compared to US$ 7.9 billion in 72 handle the exact same duration last year, according to a Mercom Capital Group report.

The most significant increase remained in venture capital (VC) financing, which rose to US$ 2.2 billion in 39 deals, a boost of 466% compared to last year (US$ 394 million in 29 offers). Of this, downstream solar business accounted for 88% of VC financing, up from 78% last year, with US$ 1.9 billion raised.

The leading 5 VC bargains this year were: US$ 800 million increased by California residential group Loanpal; US$ 250 million raised by solar software business Aurora Solar; US$ 240 million elevated by solar and also energy storage programmer Nexamp; US$ 127 million elevated by utility-scale programmer Intersect Power; and US$ 125 million elevated by Indian dispersed solar firm Fourth Partner Energy.

Furthermore, public market financing was 209% higher with US$ 6.3 billion raised in 23 deals compared to US$ 2 billion elevated in 10 handle the very first 9 months of last year. There have been seven initial public offerings (IPOs) and also SPACs introduced in solar up until now this year.

" Investment task remains to be robust across the solar industry as well as not simply compared to 2020 (because of COVID). This will end up as one of the best years for solar financing since 2010," said Raj Prabhu, Chief Executive Officer of Mercom.

A Mercom report in July 2020 revealed that business solar financing fell by 25% year-on-year to US$ 4.5 billion in the first fifty percent of 2020, although the decline could have been much starker.

Nevertheless, "solar project acquisitions in the very first nine months of 2021 have already gone beyond all of 2020," explained Prabhu.

That stated, the solar market faces a challenging year ahead with manufacturing problems in China creating polysilicon and also component price rises, with some downstream installers stockpiling products therefore. PV Tech Premium has analysed how production and also procurement are adapting.

Mercom's report also showed that large-scale project financing was down from US$ 13.1 billion across 121 sell the first nine months of last year to US$ 11.6 billion over 138 offers this year. Even so, large-scale solar project procurement activity was up 129%, with 55.5 GW of projects obtained contrasted to 24.3 GW in the very first 9 months of 2020.

Finally, there have been 83 M&A purchases recorded this year compared to 42 purchases throughout the exact same duration last year.

Also read