Solar Company's Stock Plunge Signals Consumer Demand Slowdown

- Enphase drags down peers after bleak revenue guidance

- California solar subsidy cut looms over upcoming earnings

Home owners in California, the biggest United States rooftop-solar market, raced to buy panels in the very first quarter of the year. Yet the governing change that stimulated that thrill may slow installations later in the year, a possibility that has capitalists on edge.

Shares of Enphase Energy Inc., a solar tools producer and also bellwether company for the rooftop industry, plunged more than 25% Wednesday, dragging down the sector after the company issued second-quarter guidance that missed analysts' expectations.

And also yet, the headwinds facing the industry may not affect all companies equally.

Sunnova Energy International Inc. enhanced its guidance, stating it currently expects to add 125,000 to 135,000 clients in 2023, up from the previous forecast of 115,000 to 125,000. After going down more than 8%, Sunnova shares rose in late trading adhering to release of the company's quarterly earnings as well as forecast. Investors now will be expecting guidance from Sunrun Inc. and also SunPower Corp. on May 3.

California Home Solar to Slow

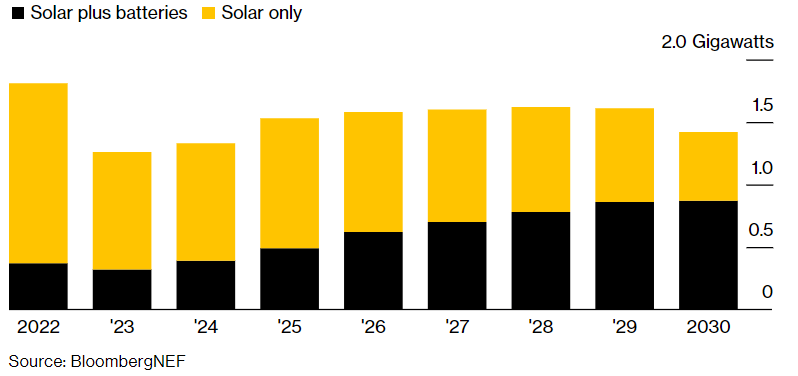

State readjusts incentives to prefer solar with battery systems only

On the whole, California domestic solar setups should be 20% to 30% greater year-over-year in the very first quarter, according to a recent investor note by Roth Capital Partners LLC. A lot of those orders likely will be completed by September, yet after that installments are expected to fall by 30% or more by the beginning of the fourth quarter through much of 2024, Roth said in its note.

Under new policies that entered into effect April 15, California solar purchasers get a much smaller credit on their bills for the electrical power they feed back to the grid. The rules accepted last year intended to motivate pairing batteries with photovoltaic panels, enabling homeowners to store power and also return it at the most ideal times for the state's electrical system.

Solar companies started offering batteries with panels in California. With first-quarter results, capitalists will be trying to find signs of the kind of consumer demand for the combined systems, stated Brett Castelli, a clean energy analyst at Morningstar Inc. The Biden administration's Inflation Reduction Act will give a prospective increase, offering house owner tax incentives.

Enphase Chief Executive Officer Badri Kothandaraman claimed he is convinced the influence will be temporary and sees California's regulatory change as a big catalyst for mounting home batteries to back up roof solar arrays. That will be particularly real come August and also September when California often flirts with blackouts throughout warm front.

"At that time, the battery's going to be your best friend," he informed analysts Tuesday during the company's quarterly earnings phone call.

Still, climbing rates of interest and also bank turmoil have actually fed issue home owners will certainly struggle to afford rooftop solar, Castelli said. These difficulties will likely be greater for medium to smaller sized installers, providing the bigger companies an opportunity to acquire market share, according to Roth.

Also read