Solar - 10 Predictions for 2022

1. 2022 will certainly be the first year in which more than 200GW of solar will be mounted

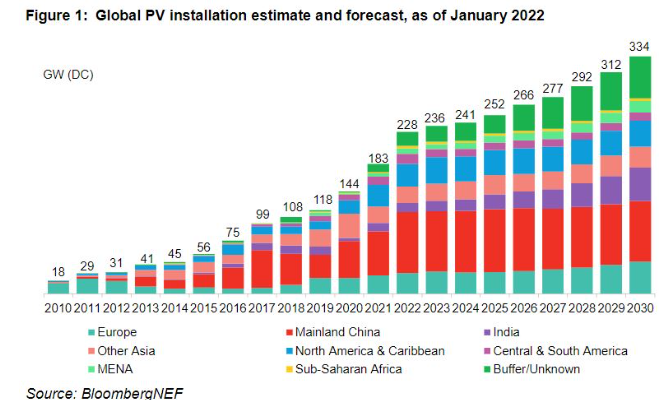

The solar train is moving quicker now, as well as our mid scenario for 2021 develop is 183GW (range 171-199GW), while our mid scenario for 2022 build is 228GW (range 204-252GW) (Figure 1). This is a substantial uptick from our expectation in November 2020, where the highest scenario for 2022 was 206GW. In our view, the largest threat to this prediction is that it is still possible that 2021 was actually the very first 200GW year. Prices would certainly not have continued to be as high as they had in 4Q 2021 if solar modules were not going somewhere.

2. Solar module prices will certainly be up to 25 united state cents per Watts in 1H 2022, and also 1-2 cents per Watt reduced in 2H 2022

Polysilicon manufacturing has been the bottleneck in 2021. Combined with strong need, it has pushed module prices as high as 27.8 U.S. cents per Watt for common monocrystalline silicon, monofacial modules using 166mm cells. We anticipate 39% more polysilicon production in 2022 than in 2021, with complete supply enough to make nearly 300GW of silicon solar products, thanks to brand-new capacity ramping up and factory debottlenecking.

This will certainly reduce the supply crunch. Already, the silicon price has fallen back from $37/kg in October to $32/kg in the last month of 2021. We anticipate that to more decline to $20-25/ kg in 2H 2022. Boosted effectiveness, and also modules made of larger wafers with side length of 182mm as well as 210mm becoming a mainstream item, are estimated to permit another 1 united state cents/W reduction in module prices. We therefore expect a 11-15% module price decline to 23-24 U.S. cents/W in 2H 2022.

3. Installed utility-scale solar-and-storage will increase

BloombergNEF's database presently tracks 278 utility-scale PV-and-storage plants fully appointed, with overall PV capacity of 12.5 GW and battery capacity of 2.7 GW/ 7.7 GWh. We will certainly release a note on this in February 2022, and expect to need to review it regularly as the market increases.

The biggest markets this year will certainly be China as well as the united state. The united state is currently a reputable solar-and-storage market. In China, 20 provinces now require or urge new-build renewables to couple with energy storage space.

4. China's property as well as commercial/ industrial roof solar market will certainly drive the country's new develop to a document 81-92GW in 2022

Given that the center of 2021, China's central authorities have actually encouraged local governments to coordinate readily available roofs as well as develop small-scale PV in bulk. The bulk growth pattern will certainly aid the growth of the household industry, specifically in rural areas, with the assistance of city governments.

State-owned business have actually gotten in the small-scale PV market to lead the bulk development, while private enterprises with experience act as EPC [design, purchase as well as building] or building and construction subcontractors. BloombergNEF expects China's domestic PV installment in 2022 to exceed a document 20GW.

In the commercial as well as industrial (C&I) sector, the power crunch in September 2021 enabled authorities to increase power prices by approximately 20%, in order to pass on some of the coal gas expenses to customers. The higher power price will make C&I roof PV a lot more successful as well as motivate power strength users to set up rooftop PV systems.

China has set a complete energy usage cap for every district every year to regulate carbon exhausts, causing power rationing and also manufacturing curbs in parts of the country in 2021. Today, renewable resource is additionally counted with in overall energy consumption. However, according to the current state council meeting, onsite renewable power may not be counted in the overall usage quota for the users next year, indicating that setting up roof PV might stop manufacturing suspension. BloombergNEF expects that higher power prices and also energy consumption allocation exemption policy will both drive C&I rooftop PV uptake, and that brand-new C&I installment will most likely surpass 10GW in 2022.

5. Residential solar and also storage space becomes the default offering in more than two markets

Residential solar-and-storage will be on the political as well as investment program with higher seriousness than in previous years, as it is starting to be a substantial industry. In Hawaii, nearly all new domestic solar systems are now built with storage; Germany, concerning half consist of storage space; while in Switzerland about 15% do, and in Australia, concerning 5%. This figure is not readily available for many markets, but we anticipate by the end of 2022, there to be at the very least two additional markets we know of that have greater than 50% storage space accessory rates.

There is little consistency in between nations regarding regulations to incentivize storage or ensure that the storage will be charged and also released to profit the grid, or whether solar and storage space systems will suffice to power a house with a grid power outage. This will change in 2022.

6. Gigawatts of solar power acquisition agreements will be checked in Europe

In north European markets (Poland, Denmark, Germany), extra companies and utilities will certainly authorize power purchase agreements for solar in 2022. This will additionally take place in Spain as the political unpredictability fades away. The Iberian market is where a lot of Europe's PPA-backed PV capacity (72% or 1.4 GW) came online in 2021, although the short-lived profit claw back on vendor as well as PPAs-backed projects, introduced in September 2021, decreased new deal finalizings.

The future pipeline looks solid, as BNEF tracked 13.1 GW of PV PPAs because of come online in the 2022-2025 period.

7. Solar auctions will certainly come to be a lot more challenging and also often include storage

In 2021, India, South Africa and also Chile held fascinating solar auctions where various modern technologies contended to attend to intermittent supply.

In South Africa, the auction was for emergency power and also was expected to lead mainly to oil and also gas plant develop, however awarded 1,687 MW of PV, some 160MW of wind and 640MW of battery capacity to be built in 2022, as well. In India, the first auction for 2.5 GW of round-the-clock renewables received 11.8 GW worth of bids at an ordinary price of $42.55/ MWh in October 2021. Chile's technology-agnostic auctions awarded 2.3 TWh of annual contracts to solar and storage space projects and also wind in September 2021, to be developed by 2026. Israel additionally runs solar-and-storage tenders.

We anticipate at least five more nations to hold intricate solar-and-storage auctions in 2022.

8. Solar manufacturing capacity will remain to grow, with brand-new modern technologies signing up with the mix

Substantial factories for new cell modern technologies such as tunnel oxide passivated contact (TOPCon) and heterojunction will be constructed in 2022. There is currently over 400GW of annual capacity to make the current standard passivated emitter and back call (PERC) cell (> 400GW by the end of 2021), which is coming close to the effectiveness restriction of the current framework at around 24%.

Many strategies have been revealed for TOPCon and also heterojunction manufacturing for many years, primarily by brand-new entrants planning to enter the business with separated items, yet they have actually not been financially affordable with mainstream products. New and also significant strategies by the existing large cell and also incorporated module manufacturers are likely to alter that. Among the new modern technologies, TOPCon is most likely to be a quicker winner viewing as it is considered to have better expense efficiency and is much more compatible with existing cell production in regards to procedure, tools and materials, that makes it simpler to scale up compared with other technologies. PERC, however, will certainly continue to be the mainstream item for one more 2 to 3 years.

There will also be some niche products released, specifically for the Chinese domestic market which has some assistance for building-integrated PV. For instance, Chinese glass-free crystalline silicon-based leader Sunman Energy has actually simply opened up a 1GW/year factory in Yangzhong City, Zhejiang.

9. Agrivoltaics will certainly begin to be appropriately comprehended for commercial objectives

Agrivoltaics-- making solar projects to make sure that crops can be grown beneath them-- is something of a buzzword in solar circles. Occasionally agrivoltaics are just a method to get permission or aid to build PV on agricultural land, and supports low-yield farming (see PV + Farming-- Not Necessarily a Good Friendship. Solar projects restrain mechanical access to the ground beneath, making planting and also harvest harder.

There are however some persuading researches that in some applications returns can be good, and also some crops are harvested by hand. Players like GroenLeven (a subsidiary of BayWa r.e.) and also Baofeng Group are currently installing agrivoltaic systems to improve the yield of particular crops such as raspberries, goji berries, and also grapes for red wine making. Installers are in the process of finding out which crops expand far better under what system layout, as there is no standardization, and also vertical bifacial projects are being considered for certain applications. We will certainly see progress in choosing optimum applications in this space in 2022.

10. Solar factories will certainly be introduced in nations outside China, but will certainly take some time to commence large-scale manufacturing

India has without a doubt one of the most significant solar cell and module manufacturing base of any country except for China (India currently has concerning 12.4 GW of module capacity and 3.3 GW of cell capacity). The government likewise prepares to include significant further capacity from polysilicon to modules, as well as ran an auction in November 2021 to award 45 billion rupees ($ 600 million) of production-linked incentive. This was granted to three winners, Reliance Industries, Jindal Poly Films and Shirdi Sai Electricals, which each bid to build four gigawatts per year of module production, together with associated capacity for vertical assimilation beginning with polysilicon.

In the united state, the stalled Build Back Better bill consists of substantial support for domestic manufacturing, especially for solar wafers where currently nearly all capacity remains in China, with a small portion in southeast Asia. BloombergNEF views it as very possible that some kind of methodical assistance will certainly pass for united state production early this year. In Europe, heterojunction specialist Meyer Hamburger (SWX: MTBN) plans to increase its cell and module factory in Freiberg, Germany from 400MW to 1GW this year, although manufacturing was temporarily cut in December 2021 due to staff members taking time off with Covid. Meyer Burger is also planning a factory in the U.S. and also is among one of the most major challengers.

In spite of this, we would certainly be amazed if a big increase in the worldwide share of cells and also modules made outside China takes place in 2022, and also anticipate little new wafer capacity in India, Europe or the united state Suppliers are most likely to be mindful to increase into an oversupplied market without solid and also guaranteed need for solar products at costs prices

Also read