Shoals Technologies profits up less than expected as supply chain disruptions bite

- Solar equilibrium of system (BOS) solutions carrier Shoals Technologies saw its Q3 revenues increase 14% year-over-year, however stated this increase was less than anticipated as some clients changed product requirements or postponed shipments as a result of provide chain concerns.

Having actually reached Q3 2021 earnings of US$ 59.8 million, Shoals is currently forecasting this to be up to US$ 40-- 50 million in the fourth quarter as the US business exposed a number of projects it is providing have actually been delayed to accommodate style updates as a result of panel modifications or inaccessible parts, leading it to change some expected Q4 earnings into Q1 2022.

"The crucial challenge to our development is the existing supply chain environment," said Shoals chief executive officer Jason Whitaker, including that the firm's customers are still emulating these concerns, causing fluid shipment timetables as customers make frequent changes, both in terms of item specs and when they desire products on site.

However, Shoals has not had to cancel any orders as well as the kind element of its projects is said to have restricted the effect of delivery and logistics lacks on its operations.

Whitaker said the company views the present supply chain problems as momentary. "We have seen a phenomenal quantity of disruption in the worldwide supply chains, but it is clear to us that the marketplace is slowly beginning to normalise. Distributors are adjusting, customers are adapting, logistics carriers are adapting," he said in a teleconference with investors.

Shoals finished Q3 with a backlog and awarded orders of US$ 270.7 million, a brand-new document for the business as well as an increase of 101% and 35% contrasted to the exact same time last year and also June 2021 respectively, mirroring demand for its products from US-based clients.

Q3 changed EBITDA was US$ 16.9 million, down 15% on the prior-year duration, while gross margin lowered to 36.4% from 39.3% in Q3 2020, partially as a result of lower-margin components standing for a bigger share of the product mix.

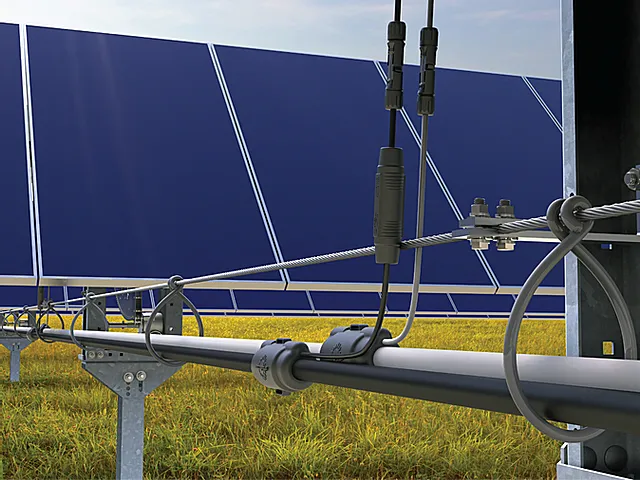

Whitaker stated that because the beginning of the year, the variety of solar EPCs and programmers that use its Big Lead Assembly option-- which combines cable assemblies, combiner boxes and fusing right into a solitary item-- has actually more than quadrupled and also there are an additional 12 clients that are currently transitioning to its system.

"We are not simply taking a larger slice of the pie we are in, we are expanding the dimension of the pie readily available to us by broadening our product portfolio," Whitaker said. This has actually been done naturally via new item intros such as cord management solutions and inorganically with the procurement of ConnectPV, a California-based provider of solar and storage space electric BOS products.

Representing Shoals' initial procurement, the deal closed in Q3 and is anticipated to provide the firm access to extra consumers, while bringing it brand-new items targeted specifically to energy storage.

Past the weak Q4 assistance, Q1 2022 profits are expected to be in the series of US$ 71-- $76 million, a significant jump on the US$ 45.6 million posted in this year's initial quarter.

Also read