Shoals beats 'challenging environment' with record revenue and also profit in Q2

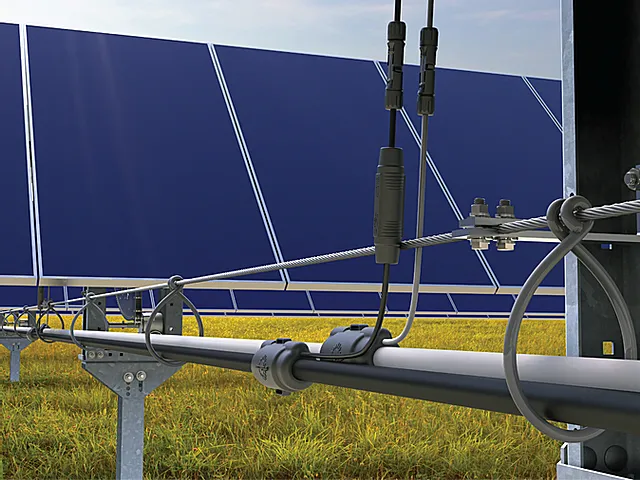

- US solar product supplier Shoals Technologies Group saw record revenue as well as gross profit in the second quarter of 2022 because of strong demand for its combine-as-you-go system as well as a large number of new customers buying up components.

The firm, a company of BOS options for solar, storage, as well as electrical vehicle (EV) charging framework, surmounted the significant problems as well as uncertainty encountering the industry during Q2 to achieve these records whilst also preserving gross margin within its targeted array.

Only in May, the company had actually joined other suppliers in adjusting its guidance for the year, criticizing an "progressively challenging environment" caused by the United States AD/CVD examination, which halted shipments of tools to the US from certain suppliers.

In spite of this, Shoals, whose modern technology has actually been released on more than 20GW of solar projects worldwide, had backlog and awarded orders of US$ 327.2 million in Q2, up 63% on the previous year, and up 8% from Q1 this year. These rises were again put down to robust need for the company's products.

" Need for our combine-as-you-go remedy remains to expand," stated Jason Whitaker, CEO of Shoals. "Throughout the quarter we transformed four added customers, bringing the total Huge Lead Assembly (BLA) [Shoal's in-line fuse as well as cable manufacturing innovation] customers to 29. Customer rate of interest in our lately introduced products is strong, specifically within battery storage space, cable monitoring and EV charging."

The two-year tariff exemption for solar panels announced by the White House, Whitaker kept in mind, had additionally been a "transforming point" in customer view, that led to the normalising of order patterns.

The company's revenue boosted to US$ 73.5 million, up 23% on US$ 59.7 million for the prior-year period, driven by increases of 97% in components and 11% in system options, according to its Q2 outcomes.

Components revenue was driven by shipments of both battery storage space and also solar products to a considerable variety of new customers. New customers have a tendency to buy components before transitioning to system remedies.

On the other hand, strong demand for the company's combine-as-you-go system was the vital consider the development in system services revenue, which represented 77% of the overall revenue in the quarter.

Gross profit enhanced to US$ 28.6 million, up 9% on US$ 26.2 million in the prior-year period. Gross profit as a percent of revenue went a little down to 38.9% compared to 43.8% in the prior-year period, due to a greater proportion of components sales, which have reduced margins than system solutions and also greater resources and logistics expenses.

Adjusted EBITDA was US$ 19.8 million contrasted to US$ 20.6 million for the prior-year period.

Expecting the complete year, Shoals still anticipates revenues to be in the series of US$ 300-325 million, adjusted EBITDA of US$ 77-86 million and adjusted net income between US$ 45-53 million.

In March, Shoals claimed it would certainly increase its BOS production capacity with a new United States facility as its backlog as well as awarded orders got to a record high.

New CFO appointed

In associated information, Shoals has actually appointed Dominic Bardos as CFO, beginning with 3 October this year. Bardos has worked in senior financing settings at numerous companies consisting of at vehicle manufacturer Holley, and also Tractor Supply Company.

" We are thrilled to welcome Dominic to our company's executive management team," claimed Jason Whitaker, CEO of Shoals. "His considerable experience as a public company money leader will certainly be instrumental in additional sustaining Shoals' continued monetary performance and execution of our global growth plans."

Also read