Renewables developers to be primary beneficiaries of high power prices in Europe this decade

- European developers will certainly be the primary beneficiaries of existing higher wholesale prices and favourable business economics for renewables projects over the next decade, according to a report from advising company Edison Group.

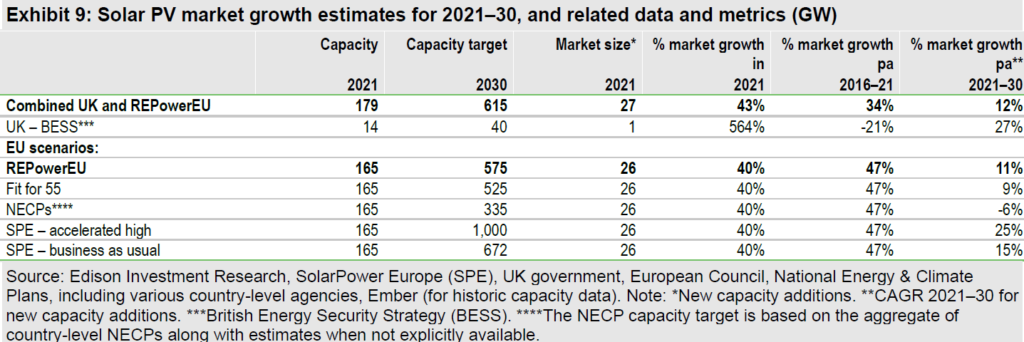

The solar market in itself would see a compound annual growth rate (CAGR) of 12% over this decade, with developers being able to see double-digit returns on resources, helped by long-term growth in European renewables (mostly solar and wind) and thanks to a beneficial regulative environment.

The report outlines that one of the most capital-intensive design for developers is the growth of greenfield sites, where developers that build eco-friendly properties from square one without offering them later on will certainly get a far better return on their financial investment.

Furthermore, developers able to fund properties via their very own balance sheets will additionally benefit from the current wholesale high prices as well as developers securing power purchase arrangements (PPAs) for longer than one decade because of high market prices, stated the report.

Passion in long-lasting PPAs among the commercial and industrial (C&I) field and business entities has increased business look for to reduce their greenhouse gas discharges and mitigate energy price volatility.

The PPA market has almost increased between 2020 and 2021 to nearly 7GW, said the report, with business PPAs making up just 9% of yearly installations for solar PV, contrasted to 30% for wind.

Even if sustainable projects can be financially viable without any federal government aids, different governing assistance-- increased project approvals, encouraging company PPAs, market or grid investments-- might enhance project economics, said Edison Group.

Among the instances displayed in the report is just how Poland's aid for rooftop solar aided the marketplace expand in comparison to the wind industry, which halted as a result of an unfavourable policy.

National-level policy, nonetheless, requires to urgently boost its policy support in terms of investment in grid and power storage space, as the existing policies suggest an annual decrease in the growth by 6% as received the chart below.

The EU and the UK will require to spend "hundreds of billions of euros" to support the power system if they intend to reach their renewables target by the end of the decade, with brief, tool and big duration storage solutions needed to improve the grid.

James Magness, director of power & sources at Edison Group, stated: "The geopolitical dilemma in Europe has increased the demand for European countries to decarbonise power generation.

" With the European power crisis and Russia's intrusion of Ukraine causing an increase in fuel prices-- and our team believe they will remain structurally higher in the lasting-- there has never ever been more chance for renewable energy developers to profit, specifically in the solar and wind sectors."

Also read